A friend in the backstage asked me: “The fund managed by Xie Zhiyu is too large. Since you think that the large scale will affect the difficulty of obtaining excess returns, why don’t you know how to combine actions and replace Xie Zhiyu?”

At present, I hold 3 funds managed by Xie Zhiyu (participating in), Xingquan Herun, Xingquan Heyi and Xingquan Trend. Among them, Xingquan Trend has been held for the longest time and has been held since the end of 2017. Xingquan Herun and Xingquan Heyi have been held since March and April 2020.

In all fairness, I have always placed the position of “center forward” (both offensive and defensive) in the Xingquan trend. I am quite satisfied with Dong Chengfei’s era. The second and third quarterly reports for 2021 show that Xingquan Trend has significantly reduced its equity position to 63-65%, reserved a large amount of cash in its hands, and its defensive status is clear at a glance.

Unexpectedly, after Dong Chengfei left, Xingquan Trend increased the equity position to 85% in a short period of time. I realized that once the fund manager changes, the investment style of the entire fund must also change. That is to say, Xingquan Trend It may have changed from the original stable style to a more aggressive offensive style. Due to the needs of different style configurations, I reduced the original proportion of Xingquan Trend from about 12% to about 6% of the positions, of which about 3% of the positions were converted to Hang Seng Internet in mid-March 2022.

On the other hand, Xingquan Herun and Xingquan Heyi have kept holding positions of about 5% each, without any conversion.

In fact, although the funds of Xingquan Herun and Xingquan Heyi are relatively large, and Xingquan Heyi even raised more than 30 billion yuan in early 2018, the performance of the two funds in 2019 and 2020 is still good. Xingquan Herun’s similar rankings are all in the top 25% of the excellent level, while Xingquan Heyi has achieved the top 50% of good and the top 25% of excellent levels.

In 2021, the performance of the two funds will be slightly different. Xingquan Herun is still at a “good” level, while Xingquan Heyi is a little worse, at the bottom 25% of the “poor” level. The reason is also very clear, mainly because of Xingquan Heyi’s allocation Part of the Hong Kong stocks, and the poor performance of Hong Kong stocks in 2021 is caused.

Xie Zhiyu was scolded the most, of course, in 2022. During this period, the performance rankings of Xingquan Herun and Xingquan Heyi once fell to the level of “poor”. In the top 75% of the “average” level, Xingquan Herun’s 2022 annual performance ranks in the top 57.44% of the same category, and Xingquan Heyi and Xingquan Trends rank in the top 64.56% and 74.65%, respectively. It does not seem to be so “scumbag” .

I have not adjusted the position ratio of Xingquan Herun and Xingquan Heyi. One of the reasons is that Xie Zhiyu’s turnover rate is not high. Taking Xingquan Herun as an example, the turnover rate has been at 100-100 since 2018. The low level of about 120%, which is slightly higher than that of index funds, shows that Xie Zhiyu does not mainly rely on trading but on stock selection to obtain excess returns.

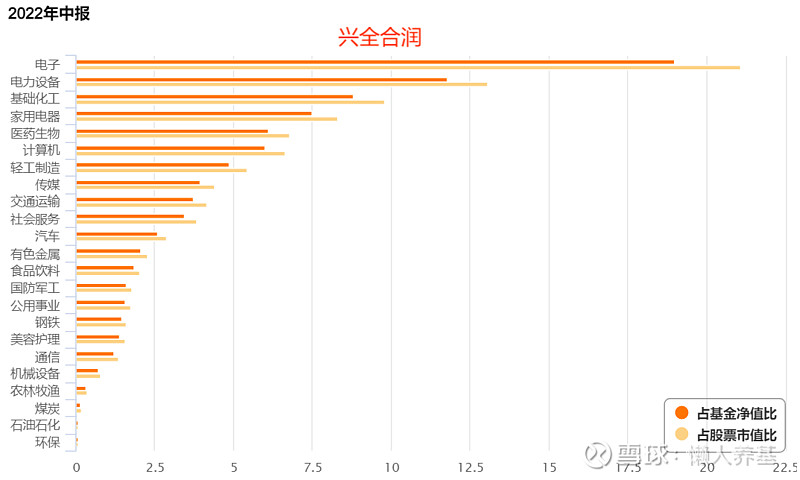

In addition, Xie Zhiyu’s industry allocation is relatively balanced. Shenwan’s 28 first-tier industries are usually allocated to about 20. Such a scattered industry allocation is actually unlikely to exist. Because the fund is too large, there is no stock to choose from. The restriction of scale on Xie Zhiyu’s excess returns should be relatively small.

Unlike high-frequency trading funds, which have higher uncertainties, low-turnover funds usually have a relatively stable need for mean reversion due to their relatively stable holdings. Taking Xingquan Herun as an example, it also fell to “average” in 2018 level, but returned to the “excellent” level in 2019. Therefore, I still have the expectation of “reversion to the mean” for the funds managed by Xie Zhiyu. Their backward hope in 2022 is to “gather energy” for the subsequent take-off.

Of course, the reason why I can have such a “tolerance” is largely because I treat every fund manager as an allocation tool with the idea of spreading the pie, and the funds managed by Xie Zhiyu account for the proportion of my holdings. It’s only about 16%. If Xingquan Trend is actually managed by Dong Li, then the fund managed by Xie Zhiyu accounts for less than 10% of my holdings. Only such a low holding percentage can allow me to let go of every fund manager , Each fund to “toss”, to observe them from a longer-term perspective.

With more and more funds I have a deep understanding of, I will most likely allocate more funds in the future, thereby reducing the proportion of each fund’s holdings, so that the short-term rise and fall of each fund will be less likely to affect my entire Fluctuations in the net value of positions are more conducive to long-term holdings and ultimately long-term profits.

All opinions and funds involved in this article do not constitute investment advice, but a true record of my own thinking and practice, and invest in the market based on this, at your own risk.

@雪球创作者中心@今日话话@雪球fund@ ETF Star Push Official

$Xingquan Herun Mix(F163406)$ $Xingquan Heyi Mix(LOF)A(F163417)$ $Xingquan Trend LOF(SZ163402)$

This article was first published by Lazy Raising Foundation , and the copyright belongs to the author. Reprinting without permission is strictly prohibited. Friends are welcome to forward Moments.

For more past articles, please click:

【Catalogue of Lazy People’s Foundation Snowball Column】

There are 26 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/2356382715/240030106

This site is only for collection, and the copyright belongs to the original author.