Is there an investment opportunity in medicine? 17 indicators screen 46 medical fund managers to see who is the strongest

——Regularly sort out pharmaceutical theme fund managers (2022-12)

Foreword: Medicine will peak on February 10, 2021, and will last 19 months until September 26, 2022. In terms of relative income, medicine has underperformed the market since August 2020, for as long as 25 months.

The picture below shows the comparison between the 300 Pharmaceutical Index (black line) and the CSI 300 (red line) (2020.8 to now, as of 2022-11-30, the same below, the data comes from wind)

Reasons why medicine has underperformed the market for a long time:

First, the centralized procurement of medicines has reduced the profits of pharmaceutical companies;

Second, geopolitics has triggered market concerns;

Third, the epidemic has affected consumption scenarios and willingness to consume;

Things go against extremes. The pharmaceutical industry started a violent rebound on September 26, bottoming out a month earlier than the broader market. As of November 30, the 300 Pharmaceutical Index rebounded by 12.25%, while the CSI 300 was 1.2% during the same period.

Reasons for the rapid rebound in the near future: First, sufficient adjustments and low valuations; second, the recent frequent positive medical news, which is better than expected.

In the long run, the demand for medicine will exist for a long time, the epidemic will eventually pass, centralized procurement will become milder, my country’s innovative drugs will gradually enter the world stage, and the medical device field is implementing self-control. There are still many investment opportunities in the pharmaceutical field.

With the recent rebound in medicine, there have been more and more questions in the background about which medical fund to choose. We will regularly sort out funds in various industries and styles to facilitate your selection. I have sorted out many times before, and looking back, there are right and wrong, and the screening method is constantly improving.

The competition for managers in the pharmaceutical industry is fierce. In recent years, many newcomers have emerged, and many people have quit. We sorted out again. This time, we used 17 indicators to screen 46 fund managers. help.

Screening criteria for pharmaceutical theme funds

①If it is a medical theme fund, there should be no drift, and it is best not to have a broad theme such as general health;

②The fund manager should preferably be a medical professional or a medical researcher, focus on medicine, and have little or no management of the whole market fund;

③ Since taking office, the performance ranks in the top third, and the risk control ranks in the top half

④Strong performance stability

⑤ To outperform the Pharmaceutical 50 Index

⑥ The management scale and the number of funds managed by the fund manager should be as small as possible;

