1. Market review

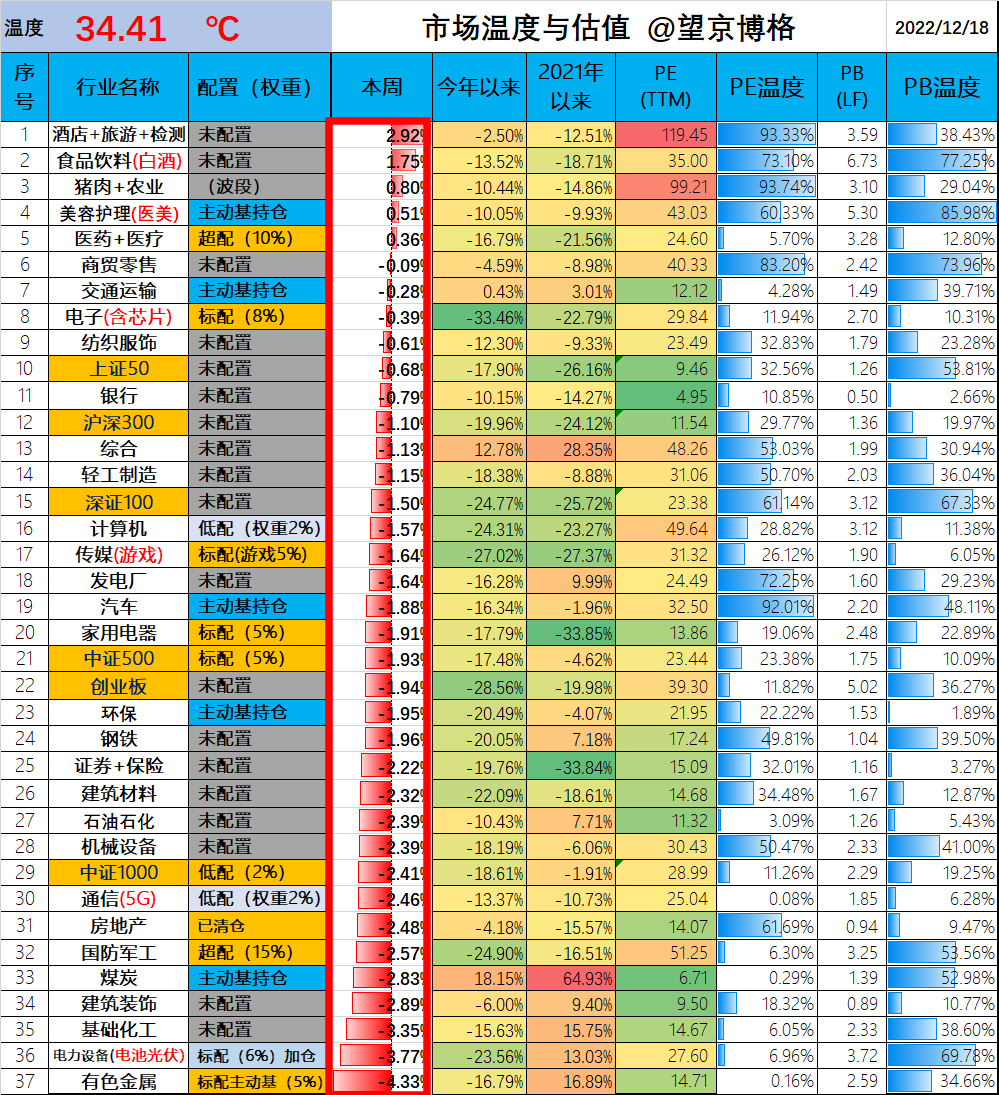

(1) The Shanghai and Shenzhen 300, which represents the large market, -1.10% this week, the CSI 500, which represents the small and medium caps, -1.93% this week, and the CSI 1000 -2.41% this week. It is caused by the rise of stocks with the Chinese prefix. The market lacks hot spots and small and medium-cap stocks continue to pull back. It is expected that the funds held by everyone will also have a high probability of losing money this week.

