There has never been a 20cm consecutive word in the history of A-shares, and electric testing is undoubtedly the most concerned stock after the year.

The main line is where the attention is, and the hype around the military industry group has logic.

I have to say that the current market is still relatively chaotic, and there is still no clear idea for the entire military industry sector, and no joint force has been formed.

But the main force may have figured it out during the week of the Chinese New Year, so I will sort it out for everyone before the new year.

Let’s start with the essence of Chengfei’s backdoor. Why do you need a backdoor?

Because the asset securitization rate is not up to standard.

There are a total of ten military industrial groups in China, and the asset securitization rate has always been one of the important business objectives of military industrial groups. Obviously, stock market fundraising is an important way to raise military expenditures, especially when wars are expected.

For example, the goal set by the aerospace industry is 70%. If Chengfei does not inject, it will not meet the target, so the market has always expected this. In fact, Chengfei did choose one of its companies to inject.

What about the other substandard groups?

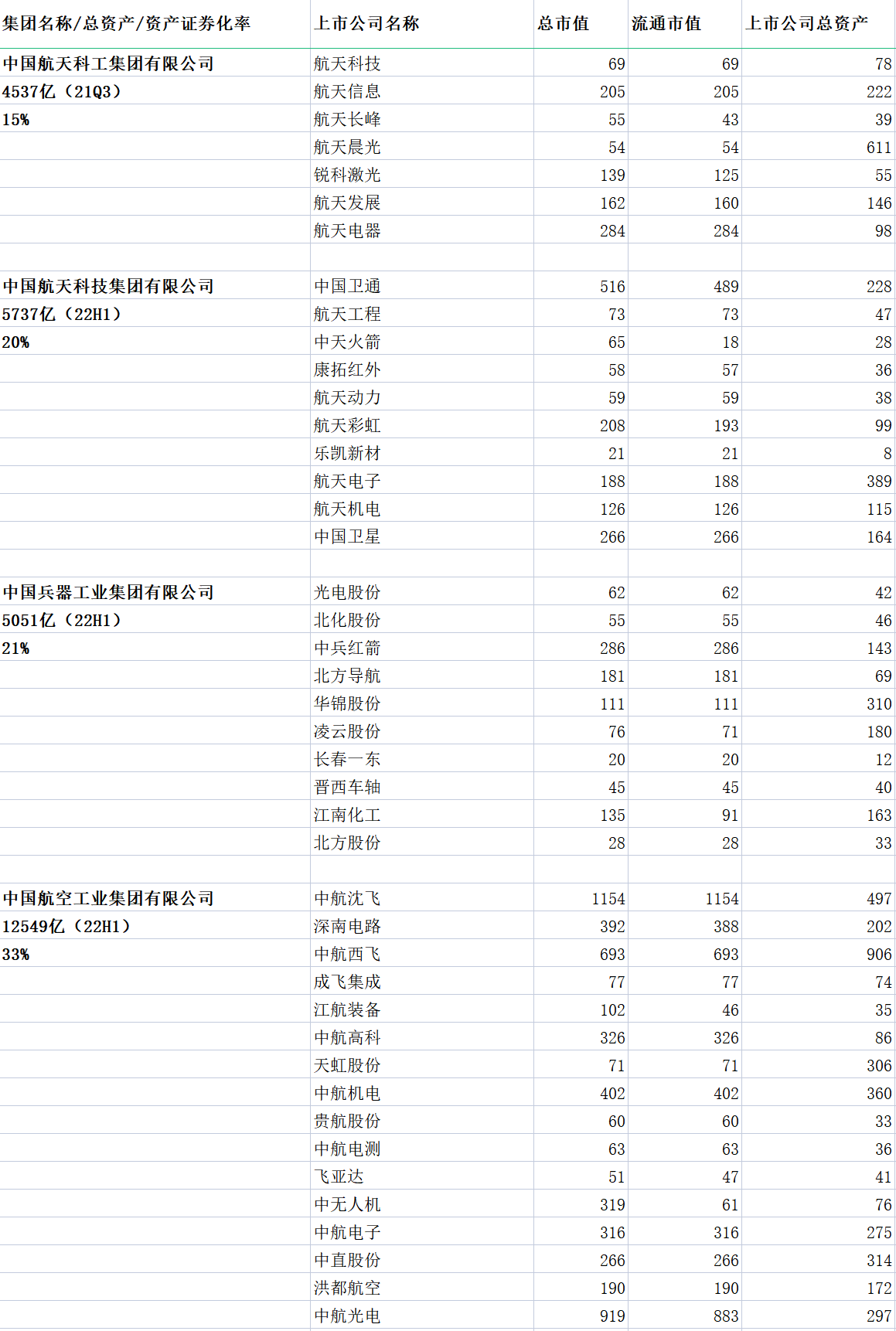

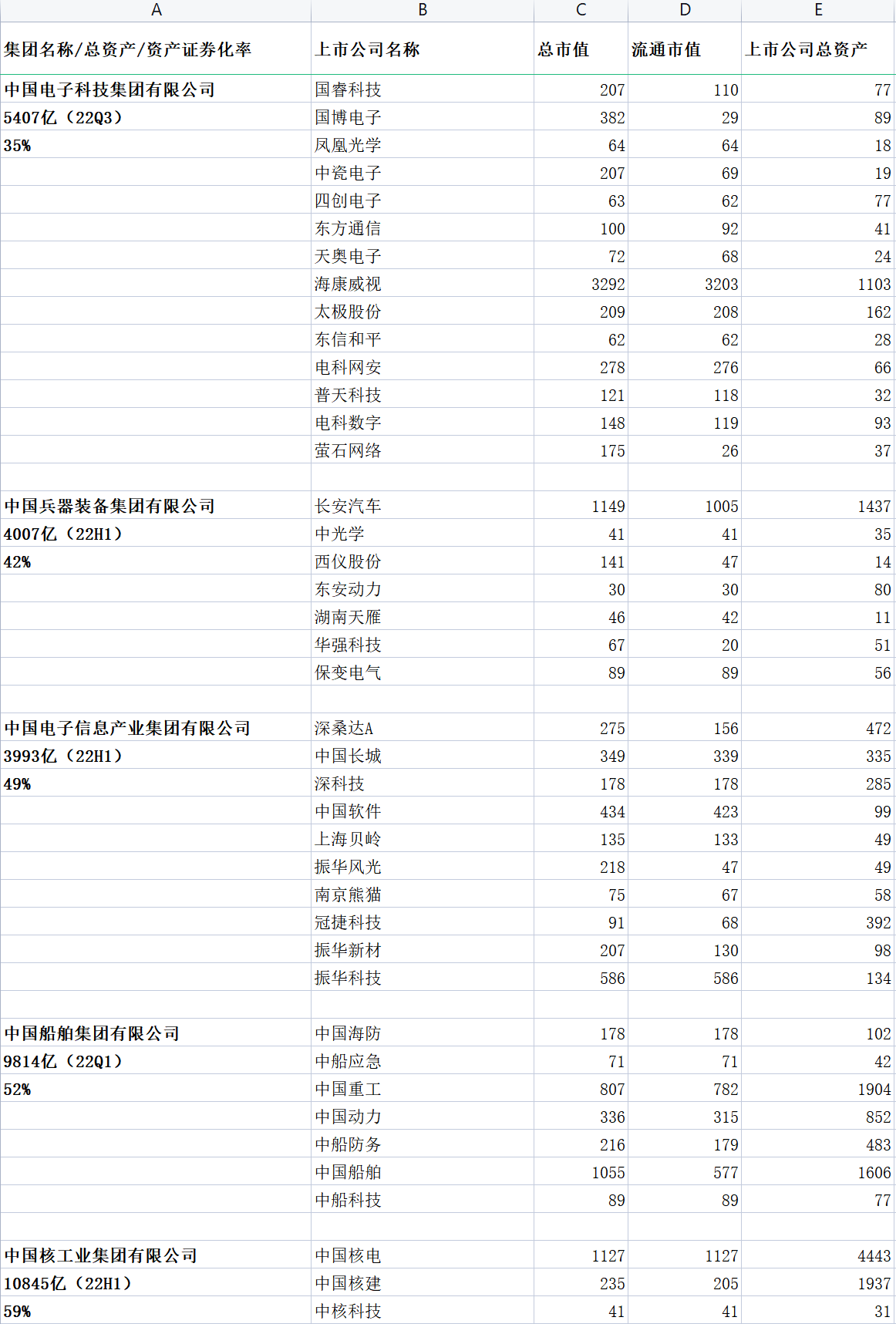

Refer to the chart below for the securitization rate of the top ten groups. At present, the lowest is CASIC with only 15%, and its target is 45%.

The 23-year work plan article of CASIC’s recent official account has the following original text:

Increase investment and financing in key industries, establish 11 new platforms such as Aerospace Intelligence Institute and Aerospace Science and Technology Insurance; complete external financing of rocket companies and space companies with high quality. Complete the “two non-” stripping and mixed reform pilot work.

• Continue to promote professional integration and capital layout optimization.

Highlight the main business of serving the main responsibilities, actively optimize the stock, refine the increment, and continue to promote the adjustment of industrial structure and the optimization of capital layout. Focus on key and advantageous industries, increase investment and financing, and actively connect with the capital market.

• Actively and steadily improve the quality of listed companies. Clarify the positioning of listed companies and increase the concentration of main businesses. Cultivate and promote asset securitization of high-quality enterprises.

It’s hard to say what benefits Chengfei’s backdoor will have for the individual stocks that are currently hyped in the market. Groups with a low securitization rate, such as Aerospace Science and Industry, have clearer injection expectations.

The author believes that the speculation surrounding the small market capitalization shell of military industrial groups with low securities ratio should be the right direction.

There are 45 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/7022880143/240355946

This site is only for collection, and the copyright belongs to the original author.