Original link: https://www.hellobtc.com/kp/du/06/3967.html

Author: @shivsakhuja / Huo Huo Yi / Source: Vernacular Blockchain

Author | @shivsakhuja

Produced | Vernacular Blockchain (ID: helloBTC)

DeFi started in 2018, and after a year of dormancy, it emerged in 2019, becoming the recognized first year of DeFi. Subsequently, the sharp increase in on-chain liquidity made 2020 the DeFi Summer, and DeFi has experienced explosive growth since then. But entering this round of bear market, DeFi ushered in a major contraction period.

But no matter what, DeFi, as an important foundation of the Internet of Value, has unlimited future with the development of the industry.

So, when you are participating in DeFi, have you considered how your income comes from? Are there any real revenue streams for DeFi other than pure Pond’s?

Today, I will take you to understand the real source of income of DeFi: “Where does the money come from?”

01

How does DEX/AMM work?

What is a liquidity provider?

About impermanent loss/tool

Uniswap, Sushiswap, TerraSwap, etc. going to CEX are called automatic market makers (AMM: Automated Market Maker). A traditional order exchange (think NYSE) would match buy orders with sell orders to facilitate trades. DEXs work a little differently.

On DEXs, there are generally two types of participants: traders and liquidity providers.

Liquidity providers offer two assets of equal value. (eg, $ETH and $USDC). This “liquidity” provided allows traders to freely and automatically trade between two assets.

The most common DEX types use “constant product” AMMs. The basic formula behind these is: token_a_balance * token_b_balance = k, where k is some constant.

Here’s how it works: Say you offer $500 in $ETH and $500 in $USDC. Now someone buys $50 of ETH with $50 of USDC. The pool will now hold $450 in ETH and $550 in USDC. So the mining pool will automatically adjust the price of the ETH-USDC pair, making $500-$500 appear again.

This is a simplified explanation, but the listing price is automatically adjusted by AMM. As long as there is sufficient liquidity in the pool, this price adjustment is negligible and slippage is not much.

If the pool is too small or the trading volume is too large, “slippage” occurs. This means that the effective price of your trade is worse because the price is driven higher by your trade itself.

Now, you probably know why the price on the DEX deviates from the price on the CEX because it adjusts automatically. Yes, it can – but it usually only lasts for a short time until arbitrageurs come in and profit from the difference.

Example: Suppose the $ETH – $USDC pair is trading at $3800 on UniSwap but $4000 on Coinbase, you can buy on UniSwap and sell on Coinbase. This will eventually lead to the price convergence of DEX and CEX.

-

Of course AMM also has some advantages:

> An easy way to add liquidity to the market

> Especially suitable for new projects

> No need to wait for the counterparty to trade

> Decentralization + self-executing contracts = no middlemen

> can be plugged into smart contracts other protocols

-

The disadvantages of AMM are:

> If the pool size is small, the slippage is high

> Risk of Smart Contract Exploitation

> On-chain transactions increase network congestion (UniSwap is one of the biggest gas hogs on $ETH)

> There is a risk of impermanent loss (impermanent loss refers to the temporary loss caused by market price fluctuations when the liquidity provider (Liquidity Provider) provides liquidity to the fund pool under the operating environment of automated market making (AMM). Impermanence loss. Impermanence loss is caused by price divergence, and when the price returns, impermanence loss will be gradually wiped out.)

For impermanent loss calculation, you can go to the website: https://ift.tt/JnlzkR1 View.

02

The Truth About Liquidity Pool APRs

Why sometimes you don’t really get the high APR that is being touted?

