After two sharp falls in 2022, the risks in the A-share market have been fully released. Stabilizing growth in 2023 will become the government’s top priority. Overseas tightening policies are coming to an end, and the internal and external policy environment is extremely favorable. The equity market may stage a recovery. Hong Kong stocks have greater opportunities than A shares. In terms of A-share allocation ideas, the pharmaceutical consumption and real estate industry chains of “reversal of difficulties” are emphasized, as well as Xinchuang, industrial master machines and new energy of “safety and development”. In addition, pay attention to the benefits of falling commodity prices to midstream manufacturing.

1. In 2023, A shares may come out of the “recovery bull”

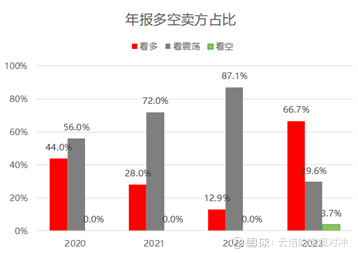

1. The proportion of sellers who are bullish in their annual strategy hit a 4-year high

As of December 26, 27 sellers have disclosed their annual A-share market outlook for 2023. 67% of the sell-side strategies are optimistic about the market conditions next year, the highest level in the past four years , and most of them are optimistic about the volatility. Hot words for sellers include: post-epidemic recovery, steady growth, the Federal Reserve, Slow Bull, and Hong Kong stocks.

Data source: Annual strategic reports of 27 sellers as of December 26, 2022

2. Market Outlook: “Recovery Bull”

Every 3-5 years, the A-share market will give an excellent opportunity to get in the car. Connecting several low points on the monthly chart of the Shanghai Composite Index can get the “long-term support line” of the market. Usually, when the index falls to this position, there will be a decent rebound. In October this year, many investment tycoons were optimistic about A-share strategic investment opportunities, partly because of this. We also clearly stated in the report ” Turning in sight-A-share market outlook for the fourth quarter of 2022 ” published on November 8 that “the mid-term bottom of the A-share market may have appeared, and we are optimistic about the oversold rebound at the end of the year.”

Data source: Wind

The market based on the optimization of the epidemic prevention policy is coming to an end, and as the number of infected people in cities across the country “passes the peak”, the market needs a correction. However, we believe that the short-term correction is to lay a better foundation for the development of the market next year. In the past 10 years, the operating law of A shares has shown a trend of evolution from “bull short and bear long” to “bull long and bear short”. After experiencing a decline in 2022, we believe that next year the market is expected to emerge from the “recovery bull” similar to 2016 and 2017 .

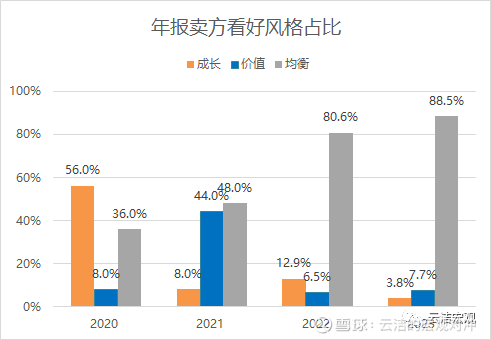

From a structural point of view, next year’s market may be similar to this year’s, with extremely fast rotation and no sustained dominant industry or style. The proportion of sellers optimistic about the balanced style reached 89%, which is also a new high in the past four years. From the perspective of internal and external economic recovery, small-cap companies are usually more sensitive to economic recovery and interest rate declines. Therefore, we recommend the small and medium-sized balanced style represented by CSI 1000.

