Welcome to the WeChat subscription number of “Sina Technology”: techsina

Written | Edited by Xiong Xing | Wu Xianzhi

Source: Photon Planet

What Apple has not entered may be a track that is not “mature” enough.

In recent years, the iPhone has always been one shot behind the Android camp, with multiple cameras, full-screen, high-swipe, etc., the lack of innovation and slow “follow-up” actions seem to be gradually changing with the people who “change the world”. Go further away.

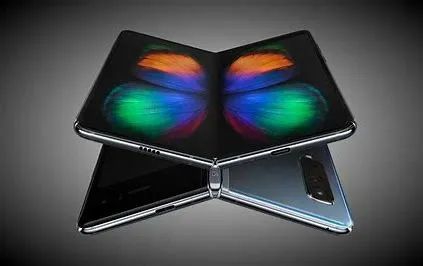

The subversive product of the mobile phone form of the folding screen has been born in the Android camp for two years and has begun to iterate, and there have been significant improvements in the hardware level from crease to hinge life. According to Counterpoint Research data, domestic mobile phone sales in the first half of the year fell by 21.7% year-on-year, returning to the level of seven years ago, but the sales of folding screen mobile phones rose to 1.3 million units, exceeding the whole year of last year.

As the only bright spot in the downward trend of the mobile phone market, the folding screen has become a “high” springboard for domestic manufacturers. After Huawei, most of the new mass-produced models have lowered the price to less than 10,000 yuan. In terms of price, it already has a high degree of overlap with the iPhone, and the latter has not yet followed up with foldable products.

If there is no accident, the current folding screen is still not enough to impress Apple, which is indeed in line with its practice.

Apple is waiting for the “thousand yuan machine”?

Apple remains on the sidelines until the mainstream takes hold, and Android makers are testing the waters to find the mainstream.

In May 2019, the OnePlus 7P was launched with a 90Hz high-brush screen. After that, Huawei and Rongmi OV’s high-brush products were launched one after another. It was not until two years later that the iPhone 13Pro added high-brush.

Once the high-brush screen was launched, it had a high degree of maturity and reliability, and the OnePlus 7P screen still has a stable performance so far. Although fragmentation has increased the difficulty of Android software adaptation, after three years, the sense of fragmentation in the experience has almost been eliminated. Relatively speaking, the self-contained iOS has a more unified appeal, and waiting for two years, in addition to Apple’s high requirements for the supply chain, and cost concerns.

With the decline of supply chain costs, high-speed brushes have been devolved from Android flagships to thousand-yuan phones, and the iPhone has finally followed suit. According to the dismantling analysis of iFixit, the hardware BOM cost of the iPhone 13 Pro has risen from $548.5 to $570 compared to the 12Pro, an increase of only 4%, and includes inflation and A15 iterations, and the proportion of high brush costs will only be less.

At present, the main cost of the folding screen lies in the screen and hinge. According to the cost of the vivo X Fold hinge exceeding 1,200 yuan, it accounts for about 13% of its starting price, and its hinge supplier, Amphenol Feifeng Communication, is also a fruit chain. As early as January 2018, Apple submitted its folding screen patent application in the United States and was approved the following year, but in 2022, when the second-generation folding screen products are frequently launched, the cost is obviously the primary issue.

It is not nonsense that the iteration of the iPhone in recent years has been jokingly called “paying for the money”. The “hysteresis” in the product is due to the change of industry status. The iPhone 4 became the single model with the highest sales volume in the world in 2010. Since 2012, the overall sales volume of the iPhone has been stable in the top three in the world, and it has maintained its position as the champion of the global high-end mobile phone market share all the year round. This year The second quarter accounted for 80% of global mobile phone profits.

Apple has the capital to “wait and wait”. Under the changing situation of offense and defense, the exclusive iOS ecosystem and iTunes are the core competitiveness. Apple’s hardware can secure the majority of profits in the high-end market with only “daily updates”, and there is no “radical” in the form of new products. “Rising demand.

