According to Dongcai Choice data, there are currently 745 ETF funds in the market, including 634 passive index funds, 45 QDII funds, and 27 money market funds… After excluding money funds, only employees are retained to hold shares There are 27 funds with more than 50,000 shares, including 23 passive index funds and 4 QDII funds.

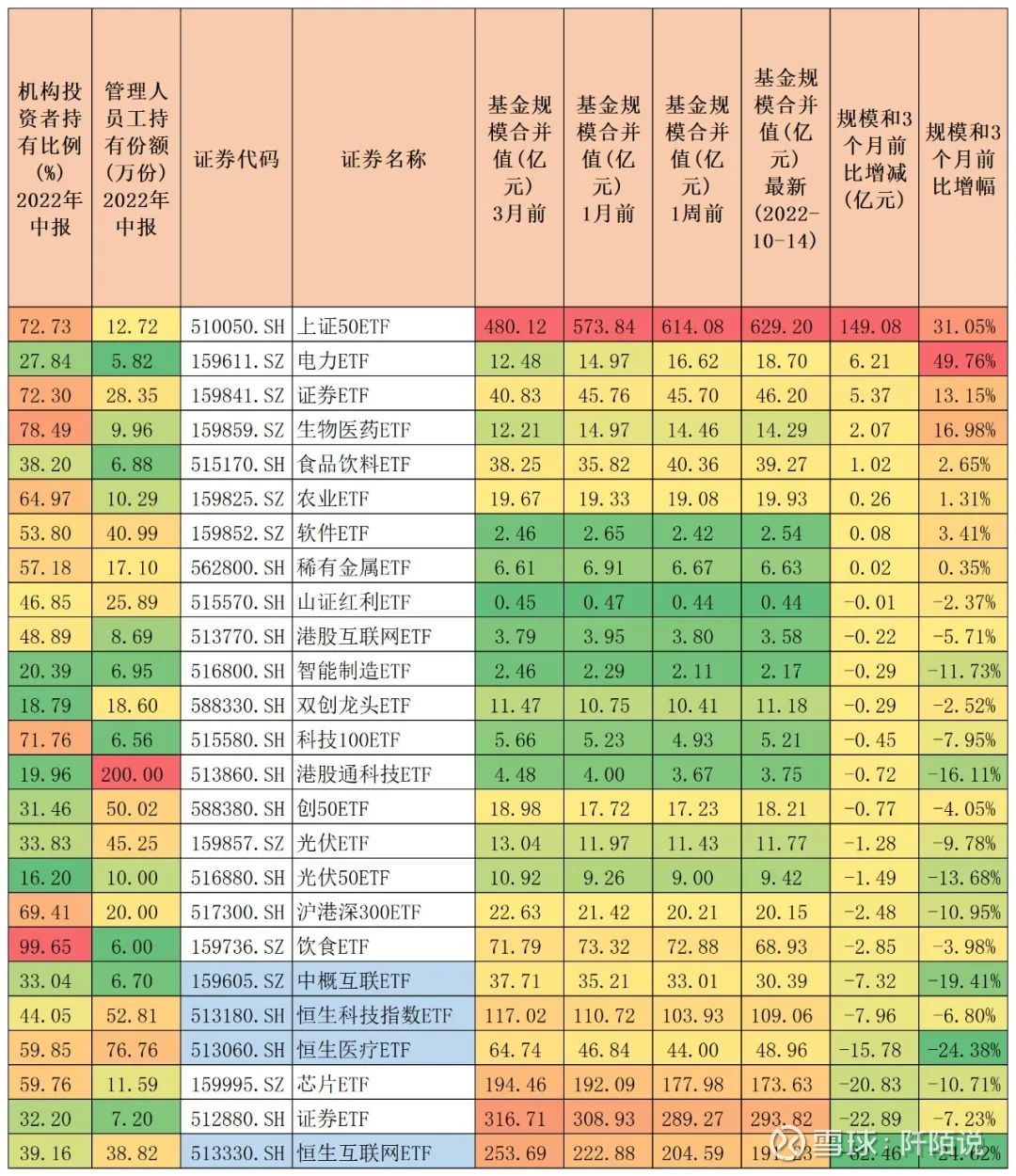

The 27 funds are ranked as follows according to the shares held by the employees of the fund company . From the perspective of the proportion of institutional investors, the average proportion is 49.28%, which can be said to be a group of institutions.

