Original link: https://www.hellobtc.com/kp/du/05/3948.html

Author: Five Fireball Leader / Source: Vernacular Blockchain

Author | Five Fireball Leaders

Produced | Vernacular Blockchain (ID: helloBTC)

Before you know it, 2022 is almost half over~

If everyone is still struggling in the first half of the year, is it a callback that the bull market has not ended, or is it a sign that the bear market has already arrived? The Luna crash event directly made the entire market reach a consensus: we are bears, and we have been bears for a long time!

There is a jargon in the industry, learn more in a bear market. Since it is already a bear, don’t care too much about the market, don’t do too much operations, concentrate on learning, and prepare for the next bull market.

You must know that almost all good projects are invested in the bear market. This is what “bear market sows, bull market harvest “.

Learning starts with a simple review of an industry.

01

Global Regulatory Level

From a policy perspective, we have always been in a bull market.

After all, the blockchain is moving out of the circle step by step, and step by step, more people’s consensus is achieved.

The major events at the policy level in the first half of the year are at least these:

1. After El Salvador, Bitcoin has also become legal tender in the Central African Republic, and Panama is meeting to discuss and hopefully become a third country.

2. Biden signed an executive order on digital assets, and Nasdaq considered offering services to cryptocurrencies.

3. Goldman Sachs provided the first bitcoin-backed loan, Fidelity plans to use bitcoin as an option for 401K plan accounts (pension) this year, and Bently University accepts Ethereum and USDC for tuition payments.

4. Banco Galicia, the largest private bank in Argentina, began to support users to buy ETH, BTC, USDC.

Well, basically all major events are positive. The only negative event that can be thought of is that after the Luna crash, U.S. Treasury Secretary Yellen directly named UST at the Capitol Hill meeting. Everyone speculated that stricter regulation of stablecoins is coming soon. !

Of course, when it comes to supervision, the benevolent sees the benevolence and the wise sees the wisdom, and it looks like a bad thing, but there is nothing wrong with you understanding it as a good thing.

02

Public chain and cross-chain bridge

2021 is the world of the Alt L1.

The first half of 2022 will be the rise of ETH L2 and the popularity of the term “modular public chain” .

There hasn’t been much to behold on the Alt L1 over the past few months. On the L2 side, Arbitrum and Optimism have grown steadily since the launch in the second half of last year. There are more and more TVL and high-quality projects, and they are more and more likely to compete with Alt L1. Recently, Starkware and Zk-sync have also been active frequently. I believe that in the second half of the year, we will see the launch of two Zk-rollup ace players. From 2022 to 2023, I believe it is the era of ZK and OP fighting Alt L1.

On the Cosmos side, the project Celestia detonated the word modular public chain by abstracting the DA (data availability) layer, making the original L1 (settlement + data availability) + L2 (execution) further extended to L1 settlement, DA data availability, Three-tier modular structure implemented by L2. Of course, the project has not been launched yet. This three-tier structure needs to be tested by the market before it can be determined whether it is the standard of the future “modular” public chain. Originally, Cosmos went smoothly in the first half of the year. Interchain Account (cross-chain contract-level interoperability) and Interchain Security (shared security) were launched one after another. However, Luna, the first ecosystem in the circle, suffered a thunderstorm and lost the only stable coin in the entire ecosystem, UST. hit hard.

Polkadot’s parachain auction was conducted in an orderly manner, but it obviously lost its popularity after the first few rounds . After all, there are too many options for issuing chains. Cosmos or Avax have much cheaper options, and the requirements for shared security are not so high. , or a team with insufficient financial resources, competing for slot auctions is often a waste of money.

The launch of AVAX’s first sub-network, DFK Chain, is a landmark event for Appchain and modular public chains. It also allows Avax to officially enter the three-nation hegemony with Polkadot and Cosmos in the matter of “chaining”. era.

In the first half of the year, Solana’s reputation value dropped significantly due to several downtime events. The latest “bomb” incident has aroused the industry’s overall thinking on the security of this high TPS and ultra-low Gas model.

