Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Wu Xianzhi

Source/Photon Planet (ID: TMTweb)

MEG (Mobile Ecological Business Group) is Baidu’s basic business. In the past year, this most profitable business group has faced huge challenges due to pressure from online advertising.

On May 5th this year, He Junjie took office. In addition to making big moves for the Digital and Vientiane Conference, so far, the entire MEG and the speakers have been quite low-key.

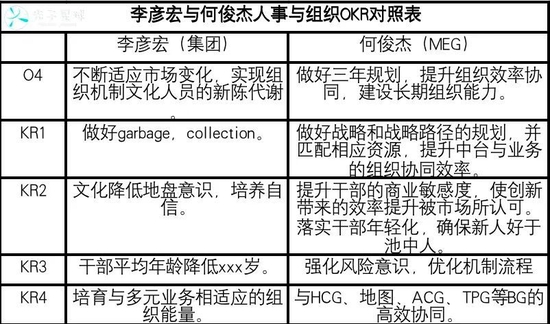

Photon Planet tries to interpret the OKRs of Baidu’s executives in order to explore the next business development direction of MEG. Since the introduction of OKRs in 2019, Baidu has made corresponding adjustments to its business priorities every year from top to bottom. Among them, Li Yanhong’s OKR has programmatic and directional guidance, and He Junjie’s OKR should not only align with Li Yanhong, but also provide operational directions and measures for MEG’s current and future.

According to people familiar with the matter, Baidu MEG convened an all-hands meeting in October, focusing on aligning business goals in the fourth quarter.

On the whole, He Junjie’s OKR in the fourth quarter still focused on revenue diversification and increasing the proportion of non-advertising revenue. Strengthen AIGC (AI creation) in content production, all in video in content form, emphasize efficiency in monetization, and continue to strengthen service capabilities. In addition, for businesses that continue to shrink, such as Seven Cats and YY, they have also formulated policies to stop falling, most of which are aggressive KRs.

Judging from the current situation, “exploration and conservation” are the two core keywords of MEG under He Junjie’s rule.

online advertising snow

When He Junjie accepted MEG, the industry had entered a cold winter.

Wei Ning (pseudonym) is an online advertising agency. Of the four or five peers he knew this year, only one remained in the fourth quarter.

Advertising agencies play three roles, the first is the connector between advertisers and the platform’s advertising alliances (such as Baidu Alliance), the second is the agency operation, and finally the role of the firewall – once there is a compliance problem, the advertising agency A businessman is a scapegoat.

Therefore, the temperature of online advertising, they have a skin-to-skin.

“Several big clients in my hands are cutting their budgets. If we don’t live well, it will definitely be transmitted to Baidu.” For the two online advertising giants, Baidu and Byte are both tit for tat and have their own advantages. Wei Ning believes that Baidu Alliance is difficult to shake in terms of search advertising, and Duohui provides a more diversified form of realization. Bytes are relatively conservative and rely heavily on recommendation engines.

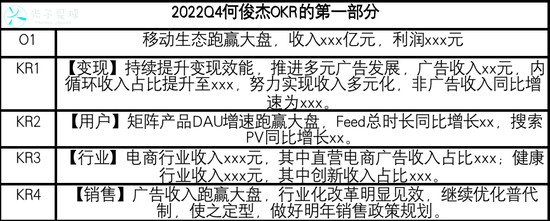

This year, Byte has made major adjustments to the advertising business sector. On Baidu, He Junjie has been very dull since he took office. In his 2022Q4 OKR, he has a very clear goal for revenue: the mobile ecosystem will outperform the market, mainly involving revenue and profits. . It is easy to find that there is only scale in the target and no growth rate is mentioned, indicating that the top management does not expect growth.

In order to achieve the above goals, He Junjie split O1 into four commitment-type KRs (equivalent to the results that must be completed), which in turn involve realization, users, industry and sales. This order reflects the priority of the four .

The highest priority is KR1, which requires advertising revenue to put more emphasis on efficiency, and at the same time, the proportion of internal circulation revenue is included in the indicator. Obviously, this statement shows that MEG will focus on internal potential exploration, rather than external customer acquisition, which also makes Baidu online advertising more popular. The market strategy is conservative.

As of the second quarter of this year, the monthly activity of Baidu App was 628 million, and Baidu MEG clearly released the signal of shifting from scale to duration. Therefore, in KR2, it was mentioned that matrix DAU outperformed the market, as well as the total duration of Feed (media streaming) and search PV. (page views) growth.

Surprisingly, in KR3 for the industry, both the e-commerce industry (revenue diverted for e-commerce platforms) and direct e-commerce advertisements (Duxiaodian) have set up revenue ratio indicators. According to the data previously disclosed by the official, there are 3,000+ promotional stores, the average daily orders are 250,000+, and the GMV is 6 million per day. By analogy, the annual GMV of Duxiaodian is slightly shabby, and Li Jiaqi’s GMV on the first day of double 11 pre-sale is 21.5 billion. Yuan, Duxiaodian’s annual GMV is less than one-tenth.

