Today we continue to discuss the stock-debt balance of the Shanghai and Shenzhen 300. We find out all the Shanghai and Shenzhen 300 indexes.

Among the more than 100 CSI 300 funds of various types, including enhanced funds, we use such a condition to select, that is, the annual growth rate of this fund must outperform the median of all 300 funds of the year. The result surprised me, because from the beginning of 2018 to December 23, 2022, all the 22 funds with the word “enhanced” with five years of data did not meet the conditions. Instead, two 300LOF funds met the conditions: Penghua 300LOF (160615) and Changsheng Shanghai and Shenzhen 300LOF (160807). Among them, Penghua 300LOF has beaten the median every year for 8 consecutive years since 2016. We choose Penghua Hua 300LOF is the representative of 300.

Debt funds are more sensitive to positive returns. Among the 4,177 bond funds that meet the condition of positive returns for 12 consecutive years, we only found 3 bond funds: Harvest Ultra-short Bond Bond C (070009), Wells Fargo Huili Dingkai (161014), China Merchants Credit Tianli LOF (161713), it stands to reason that it is not difficult for bond funds to maintain positive returns, but the result is less than 1%. Except for the pure short-term debt of Harvest, the other two are hybrid funds, which shows that even a good fund is not necessarily more risky than a pure bond fund even if it is a hybrid fund.

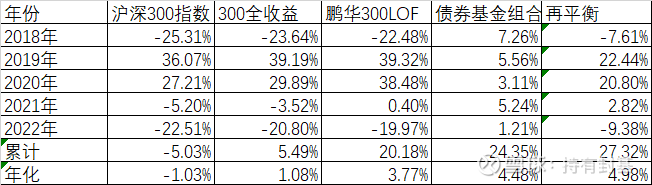

We then calculated the stock-debt balance over the past five years, and found that Penghua 300 LOF is really good. In five years, it not only beat the Shanghai and Shenzhen 300 Index, but also beat the 300 Total Return Index. However, compared with the combination of the three bond funds, it is still a bit worse, and the bond fund combination has reached 24.35% in 5 years. The most surprising thing is that after the annual debt balance, the cumulative yield of 27.32% actually beat the 20.18% of Penghua 300 and the 24.35% of the debt-based portfolio.

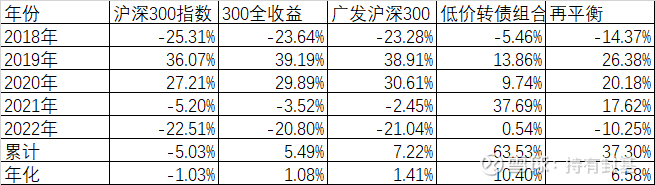

Let’s review the on-site combination of the previous few days (the data has been updated to the latest last Friday):

These two programs have their own advantages and disadvantages. Judging from the cumulative income, the on-market portfolio is still much higher, mainly due to the amazing performance of low-priced convertible bonds, but from the perspective of the retracement, the off-market portfolio is still a little lower.

We can simply calculate the correlation between the two combinations. The correlation of the on-market combination is 31.53%, while the correlation of the off-market combination is -2.25%. One is still positively correlated, and the other is negatively correlated. Of course, the effect of negatively correlated will be better.

But overall, in the volatile market of recent years, even the most conservative low-price strategy convertible bonds performed very well. Of course, it would be a different matter if there was a big bull market for several consecutive years, but I estimate that this possibility is basically impossible even in the next few years.

I started to have a fever from the day before yesterday, and yesterday it reached a maximum of 39 degrees. I started to cough, and my heart rate was over 100, but it was not severe. Today, my body temperature is normal, my blood oxygen level is 98, and my heart rate has returned to 80. I should be considered mild symptoms, thank you for your concern!

There are 33 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/6146592061/238542631

This site is only for collection, and the copyright belongs to the original author.