In the face of cyclical risks in the industry, no matter how profitable COSCO SHIPPING Holdings can be, it is still difficult to truly win the confidence of investors.

Text丨Qing Qiu

BT Finance original article

Head image source丨Maker stickers

Recently, COSCO SHIPPING Holdings officially distributed the 2022 mid-term cash dividend. Based on approximately 16.095 billion share capital, a cash dividend of 2.01 yuan (including tax) per share was distributed, and the total cash dividend distributed was approximately 32.35 billion yuan.

It is understood that this is the company’s first interim dividend in 10 years, and the dividend amount accounts for about 50% of the net profit attributable to the first half of the year. Not only that, the board of directors also plans that the total cash dividends in the next three years (2022-2024) should account for 30%-50% of the attributable net profit realized in the current year.

Behind such a generous dividend distribution is the record high performance of COSCO SHIPPING Holdings in the first half of 2022. According to the interim report, COSCO SHIPPING Holdings realized operating income of 210.785 billion yuan, a year-on-year increase of 51.36%; net profit attributable to the parent company was 64.722 billion yuan, a year-on-year increase of 74.46%. Refresh the record.

However, the secondary market did not show high vibrations at the same frequency. Since 2022, the price of COSCO SHIPPING Holdings has been falling all the way. On October 10, it hit a new low of 8.87 yuan per share for the year. Compared with the high of 24.2 yuan per share in July 2021, it has fallen by 63.35%, and its market value has evaporated by 226 billion Yuan.

At the same time, many media also expressed negative views on COSCO SHIPPING Holdings, believing that COSCO SHIPPING Holdings is in a highly cyclical shipping industry, and it is difficult to maintain such high performance for a long time. It may be the “last carnival” of COSCO SHIPPING Holdings.

COSCO SHIPPING Holdings, which can earn 360 million yuan a day, is the only listed company in the A-share container shipping sector. Why has it caused such widespread concern?

Hidden worries under huge profits

In the first three quarters of 2022, COSCO SHIPPING Holdings achieved revenue of 316.5 billion yuan, a year-on-year increase of 36.75%; attributable net profit of 97.21 billion yuan, a year-on-year increase of 43.74%, showing a very strong performance. In contrast, Maotai is ashamed of itself, with revenue of 89.79 billion yuan and attributable net profit of 44.4 billion yuan in the same period, which is less than half of COSCO SHIPPING Holdings.

According to the Accounting Standards for Business Enterprises, from January to September 2022, COSCO SHIPPING Holdings’ earnings before interest and taxes (EBIT) reached 143.608 billion yuan, a year-on-year increase of 47.82 billion yuan, or 49.92%.

In the first three quarters, the net cash flow generated by COSCO SHIPPING Holdings’ operating activities reached 166.435 billion yuan, a year-on-year increase of 46.03%. According to COSCO SHIPPING Holdings’ announcement, it is mainly due to the substantial increase in the benefits of container shipping business.

From January to September 2022, the container shipping business achieved revenue of 311.217 billion yuan, a year-on-year increase of 37%. Among them, route revenue was 297.717 billion yuan, a year-on-year increase of 38.35%; net profit reached 116.681 billion yuan, a year-on-year increase of 46.21%; the EBIT margin reached 44.42%, a year-on-year increase of 3.54%. The single-container revenue of international routes was US$2,876.04 per TEU, a year-on-year increase of 932.19%.

Such astonishing profitability also makes COSCO SHIPPING Holdings’ book funds very full.

As of the end of September 2022, the monetary funds on the books of COSCO SHIPPING Holdings reached 297.338 billion yuan, a year-on-year increase of 66.28%, accounting for 54.09% of total assets. It is worth mentioning that the total liabilities of COSCO SHIPPING Holdings in the same period amounted to 275.332 billion yuan, and monetary funds alone can already cover the total liabilities of the group.

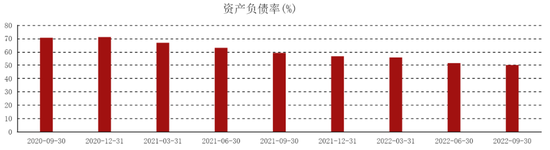

At the same time, the asset-liability ratio of COSCO SHIPPING Holdings has further dropped to 50.08%, which has declined for eight consecutive reporting periods, which shows that the company’s assets are in good condition.

