Disclaimer: This article is only my thoughts and staged combing in my personal investment process. I am just an ordinary casual person. The opinions of the article may not be correct, and the investment level is also very average. The stocks or funds involved in the article may have the risk of a sharp decline , please maintain independent thinking, the market is risky, investment needs to be cautious, the opinions of the article are for communication only, and do not constitute any investment advice, readers and friends, please do not operate accordingly!

The recent wave of Hong Kong stock market is really strong. Hong Kong listed companies represented by Tencent Holdings have risen a lot from the bottom. In recent months, the trend of Hong Kong stocks has been stronger than that of A shares. Let’s analyze it in this article. How to use funds to make a layout for Hong Kong stocks. In this article, we use the “dual engine” investment strategy to analyze the fund layout for Hong Kong stocks.

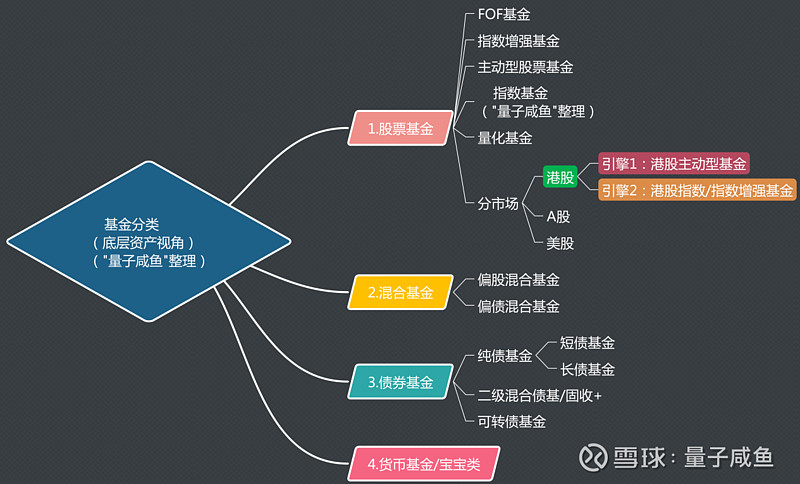

We have written many varieties in the “army” of fund investors, such as FOF funds, stock active funds, fixed income funds, industry index funds, index enhanced funds, etc., if classified according to the investment market, it mainly includes A-shares, US stocks, Hong Kong stocks and other major markets, let us first review the fund classification based on the perspective of underlying assets:

It can be seen that in major markets such as A-shares, US stocks, and Hong Kong stocks, the Hong Kong stock market mainly adopts a “dual-engine” investment strategy:

Engine 1: Hong Kong stock active funds

Active funds can obtain excess returns relative to the broader market through the stock selection and timing of fund managers, and the same is true for the Hong Kong stock market. If some excellent active funds for Hong Kong stocks can be selected, in addition to enjoying the overall beta income of the Hong Kong stock market, you can also Can obtain the excess α return brought by the fund manager;

Engine 2: Hong Kong stock index/index enhanced fund

If you want to obtain the overall average income of the Hong Kong stock market, or obtain the income of certain industry sectors in the Hong Kong stock market, or enhance the strategy on the basis of the overall index, then it is a good choice to choose the Hong Kong stock index/index enhancement fund when deploying Hong Kong stocks s Choice;

In this article, we use the “dual-engine” investment strategy to analyze and evaluate the corresponding funds.

This article evaluates Hong Kong stock active funds: Wells Fargo Blue Chip Select Stock (F007455), Wells Fargo China Small and Medium Cap Mix (F100061), China Europe Fenghong Shanghai, Hong Kong and Shenzhen A (F002685), Huaan Hong Kong Select (F040018), Southern Hong Kong Growth (F001691), ChinaAMC Shanghai-Hong Kong Stock Connect Hang Seng ETF Link (F000948), China Universal Hang Seng Index (QDII-LOF) A (F164705), GF Hang Seng Technology Index (QDII) A (F012804), Celestica Hang Seng Technology Index A(F012348)

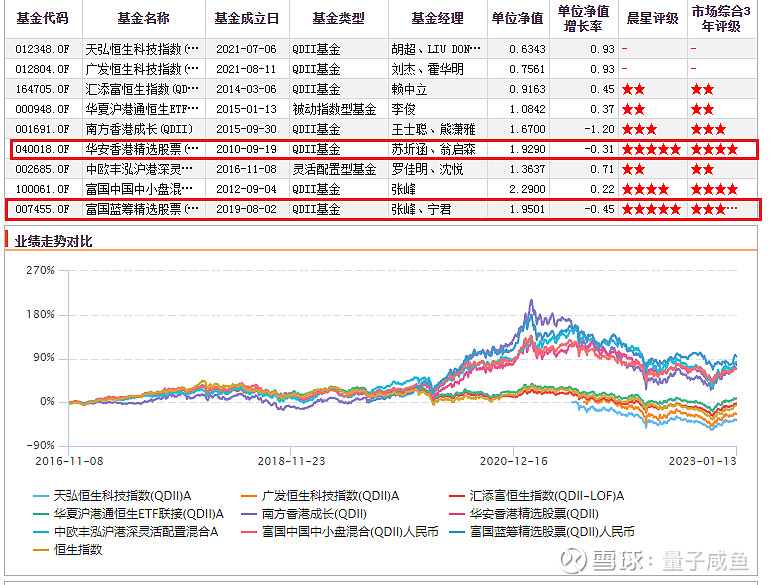

First of all, let us look at the comparison of performance trends of 9 Hong Kong stock funds:

Note: The picture data comes from choice

Quantum salted fish analysis: From the perspective of performance trends, the net value curves of several Hong Kong stock active funds including Fuguo Blue Chip Selected Stock (F007455) performed better than other Hong Kong stock index funds, and also outperformed the Hang Seng Index. Wells Fargo Blue Chip Selected Stocks (F007455) and Huaan Hong Kong Selected Stocks (F040018) have even received a 5-star rating from Morningstar and have been recognized by professional rating agencies;

Since several Hong Kong stock index funds have been established for a relatively short period of time, we separately split the trend of their net value curves:

Note: The content of the picture comes from wind

Analysis of quantum salted fish: It can be seen that the two index funds tracking the Hang Seng Technology Index did not significantly outperform the Hang Seng Index. This may be related to the industry environment of the Internet sector in the past two years. The Hong Kong dollar once fell below 200+ Hong Kong dollars, and the deepest drop was as high as 70%+. From this, we can also see the tragic degree of the Internet sector in Hong Kong stocks. At the same time, the two index funds tracking the Hang Seng Index have outperformed the Hang Seng benchmark index. Among them, the Huaxia Shanghai-Hong Kong Stock Connect Hang Seng The excess return of ETF Linkage (F000948) relative to the Hang Seng Benchmark Index is more obvious;

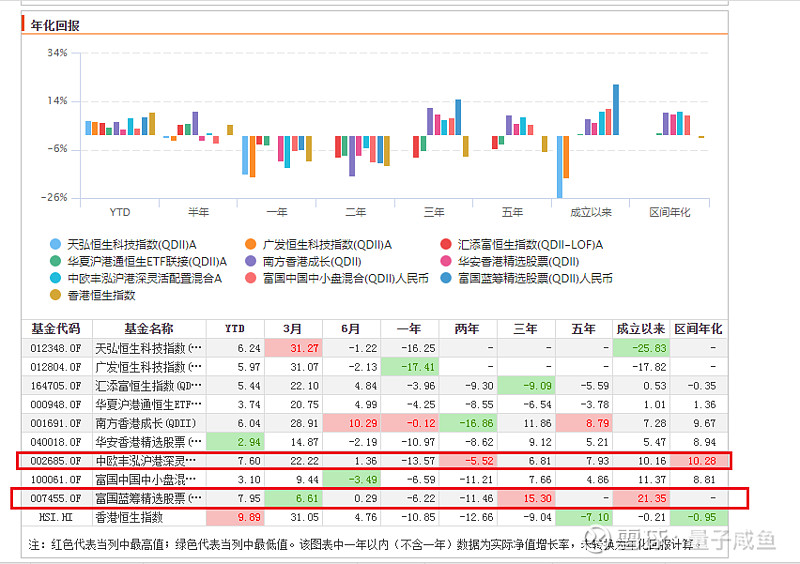

Comparison of annualized returns of 9 Hong Kong stock funds:

Note: The picture data comes from choice

Quantum salted fish analysis: It can be seen that the better performance in “Engine 1: Hong Kong Stock Active Fund” is: Wells Fargo Blue Chip Selected Stock (F007455) (annualized return rate of 21.35% since its establishment) and China Europe Fenghong Shanghai, Hong Kong and Shenzhen A(F002685) ( interval annualized rate of return 10.28%), under the premise that the annualized range of the Hang Seng Index is negative, it is still very good for two Hong Kong stock active funds to obtain this rate of return. China Xia-Hong Kong Stock Connect Hang Seng ETF Link (F000948) Since it has a certain excess return relative to the Hang Seng Index, the annualized return rate of the interval is still positive;

Comparison of excess returns of 9 Hong Kong stock funds:

Note: The picture data comes from choice

The indicators for evaluating the excess return of funds are generally the Sharpe ratio and the Sordino ratio. I personally value the Sordino ratio more. Some children’s shoes may not know the Sharpe ratio and the Sordino ratio. Here is a brief introduction:

Sharpe ratio: Sharpe ratio = (annualized rate of return – risk-free interest rate) / portfolio annualized volatility = excess return / annualized volatility

The Sharpe ratio is meaningless by itself, only in comparison to other combinations

Sodino ratio: It is similar to the Sharpe ratio, the difference is that it does not use the standard deviation as the standard, but uses the decline deviation, that is, the degree to which the investment portfolio deviates from its average decline, to distinguish the quality of volatility. Therefore, when calculating volatility Instead of the standard deviation, it uses the downward standard deviation

