Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Yang Lei

Source/AI Lanmeihui (ID: lanmeih001)

Recently, Tims China’s listing in the US stock market has reignited the war in the domestic coffee market.

In addition to the small blue cup and the small green cup, consumers have added the choice of the small red cup.

But the secondary market does not seem to buy Tims China. Only half a month after its listing, the market value of Tims China fell 48.44% to US$611 million, nearly halving.

This is another coffee brand taking the U.S. stock market test after Ruixing, and the market will also compare Tims and Ruixing. But from the perspective of business strategy, what Tims told is not the same story as Luckin.

In order to find out, AI Blue Media Exchange recently visited the Tims store in Tianjin Kerry Exchange. This store is a standard store of more than 200 square meters. During the afternoon peak period, the order volume is 55 orders (including takeaway orders), and the customer flow is 70%. The Starbucks selection store, also located in Kerry Hui, has 33 customers during the same time period; in comparison, the Ruixing self-pickup store of about 10 square meters in the same business district has a two-hour order volume during the afternoon peak period. 83 orders.

To sum up, Starbucks’ unit price is higher than Tims, but the order rate is lower than Tims; Luckin’s unit price is lower than that of Starbucks and Tims, but the order rate is higher than that of Starbucks and Tims, and the operating cost of stores is also lower than the former two.

In the consumer market, Luckin has beaten Starbucks and Tims with higher efficiency and lower cost, but does the competition in the coffee market really rely on efficiency alone? What other stories can Tims bring to the coffee war?

Tims’ timing and ambition in China

In 2018, Tim Hortons parent company RBI and Descartes Capital jointly established Tims China. In February of the following year, Tims China’s first store opened in Shanghai’s People’s Square.

At that time, Luckin was fighting with Starbucks China, and Tims China just got the ticket.

However, this “North American Legendary Coffee” has a coffee culture of 58 years, especially in Canada, its market share is more than 9 times that of Starbucks. The old coffee came to China, and with its reputation accumulated over the years, it ignited a wave of memory killings in the circle of many international students and returnees. Especially on Xiaohongshu, these people have naturally become Tims’ “tap water”, arousing the curiosity and social psychology of consumers to try early adopters and punch cards.

Therefore, even if Tims does not have a 3.2% discount coupon, just relying on a small red cup with a maple leaf and a bagel covered with cheese attracts young people to flock to it.

“Let’s just say, Tims in China is too tall.”

“Going to Tims isn’t about punching in, it’s about missing Canada.”

In the eyes of most consumers, the Tims brand is more novel, niche, and more “net celebrity physique”. Searching for the keyword “Tims” on Xiaohongshu, more than 40,000 notes seem to be carved out of a unified template. An eye-catching copy with beautiful photos of Tims store punch cards has certain social attributes.

However, Tims’ ambition is not limited to being an “Internet celebrity coffee”. Although Tims China CEO Lu Yongchen has always said that “no one replaces anyone” and “everyone cultivates the coffee market together”, it is not difficult to see that Tims China is trying to start from In the battle between Starbucks and Ruixing, they won a third of the Chinese market.

In June 2020, Luckin was suspended due to financial fraud.

After Ruixing, the coffee track did not cool down, but was lively. At that time, capital showed great interest in recreating a Ruixing.

Tencent took the fastest shot, targeting Tims, which has already opened up the international market.

Almost at the same time that Luckin was suspended, Tims China received a strategic financing of over 100 million yuan from Tencent; in February 2021, Tencent joined the investment again.

Tims China has also received long-term support from many blue-chip shareholders such as Descartes Capital, RBI, the brand owner, Tencent Investment, Sequoia China, and Bell Capital.

Another local brand, Manner, has also taken advantage of the trend. From the end of 2020, Manner has also received intensive financing. It took only half a year to raise 4 financings. The investors are H Capital, Coatue, Temasek, Meituan Dragon Ball, Bytes and other header mechanisms.