Data source: Annual strategic reports of 27 sellers as of December 26, 2022

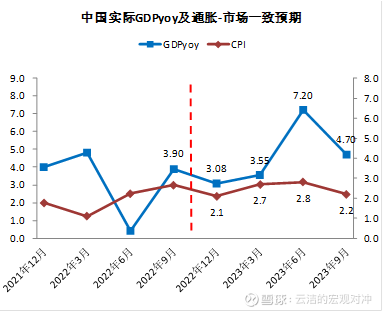

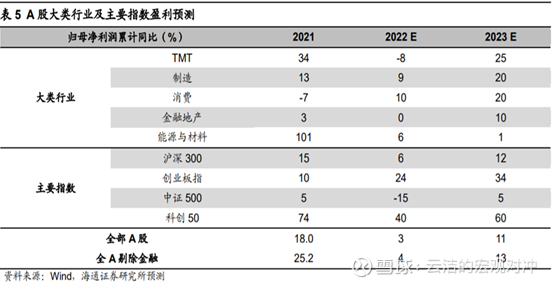

3. Fundamentals: From “recession” to recovery

At present, China’s economy is in the late stage of “recession” and is moving towards the early stage of recovery. Analysts’ consensus forecast for the economy next year is to rebound to 5% from around 3% this year. This recovery is a restorative recovery after the epidemic, and it is closer to 2016 in terms of recovery strength. Compared with the previous quarter, the recovery efforts in the second quarter may be relatively large, and the slowdown in overseas demand in the second half of the year may drag down exports . According to the forecast of Haitong Securities, with the economic recovery in 23 years, the year-on- year growth rate of all A-share net profits attributable to the parent company is expected to reach 10-15% in 2023. The pace of corporate profit growth is also expected to follow the trend of the economy showing a low first and then a high.

Data source: Bloomberg

From the perspective of the structure of economic growth, next year, with the liberalization of domestic epidemic prevention policies, consumption will be the first to recover, and then will stimulate manufacturing. Exports will become a pressure item, while infrastructure will remain supportive. However, as geopolitics cools down, commodity prices will tend to fall, and the mid-stream and downstream manufacturing industries will benefit from cost reduction and demand recovery, and profitability may improve significantly. Consumption, the real estate industry chain, and high-end manufacturing may benefit .

Using the reciprocal of Shanghai and Shenzhen 300 pe minus the 10-year CDB interest rate can be used to measure the “price ratio of stocks and bonds”. At the end of October this year, the index reached 98.5% since 2008, and then the market bottomed out and rebounded up. At present, the indicator is at the level of 86.8%, which still has high investment value .

Data source: Wind

4. Policies: Optimizing industry policies to stabilize growth

The Central Economic Work Conference at the end of 2020 proposed “to make good use of the precious time window and concentrate on promoting reform and innovation.” That is, to “adjust the structure” with all efforts. In 2021, the government issued a series of industry policies to achieve fair education, no speculation in housing and housing, standardize the platform economy, dual control of energy consumption, etc., and had a significant impact on the capital market.

After a year of “structural adjustment”, the Central Economic Work Conference at the end of 2021 began to balance “steady growth” and “structural adjustment”. Industrial policy optimization has temporarily given way to responding to the epidemic. Therefore, the two dips in the A-share market this year are also related to the development of the epidemic.

With the recent evolution of the epidemic, the central government’s epidemic prevention policy has also been adjusted in a timely manner. The just-concluded central economic work conference continued last year’s main tone of “focusing on economic construction” and raised “steady growth” to a higher level. Height, and emphatically emphasize the need to “improve social psychological expectations and boost confidence in development”. The last time the central government made a similar statement was “confidence is more important than gold” during the 2008 financial crisis. It can be seen that in the future, a series of fiscal and monetary policies will be introduced to stabilize the total growth, and a series of industrial policies will be introduced to boost the confidence of market owners.

Expectation 1: Since this meeting puts forward clearer requirements for next year’s economic growth, it is expected that fiscal policy, supplemented by monetary policy, will be adopted in the recent and next year’s two sessions of the government work report, and efforts will be made in advance to achieve a “good start”. According to Soochow Securities’ forecast, the fiscal budget deficit target for 2023 may be 3.2% . In addition, all sellers are looking forward to the trillion-dollar special treasury bonds next year . If there is such a new arrangement for special treasury bonds, then the strength of “steady growth” in the government work report next year may be comparable to that of 2020.

Expectation 2: Expect landmark events to boost the confidence of the private economy.

In the report of the 20th National Congress of the Communist Party of China, it is proposed to “optimize the development environment of private enterprises, protect the property rights of private enterprises and the rights and interests of entrepreneurs in accordance with the law, and promote the development and growth of the private economy.” The most dynamic platform economy in the private economy has suffered multiple impacts from special rectification and economic slowdown in the past two years, and it is an industry that urgently needs to boost confidence.