The strongest medical index fund

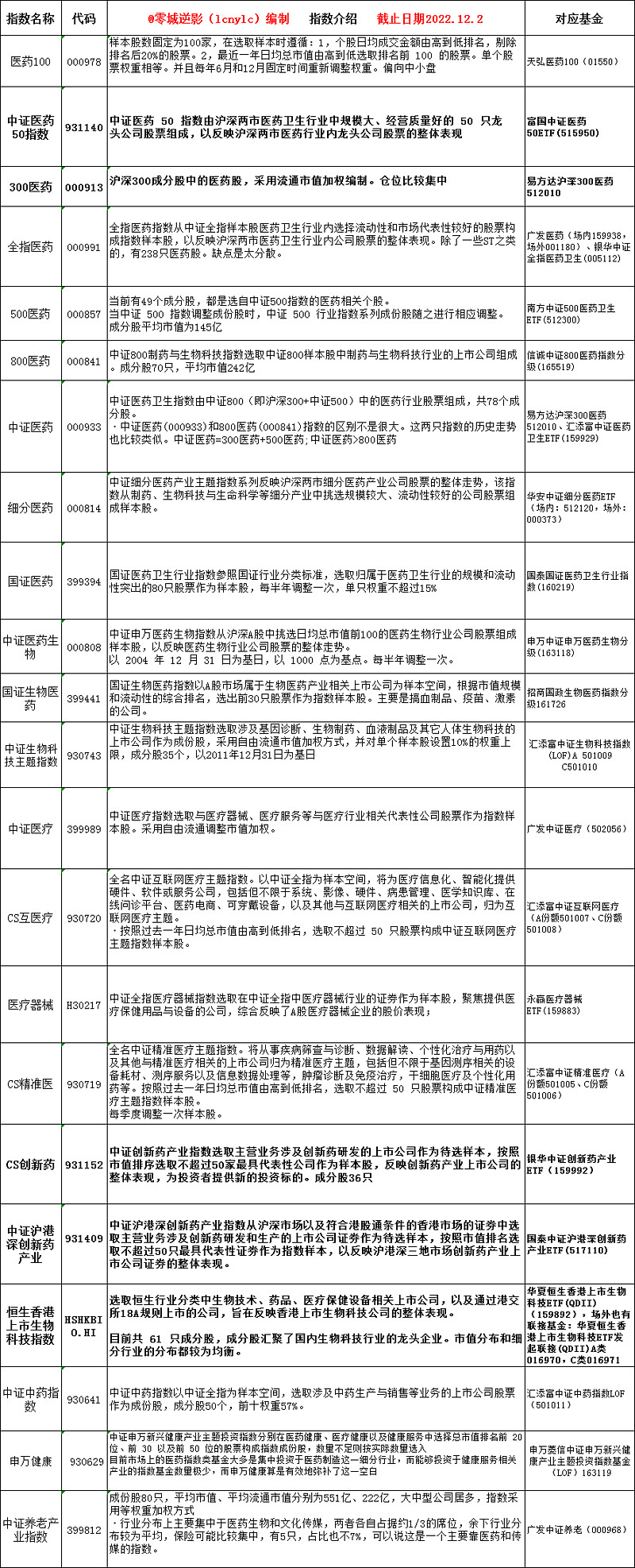

The following table is a complete list of pharmaceutical index funds, you can collect them

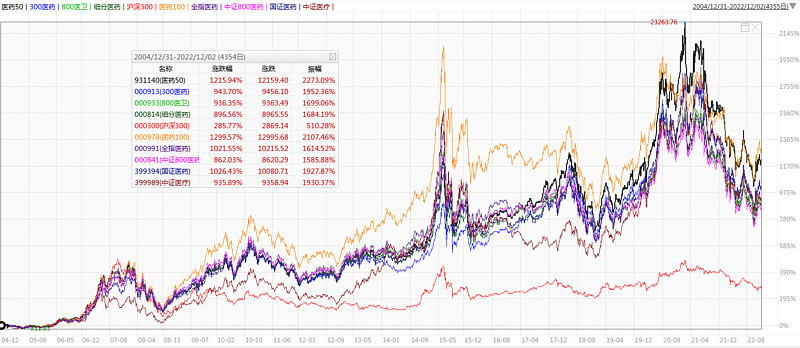

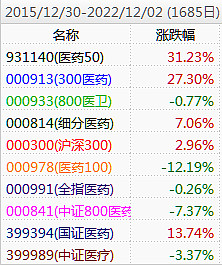

Even after nearly two years of correction, in the long run, since 2005, the pharmaceutical sector has still outperformed the Shanghai and Shenzhen 300 by a large margin, reflecting the demeanor of a long-term industry.

In this range, the pharmaceutical 100 index is the strongest (the index is small), and the pharmaceutical 50 is second.

However, since 2016, the pharmaceutical sector has gradually shown the characteristics of the strong and constant strength, especially after the establishment of the Medical Insurance Bureau in 2018, the performance of the 300 pharmaceuticals and the pharmaceutical 50 in the larger market has been stronger.

Personally, I think that Pharmaceutical 50 is the strongest pharmaceutical broad-based index.