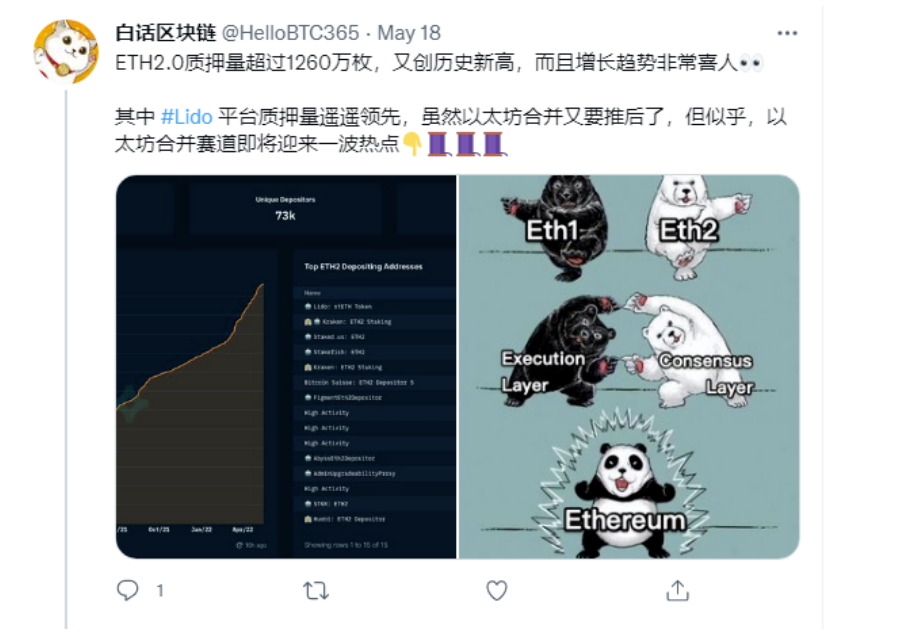

Merge of ETH? Unsurprisingly, the first half of the year was postponed again . At present, August and September are optimistic estimates. However, if it is postponed again until the end of the year, don’t be too surprised…

The competition on the cross-chain bridge is similar to that of the public chain, and it has also entered a fever. After all, the future multi-chain universe is basically a sure thing in people’s minds, and each cross-chain bridge has tried their best to compete for TVL. Last year, it was basically asset cross-chain. Recently, cross-chain protocols based on messages have also begun to appear one by one. Multchain has launched Anycall, Celer has launched Celer IM, IBC has been upgraded to Interchain account, and Polkadot XCM has just been launched last week. There are also Axelar, Zetachain, Teleport and other projects eyeing…

In the next 1-2 years, in addition to watching the public chain chaos, the bridge battle will also be a highlight . The bridges in the first half of the year are basically based on asset bridges, representing Multichain, Synapse, and liquidity with third-party validator models. Celer, Hop of Sex Network, IBC of light client, STG based on LayerZero are new players of ultra-light client. Since last month, Multichain has launched Anycall, Celer has launched Interchain Account in addition to Celer IM, and Polkadot has been activated. XCM… In the future, there are still cross-chain messaging protocols such as Link’s CCIP, Axelar, Zetachain, and Teleport waiting for us. The bridge battle has officially entered the message bridge era from the asset bridge era.

03

Defi and Gamefi

Defi 1.0 actually took the lead from 2021. In the first half of 2022, all the so-called Defi 2.0 projects are still tossing. The word Curve War has also begun to spread because of the stability of various channels, and Crv and Cvx frequently appear in various articles. and on Twitter.

However, first OHM, Time, etc. (3, 3) plummeted, and then Terra crashed. Defi2.0 was almost falsified across the board. It felt that the market began to turn its attention back to the Defi1.0 infrastructure represented by Uniswap, AAVE, and MakerDAO. , although it does not mean that these tokens should rise, but after generally falling by about 90%, the Defi 1.0 blue-chip has obviously entered a relatively good cost-effective stage.