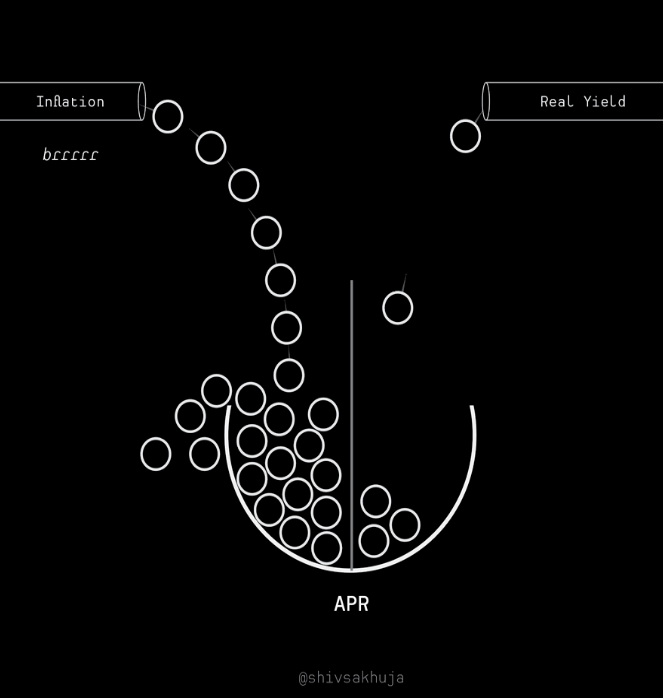

Farms can be very misleading in the way they display APR numbers. The truth is that the APR you actually get when you farm is much lower than the official displayed APR. So why is the APR advertised so high? What are some common pitfalls/tricks here?

Here, please first understand how some liquidity providers usually get rewards. Liquidity providers are rewarded in 2 forms:

-

transaction fee

-

farm incentive

Most of the time, most of the APR comes from farm incentives, not transaction fees.

Let’s understand how APR numbers are calculated. Most DeFi yield farms will pay a fixed amount of tokens (emissions) per pool per day. These are new tokens that are printed and distributed proportionally to farmers holding LP tokens .

See an example. In order to incentivize the liquidity providers of the $ETH/$BTC pool, the Farm X platform promises to reward 1,000 LPs of X from the X platform every day. Suppose there is $100,000 of liquidity in the pool and you provide $1,000 of liquidity. You now own 1% of the pool.

So you receive a 1% reward (10 X per day for X platforms). Currently, 1 X platform X = $1, which means you receive $10 per day. On an annual basis, this would be 365% APR. That means you should be making $3,650 a year, but the truth is, that good thing doesn’t exist.

The actual APR depends on:

-

How many farm tokens are issued every day

-

The price of issuing farm tokens

-

How many dollars are in the pool (TVL)

-

How much transaction fees are generated by the pool

This is why you don’t actually get 365% APR because:

1. Emissions decrease over time: Farms tend to incentivize pools earlier.

2. The price of the X platform will drop over time: most farm tokens have no utility and are constantly being sold.

example chart

example chart

If it’s a popular farm or the rewards are high for a period of time, the TVL may increase, diluting your share of the pool.

Obviously, there are exceptions to all of these. Some farms have designed smarter token economics to prevent or reduce ongoing dumping. But even then, unless the farm token has some real utility, it will be hard to stop the price from falling.

If inflation tokens do not have a strong demand driver, prices are bound to fall. The only question is how fast. So what can you do with this information?

Here are some practical farming tips:

1. Understand token economics. If you get paid with cheap farm tokens , sell them as often as possible .

2. Or use an automatic compounder such as beefyfinance to automatically sell rewards.

Don’t be bound by the attractive yield of farm tokens: most farms will pay a higher APR to provide liquidity on farm tokens. (Example: ETH/X on X platform) In my experience, APR is almost never enough to make up for a price drop.

Another sneaky thing I’ve seen some farms do is show the 7 day average instead of the current APR (opaque). Remember to check how much you’ve earned after 24 hours and how it matches your expected daily earnings. Not surprisingly, it is usually lower.

Another sneaky thing : they might advertise APY instead of APR. Since rates are transient, APY numbers are very misleading. The difference between APR and APY is especially important for higher numbers. 1% per day = 365% APR = 3,678% APR.

Finally, don’t forget impermanent loss (IL) when choosing a pool. Be careful when pairing 2 tokens with low correlation or large market cap difference.