Domestic manufacturers have the opposite situation, and the degree is slightly different. Although the current cost of folding screens is about 150-250 US dollars, the fastest ASP drop to civilians will be 2023, and it is also necessary to change and establish a high-end image early. For Apple, which tends to be conservative, referring to its high-screen “late”, the time when the folding iPhone will be launched may depend on when the mainstream domestic manufacturers will launch the thousand-yuan folding machine.

This is not realistic. According to the plan of reducing the whole machine configuration to 100 yuan machine, the cost space is freed up to cater for the folding screen, which will inevitably lead to a significant reduction in the experience of hinge life, screen quality, and insufficient performance. However, subject to the constraints of high supply chain costs and generally rising demand, domestic manufacturers can only bind folding screens to flagships, and at the same time, it is difficult to quickly move the volume, and the promotion of large-scale cost reduction is slow.

On the one hand, the cost cannot be quickly reduced. On the other hand, consumer experience believes that new technologies still have room for sinking and more mature solutions, and the folding screen has not yet reached the inflection point.

According to data from CINNO Research, the cumulative sales volume of domestic folding screen mobile phones in the first half of the year was 1.3 million units, although it exceeded that of the whole year of last year, but only 9/1000 of the total 136 million units. Analysts estimate that the domestic sales of folding screen mobile phones will be close to 4 million units this year. Based on this data, it is difficult to break 2%.

Counterpoint Research’s estimate was 1.2%. The high price of folding screen mobile phones is the main reason for the difficulty in penetration. Last year, the global mobile phone sales in Q4 fell by 6% year-on-year, while the domestic year-on-year decline reached 11%. According to iiMedia Research, the global average price of smartphones is 2,061 yuan. Folding screens that cost 10,000 yuan are more expensive at this node.

IDC data shows that in Q1 this year, iOS accounted for 71.3% of the market share of mobile phones over US$600, and 69.5% in Q2. “Weak Q2” stems from the wait-and-see market caused by Apple’s timely release of new phones in Q3 over the years. The two generations of folding screen mobile phones have not broken the market structure of the iPhone in high-end mobile phones.

The difference between 14 and 14Pro once again gave the Android camp a chance to counterattack with folding screens.

With a market share of less than 2% and a yield rate of about 50%, there is no reason for the supply chain to increase production, and the process of scale effect and cost reduction can only follow step by step in the market downturn. Although it is a window period before Apple enters the market, it is difficult for domestic manufacturers to bring the price of folding screen models to the price of 3,000-5,000 yuan of previous flagship products in the short term. The market trend is down. In the first half of the year, the sales of 100 million iPhone units fell by 2.9% year-on-year. The price of folding screens around 10,000 yuan is more “sensitive” and a bit “untimely.”

If the market trend continues to decline, the iPhone folding screen will be delayed, and it may still have to wait for a mature opportunity for Apple.

In other words, before Apple “folded”, the Android camp itself gave up the high-end.

High-priced “contradiction”

Since the fourth quarter of last year, the sales of folding screen mobile phones have grown against the trend, releasing a positive signal: the upside of domestic manufacturers has found the right direction.

This year, domestic manufacturers have successively launched their own second-generation folding screen products, with obvious optimizations in hinge, screen, and thickness, and the software adaptation at the system level tends to be perfect, which is one of the factors that bucked the trend of folding screen sales. However, the adaptation of third-party software is mixed, not only because the number of users is low, but also because the manufacturers are still in the tentative stage.

Judging from the domestic market share of various folding screen models in the first half of the year, Huawei took the top three: P50 Pocket won the championship with 21.5%, Mate X2 and Mate Xs ranked second and third, Samsung Galaxy Z Flip3 fourth, Z Fold3 ninth. It is not difficult to see that the sales volume of vertical folding screen mobile phones of the same brand is better than that of horizontal folding screens.

In terms of function, the two seem to have different tendencies: vertical portability, horizontal entertainment and office. However, the actual need for alignment is worth exploring. For example, vivo X Fold+, the body length is 162.01mm, the unfolded width is 144.87mm, and the screen unfolding ratio is close to 16:14, while the commonly used movie screen ratio is 16:9, which is closer to the screen ratio of the current candy bar flagship. In other words, in the movie and long video scenes, the increase in the “realized area” after the horizontal folding screen is unfolded is not obvious, but the “shared area” is more intuitive.

