In the past two months, Weimob’s stock price has entered a period of continuous rise. Will it make Weimob out of the quagmire of losses?

In the past two months, Weimob’s stock price has entered a period of continuous rise. Will it make Weimob out of the quagmire of losses?Text丨Wuji

Source丨BT Finance

At the beginning of 2022, Weimob Group, the leader of e-commerce SaaS, suddenly entered a continuous growth mode.

In the six trading days in November, Weimob once rose by more than 50%. After entering December, the consecutive rise continued, with a cumulative rise of more than 42% within the month. On December 29, Weimob closed at HK$6.34 per share. Although there was a 0.78% decline, it was also at a high level.

On March 29, 9 months ago, Weimob’s share price was HK$5.45 per share, and its current market value has increased by HK$2.27 billion, but it is still 81.1% away from the highest point of HK$33.50 per share on February 26, 2021. The market value has evaporated by 69.23 billion Hong Kong dollars.

Since 2022, Weimob’s stock price has fluctuated greatly. The intraday HK$6.48/share on December 29 was the highest point since February, and it once touched HK$6.23/share in intraday trading, a new high since February this year. Among them, October 31 was the lowest value of HK$2.21 per share during the year, and the stock price fluctuated like a roller coaster.

So at the end of the year, will the sudden rebound in Weimob’s stock price make Weimob out of the quagmire of losses?

Shares soar after three quarterly reports

On November 2, Weimob released its financial report for the third quarter of 2022. According to data, in the third quarter, Weimob SaaS (excluding Haiding) orders increased by 30% year-on-year, and gross advertising revenue was 2.87 billion yuan, a year-on-year decrease of about 5%. Among them, the gross advertising revenue in September was RMB 970 million. The stock price rose by 5.69% on the day the financial report was released, and continued to rise by 10.13% the next day, starting a continuous increase mode.

Some industry analysts believe that the bottoming out of Weimob’s stock price was driven by the gross advertising revenue of 970 million yuan in September. This is the first time since 2022 that the gross income exceeded the same period last year. confidence.

It is understood that since becoming the official operator service provider of WeChat video accounts, Weimob has vigorously developed the video account business. Through the opportunity of the 616 Weimob Retail Shopping Festival, the business scale of Weimob’s video account live broadcast business has reached a new high. Weimob’s smart retail business has maintained growth. At present, the service brands include Lenovo Lebei, Shanghai Jahwa, Mengniu, Laiku Technology, 3trees, and Uni-President Enterprise, and nearly 100 mainstream brands in the retail industry. As of September 2022, there will be more than 2,000 applications and services on Weimob Cloud Market.

With the improvement of the epidemic situation, the two major businesses of Weimob subscription solutions and merchant solutions have achieved growth, but an unavoidable fact is that Weimob is still in a loss state since the second year of listing, even after the stock price soared. There was no profit at the time, and the income and expenditure were difficult to balance.

It is worth mentioning that the third quarterly report of Weimob did not announce the specific loss amount, but in the first half of the year, Weimob disclosed the amount of loss. The adjusted loss reached 567 million yuan. The loss in the third quarter was inevitable, but Not disclosed in the financial report. As of the evening of December 29, 2022, for unknown reasons, professional investment platforms such as Oriental Fortune have not updated the data of Weimob’s third quarterly report (Weimeng announced the publication of its third quarterly report on November 2).

Listed companies must disclose their financial statements in accordance with relevant regulations. The data of Weimob’s current third quarter report is only published by itself, and the relevant platforms have not been updated in time, which is rare among many listed companies.

Profits double down, losses intensify

Weimob’s third quarterly report has no specific reference data, and BT Finance can only refer to the data of the semi-annual report.

Weimob’s semi-annual report shows that the total revenue in the first half of the year was 900 million yuan, a year-on-year decrease of 6.2%; the operating loss was 659 million yuan, a year-on-year increase of 17.6%, and the adjusted net loss was 567 million yuan, a year-on-year increase of 499.2%, of which the gross profit was 598 million yuan, a year-on-year decrease of 21.4%. Throughout the first half of the year, Weimob’s profit doubled, and its loss increased by 5 times.

Through financial data, it can be found that Weimob has been in the red except for realizing profits in 2017 and 2019. Among them, the net profit attributable to the parent in 2017 was 2.831 million, and the net profit attributable to the parent in 2019 was 312 million yuan. From 2015 to 2021, Weimob has lost 2.88 billion yuan. Based on the loss value in the first half of 2022, the loss in 2022 may exceed 1 billion yuan, with a total loss of nearly 4 billion yuan.