03

How to tell if DeFi has real income

Lenders, pledgers and some other liquidity providers deposit their tokens from the DeFi protocol to receive the corresponding percentage reward APR (Annual Percentage Rate). But where do these yields and promised APRs really come from?

Many projects are built on unsustainable Ponzi economics backed by inflationary tokens. It is important to identify whether the project has a real source of income, because only sustainable income, as the token holder (ie – you) can get a steady stream of income.

Here are some metrics for judging whether DeFi has real revenue:

• LP’s transaction fees

• Transaction fees for services

• Agreement fees (including option fees/insurance fees, etc.)

• Borrower Interest

Next, let’s take a closer look at what these four indicators are worth.

-

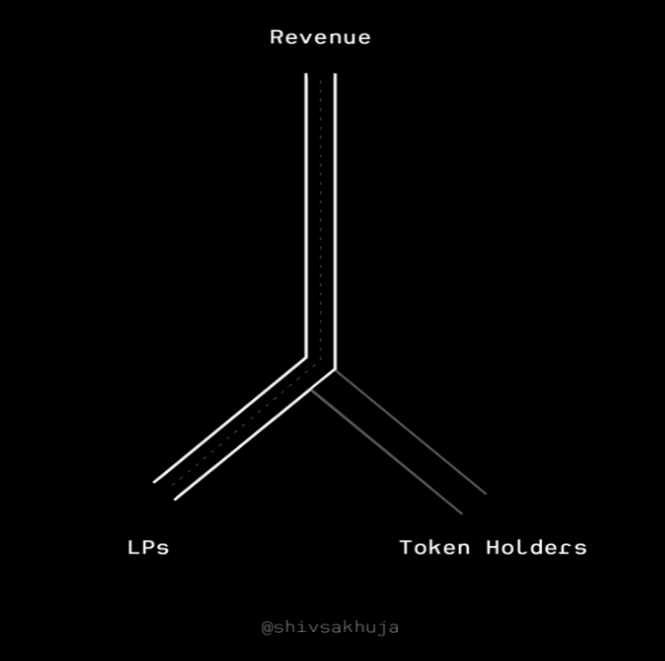

LP’s transaction fees

The fee a trader pays for an asset transaction. These fees go to those who provide liquidity (ie LP: liquidity providers abbreviation).

LPs earn APR by:

> Incentive rewards (unsustainable)

> Transaction fees (actually incurred)

A lot of APR comes from the Incentive Rewards section. These rewards are earned through token inflation and are not sustainable. Because there is no external income to support these awards.

-

Service transaction fee

Transaction fees are the real income.

Users pay transaction fees for services provided by LPs. Some other DEXs on the X platform charge a 0.3% transaction fee. Uniswap transaction fees are between 0.01% and 1%.

Note that in Uniswap’s case, none of these earnings belong to $UNI holders. All of these are distributed to LPs. So even though Uniswap has processed over a trillion dollars in transaction volume, none of the fees belong to UNI Token holders.

Key takeaway: Income is important, and the ultimate goal of what you’ll be looking for tokens is to add value from those incomes. For example: by assigning to the holder or Token destruction

-

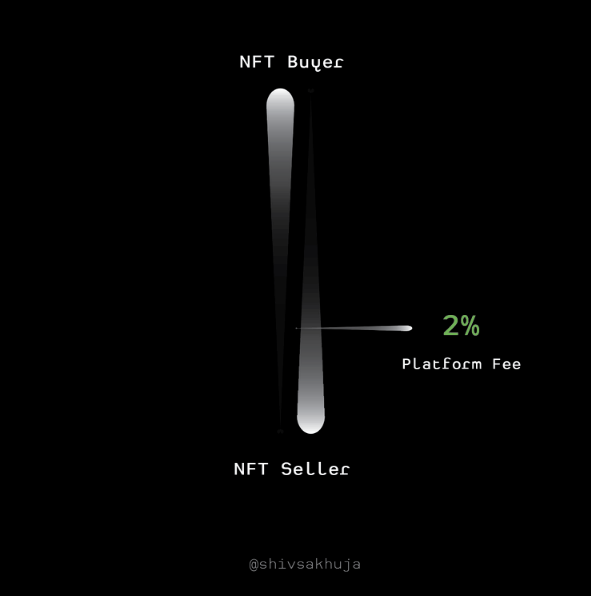

agreement fee

Agreement Fees These are fees paid to the Agreement to obtain the services provided by the Agreement.