The Central Economic Work Conference proposed that “we must vigorously develop the digital economy and improve the level of normalized supervision. Support platform companies to show their talents in leading development, creating employment, and international competition. From the Central Economic Work Conference last year, it was proposed that “traffic lights” should be set for capital. Since then, there have been a number of central documents this year indicating the completion of the special rectification of the platform economy, the implementation of normalized supervision, and the introduction of specific measures to support the healthy development of the platform economy, but there has been no clear policy implementation.

In November 2018, at a critical moment when the market lacked confidence in the prospects of the private economy, the central government held a “private economy symposium”, which successfully boosted market confidence and also gave birth to a big bull market for the ChiNext. Now it is a critical moment, and we look forward to the government issuing landmark events such as completing rectification and allowing re-listing of well-known platform companies to boost market confidence.

Expectation 3: Expanding domestic demand and increasing real estate stimulus.

This meeting emphasized the expansion of domestic demand, and clearly “supported consumption such as housing improvement, new energy vehicles, and elderly care services.” According to historical experience, one of the important starting points for expanding domestic demand is the automobile chain and the other is the real estate chain. First of all, next year’s stimulus policies for durable consumer goods such as new energy vehicles and home appliances will continue or be increased. Secondly, the restrictive policies aimed at residents’ improved housing needs may also be canceled, which will drive the recovery of related consumer goods. Recently, many high-level executives have revisited the “pillar industry status” of real estate, and saving real estate developers alone is not enough to stabilize real estate. Next year, we can look forward to the stimulation of real estate demand in various places. For example, more cities will implement “recognize houses but not mortgages” or even discount existing mortgage loans (only used in 2008). The timing may be in the middle of next year.

Expectation 4: Safety and development. While emphasizing stable growth, this Central Economic Work Conference also emphasized the importance of “structural adjustment” – accelerating the construction of a modern industrial system and ensuring the safety and development of the industrial system.

Security may focus on Xinchuang, semiconductors, medicine, etc. next year.

In terms of development, in addition to new energy , it is also recommended to pay attention to the direction of new industrialization, such as specialization, specialization, industrial master machines, etc.

Liquidity: USD may fall back to 97 inside and outside Shuangpine

According to the formulation of the Central Economic Work Conference, liquidity should be kept reasonably sufficient next year. Therefore, the internal liquidity environment will continue this year’s loose situation. In particular, this meeting clearly stated for the first time that “the growth rate of social financing scale should basically match the nominal economic growth rate”, which is expected to start the credit expansion cycle of the Chinese economy. The timing may be in the second half of next year, when procyclical industries will benefit.

A very important reason for the sluggish performance of A-shares and all emerging markets this year is the rapid tightening of the Federal Reserve, which triggered a double rise in the US dollar and US bond yields. According to historical experience, in this situation, emerging markets usually encounter the triple kill of “stock, bond and foreign exchange”. A-shares and Hong Kong stocks are no exception. With the decline in US inflation, the US dollar index has peaked and fell in October. The Fed has already slowed the pace of rate hikes in December. Due to the asynchrony of the European and American economies, the interest rate spread between the United States and Europe is expected to peak and fall in the first quarter of next year. For the first time, the U.S. dollar index is expected to fall back to 97 next year.

It can be said that the internal and external liquidity environments facing A shares next year are very friendly. In particular, Hong Kong stocks, which have fallen for three consecutive years, are expected to benefit from triple benefits: economic recovery, depreciation of the US dollar and optimization of platform economic policies.

2. What is the main line of “Recovery Cow”?

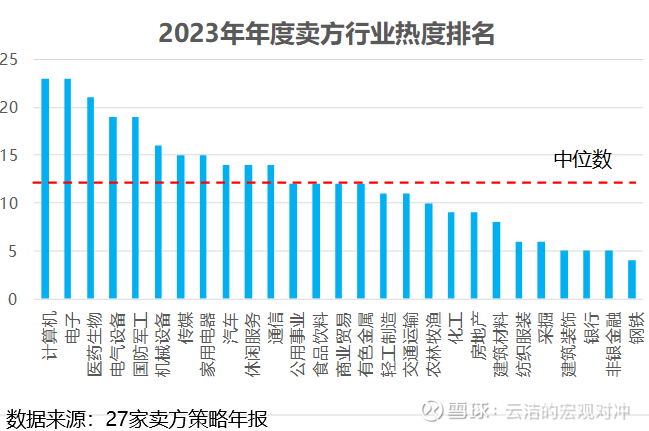

Corresponding the promising industries in the annual A-share market outlook of 27 sellers to the 28 primary industries of Shenwan, the results are as follows: TMT, medicine, electrical equipment, national defense and military industry, machinery, media, home appliances, automobiles, etc. are more promising industries .