Although COSCO Shipping Holdings has made a lot of money recently, the financial report for the third quarter also exposed some hidden worries.

On the whole, COSCO SHIPPING Holdings still achieved operating income of 105.8 billion yuan in the third quarter, which was only a slight increase from the 105.3 billion yuan in the second quarter, and it was still stable. However, the attributable net profit has experienced a 12.43% month-on-month decline, from 37.1 billion yuan in the second quarter to 32.49 billion yuan in the third quarter. In terms of gross profit margin, it dropped from 53.82% in the second quarter of this year to 42.94%, not only a quarter-on-quarter decrease of 10.88 percentage points, but also a year-on-year decrease of 9.11 percentage points.

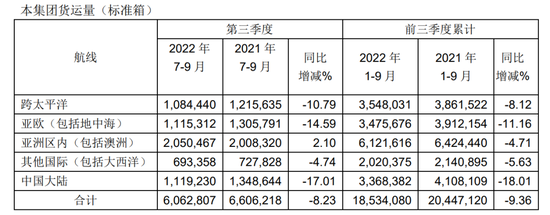

Except for intra-Asia routes, the cargo volume of other major international routes has declined. In the third quarter, the cargo volume of COSCO SHIPPING Holdings’ trans-Pacific routes decreased by 10.79% year-on-year, the cargo volume of Asia-Europe (including Mediterranean) routes decreased by 14.59% year-on-year, and the cargo volume of other international (including Atlantic) routes decreased by 4.74% year-on-year. Overall, from January to September 2022, the freight volume of COSCO SHIPPING Holdings’ container shipping business was 18,534,080 TEUs, a decrease of 9.36% from the same period last year.

In addition, the increase in sub-line revenue is also shrinking. Trans-Pacific route revenue will increase by 92% in the same period in mid-2022, and the year-on-year increase in the third quarter is only 28.77%. Asia-Europe revenue also fell 4% year-on-year in the third quarter.

In addition, there are constantly high operating costs. In the first three quarters of 2022, the operating cost of COSCO SHIPPING Holdings has reached 171.697 billion yuan, a year-on-year increase of 31.84%. Among them, taxes and surcharges reached 2.074 billion yuan, a year-on-year increase of nearly nine times, mainly due to the relatively large increase in the three items of urban maintenance and construction tax, education surcharges and stamp duty. In addition, the credit impairment loss (bad debt provision) reached 487 million yuan, an increase of 363.81% from 105 million yuan in the same period in 2021.

the invisible hand of the cycle

In the long run, COSCO Shipping Holdings has not always been so profitable.

The predecessor of COSCO SHIPPING Holdings was China COSCO, which landed in A shares in 2007. At that time, the demand for global trade was growing explosively, the supply of shipping capacity was in short supply, and the price of shipping was also at a high level. The net profit of COSCO that year was as high as 20.8 billion yuan, which was nearly ten times that of the previous year, and its stock price also rose by more than seven times.

However, due to the global financial crisis in 2008, the international shipping industry began to enter a long winter, and COSCO’s performance shrank. In 2013, it once wore the ST hat, and had to sell its assets to avoid delisting. In order to change this situation, COSCO Group and China Shipping Group were reorganized in 2016, and COSCO was renamed COSCO SHIPPING Holdings.

After the reorganization, COSCO SHIPPING Holdings eliminated the dry bulk shipping business and concentrated on container shipping and terminal business, turning losses into profits. However, the net profit in 2017-2018 was not huge, and the deduction of non-net profit was only 950 million yuan and 190 million yuan respectively.

Since 2019, the operating performance of COSCO SHIPPING Holdings has gradually improved. From 2019 to 2021, COSCO SHIPPING Holdings achieved operating income of 151.057 billion yuan, 171.259 billion yuan, and 333.694 billion yuan, a year-on-year increase of 25.02%, 13.37%, and 94.85%. The corresponding attributable net profit reached 6.764 billion yuan, 9.927 billion yuan, and 89.296 billion yuan, a year-on-year increase of 449.92%, 46.76%, and 799.52%.

The most eye-catching performance is the amazing growth in 2021. The net profit in one year exceeds the sum of the past 12 years.

This is mainly due to the fact that the shipping industry has ushered in a period of high prosperity. It is generally believed in the industry that since 2020, affected by the global epidemic, the shipping market has experienced more-than-expected demand, causing port congestion and freight rates to remain high. The performance of COSCO SHIPPING Holdings has naturally risen and become a big winner.

