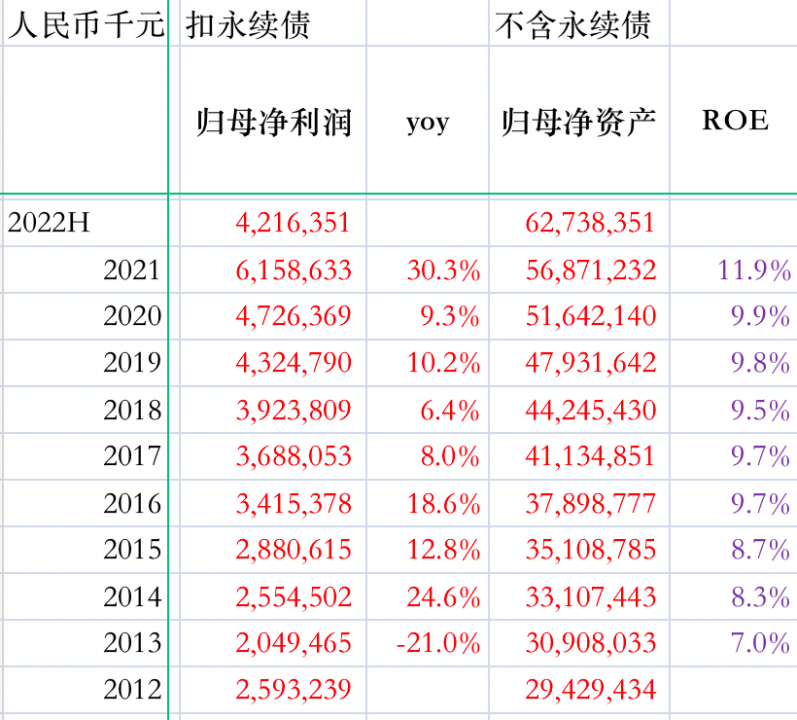

After understanding the steady-state operation we mentioned in the previous article, it is natural to deduce that the ROE of green power companies will increase steadily year by year. Because before reaching steady state operation:

1. The number of wind turbines held by the enterprise is increasing, but the net assets remain unchanged;

2. The profit generated by a single fan remains unchanged. With the increase of the number of fans, the net profit of the enterprise will increase;

3. Therefore, the ROE of the enterprise is getting higher and higher.

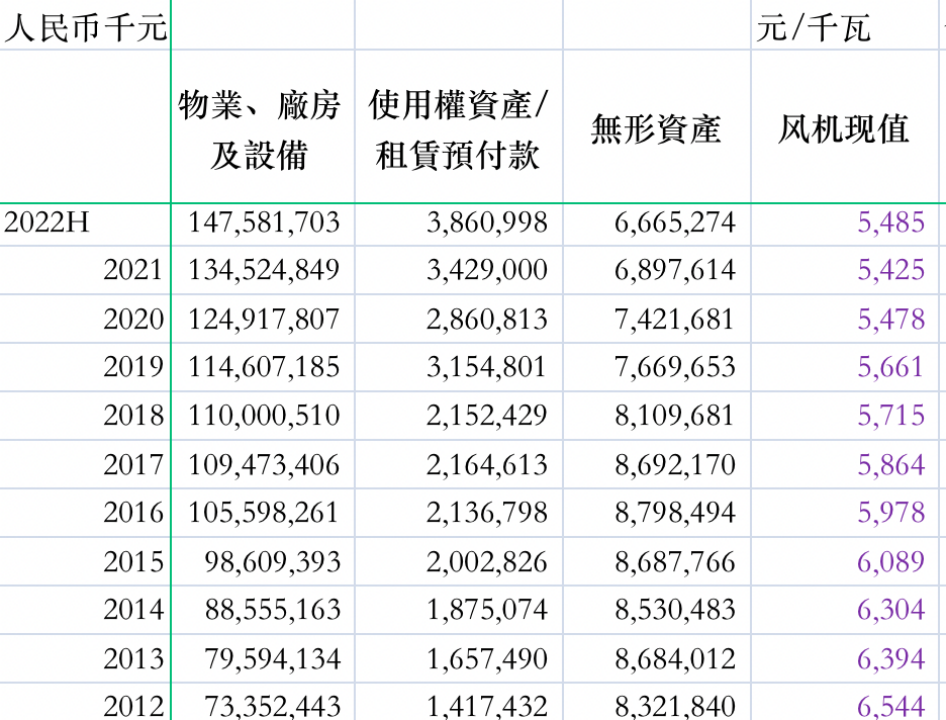

The main reason behind this is that with the increase of depreciation, the net assets of old wind turbines (assuming no debt operation) decrease year by year, so the ROE of old wind turbines increases year by year. Let’s take a look at the data of Longyuan Power:

Longyuan Power had more than 10GW of installed wind power capacity in 2012, and more than 23GW of wind power installed capacity by the end of 2021. At present, it is a typical wind power enterprise with old and new models. The current value of the fan is less than 5,500 yuan/kw. In fact, in 2012, the national average cost of wind power generation was above 8,000 yuan/kW.

The current value of Longyuan Power’s old fans is lower than 5,500 yuan/kW (the average current value of new and old fans is 5,500, and the current value of old fans is even lower), but the net profit generated by it has not declined. This has led to the ROE of China Longyuan Power Co., Ltd. increasing year by year. As shown below:

At the same time, a new question is extended here:

The PB valuation of old projects sold should be higher

For example, in the first half of this year, CNE sold its two wind power projects built in 2016 at a price of 2.4PB. These two projects have been in operation for more than 5 years, and the value of their fixed assets has been reduced to 75% of the original value through depreciation, but the annual net profit released by these two projects has not declined.

Therefore, no matter in the calculation of ROE or IRR, the rate of return of these two old projects is higher than that of new projects with the same resource endowment.

Therefore, it is reasonable for old green power projects to sell higher PB.

Series review:

Green Power Code 2: Illusion of Capital Return (EIRR)

Green Power Code 3: The business model of green power has shifted from “high leverage” to “cash cow”

Green Power Code 4: The ROE of a single project is also an illusion

Green Power Code 5: All-investment IRR has universal comparative significance

Web links

Green Power Code 6: Profitability: “Extreme Formula”

Green Power Code 7: Asset-liability ratio represents room for growth

Green Power Code 8: The special case where IRR is equal to ROE (green power model and hotel model)

Green Power Code 9: Low interest rate environment is the golden period for the development of green power

Green Power Code 10: The most important piece of the puzzle of the Green Power Model (steady-state operation)

There are 12 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/3727797950/238304426

This site is only for collection, and the copyright belongs to the original author.