Behind the “chicken rib” attribute is the price close to 10,000 yuan, which makes it difficult for consumers to have a choice mentality of “what kind of bicycle do you want at this price”.

To solve this problem, vivo needs to control the folding width to about 45mm, but the screen ratio after folding is 16:4, and the “stick screen” obviously completely abandons the use scene after folding, which is unrealistic. This is the dilemma of horizontal folding screens, and there is a temporary disconnect between the product form and user needs.

At present, the vertical folding screen mobile phone just avoids this short board, and its portability is also a major factor that is more popular in the market. Although the three-dimensional and weight differences are not much different from those of the candy bar flagship, the folded size is only half of what current users are used to. The horizontal folding screen generally has a weight of more than 250G and a thickness of more than ten millimeters after folding, which is the current extreme.

This is still not friendly enough for users who pursue portability, and even more “weight” than the past candy bar flagships.

As far as manufacturer positioning is concerned, horizontal folding screens focus on male users and vertical focus on women. Data from iResearch shows that 44.7% of users of vertical folding screens are male users, and 45% of users of horizontal folding screens are female users. Manufacturers do not have a clear customer base for their “horizontal and vertical” positioning, and the product form is still facing the market. Debugging during the inspection will undoubtedly increase the difficulty of third-party software adaptation, which is not conducive to the ecological maturity of the folding screen.

In general, folding screen mobile phones still need market debugging in terms of the contradiction between user needs and their own form. Growth against the trend has allowed manufacturers to see the hope of a higher brand. Except for Huawei, other domestic manufacturers have successfully touched the price of around 10,000 yuan with folding screens. However, they still cannot avoid the “deconstruction thinking” of the market: why not mobile phones + tablets, and Is it a folding screen?

The price is very intuitive. The starting price of Xiaomi Mi 12S Ultra is 5999 yuan, and the starting price of Xiaomi Mi Pad 5Pro is now 2799 yuan, which is a total of 8798 yuan. However, the starting price of its MIX Fold 2 is 8999 yuan, “the price is upside down”. OV also has a similar situation, and it is still unavoidable that the market has two ideas.

The ability to own a flagship phone and a tablet at the same brand cost less, which means that in terms of computing power, battery life, storage, etc., it has nearly double the advantages of a single folding screen phone, and the latter has two main advantages. All-in-one portable. The problem of “price inversion” will indeed affect the final choice of some buyers.

In addition to industry problems, the “upside-down price” of folding screens also reflects the overall conservative pricing among domestic manufacturers’ products. This still needs to be alleviated by brand rushing, but the rushing is obviously not just a price increase.

The analysis result given by iResearch is that “users with horizontal folding screens are more inclined to technology, and users with vertical folding screens are more inclined to fashion”. This reflects what folding screen users have in common: freshness. However, after the novelty, manufacturers still need relatively rational product prices and a mature folding ecosystem to retain users.

write at the end

At present, scroll, pull-out, and wrap-around screens are also the research directions of manufacturers. Similar to the folding screen, they are all attempts to expand the screen of the candy bar phone after reaching the limit. Whether it is product form or functional experience, the current mobile phone market has started a new round of innovation.

This year, various second-generation folding screen products have appeared one after another. Many data consulting companies are optimistic about the development trend of folding screen mobile phones as a whole. It seems that it is only a short time before folding screen mobile phones mature. The period of no “fruit” will eventually come to an end. After the brand’s high demand is released, whether domestic manufacturers can find the core point in key technologies such as hinges, and the formation of inescapable patent barriers are equally important.

After all, domestic manufacturers that have developed new technologies such as multi-camera, full-screen, and high-speed refresh have not hindered Apple’s follow-up. After Huawei, no manufacturer can directly threaten Apple’s high-end market share. .

The “attacked” iPhone has changed the world, but it is not good for the development of the industry to keep winning. Apple, Android, Hongmeng, and many camps are blooming to get out of the current dilemma of the same mobile phones and sweep away the market downturn.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-10-21/doc-imqmmthc1691996.shtml

This site is for inclusion only, and the copyright belongs to the original author.