Regarding the decline in performance in the first half of the year, Weimob stated that it was mainly due to the decrease in revenue from merchant solutions. From the revenue structure, we may find clues. In the first half of the year, Weimob recorded a revenue of 581 million yuan in terms of subscription solutions, achieving a growth of 5.7%.

According to the financial report data, the Weimob payment merchants are mixed. There are 103,616 paying merchants, an increase of 1.7% year-on-year, but the turnover rate has increased from 11.1% to 12.1%, which means that the marketing team has worked so hard to win the payment. For users, the churn rate is as high as 12.1%. In terms of merchant solutions, it recorded revenue of 319 million yuan, but it fell by 22.3% year-on-year, compared with 410 million yuan in the same period last year, while the number of paying merchants fell by 2.6% to 26,770.

It can be seen that the reduction of merchant advertising budgets under the epidemic has a greater impact on Weimob’s revenue. While revenue is declining, what worries investors is the decline in Weimob’s core profitability. The overall gross profit margin of Weimob in the first half of the year was 66.4%, compared with 79.2% in the same period last year, a drop of nearly 13 percentage points year-on-year, which is an astonishing rate of decline.

The gross profit margin of Weimob subscription solutions fell from 74.0% to 60.8%, and the gross profit margin of merchant solutions fell from 79.2% to 66.4%. The gross profit margin of the two major businesses has declined, and the decline in the overall gross profit margin is inevitable.

Soaring Operating Costs

Under the macroeconomic downturn affected by the epidemic, many companies are reducing costs and increasing efficiency, but Weimob’s operating costs have not decreased but increased. High costs and expenses may be a major reason for Weimob’s losses.

According to the semi-annual report, Weimob’s sales cost in the first half of the year was 302 million yuan, compared with 199 million yuan in the same period last year, an increase of 51.76%. The financial cost in the first half of the year was as high as 631 million yuan, compared with 164 million yuan in the same period last year, an increase of 285% year-on-year. The financial cost in the first half of this year is almost four times that of last year. General and administrative expenses soared from 310 million yuan in the same period last year to 544 million yuan, an increase of 75.48%.

From the above data, it can be seen that Weimob’s sales expenses and financial costs have both risen sharply. Even with a financial income of 80 million yuan, it cannot make up for the huge gap in these two data, which directly led to the intensification of losses.

In the case of sales expenses, financial costs and general administrative expenses all increasing significantly year-on-year, the squeeze on profit margins is inevitable. One of the reasons for the loss given by Weimob is the expenditure on research and development. In the first half of the year, Weimob’s research and development expenses increased from 304 million yuan in the same period last year to 469 million yuan, an increase of 54.4%. This increase was significantly lower than the increase in related expenses such as sales expenses and finance costs.

Looking at Youzan in the same period, it cut costs and increased efficiency. Even in research and development, there was a 28% decline. The research and development expenditure was only 213 million yuan, which was less than half of Weimob’s research and development expenses.

The increase in Weimob’s R&D expenses is mainly due to the annualized cost effect of the increase in R&D personnel in the second half of 2021. Under the three major strategies of “big customerization, ecologicalization, and internationalization”, Weimob has to invest more people in business to seek breakthroughs in personalized services for large customers, regardless of whether it is active or passive. Improving its own platform products requires a lot of manpower and material resources, which greatly increases its cost expenditure, which in turn affects the profit level.

Video accounts are hard to see results in the short term

The market prospect of SaaS is worth looking forward to.

According to data from iiMedia Consulting, the market size of China’s SaaS industry will reach 32.26 billion yuan in 2021, and it is expected to reach 55.51 billion yuan in 2023. The leading companies in the SaaS industry, Weimob and Youzan, will have their total revenues in 2021 respectively. It is 2.686 billion yuan and 1.57 billion yuan. The sum of the two is only 4.256 billion yuan, accounting for only about 13% of the total market. Among them, Weimob, as the leading enterprise in the industry, also has a market share of only 8%, which is still far away from the “monopoly” unicorn enterprises.

A cruel fact is that under the influence of the epidemic, Weimob and Youzan, two leading companies in the industry, have experienced the embarrassment of declining performance.

