2022 has entered the last trading week, and there is a major event this week, that is, the National Health and Medical Commission announced that it will adjust the new coronavirus infection from “Class B and A” to the same “influenza” on January 8, 2023. Class B and B control”, which means that from the perspective of the Law on the Prevention and Control of Infectious Diseases, the three-year concentrated fight against the epidemic has been completely over.

The cities that were the first to let go of control have gradually returned to “fireworks”, while other places will gradually return to normal order after experiencing short-term pain.

In 2023, we will “throw away our arms” and spare no effort to expand domestic demand and promote economic growth. Of course, this also means that investment in 2023 will be promising.

So, what investment aspects to watch in 2023? Let’s sort it out today.

First of all, from the perspective of expanding domestic demand, the consumption of “big-ticket” real estate and new energy vehicles, which were specifically mentioned by the Central Economic Work Conference, have a long industrial chain and an obvious role in stimulating the economy. They are the key directions for stabilizing growth and should naturally be paid attention to.

At the same time, the large financial sector, which has been suppressed by real estate regulation in recent years, will also benefit and can be paid attention to periodically.

Secondly, the broader consumption sectors affected by the epidemic, such as catering, hotels, tourism, aviation, etc., may usher in explosive growth in 2023, and we can pay attention to them in the short and medium term.

Third, the platform economy that “leads development, creates jobs, and demonstrates its talents in international competition” will show its talents in future economic growth and have long-term investment value.

Finally, from a longer-term perspective, the “high-end manufacturing” that has undergone major adjustments in 2022 may also usher in layout opportunities in 2023. After all, buying cheap can win greater profit margins for the future.

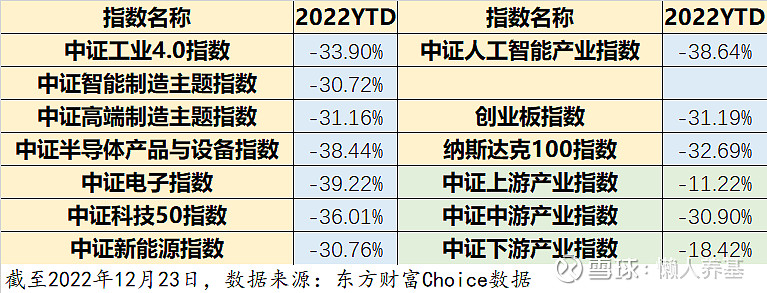

Lazy Yangji has sorted out the industry theme indexes and broad-based indexes that have fallen by more than 30% as of last weekend (December 23) in 2022. See the table below for details.

In terms of broad-based indexes, the ChiNext Index and the Nasdaq 100 Index, which are typical technology growth style indexes, fell by more than 30%.

Industry theme indexes that fell by more than 30% are almost all “high-end manufacturing” theme indexes: subdivided industry theme indexes include CSI Semiconductor Products and Equipment Index, CSI Artificial Intelligence Industry Index, CSI Electronics Index and CSI New Energy Index; comprehensive theme index includes China Securities Technology 50 Index, China Securities Industry 4.0 Index, China Securities High-end Manufacturing Theme Index and China Securities Intelligent Manufacturing Index.

The CSI upstream, midstream and downstream industry indexes fell by 11.22%, 30.90% and 18.42% respectively, which also shows that the manufacturing industry in the midstream is the “hardest hit area” in 2022.

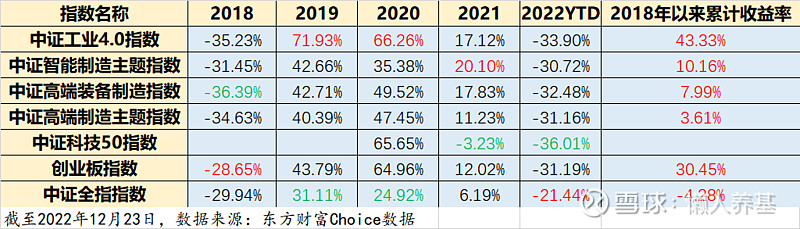

Comparing several comprehensive thematic indexes, there are the following characteristics:

1. The main industries they cover are similar, mainly in electronics, computers, electrical equipment, mechanical equipment, national defense and military industries.

2. There are as many as 500 constituent stocks in the CSI High-End Manufacturing Thematic Index, and there is no “preferred” feature at all, which may affect the long-term return of the index; the constituent stocks of the CSI Industry 4.0 Index and the CSI Intelligent Manufacturing Thematic Index are relatively concentrated, 68 respectively Only and 100; the CSI Technology 50 Index has the least constituent stocks, only 50, and the highest concentration.

3. The return performance of several indexes since 2018 is detailed in the table below.

Obviously, the CSI Industry 4.0 Index has the best return performance, with 2 of the 6 annual returns being the highest, and no annual performance at the bottom; the cumulative return of the CSI Industry 4.0 Index not only far exceeds the other three thematic indexes, but also It surpassed the GEM index, which performed outstandingly in the last round of bull market.

We all know that since the United States provoked the Sino-US trade friction in 2018, “Made in China” has won the trade dispute with its strong resilience, and a strong manufacturing industry, especially high-end manufacturing, will be the basis of future international competition.

