——Does stock fluctuations count as a loss of money? How to do it without losing money?

Although the investment methods of different investment masters are different, almost all masters emphasize – don’t lose money . It is even considered that not losing money is more important than pursuing high returns .

We don’t need to emphasize it, we understand, because people hate losses, which is engraved in our genes.

But in fact, everyone has suffered a lot this year, right? I’ve lost a lot anyway. If I follow the master’s standard, I’m definitely not qualified!

1. Why is it so important not to lose money?

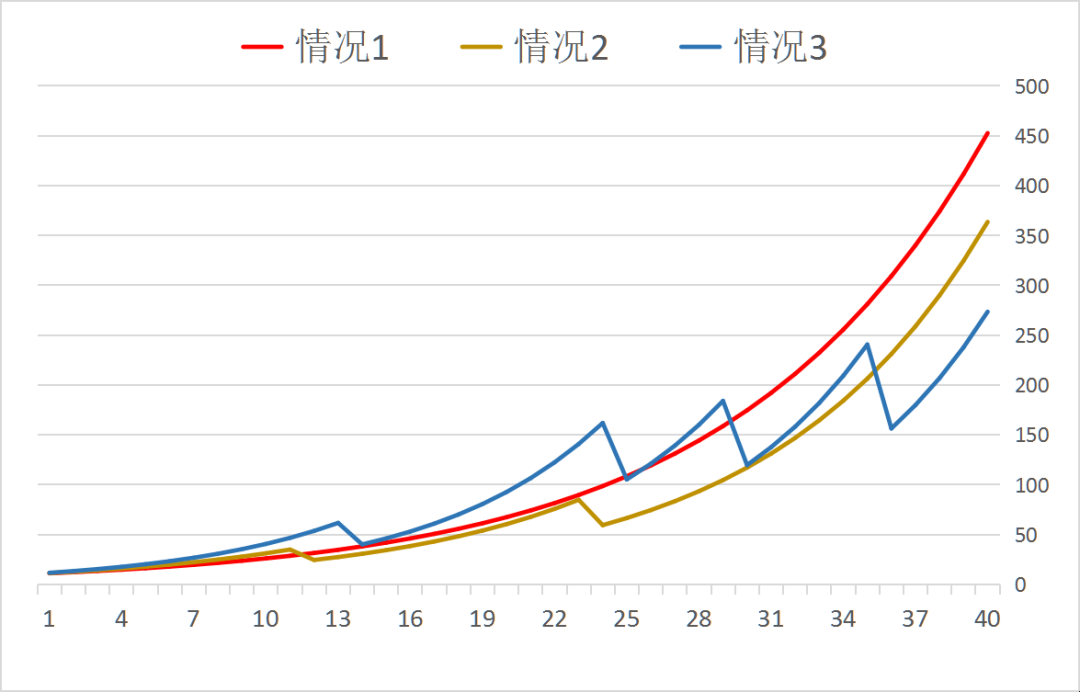

First simulate and compare the loss and no loss. Assume that the initial principal is 100,000 and the investment period is 40 years.

Situation ①: 10% annualized income, stable.

Scenario ②: 12% annualized return, but 2 years of method failure, resulting in 30% loss.

Scenario ③: 15% annualized return, but the method fails for 4 years, resulting in a 35% loss.

Final assets: ①452.6; ②363.5; ③273.4. (No matter which year the loss occurs, the result is the same)

It can be seen that not losing money is indeed more important than pursuing high returns, or in other words, income stability (win rate) is more important than high risk and high return (odds).

Taking case ② as an example, if there is only one loss, it should be 5.816 million in the end, and a single loss will lead to a profit gap of nearly 2.2 million! If there is no loss at all, it will eventually be 9.305 million.

In addition, losses can easily lead to an unbalanced investor’s mentality. It was originally a floating loss, but if you cut the meat at the bottom, it becomes a real loss.

2. Why it is difficult to practice not to lose money

However, due to the influence of emotions, asset prices often fluctuate greatly. A-shares drop by 7% in a week and 30% in a year, which are normal things. Even if it is as stable as the U.S. stock market, there will often be slumps and fluctuations. No matter what type of asset it is, it is impossible to make a steady profit.

The following table shows the annual increase of the CSI 300 Total Income Index since 2005, with losses in half of the years.

It is very difficult to choose the time, and most investment masters also emphasize not to choose the time. If it is 2008 and 2015, the timing is excusable based on the valuation. However, most of the years in which A shares fell are not overestimated. Timing based on the rise and fall is more likely to lead to chasing up and down and more losses.

If you do a balanced allocation of stocks and debts to reduce volatility, it will deplete the yield. According to the backtest data, only when stocks:debt=1:9, there will be no loss-making years, and the annualized rate of return will shrink to 5%, underperforming the CSI 300.

As a result, if you want to practice “don’t lose”, you can’t play the game, or you have to suffer losses.

Therefore, the “don’t lose money” that the masters said is more of a starting point than a result. Buffett’s career has also suffered losses for three years. He is in the US stock market and is a stock god. We ordinary people can’t compare it.

For ordinary people in A-shares, in real investment, they can only settle for the next best thing and take “reducing losses” as the starting point. Work hard at the source and in the process, don’t pay too much attention to the result of the loss.

3. How to “minimize losses” as much as possible

1. Try to buy good assets , good assets can pass through bulls and bears, and it is not easy to explode; in the process of falling, more people will take over, and it is not easy to fall too much.

2. Pursue the margin of safety . When we see it wrong, or the situation gets worse, the margin of safety can protect us from causing too much loss. If you buy too expensive, the fault tolerance rate will be lower.

3. Moderately diversify positions and stay away from high-risk varieties. High returns may be accompanied by high risks. If our positions are too concentrated, it will cause huge losses in case of misunderstanding or encountering a black swan.

4. In-depth research to reduce mistakes. The further you research, the less likely you are to make mistakes.

5. Don’t increase leverage and invest with spare money. Leverage and short-term use of money will force us to sell, which will easily turn floating losses into real losses, which we must avoid.

6. Be patient and bearish on short-term market volatility. Even if we do the above, there will still be losses, because the market is this characteristic. Therefore, it is still necessary to correct the mentality, be bearish on fluctuations, and believe that the market will be a weighing machine for a long time.

@Today’s topic @snowball fund @snowball talent show

#雪ball star plan public offering talent# #Find you who loves funds # #Investment and finance#

$ Bank of Communications Trend Mix A (F519702)$ $ Xingquan Herun Mix (F163406)$ $ E Fund Consumer Industry (F110022)$

This topic has 8 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9290769077/232641302

This site is for inclusion only, and the copyright belongs to the original author.