Data source: Oriental Fortune Choice data, data as of October 14, 2022

The 27 funds show the combined size of 3 months ago, 1 month ago, 1 week ago, and October 14, and they are sorted as follows in the order of size and increase or decrease compared with 3 months ago:

Data source: Oriental Fortune Choice data, data as of October 14, 2022

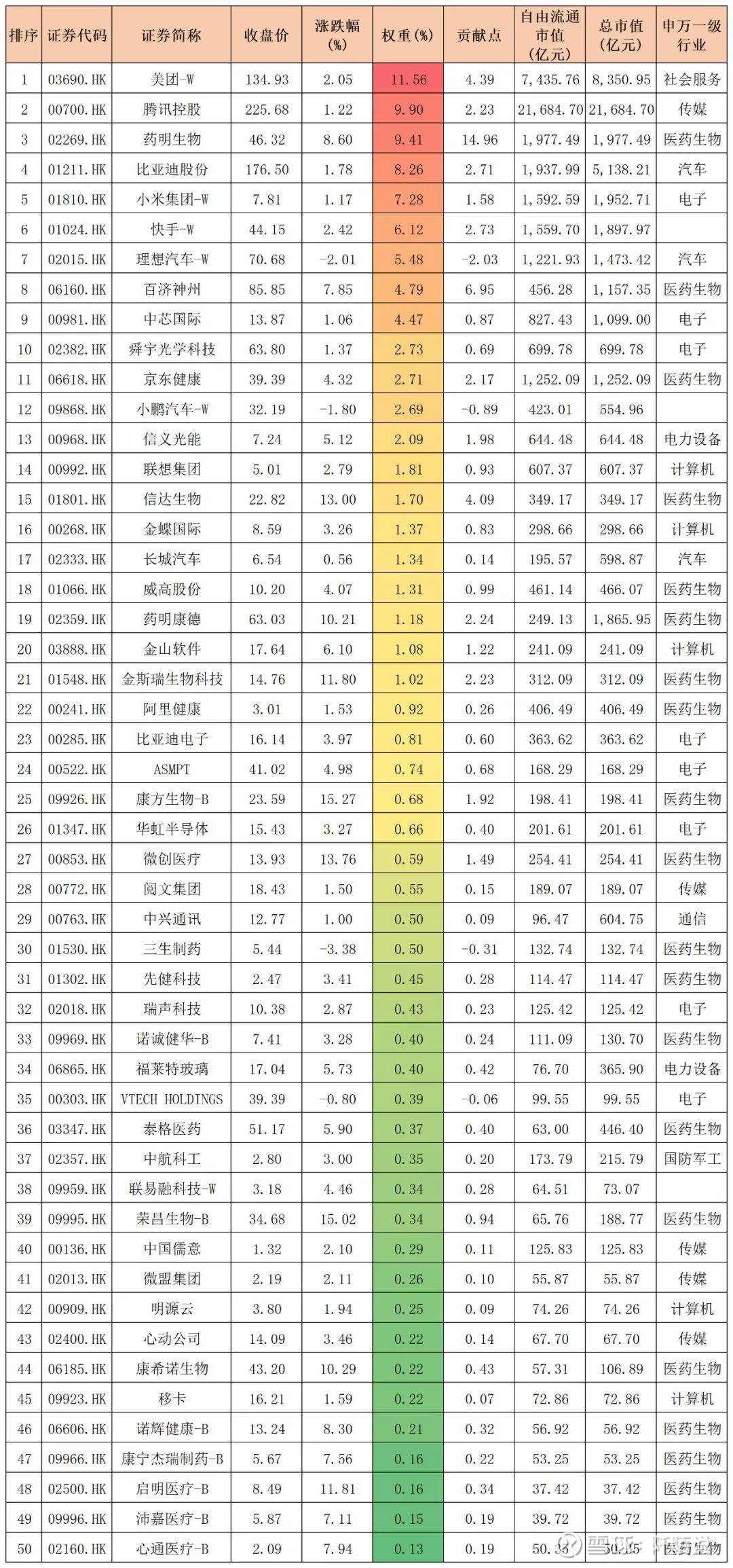

1. The top share held by employees is the Hong Kong Stock Connect Technology ETF (513860) , with institutions accounting for 19.96% and a scale of only 375 million yuan, while the share held by employees has reached 2 million. This index tracks the CSI Hong Kong Stock Connect Technology Index (931573). The constituent stocks and weights are shown in the table below.

Data source: Oriental Fortune Choice data, data as of October 14, 2022

2. The scale of the Shanghai Stock Exchange 50ETF (510050) increased by 14.908 billion yuan compared with three months ago, with a scale increase of 31.05%. The SSE 50 ETF (510050) fell by 13.65% in the third quarter and 0.94% since October. In the case of continuous decline, the scale has increased. It feels that a lot of funds have been buying the SSE 50 index in the past three months.