Analysis of Quantum Salted Fish: In terms of excess return and drawdown control, the better performers in “Engine 1: Hong Kong Stock Active Fund” are Fuguo Blue Chip Selected Stock (F007455), China Europe Fenghong Shanghai, Hong Kong and Shenzhen A (F002685) and Southern Hong Kong Growth (F001691), especially Fuguo blue-chip selected stocks, can achieve excellent returns while achieving a super-high Sodino ratio that far exceeds other similar active funds, which is enough to reflect the excess profitability of its fund managers. It can be seen Morningstar’s 5-star rating still has a certain amount of gold;

Comparative analysis of investment research strength of fund companies of 9 Hong Kong stock funds:

Note: The picture data comes from choice

Analysis of Quantum Salted Fish: The first echelon of rich country blue chip selected stocks (F007455), China Europe Fenghong Shanghai Hong Kong Shenzhen A (F002685) and Southern Hong Kong Growth (F001691), the assets under management of their fund companies rank: 7th, No. 21 and No. 6. Compared with passive index funds, the stronger the investment research strength of the fund company to which the active stock fund belongs, the better the performance of the active fund under its management. The scale of assets is a very important indicator. After all, the larger the scale of assets under management, the more management fees it receives. Only with more management fees can we have money to recruit more excellent asset management talents. The investment and research strength of fund companies can increase The effect is still very important. After all, every position adjustment of the fund requires the contribution of one excellent researcher after another. I personally think that the top 30 fund companies in terms of assets under management can be regarded as leaders. The assets under management of these three funds in the echelon are all ranked in the top 30, reflecting that the investment and research capabilities of Wells Fargo Fund, China Europe Fund and China Southern Fund are still relatively strong;

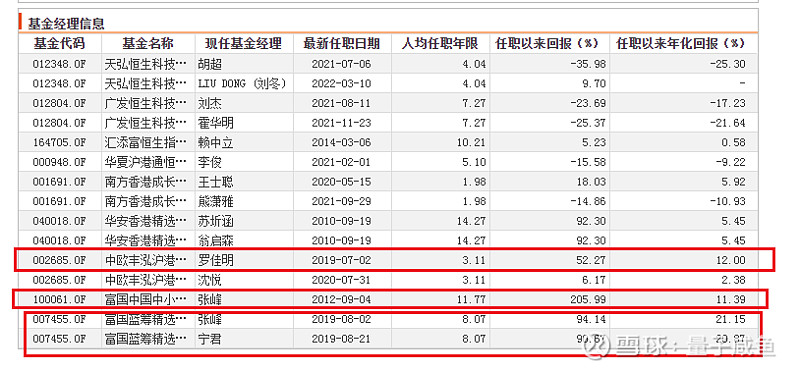

Comparative analysis of the return of fund managers of 9 Hong Kong stock funds:

Note: The picture data comes from choice

Analysis of Quantum Salted Fish: Zhang Feng and Ning Jun of Fuguo blue-chip selected stocks are still outstanding, with an annualized return of 20%+. Under the environment of the Hong Kong stock market, it is quite good to be able to achieve this annualized rate of return. In particular, the tenure of Zhang Feng’s tenure of Fuguo Blue Chip Selected Stocks has also reached 3 years and 166 days, which is not very short, and it can still reflect his comparative Strong asset management capabilities, especially in a mature market like Hong Kong stocks, where excess returns are even more rare;

Finally, to summarize:

This wave of Hong Kong stock market, represented by Tencent Holdings, has risen a lot from the bottom. In recent months, the trend of Hong Kong stocks has been stronger than that of A shares. Layout nuggets:

Engine 1: Hong Kong stock active funds: Through the fund manager’s stock selection and timing to obtain excess returns relative to the broader market, in addition to the beta returns of the Hong Kong stock market as a whole, you can also obtain the excess α returns brought by the fund managers;

Engine 2: Hong Kong stock index/index enhanced fund: can obtain the overall average return of the Hong Kong stock market, especially for the specific sector layout of the Hong Kong stock market;

Among the funds evaluated and analyzed in this article, the performances of Fuguo Blue Chip Selected Stock (F007455), CEIBS Shanghai-Hong Kong-Shenzhen A (F002685) and Southern Hong Kong Growth (F001691) in the first echelon of “Engine 1: Active Funds for Hong Kong Stocks” Better, “Engine 2: Hong Kong Stock Index/Index Enhanced Fund” China Summer Shanghai-Hong Kong Stock Connect Hang Seng ETF Link (F000948) performed better, compared with the Hang Seng Index, it can have a certain excess return, if you are optimistic about the Internet, technology and other details of Hong Kong stocks According to the future development of different fields, the performance of Guangfa Hang Seng Technology Index (QDII) A ( F012804 ) is better. s Choice.

#老司基hard core evaluation# #雪球创作者中心# #雪球星计划#

@今日话题@雪球创作者中心@ETF星推官@富国基金@中欧基金@华夏基金

$Fuguo Blue Chip Selected Stock(F007455)$ $China Europe Fenghong Shanghai-Hong Kong-Shenzhen A(F002685)$ $Southern Hong Kong Growth(F001691)$

There are 36 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9600110938/240039580

This site is only for collection, and the copyright belongs to the original author.