At the end of last year, I thought that with the gradual overheating of the US economy and the increase in the global demand for aviation fuel, there should be no doubt that the price of oil would rise above the $100 mark. With the outbreak of the Russian-Ukrainian war in the first quarter, the rapid The price of crude oil was pushed up to around $140, which greatly exceeded the market’s previous expectations for oil prices. The Russo-Ukrainian War has changed the global energy supply and the original pattern of the supply chain, which has had a dramatic and far-reaching impact on global energy prices.

The weak demand for crude oil brought about by the gradual downward trend of the global economy should be expected before. This year, I have basically been talking about the logic of bearish industrial products. Up to now, the big point of view has not changed, but I have to admit that , if you look forward to 23 years, you really need to consider some new changes and logic. Regarding the previous judgment: Due to the insufficient capital expenditure of crude oil, the central oil price is maintained at 60-70 US dollars is something that all parties are willing to see. Therefore, if there are no extreme events (such as economic crisis), this price may still be the benchmark in the future As for the central price level, I still think there is no big problem.

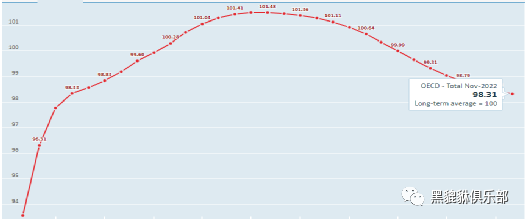

OECD Economic Leading Indicators: Trends in the Global Economy – 23 Years Towards Recession

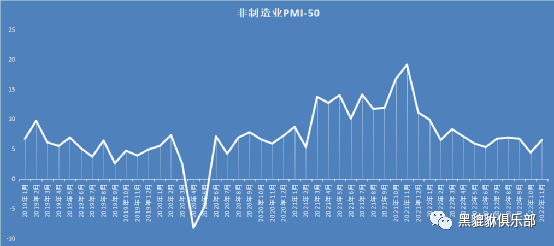

US non-manufacturing PMI: steady decline since the end of last year

The price of crude oil is highly sensitive to global demand. Under the expectation of relatively limited increase in supply (opec+ production cuts and limited increase in shale oil in the United States), global economic expectations are a crucial part of crude oil. . If we look at the leading economic indicators of the OECD, the pressure of the economic downturn will be one of the core variables that cause the weakening of crude oil demand.

The Federal Reserve’s continuous interest rate hikes and the weakening of demand brought about by maintaining interest rates at a high level, as well as some uncertain economic events caused by it, should be one of the core factors affecting oil prices in the first half of 23 years , although China’s economy can Talk about the logic of recovery, but at least until March-April, the pressure is still relatively high. In fact, from this point of view, the logic of copper and oil is very similar, but the oil lags behind.

Some new changes in crude oil:

(1) The European Union, the Group of Seven (G7) and Australia have capped the price of Russian seaborne crude oil at US$60 per barrel; this shows that US$60 is basically a price that “foreigners” can accept.

(2) WTI price is at or below 67-72 US dollars, the Biden administration will replenish the strategic reserves of crude oil, and the release of this part is 180 million barrels;

U.S. Strategic Crude Reserve Repurchase: $67-72

(3) Since the demand for crude oil is highly sensitive to the travel needs of residents, under normal circumstances, the recovery of China’s service consumption and travel in the second half of the year will bring about an increase in demand, which may be due to the general decline overseas In the background, there are few bright spots;

(4) Whether a new round of the European energy crisis will erupt in the second half of next year still faces greater uncertainty. If Russian natural gas still cannot be effectively delivered to Europe, whether it will lead to a new rise in oil and gas prices is still worth careful consideration. considerations.

To simplify things, if crude oil hits a low point in the first half of the year due to various macro events, whether it is 60 or lower, it may be a good opportunity to observe.

$China Petroleum(SH601857)$ $Sinopec(SH600028)$ $CNOOC(00883)$

There are 4 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/6087293231/239114992

This site is only for collection, and the copyright belongs to the original author.