Internet investor Liu Bo pointed out that under the epidemic, small and medium-sized enterprises are all tightening their belts and striving to survive. As the main source of income for the SaaS industry, they themselves have been greatly affected. It is difficult for Weimob and Youzan to not be affected. The most important thing for SaaS service providers is to survive, and they cannot easily fall behind. Once they fall behind, it will be even more difficult to catch up.

Liu Bo believes that against this background, many companies in the SaaS industry have begun to make corresponding adjustments to their services. Weimob’s deployment of video accounts is a major manifestation of business adjustments in order to seek new breakthroughs.

As we all know, the video account has risen rapidly in recent years. In the WeChat traffic market, the video account has developed rapidly, and has the momentum to catch up with Douyin and Kuaishou. With its unique social attributes, it is decentralized and other short video platforms do not have it. The ability to combine public and private domains may change the industry structure in the future.

Many platforms have also sensed the development trend of video accounts and began to continue to focus on video accounts. However, it is not easy to re-layout in unfamiliar fields. The fastest way is to find professional service providers to achieve the goal of the layout, while Weimob and WeChat The special relationship between them has the advantage of being close to the water and building first. This makes Weimob usher in new development opportunities.

As the first service provider to enter this field, Weimob has a first-mover advantage, but it also has unavoidable disadvantages. They have no operating experience in the field of short video, and now entering the short video is also in the exploratory stage. Compared with the experience of trial and error of other leading companies, Weimob is relatively lacking, which leads to Weimob’s deployment of video accounts, which also has certain risks.

Judging from the semi-annual report and the third quarterly report that Weimob has concealed the business of the video account, the development of this business may not bring any tangible benefits to Weimob at present. It will take time to consider how the future development will be. In the short term, it is difficult for this business to turn Weimob into profit.

Constant complaints

As a service provider, Weimob will inevitably have complaints due to service problems, especially in the period of rapid development of Weimob, which may ignore the feelings of customers.