1. Focus on medicine and consumption throughout the year

According to international experience, the number of infected people and the rate of severe cases will rise after the epidemic prevention measures are lifted, and there will be a time lag of about 4 weeks between the number of infected people peaking and the hospitalization rate peaking. At that time, the focus of epidemic prevention will shift to severe treatment for high-risk groups. The National Health and Medical Commission has issued a document requiring cities to complete the upgrading of shelters and designated hospitals by the end of December. In the early stage, the pharmaceutical industry mainly interpreted the home medication of large-scale infected people, and the response to medical devices and biomedicine was not sufficient. At the beginning of the year, medicine can trade medical infrastructure for epidemic prevention, in the middle of the year, it can trade non-new crown medical needs that have been suppressed for 3 years, and at the end of the year, it can trade pension services. We believe that medicine may become one of the main lines repeated throughout the year. $Biomedicine ETF(SZ159859)$

With the relaxation of the epidemic prevention policy, next year’s consumption may usher in a “Davis double-click” . Since consumption peaked at the beginning of 21, it has been adjusted for 2 years. The epidemic has also had the biggest impact on the profitability of the consumer industry. With the liberalization of the epidemic policy, residents can go to work, their income will increase, and their consumption ability and willingness to consume will increase. According to the forecast of Haitong Securities, the growth rate of the net profit of the consumption industry will be significantly improved next year. Considering that the release of the domestic epidemic prevention policy is approaching the Spring Festival, the trend of consumption recovery after February-March next year will be clearer. Considering that there will be a wave of infection peaks after the liberalization, residents will instead go out less and increase online shopping.

As mentioned above, one of the biggest policy expectations for next year is to target the landmark events of the platform economy and boost the confidence of the private economy . Therefore, we recommend focusing on Hong Kong consumer stocks that are not constrained by offline scenarios and related listed companies benefit from the shift in platform economic policies. $Online ETF(SH517280)$

2. Focus on growth industries in the second quarter

Considering that the focus of the government’s work next year will be steady growth, next year’s growth industries may be more transactional opportunities.

Both the report of the 20th National Congress of the Communist Party of China and this Central Economic Work Conference have made it clear that we must speed up the construction of a modern industrial system to ensure the safety and development of the industrial system. Specific industry policies are expected to be released after the two sessions next year. Superimposed on the confirmation of the inflection point of the Federal Reserve’s monetary policy in the second quarter, it will bring about a second decline in the US dollar index and US bond yields. Growth style or dominant. It is recommended to pay attention to Xinchuang-related $computer ETF (SZ159998)$ , robots representing “industrial mother machines” and photovoltaics representing the energy revolution.

3. Focus on the real estate industry chain in the second half of the year

In December, based on the optimization of real estate policies, the market has already traded a round of real estate industry chains . According to the spirit of the Central Economic Work Conference, next year’s two sessions may not introduce demand-side stimulus policies. The government may adopt a discretionary approach to determine future policy directions . Therefore, we believe that the policy on the demand side of real estate may be delayed until the middle of the year, and the growth rate of real estate sales may not turn positive until the second half of the year. Therefore, the real estate industry chain industry is expected to regain attention in the second half of the year .

In addition, pay special attention to the price correction of bulk commodities that may be triggered by the end of the conflict between Russia and Ukraine, which will bring about investment opportunities in the midstream manufacturing industries, such as chemical industry, at an uncertain time.

#板团运家# # A- share shrinkage group, which demon stock can have the last laugh? # #Annual Strategy Report#

The above views are for reference only and do not constitute investment advice. The market is risky, and investment needs to be cautious. Before buying a fund, please carefully read the fund contract and other legal documents, and choose a product that suits your risk tolerance. Index funds suffer from tracking error.

There are 11 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/3621716791/238752130

This site is only for collection, and the copyright belongs to the original author.