Example:

> Bridge Fees: Bridges transfer funds from one chain to another and charge users a fee for this service.

> Fund management fee : iearnfinance’s yVault charges a 20% performance fee and a 2% management fee for the services of managing funds. (same as hedge funds)

> Platform management fees for NFT marketplaces : For example, LooksRareNFT matches sellers and buyers and facilitates transactions. LooksRare takes a 2% platform fee from every NFT sale (excluding private sales)

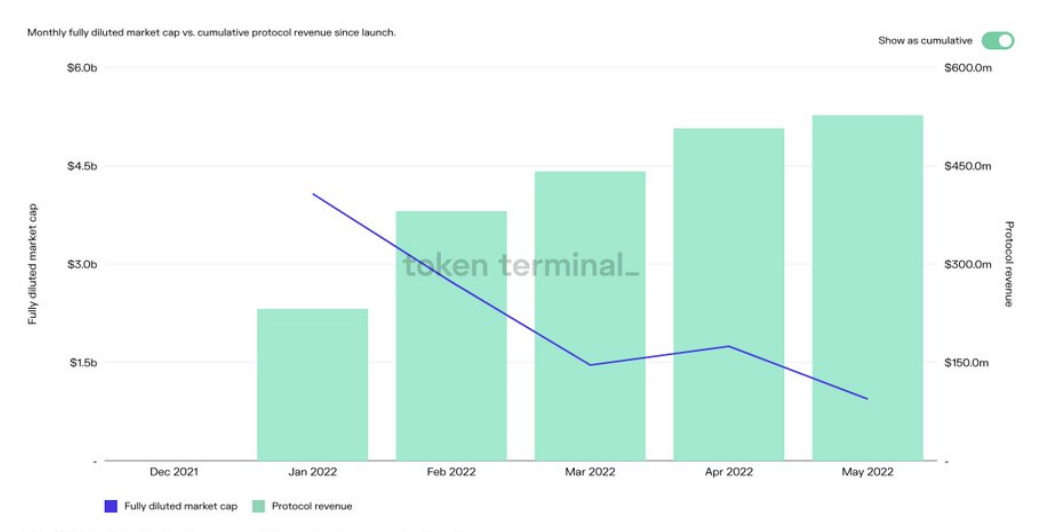

LooksRareNFT has generated over $500 million in revenue since its launch earlier this year. This is the real money people pay for platform services.

You can view related data in tokenterminal

-

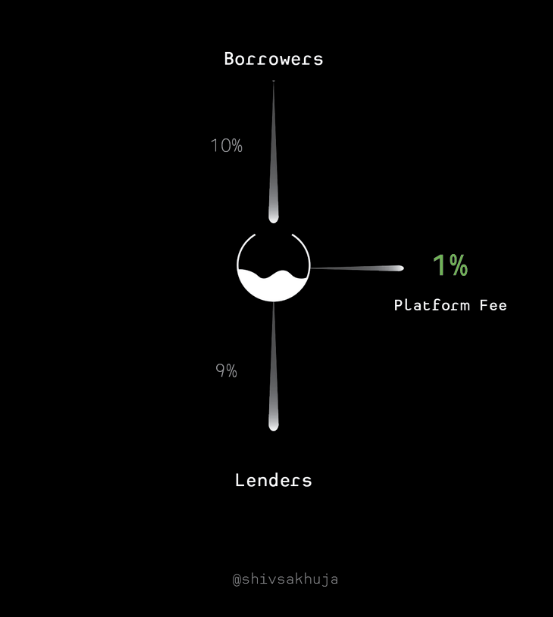

Borrowings

The borrower’s interest is also real income, although much of it goes to the lender.