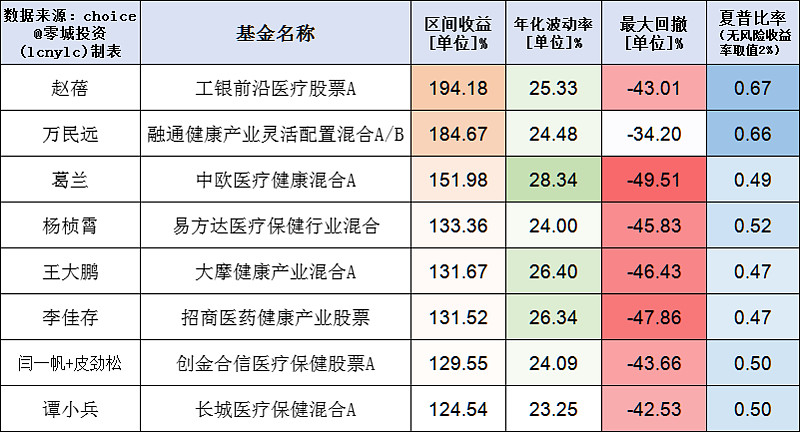

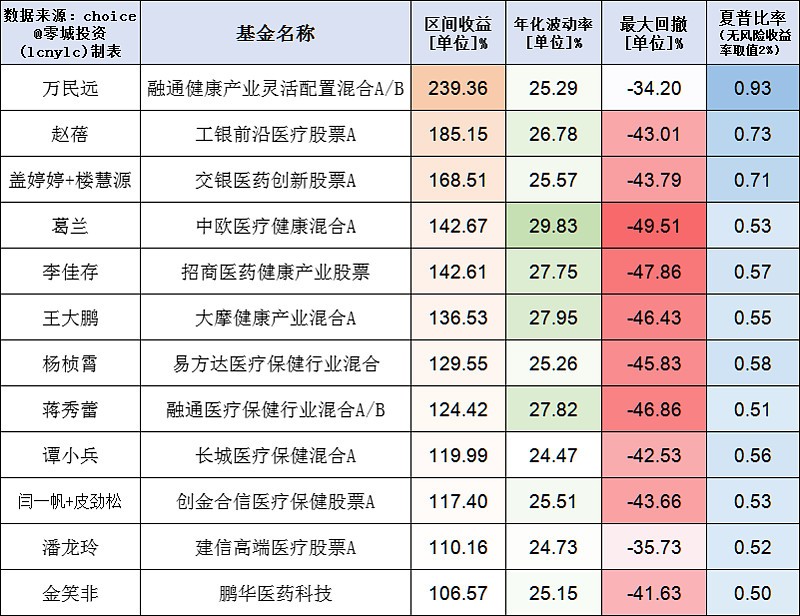

3. Comparison of performance and risk control

There are more than 200 medical-themed funds in the market. I first conducted some rough screening and selected 46 funds.

Let’s compare the data from the same time to reflect the level of the fund manager. I start the comparison from the tenure time of different managers, and try to keep one data per year.

·Contrast from the opening of the warehouse on 2016-10-29

This is a duel between veterans. Zhao Bei has the best performance and risk-benefit ratio, Gu Lan has the largest fluctuation, and Wan Minyuan has a good performance and a relatively small drawdown.

Zhao Bei is indeed very good. She can maintain a high-ranking performance in the following intervals, and she also experienced two maternity leave for giving birth.

·Comparison started after Pan Longling took office on July 18, 2017

·Contrast from Pi Jinsong’s tenure on October 31, 2018

2018 is the year when pharmaceutical themed funds were issued intensively. Many excellent managers have joined the track. Judging from this performance range, the difference between the beginning and the end is still quite large, with a difference of about 230%.

·Contrast from Xie Wei’s tenure on April 12, 2019

Xie Wei’s performance is not bad, but the fluctuation is the biggest in the same period!

·Contrast from Xu Zhibiao’s appointment in 20200827

This range is the range where pharmaceuticals underperformed the broader market, and it was a complete bear market in the pharmaceutical sector. The pharmaceutical sector suffered a cut in half, and the average maximum drawdown of these funds was -49.9%.

Only 3 funds have maintained positive returns, and their drawdown control is relatively good. Many managers have made Jimin pay a heavy price for being too aggressive…

·Contrast from Hao Miao’s appointment on July 27, 2021

The top few in this range have finally changed, and they are generally new and cutting-edge managers. The characteristics of these managers are that they have a small management scale, do not hold together, dare to allocate small and medium-sized caps, and have a high turnover rate.

There are too many excellent medical managers, and we don’t need to pay attention to and invest in so many fund managers. The dense data, I don’t know if everyone has seen something.

I think individual managers such as Wan Minyuan, Zhao Bei, Tan Donghan, Lou Huiyuan, Pan Longling, Xie Wei, Liu Xiao, Jiang Xiulei, and Wang Dapeng deserve further scrutiny. Among the newcomers, Chi Chensheng, Yi Xiaojin, Xu Zhibiao, Yang Ke, and Wang Xiaoying are worthy of attention.

4. Performance stability

Next, we continue to use the performance stability of fund managers for further screening. Instead of looking at the data, look directly at the excess return graph, which is the most intuitive.