To the surprise of the market, it took Ruixing more than a year to realize the feedback of the consumer market to the capital market. In the second half of 2021, with Luckin’s coconut latte, velvet latte and other products selling well in the consumer market, its capital market is also showing signs of recovery.

Tims chose a more rapid IPO strategy in the more curly Chinese coffee market.

To this end, Tims China chose the “SPAC+PIPE” combined listing model, that is, an indirect “backdoor listing”, and in the last round of financing before listing, it actively lowered the equity consideration, which means that the corresponding market valuation also dropped by nearly 300 million US dollars , lowered the entry valuation to $1.4 billion.

However, strategies such as lowering valuations and backdoor listing are also considered by the outside world to be self-depreciating and eager to go public.

Loss dilemma to be solved

Tims China’s three-year landing on the Nasdaq is just a microcosm of the coffee boom.

Fast store opening and hot financing are the main features of the domestic coffee industry in recent years. According to statistics from iiMedia Research, there will be nearly 20 investment and financing cases involving the coffee field in 2021, with a total amount of nearly 6 billion yuan, a significant increase over the previous two years.

Under the intensive capital-intensive warehouse, China’s coffee market is entering a stage of rapid development. According to the forecast of iiMedia Research, the new coffee brand will maintain a growth rate of 27.2%, which will be much higher than the global average growth rate of 2%. In 2025, the Chinese market size will reach 1 trillion yuan.

For the uninitiated, in 2022, the coffee track will become the first choice for cross-border marketing and transformation of other companies.

Experts look at the doorway and solve the problem of profit, which is the only option for real players.

Tims China, whose stock price has been declining since its listing, has been observed by the industry with a magnifying glass.

According to Tims China’s prospectus, from 2019 to 2021, Tims China’s revenue is 57.257 million yuan, 210 million yuan and 640 million yuan respectively, mainly from product sales of self-operated stores, franchise fees, other franchise business and e-commerce business. In 2021, the revenue share of the four major businesses will be 95.9%, 0.3%, 1.5% and 2.2% respectively.

It can be seen from the above data that 2021 is the fastest growing year for Tims China, with its revenue soaring by 203%, more than three times that of 2020. But net losses have also multiplied.

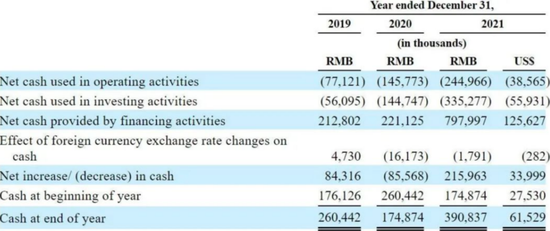

Data shows that from 2019 to 2021, Tims China’s net losses were 87.828 million yuan, 140 million yuan and 380 million yuan respectively. The net loss in 2021 will more than double that in 2020, and the total loss in 3 years will exceed 600 million yuan.

This situation is similar to the new tea drink Nai Xue’s tea – the more stores you open, the greater the loss.

In terms of losses, Tims China explained that this was due to rising raw materials and the impact of the epidemic.

According to the prospectus, after the establishment of Tims China, it just caught up with the continuous rise of global coffee beans. “The price of coffee beans in January 2022 is about 16.6% higher than that in 2021.” From the financial data of Tims China, its 2021 The annual raw material cost was 207 million yuan, accounting for 32.3% of the total revenue.

Affected by rising raw material prices, in early 2022, many coffee brands, including Tims China, raised their product prices. According to the Tims China prospectus, starting from January, the price of each drink will increase by 1-2 yuan. The corresponding product promotional coupons are reduced by 3%-5%.

The epidemic prevention environment has an impact on a number of brands including Tims. For Tims, the main impact is the Shanghai area with the largest number of stores.

AI Blue Media Hui also visited the Tims Tianjin Mixc City store during the 11th. Due to the impact of the epidemic, the store was unable to provide dine-in. Tables and chairs are placed against the wall and the red lines are drawn. Coupled with the sparse flow of people, the originally empty storefront appears more cluttered.