Actual USD retained by the protocol and shared with token holders = interest paid by borrower – interest paid to lender

05

negative example

Now, let’s look at an example of a protocol with no truly sustainable income. Here are some sources of unsustainable returns in DeFi, as well as some common pitfalls you can fall into when evaluating protocols.

-

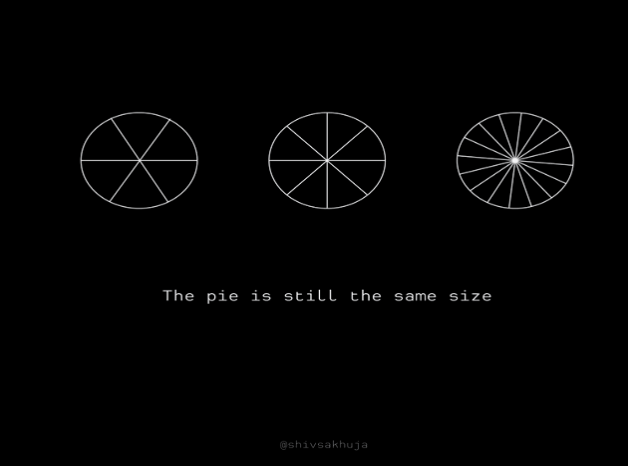

About the inflation rate

Which pizza is bigger in the picture above? Is it a 6-slice pizza or a 10-slice pizza?

Neither – it’s the same bloody pizza. Just split into more slices.

Example of Inflationary Benefit 1: Incentive Farming Rewards in LP

Farming rewards are just tokens printed and distributed at the expense of inflation. Rewards for new tokens issued are not “real” earnings.

You can make dollars from them by planting and short-term dumping, but they are not a real or sustainable source of yield. If you farm for inflationary token rewards, make sure you have a strategy for earning rewards.

Example 2 of inflation rate: Inflation pledge rate The average supply inflation rate of the top 25 PoS tokens is about 8%.

Staking income comes from:

• New Token issuance (supply inflation)

• Transaction fees (actual)

-

See why it’s so hard to determine how much you actually earn?

Unknown Fees – Fees can be both off-chain and on-chain, making it difficult to assess cash flow. Income alone doesn’t give you a complete picture of where your money is going. Think about it a little more and you’ll see that it’s just a number.

Imagine trying to value a business based solely on revenue without knowing its expenses. WeWork generates billions of dollars in revenue every year – that sounds great! …but you find that it costs more revenue each year, which means the company is losing money every year.

What you should be figuring out is how much value of the revenue goes to the token. In most protocols, a portion of the revenue is returned to token holders. Protocol revenue that goes back to token holders is almost like dividends paid to stockholders.

Unsustainable Income – Some sources of income are unsustainable. Example: Anchor used inflationary incentives to subsidize borrowing to attract more borrower demand.

Interest rates fluctuate – there may be a time when you can actually get paid for borrowing. Borrowers have to pay 20%, but they also receive 27% as an incentive reward in ANC Token.

Great for borrowers, but less so for ANC Token holders. When these rewards dry up: → Borrowing demand plummets ↓ → Income plummets↓

There are also some other judgment criteria, such as whether the income is completely dependent on new token buyers; if the protocol can operate normally without rewarding tokens , etc.

06

summary

Bear markets in general are also a good thing for DeFi, a catalyst for it to mature, allowing the really valuable things to survive.

But for your previous DeFi investments, what pits have you stepped on? Welcome to the comment area for interactive communication~

Original title: “Where is the money coming from?” The MOST important question in DeFi that most investors don’t ask..

Original link: https://twitter.com/shivsakhuja/status/1530712622374342658

Author: @shivsakhuja

Compilation: Fire

END

This article is reprinted from: https://www.hellobtc.com/kp/du/06/3967.html

This site is for inclusion only, and the copyright belongs to the original author.