Major Western countries are making great efforts to guide the return of manufacturing; building a strong manufacturing country has long been a national policy of our country. The “Made in China 2025” strategy formulated by our country in 2015 is actually another version of Industry 4.0.

The so-called “Industry 4.0” (Industry 4.0) is also considered to be the fourth industrial revolution. It is a concept first proposed by the German Federal Ministry of Economics and Technology at the 2011 Hannover Industrial Fair. Its core purpose is to improve the competition of German industry. In 2013, it was included in the “High-tech Strategy 2020” memorandum of the German Federal Government and upgraded to a German national strategy, and has since gained fame.

According to different development stages, Industry 1.0 refers to the era of steam engines, Industry 2.0 refers to the era of electrification, Industry 3.0 refers to the era of informationization, and Industry 4.0 refers to the era of intelligence.

Industry 4.0 covers smart factories, smart production and smart logistics, and realizes the transformation of manufacturing to intelligence.

“Made in China 2025” is the first ten-year action plan for China to implement the strategy of manufacturing a powerful country. It is similar to “Industry 4.0”. Development of the wheel manufacturing industry.

my country is already facing the reality of an aging population and declining competitive advantages of traditional manufacturing industries. Through the combination of the Internet of Things, big data and the virtual-real integration system (Cyber-Physical System), manufacturing equipment can achieve high intelligence and production autonomy. It is possible to engage in production without a large amount of labor and realize the transformation and upgrading of Made in China, thereby maintaining and improving the competitiveness of “Made in China” in the world.

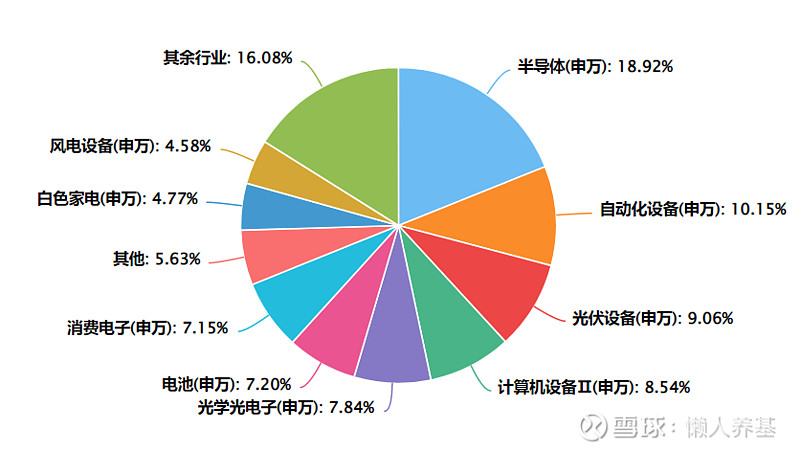

The China Securities Industry 4.0 Index (399803) was released on February 13, 2015. It selects no more than 80 providers of control hardware, control software, and terminal hardware related to Industry 4.0, as well as other representative Shanghai and Shenzhen companies that benefit from Industry 4.0 The securities of listed companies in the market are used as index samples. The current number of samples is 68. As of November 30, 2022, the average total market value of the index constituent stocks is 69.1 billion yuan. From the perspective of market value, it belongs to the medium and large market value scale index.

The SWS secondary industry composition of the CSI Industry 4.0 Index is as follows:

As of December 26, 2022, data source: Oriental Fortune Choice data

Among the component industries, there are not only new energy industries such as energy storage, photovoltaics and wind power that are getting better, but also industries such as semiconductors, automation equipment, and computer equipment that are catching up with the world’s advanced level, as well as relatively mature industries such as consumer electronics and white goods , the industry structure is relatively balanced, so that the index has a relatively stable level of profitability, which should also be the main reason why the long-term return of the CSI Industry 4.0 Index is better than other “high-end manufacturing” theme indexes.

From the perspective of valuation, as of December 23, 2022, the rolling PE of the China Securities Industry 4.0 Index is 25.32 times, which is far lower than the 38.02 times of the ChiNext Index. The index PE (TTM) is in the 25% or less quantile range since its establishment, and the valuation is low, which has a good investment value.

At present, the only fund tracking the index is Fuguo China Securities Industry 4.0 Index (LOF) (161031), with a combined scale of 666 million yuan. It is more convenient to invest on and off the market.

The year of 2022, which is full of disasters and disasters, will smash the stock market into a big “golden pit”. In fact, not only the theme of high-end manufacturing, but also the Internet, consumption, medicine, real estate, finance and other sectors are at historically low valuation levels , It provides a very good opportunity for long-term investors to find a layout.

Do you dare to buy it? How would you buy it? Welcome to the comment area to communicate together.

#老司基hard core evaluation# @雪球创作者中心@今日话话@雪球基金@ETF星迷官

$Fuguo China Securities Industry 4.0 Index(F161031)$ $China Merchants Shanghai Stock Exchange Consumption 80ETF Connection(F217017)$ $E Fund CSI Wonder Biotechnology Index (LOF)(F161122)$

This article was first published by Lazy Yangji , and the copyright belongs to the author. Reprinting without permission is strictly prohibited. Friends are welcome to forward Moments.

For more past articles, please click:

【Catalogue of Lazy People’s Foundation Snowball Column】

There are 9 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/2356382715/238683790

This site is only for collection, and the copyright belongs to the original author.