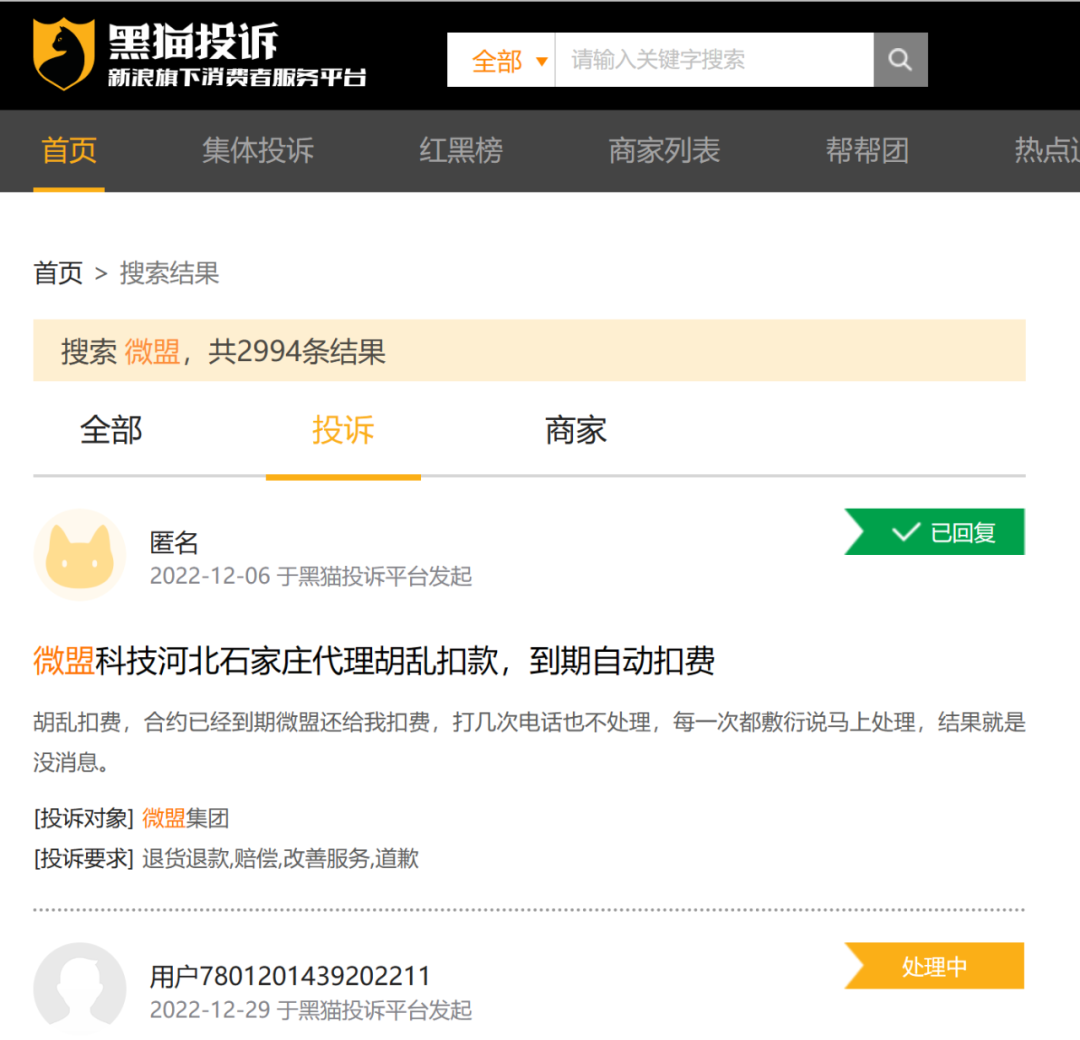

In recent years, there have been constant reports from the media that paid merchants have complained to Weimeng on Dianshubao, Blackmao Complaint, and Diansubao platforms. BT Finance saw nearly 3,000 complaints against Weimob on the black cat complaint. Although compared with Youzan’s more than 7,000 complaints, it is already a low level, but it also shows that Weimob’s service has certain flaws.

BT Finance sorted out these complaints and found that most of the complaints were about refunds not in accordance with the contract, wrong boards, non-refundable store return deposits, and fee deductions for canceling the contract after the contract expired. The rating is “order with caution”. Some people in the industry pointed out that there are two reasons for the large number of complaints of Weimeng, namely Weimeng’s own agency system and marketing methods, as well as the pressure of capital and platforms.

Weimob’s marketing method is to burn money. From 2018 to 2020, Weimob’s sales expenses accounted for 52%, 49.9%, and 49% of the total revenue respectively, almost at a level of 50%, which means that Weimob spends half of its revenue on sales. The consequence of putting too much emphasis on sales is that before becoming a customer, you can enjoy God-like treatment, but after becoming a paying user, the service is difficult to meet expectations, which naturally makes customers unsatisfied.

In the first-tier cities of Beijing, Shanghai, Guangzhou and Shenzhen, Weimeng has its own direct sales team, while in the sinking market, Weimeng adopts the agency model. The income of agents is directly linked to performance rebates. This model can maximize the market in the short term , but there are many disadvantages of post-management, and in the end, Weimob has to “take the blame” by itself.

As for the pressure on capital, as a listed company, continuous losses cannot be explained to investors. Especially the big investors who have been increasing their holdings since 2022. Goldman Sachs increased its holdings by 1.204 million shares at an average price of HK$6.91 per share. After the increase, Goldman Sachs held 12.8 billion shares, accounting for 5.04% of the total share capital; After 10,000 shares, the shareholding is 230 million shares, and the shareholding ratio is 9.02%.

Liu Bo, an Internet investor, believes that how long can these large investors who vigorously increase their holdings when Weimob is at a low point allow Weimob to lose money? Therefore, Weimob can only run desperately. While paying attention to speed, it is difficult to guarantee the quality, and the number of complaints will naturally increase.

At present, what makes Weimob feel a little relieved is that the stock price has shown a trend of recovery in the past two months. Although it is far from the peak value, it also has a gradual upward trend. Compared with China Youzan’s penny stock price of HK$0.189, Weimob’s life is not bad.

BT Finance found that in terms of valuation, Weimob’s price-to-sales ratio is 2.45 times, and the price-to-sales ratios of industry giants Kingdee International and Lianyirong Technology are 8.6 times and 4.9 times, respectively. Compared with other SaaS stocks, Weimob’s stock price has a significant discount, and it seems that there is some room for growth.

At the end of 2022, Weimob suddenly entered the continuous growth mode or brought some relief to the financial pressure. In the long run, Weimob still needs to face up to the problem of losses. The rise of private domain e-commerce and digital transformation have brought a broad market for e-commerce SaaS. To compete for this market, products are the key and technology is the core. It is time for Weimob to make changes.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2023-01-03/doc-imxywfvp9284079.shtml

This site is only for collection, and the copyright belongs to the original author.