Decentralized derivatives have been favored by people from all walks of life since last year. Last year, Dydx, Perp, etc. also attracted a lot of attention. However, the “Uniswap” era of derivatives that everyone is looking forward to has never arrived. The reason is that Dex derivatives are not Does not inherently provide a differentiated experience with Cex derivatives. Aside from the metaphysical things such as asset self-control and decentralization, Uniswap is not popular because of “on-chain” or “AMM”, but because you can buy a lot of coins on it that Cex can’t buy. To use, and Dex derivatives, obviously can’t do it at present. Of course, it is like the derivatives of long-tail currencies on Uniswap. In theory, Dex derivatives can be done, but it is difficult to do both in terms of depth and flow estimation. After all, derivatives are not spot, which is also the largest Dex derivative at present. predicament. To be honest, I can’t think of a short-term break. In the long run, when more and more people are accustomed to using one wallet to go around the world, and more and more people are used to logging in with Metamask instead of Cex, Dex derivatives will naturally not worry about users, but this is a step-by-step process. The process depends more on the development of the industry, rather than the breakthrough of its own track.

As for liquidity mining, basically high APY has not attracted many people now, and most of them have become fast-running games. When everyone is familiar with the game of Defi and expects others to take over the so-called governance tokens you dug at a high price, it is often yourself who suffers.

The major events in the Defi circle in the first half of the year are basically three things:

AC, the god of Defi, withdraws from the circle;

Curve’s Ve model has become the standard token model of more and more Defi projects;

The stable collapse represented by Terra.

As for Gamefi, it is really lackluster. The leader AXIE has an avalanche of decline in both daily activity and income, not to mention the other so-called Play2Earn. After all, to put it bluntly, Play2Earn’s Gamefi is essentially a liquidity mining in a game coat, and this game is not very fun. Once the popularity of Defi has passed, and everyone knows what they are doing, the next object of transmission is undoubtedly Gamefi.

The only thing worth mentioning is Stepn, which set off a wave of Move2Earn, and even gave birth to various gimmicks such as Watch2Earn, Learn2Earn, Sleep2Earn and so on. Although Stepn can’t get rid of the Ponzi token model, at least in terms of design, operation and other ideas, it has made great progress compared with the first generation of AXIE, and the ability to go out of the circle has also been greatly improved. In addition, the main style of running and fitness has diluted Earn’s style. ingredients, so it became the only Gamefi worth seeing in the first half of the year. As for whether Move2Earn can continue through cooperation outside the circle + Socialfi in the later stage, and not become Pay2Move, we will wait and see in the second half of the year.

04

NFT

Last year, NFT actually had the feeling of a hundred flowers blooming, with various off-chain and on-chain paintings, native paintings on the chain, AI-generated art, abstract art, and so on.

Almost no one cares about these things this year. There is only one main theme this year, that is, JPEG small avatars.

Looking back at the bear market is an incredible thing. Everyone spends tens of thousands or even hundreds of thousands of dollars to buy a JPEG, and all the functions are just used as an avatar (at most, add a pie of the Metaverse drawn behind the avatar… ) In the first half of the year, there are hundreds of new avatars in Mint every day, and now basically the floor price can’t be sold. After more than a year of hype, the NFT that can really be called a blue-chip is nothing more than five Just six.

However, in any case, NFT is completely out of the circle , and it is much more out of the circle than Defi. After all, you need someone who has never been in blockchain to understand Defi, understand mining, and understand APY. It is very difficult, but Punk And monkeys… Isn’t this just monkey tickets and raccoon Water Margin cards! I understand this shit! !

Hopefully, in the second half of the year, we can see NFTs unlock more use cases than just avatars.

The major events of NFT in the first half of the year can almost be counted in one hand:

The launch of LooksRare and X2Y2 challenges Opensea, and the showdown between Web3 and Web2.5;

Coinbase launched the NFT trading market that spent a lot of money on research and development, but basically no one uses it…

The Boring Ape Otherside exploded, burning 50,000 ETH of gas fees. Yuga Lab hinted that it may be its own chain in the future, and currently Avax and Flow have extended olive branches;

ENS short number and letter domain names began to fry, and the 10K club appeared;

JPEGD, BendDao.

It is worth mentioning that I just saw a message two days ago that “Opensea transaction volume has reached the lowest level since December 21, 2021”. Well, the little pictures haven’t really experienced a bear market, so now, their test really comes.

This article is reprinted from: https://www.hellobtc.com/kp/du/05/3948.html

This site is for inclusion only, and the copyright belongs to the original author.