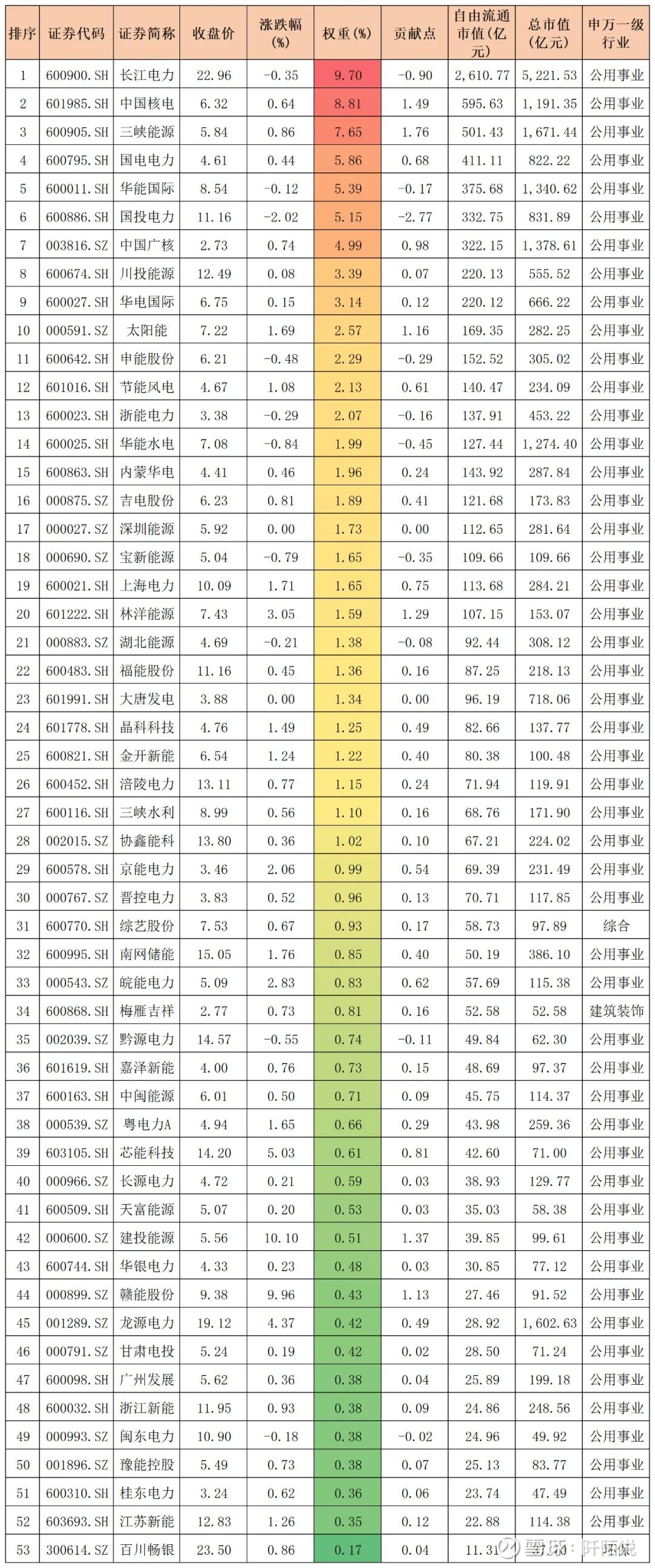

3. From the perspective of scale increase, the power ETF (159611) ranked first with a scale increase of 49.76% in the past three months. The power ETF (159611) fell 5.06% in the third quarter and rose 7.82% since October. The scale can increase so much, and there should be funds to increase positions. This index tracks the CSI All-Share Power and Utilities Index (H30199). The constituent stocks and weights are shown in the table below.

Data source: Oriental Fortune Choice data, data as of October 14, 2022

For other information, please see the table for yourself.

Disclaimer: I do not recommend funds to readers. I only show some fund data objectively. The data is neutral. If you buy a fund because of my article, the decision is your own. Don’t blame me for the money. Of course, from the bottom of my heart I want you to make money. The yield data is for reference only. Past performance and trend style do not indicate future performance and do not constitute investment advice. Investors operate accordingly at their own risk. There are risks in the market, there are risks in fixed investment, and investment should be cautious. @ Today’s topic @ Egg Roll Fund # Looking for you who loves the fund # # Snow Ball Star Project Public Fundraising Talent # @ Snow Ball Creator Center

This topic has 0 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5679199459/232816318

This site is for inclusion only, and the copyright belongs to the original author.