(2) Hotels + tourism, food and beverage, pork + agriculture, which are the top three in terms of industry growth, are all related to big consumption. After the epidemic, are you optimistic about consumption?

The price-earnings ratio of hotel + tourism is about 120 times, and the valuation level is at a historical high (93.33%). In the past year, it has been repeatedly hyped. Although hotels and tourism are good, the future growth rate has been overdrawn. This sector is Borg. do not participate;

The price-earnings ratio of food and beverage is 35 times, and the valuation level is at a relatively high position (73.10%). Liquor companies represented by Kweichow Moutai are the best consumer companies, and the ROE (return on equity) of the liquor industry has been stable at more than 20% for a long time , such a good industry is difficult to find a second one. Investors who hold liquor can continue to hold it, but Borg himself does not want to buy (without a margin of safety).

Pork (similar to nonferrous metals) is a cyclical industry. The lower the stock price, the higher the price-earnings ratio, and the higher the stock price, the lower the price-earnings ratio, because the profit of this industry mainly depends on the price of pork, and there is a so-called “pig cycle” in the price of pork. The company’s share price has fluctuated drastically. Borg currently holds 8 hamburger breeding ETF connections. Originally doing swings, the result is a current loss of about -2%. It can be regarded as a consumption allocation and continue to hold it. Later, the pork will rise more and will be sold at the right time.

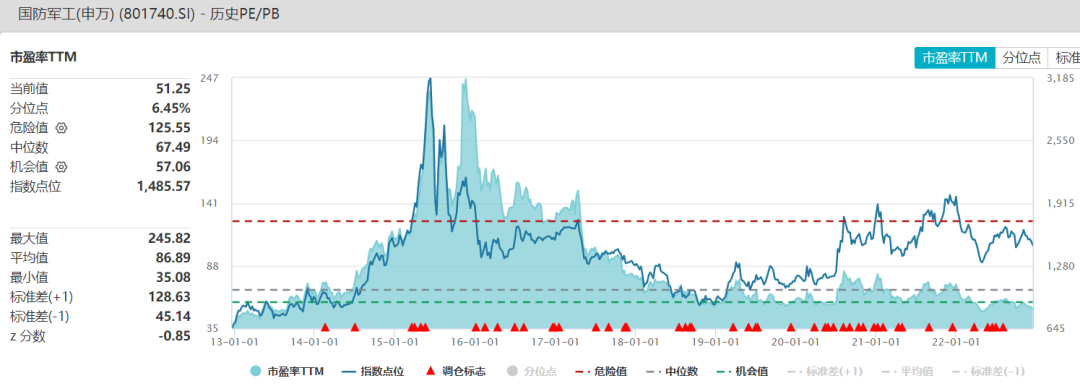

(3) The national defense and military industry has fallen again (-2.57%). Borg has held the military industry since 2018, and now it has been almost four or five years. The profit of the position is about 100%. During this period, the fluctuation of the military industry is much larger than that of other industries.

The current price-earnings ratio of the national defense and military industry is 51 times, which is slightly lower than the valuation in 2018, indicating that the price increase of the national defense and military industry index in the past four or five years is driven by (pure) profits, and everyone seems unwilling to give a higher valuation to the military industry.

A few months ago, some institutions bought a lot of military industry, and recently began to sell it, which shows that no one has yet regarded military industry as a long-term allocation. Borg’s holdings account for the most in the military industry, and those that have been ups and downs all the way before will continue to be held for a long time in the future (not ruled out to reduce their positions slightly during the rise). If you are optimistic about the military industry for a long time, you can adopt a fixed investment model. Regarding the specific target, Borg chooses the military industry active fund (history has proved that active military use is better than the index).

2. Investment opportunities in expanding domestic demand

The three major carriages of the economy are exports, investment and domestic demand.