According to the description of the store attendant to AI Blue Media, the first store in Tianjin, the Mixc City store, was affected to varying degrees by the epidemic from the beginning of the year to the middle of the year. Especially since the second half of the year, most of the stores have been banned from dine-in.

In the capital market, since the IPO of Tims China for more than ten days, the stock price has maintained a cliff-like decline.

If it is said that before the listing, Tims China still has more time for its slow development; then, after the listing, Tims China has to accept the test of the secondary market.

This is also a critical moment to test its profitability.

IPO is not the end but the beginning

From the perspective of business model, Tims is closer to Starbucks than Luckin. Therefore, it is not fair to judge Tims by Luckin’s rhythm of investment returns.

But judging from the reaction of the capital market, Tims also exposed some problems at the operational level.

First of all, from the perspective of brand positioning, Tims has no more memory points except “from Canada”. In contrast, Ruixing attracts office consumers with cost-effective and high-frequency new products; Starbucks carries more business and leisure functions; Manner is out of the circle through the advantages of affordable boutiques.

On Xiaohongshu, there are also many consumers complaining about the pricing and taste of Tims coffee. They generally believe that the “Michelle Ice City” in Canada has turned into a Starbucks in China, which is suspected of IQ tax.

Some consumers believe that Tims is more like a bakery because its bagels taste far better than coffee. On Xiaohongshu, some netizens commented sharply: “I usually go to Tims to buy bagels and Manner to buy coffee.”

Secondly, Tims still has room for improvement in terms of store floor efficiency and layout.

According to the prospectus, as of December 31, 2021, Tims China has a total of 30 flagship stores, 275 classic stores and 85 “Tims Go” stores. In addition, according to the Tims official account, as of October, Tims has opened 500 stores in the mainland.

Among them, the flagship store and the classic store are large store models. Like Starbucks and Nai Xue’s tea standard stores, the operating costs are higher. The Tims Go store is a self-pickup store with lower operating costs, but the store scale is smaller.

According to the research of CITIC Securities, the per-floor efficiency of Tims China’s standard store is 31,000 yuan, and the per-floor efficiency of Tims Go is 49,000 yuan. The latter has better return on capital, but there are fewer Tims Go stores than classic stores. The layout of these three stores is not balanced.

In fact, in pursuit of low cost and high efficiency, Ruixing has brought the “small store self-pickup” to the extreme.

These shops do not need a large area and are located in office buildings and street corners, which will further reduce rent and labor costs. At present, the number of Luckin Pick up stores has exceeded 90% of the total stores.

Combined with the revenue data disclosed in the financial report, in 2021, the average single-store revenue of Tims is 1.64 million yuan; while the average single-store revenue of Ruixing is 1.13 million yuan. The cost is much lower than Tims. During the epidemic, Ruixing also greatly increased its revenue by closing low-efficiency stores.

However, Tims is still in the brand climbing stage, and opening more flagship stores and classic stores will help strengthen consumers’ memory and cognition of the brand.

In the future, in addition to burning money for scale, Tims also plans to sink to second- and third-tier cities. In Lu Yongchen’s plan to “expand stores to 2,750 stores by the end of 2026”, he may not make a more efficient strategic layout.

It’s just that Tims, with 500 stores, is far from having the advantage of scale. Listing is just the beginning.

In the white-hot environment of the domestic coffee market, Tims after listing must not be in a hurry. If you want to be in the first echelon, you need to take a number of steps in terms of products, models and store expansion.

However, as Burger King’s brother brand, Tims also has its own expansion strategy and frequency.

It is understood that the management team with CEO Lu Yongchen as the core has expanded Burger King from dozens of stores to thousands of stores, and turned losses into profits.

And the market doesn’t have to be too pessimistic about Tims, who suffered a break just after listing. After all, in the Chinese coffee market, everyone has the ambition to compete for the next Luckin.

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-10-14/doc-imqqsmrp2587492.shtml

This site is for inclusion only, and the copyright belongs to the original author.