In addition, Baidu Health, as a department with strong monetization ability in MEG, also has revenue expectations, and the statement sets a requirement for the proportion of innovation revenue (online consultation and live broadcast). Combined with the video content mentioned later, Baidu Health hopes to be in medical care. The field of service goes further.

Medical services can be regarded as the 2.0 of Baidu’s medical and health advertising – from H5 to private domains.

A medical advertising agent Liu Hang (pseudonym) told Photon Planet that in the past two or three years, Baidu Health has been cautious and its brand reputation has recovered significantly. “Medical and medical beauty are the two most deadly sectors of Baidu’s card, and the compliance requirements are extremely high.” The above-mentioned people believe that it is difficult for Byte to take away such customers, because the delivery logic of medical and health advertisers is related to Baidu’s search + recommendation. most suitable.

It is understood that medical advertisers are both outsourced from regular hospital departments and private, and their categories include medicine, medical equipment, and medical service providers. This type of advertiser’s delivery cycle is short on a quarterly basis and long on a yearly basis, mainly based on entry bidding and post bar delivery. According to Liu Hang, “Those bosses all want to set up people who are ‘not bad for money’, so they are very generous, and a single project starts at one million yuan.”

In the first half of this year, Baidu MEG adjusted its sales structure. From He Junjie’s KR4, “Industrialization reform has obviously paid off, continue to optimize the generalization system and make it finalized”, we can see that its conservative style will continue proudly.

Videoisation and the calculations behind all in AI

Online advertising is shrinking, and Baidu MEG, the “cash cow”, is difficult to open source. In order to squeeze more profits, it is bound to reduce costs.

From He Junjie’s OKRs, we can vaguely see two trends, one is the full-scale video content, and the other is the content production mode, which is dominated by UGC and PGC, moving towards AIGC. In particular, the latter relying on digital people and TTV (Text-to-Video text-generated video) will lead to drastic changes in the content supply side.

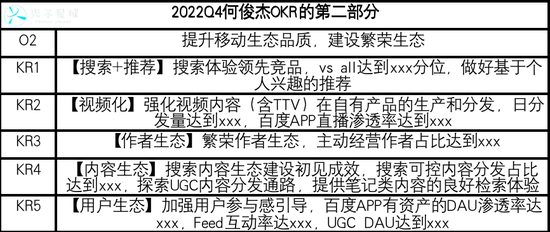

The second part of He Junjie’s OKR focuses on ecological quality. In the fourth quarter, the primary goal is to open the distance between various vertical categories and competing products through search + recommendation.

Q4 did not mention pictures and texts, but video was mentioned in the most eye-catching position. Photon Planet learned that Baidu does not pay attention to graphics and text, and nearly 75% of its internal traffic is allocated to videos, while the bulk of the video is allocated to small videos. It should be pointed out that small videos are not equal to short videos. The former is in terms of resolution and video volume, and the latter is divided according to the time dimension.

At the Baidu Vientiane Conference sub-forum on September 23, Song Jian, general manager of Baidu’s short video ecological platform and head of the Haohao video business, mentioned that Baidu’s video will seek differentiated competition, mainly for the hard-core people over 30 years old. The demand for content-services of this group is significantly higher than that of the young group dominated by Generation Z, which is the main force of entertainment content consumption.

There is an obvious progressive relationship between KR3 and KR4, emphasizing that the purpose of actively managing authors is to seek the distribution path of UGC content. The “operation” here means both content operation and may also include some content monetization. Considering the discourse system of video-based suppression of pictures and texts, there are good reasons to believe that the content author mentioned by He Junjie is more of the video author.

In terms of user ecology, the “DAU penetration rate of Baidu APP’s assets” is mentioned, which shows that Baidu’s content ecology has changed from knowledge-oriented to benefit-oriented in a short period of time. Setting the feed interaction rate is likely to be realized by Baidu dynamic or small video. .

In the past year, as a “Baidu Dynamic” similar to Weibo, it has become increasingly popular, relying on recommendation + search and celebrities, and public opinion focus figures, forming a kind of “square” ecology similar to Weibo.

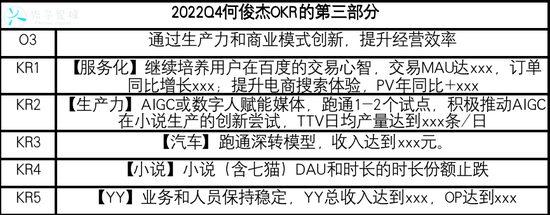

In addition to the content ecological video, another obvious feature of MEG is the introduction of AIGC to increase content supply, which is mainly reflected in productivity and business model innovation (O3).

It should be pointed out that KR2 in He Junjie’s third goal (O3) is actually aligned with Robin Li. Photon Planet learned that the first O of Robin Li’s 2022 annual OKR is aimed at MEG, of which KR3 is: improve the quality of search recommendations through AI technology, launch AI powered avatars, and gain xxx exposure.