Especially at the beginning of the epidemic, other countries were greatly affected, and our exports increased significantly. With our advantages in the new energy field, exports continued to be maintained. Everyone expects that the European and American economies will fall into recession in the future, and the United States will support its domestic manufacturing industry, and the growth rate of our exports will decline; investment will not be mentioned, and subways will basically not be built in third-tier cities. The only thing we can rely on is domestic demand.

Domestic demand mainly includes: commercial retail, catering and tourism, real estate, automobiles

(1) Platform economy . This time when Borg had a fever, he could hardly buy some medicine. If he wanted to buy some fruit, it showed insufficient transportation capacity. All districts in Beijing called on citizens to take part-time jobs to “run orders” because there was a real shortage of couriers. Since then, the profession of delivery staff has been upgraded from “noble” to “great” in Borg’s mind.

It has started to support the platform economy again. The Internet economy can not only increase consumption, but also solve employment. Zhonggai Internet has not paid off and continues to hold it.

(2) Catering and tourism , Borg checked the prices of Sanya Spring Festival hotels, and felt that the prices for this Spring Festival were significantly higher than those of the past three years.

I remember last year Borg played in Sanya for two days before the Spring Festival and posted a Weibo, and someone immediately replied: “Those who go to Sanya to play don’t have any serious jobs.” What they mean is that those who have serious jobs will be restricted due to the epidemic. go to the field. There are no restrictions this year… This price is a rocket ship, and the price during the Spring Festival is almost four times the usual price.

Regarding investment, Borg’s valuation table stated that the tourism industry has been hyped several times in the past year, and the valuation is already very high, so we will not participate.

(3) For new energy vehicles, major cities such as Beijing, Shanghai, and Shenzhen have all been approved. This seems to be a restriction on automobile consumption. According to recent news, there will be no restrictions on buying a car in the future, but there will be a fee for the right to use it.

For example, in Beijing, you can buy a car casually without lottery, but you have to pay a toll when you drive out. It costs 20 yuan an hour to drive on the roads inside the second ring road, 15 yuan an hour to drive on the roads inside the third ring road, and 15 yuan an hour to drive on the roads inside the fifth ring road. It costs 10 yuan to drive for an hour.

If the right to use fee is really realized, it will be good for car sales, and the commuting cost for those who drive to work will be greatly increased.

(4) Real estate is also a huge demand for housing, but now housing prices are too expensive, and how to improve the real estate market under the background of not rising housing prices, this blogger has no idea. Compared with optional consumption such as real estate and games and animations, if everyone’s income recovers, their performance should still be good.

In addition to the above, anyone who has experienced “a knife pulling the throat, cement sealing the nose, craniotomy without anesthesia, electric drilling eyeballs, guillotine pulling the waist”, the biggest need is not to eat meat and drink, but to no longer endure these diseases, medical treatment Service should be one of the cores of domestic demand.

Regarding investment in expanding domestic demand:

Borg currently holds medical care, new energy, chips, Hang Seng Technology, Hang Seng Medical, home appliances, games, etc., which are all considered consumption, and there are no new configuration opportunities for consumption. Next, we will look at the specific policy details.

Investment operations this week:

After experiencing the “Dayang flu” in Beijing, from Monday to Friday, I didn’t have much time to watch the market. During the period, there was a plan that was planned to be handed over to the client this week. At that time, I thought , “If you can survive it, then prepare the plan. If you can’t survive it, there is no point in preparing it… “

Don’t drink too much water during the difficult days. One night, I drank seven glasses of white water. After coughing for a while, I felt that my eyes turned black, my brain didn’t move, and it felt like the power had been pulled out. I suddenly realized that drinking too much white water had excessively diluted the salt and sugar in the body. Sit for 30 minutes before replying.

In addition, Hang Seng Technology is still in the process of automatic fixed investment.

In the end, bodies are long-term, and so are investments. Let’s get through it together.

This is the end of this weekly report, pay attention to Wangjing Borg to see the real offer!

There are 9 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/4579887327/238103968

This site is only for collection, and the copyright belongs to the original author.