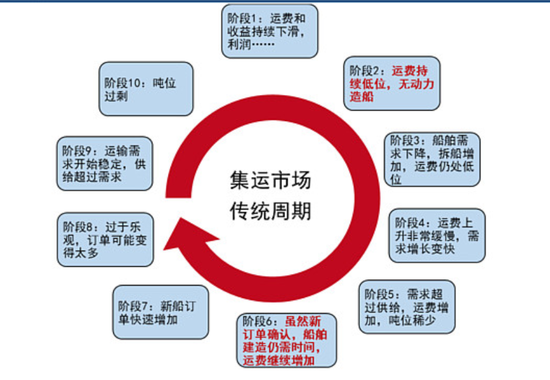

But the shipping industry is a highly cyclical industry, and this high level will not exist forever.

Affected by the global economic and trade situation, shipping demand is always changing instantly, but supply often lags behind demand. When the demand increases and the supply is insufficient, companies that have received high freight rates have placed orders to build new ships to increase capacity. However, the delivery cycle of new ships is as long as 2-3 years. When the new ships are built, there will be an oversupply. Such a game of supply and demand will form a cycle.

Source: China Securities Investment

It can be seen that the shipping industry is prone to misalignment of supply and demand, and when companies can really make money, it is only a short window period when there is excess demand and shortage of shipping capacity. Because of this, the performance of COSCO SHIPPING Holdings over the years has not been stable. The deduction of non-net profit often fluctuates like a roller coaster, and it is difficult to get rid of the control of the “invisible hand” of the industry cycle. Without the black swan of the new crown epidemic, it would be difficult for COSCO SHIPPING Holdings’ performance to hit the current high level.

So, how long can this super bonus window last? At present, the industry generally believes that it is almost coming to an end.

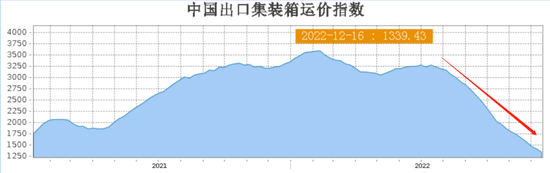

Data from various sources show that since the second half of 2022, with the decline in the growth rate of container cargo volume on major east-west routes, freight rates have also shown a downward trend.

According to the Shanghai Shipping Exchange, from June 2021 to July 2022, the China Export Container Freight Index (CCFI) has been at a high level, but then began to decline sharply. On December 16, 2022, the CCFI had fallen to 1339.43 points, a drop of 62.8% from the highest point in 2022. The container freight index in Southeast Asia has also dropped below 1,000 points, and the decline has reached about 60% within the year. Some freight forwarding companies said that Southeast Asian routes have already experienced loss-making business.

These market changes are also directly reflected in COSCO SHIPPING Holdings’ third-quarter financial report. At present, COSCO SHIPPING Holdings has maintained a high single-container revenue. Although the cargo volume has decreased, it has not yet affected the growth of route revenue. However, with the easing of the impact of the global epidemic, the problem of port congestion has been greatly eased, and effective shipping capacity is being gradually released. The situation of “hard to find a container” may not last. At that time, will COSCO SHIPPING Holdings “return to the pre-liberation” situation? “, no longer continue to attract money strongly under the low economic cycle?

In the face of cyclical risks in the industry, no matter how profitable COSCO SHIPPING Holdings can be, it is still difficult to truly win the confidence of investors. This is also the crux of why its stock price has been depressed for a long time.

40 billion gamble on the future

COSCO SHIPPING Holdings, which is not short of money, not only spent more than 30 billion yuan in dividends, but also spent more than 20 billion yuan to buy ships.

On the evening of October 28, COSCO SHIPPING Holdings issued an announcement stating that the wholly-owned subsidiary of the company’s holding subsidiary, Orient Overseas, and the wholly-owned subsidiary of COSCO Shipping Container Lines Co., Ltd. Dalian COSCO Shipping Kawasaki Ship Engineering Co., Ltd. signed a shipbuilding agreement to order a total of 12 world’s largest 24,000TEU methanol dual-fuel container ships at a price of US$239.85 million (equivalent to approximately RMB 1.71968 billion) each. The total price of the ordered ships is 2.8782 billion U.S. dollars, equivalent to a contract of 20.63612 billion yuan.

In the past two years, COSCO SHIPPING Holdings has frequently placed orders for shipbuilding.