He Junjie split the above KR into three parts. The first is to explore the pilot of 1-2 digital people. From the current situation, it is likely to include press conferences (sets) and scene advertisements (Xiyang). The second is the introduction of AIGC in the production of novels to end the continuous decline of Seven Cats data by means of volume. The third is to increase the average daily output of TTV.

It is important to mention TTV here. Earlier, Meta AI showed several related cases, one of which was a flying dog that generated video results based on text, and the other was to turn a static famous painting into a dynamic video.

At present, the landing scene of Baidu TTV seems to be mainly digital people. At present, Baidu Fei Pao Wenxin’s large model basically does not require AI engineers to manually adjust parameters, and its learning efficiency, generalization, and ability to interpret requirements have been greatly improved. It may be seen that the technology is gradually mature, and He Junjie will clearly require the average daily output of TTV in OKR.

The large-scale intervention of AI on the content supply side has greatly lowered the threshold for creators, and will aggravate the rigidity and routine of Baijiahao’s content, and will completely move towards a “degree-style” eight-legged essay:

what is xx? – Trigger search recommendation

Introduction to xx. ——Connect Baidu Encyclopedia and Baidu Know

Well, this is xx, what do you think? Please leave your opinion – mechanically stimulate interaction

This streamlined content production model seems to be at odds with the “improving mobile ecological quality” in Goal 2. Moreover, when the search and recommendation fields tend to be saturated, the value that AI can generate may be overestimated.

Wei Ning told Photon Planet that the large-scale involvement of AI in content advertising has directly changed the production model of traditional advertising. “In the past, there was an idea, and then the content was produced around it. Now it is a radish and a pit, either to fill up the ducks, or to stimulate dopamine and improve conversions. Professional, beautiful, and in-depth advertisements are gone forever.”

In addition, in the third part of He Junjie’s OKRs, seven cats and “cars” are also involved, but they are both enterprising KRs.

“Rectification” and Rejuvenation

For the past six months, Baidu MEG has been extremely quiet.

“Junjie He represents conservatives. After he took office, except for the departure of Yang Fan, the director of smart applet business, there was no major personnel and business adjustment.” A person familiar with the matter told Photon Planet that Junjie He was familiar with investment, but he did not MEG, who is not familiar with the complex business, is likely to be arranged in this way to facilitate Li Yanhong’s vertical management.

In addition, in Baidu’s organizational sequence, the director is a typical middle-level manager. Yang Fan’s departure is likely to come from two reasons, either because he failed to complete business indicators, such as commercialization; or because of the younger cadres and the diversification of business capabilities. Resigned due to major policy.

Robin Li’s OKR in 2022 and He Junjie’s OKR in 2022Q4 both involve the issue of cadre rejuvenation.

Among Robin Li’s four goals this year, the top three are business, and the fourth is personnel and organizational goals: to constantly adapt to market changes and realize the metabolism of organizational mechanism and culture personnel. Among the four KRs under this target, KR3 is: the average cadre age is reduced by xxx years.

In order to align with Li Yanhong, He Junjie’s O4 is to “implement the rejuvenation of cadres”, but it is interesting to add a sentence “to ensure that the newcomers are better than the people in the pool”. The implication is that as long as the “people in the pool” can still be used, it is unlikely to promote new people. If there are no accidents, MEG will not have too many personnel changes in the fourth quarter.

No change doesn’t mean the “pool man” will have an easier time.

MEG has many internal business departments, and there is a middle-level cadre echelon composed of dozens of directors. According to internal practice, they rotate once every three years. If there is no performance during his tenure, he will either be rotated to a marginal department, or he will leave his job sadly. In addition, the internal efforts to “anti-corruption” are still being strengthened this year, and the atmosphere is even more chilling.

It is understood that some directors who have been out of office for a year or two have been investigated for legal responsibility earlier because of corruption.

There have been intricate departmental hills within Baidu for a long time. Robin Li’s KR clearly mentioned that culturally, it is necessary to reduce the awareness of the territory, but at the same time, it is necessary to cultivate self-confidence. This KR seems to be debatable. Cadres are not sages and cannot be both confident and “I am for everyone”. Such a requirement will only be counterproductive and cultivate more two-faced people.

He Junjie’s four KRs about personnel are all commitment type, among which KR4 mentioned “with HCG (Quality Efficiency Business Group), Map, ACG (Baidu Intelligent Cloud Business Group), TPG (Technology Middle Taiwan Business Group) and other BGs. Efficient synergy.” Apparently aligned with Robin’s KR above.

It is not easy to break the mountain, and there are conflicts in the underlying business logic of many departments. For example, what is good content? Search, Baijiahao, and good-looking videos have their own standards. It is conceivable that the problem will become more complicated as AI becomes more involved.

Because the department that mainly promotes digital people is neither affiliated with ACG nor MEG; but the technology comes from ACG, and the scene is MEG. Without the establishment of a modular organizational structure, I am afraid that only by leveraging the charm of Robin can it be possible to eliminate the department. split between.

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-11-07/doc-imqmmthc3668499.shtml

This site is for inclusion only, and the copyright belongs to the original author.