In 2020, OOCL, a subsidiary of COSCO SHIPPING Holdings, ordered 12 23,000-unit container ships, with a single ship costing about 157 million U.S. dollars and a total value of about 1.9 billion U.S. dollars. The delivery period is 2023-2024. In July 2021, COSCO SHIPPING Holdings ordered 10 new Panamax container ships. In September 2021, OOCL placed another order for 10 16,000-unit container ships.

The 2022 mid-term report shows that COSCO SHIPPING Holdings holds 32 new shipbuilding orders with a total capacity of 585,300 TEUs. Including the latest 12 orders, the shipbuilding orders will reach 44.

Some media believe that when the freight rate fell sharply, COSCO SHIPPING Holdings also ordered 12 ships at one time, and the number of new shipbuilding orders in hand has reached as many as 44 ships. Crazy Gambling”.

COSCO SHIPPING Holdings believes that although the growth of container shipping demand faces certain challenges, in the long run, the global GDP is expected to maintain positive growth, and most of the containers loaded are products and commodities that are indispensable for the production of enterprises and the lives of residents. , so container shipping demand will remain resilient with global GDP growth.

As of September 30, 2022, COSCO SHIPPING Holdings has 503 self-operated container ships, approximately 2.91 million TEUs. The fleet size continues to rank first in the industry, and its capacity ranks fourth in the world.

From another perspective, it is also necessary to build new ships.

From January 2023, the carbon emission intensity regulatory index CII rules will be implemented, directly requiring a 5% reduction in carbon emissions, and then continuing to reduce by 2% each year on the basis of the previous year. It is difficult for old ships to meet the standard. As the indicators continue to tighten, dismantling is the only ending. At that time, there will be no ships available, which will shake the foundation of shipping.

According to the information disclosed by COSCO SHIPPING Holdings, the 12 ships ordered this time all adopt advanced green methanol dual-fuel technology, which caters to the industry’s green and low-carbon development trend, optimizes the fleet structure, and ensures the advantages of transportation capacity.

In addition, COSCO SHIPPING Holdings is also vigorously increasing the weight of two important domestic ports to hedge the risks brought about by the container transportation cycle.

According to the announcement on October 28, COSCO SHIPPING Holdings and COSCO SHIPPING Group signed the “Share Transfer Agreement of SIPG”, and COSCO SHIPPING Group transferred its 3.476 billion shares of SIPG (accounting for 14.93% of the total share capital of SIPG) Transferred to COSCO SHIPPING Holdings at a transaction price of RMB 18.944 billion; COSCO SHIPPING Holdings and COSCO Group signed the “Guangzhou Port Share Transfer Agreement”, and COSCO Group will transfer its 244 million shares of Guangzhou Port (accounting for 3.24% of the total share capital of Guangzhou Port) %) to COSCO SHIPPING Holdings at a transaction price of RMB 779 million.

SIPG is the largest listed port company in my country and one of the largest port companies in the world. The container throughput of its home port has ranked first in the world for twelve consecutive years since 2010. The port of Guangzhou Port is one of the largest comprehensive main hub ports and container trunk ports in South my country, and its cargo throughput and container throughput also rank among the top in the world.

The port is also one of the main businesses of COSCO SHIPPING Holdings. In the first half of 2022, COSCO SHIPPING Holdings’ terminal business revenue reached 4.616 billion yuan. Its COSCO SHIPPING Ports has invested in 46 terminals in 37 ports around the world, operating 367 berths, including 220 container berths, with a total target annual processing capacity of 1.41 million standard boxes.

According to a report released by Drewry, a shipping consultancy, COSCO SHIPPING Ports currently ranks second in the world among global container operators. Now with the support of Shanghai Port and Guangzhou Port, the terminal business of COSCO SHIPPING Holdings will be even more powerful.

COSCO SHIPPING Holdings stated that the company will further promote its transformation from “container route operation” to “container full supply chain operation” in the future, and is committed to providing customers with supply chain solutions of “container shipping + port + related logistics services”, so that It further enhanced the company’s anti-risk ability and stabilized the impact of cyclical fluctuations in the industry.

With more than 40 billion yuan in shipbuilding and port purchase, COSCO SHIPPING Holdings, the largest investment in history, can it bet on a more brilliant future? We will wait and see.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-21/doc-imxxkvke3909651.shtml

This site is only for collection, and the copyright belongs to the original author.