Note: The following data are all from Jiuquaner, as of 2022-11-30, the red line is the net value of the fund, and the black line is the cumulative excess return relative to the 300 pharmaceutical ETF. (Because the pharmaceutical 50ETF does not have such long historical data)

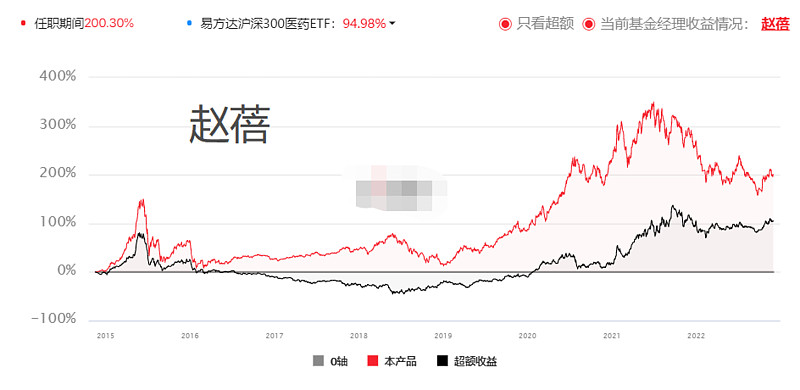

Zhao Bei

Since I took office in 2014-11, the excess returns in the first 4 years have not been very good. In the past, few pharmaceutical fund managers could beat the 300 pharmaceutical ETFs, and almost all of them underperformed.

From May 2018 to now, the excess returns are relatively good, and from September 2021 to September 2022, there is a certain underperformance.

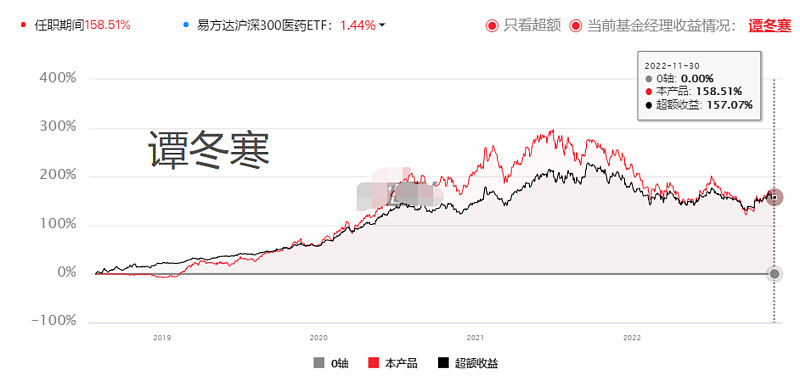

Tan Donghan

Tan Donghan and Zhao Bei have very similar investment styles. After all, they belong to the same company, and they also underperformed from September 2021 to September 2022.

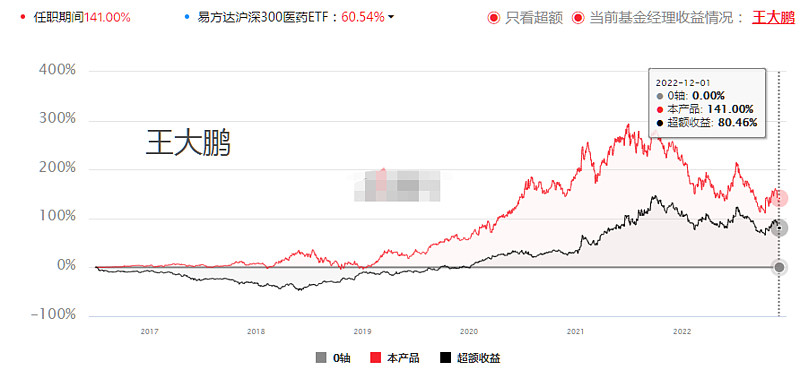

Wang Dapeng

The investment styles of Wang Dapeng and Zhao Bei are also very similar, and the time to outperform and underperform is also similar, but the performance seems to be a little worse than that of Zhao Bei, or we can directly look at the picture below, and feel that Wang Dapeng is stable and underperforms Zhao Bei most of the time. of……

Wu Xingwu

Wu Xingwu is a fund manager that I personally prefer from a qualitative point of view. He pays more attention to quality, industry and concentration of individual stocks, and does not pay much attention to valuation. Painful person.

From his excess return chart, it can be seen that the watershed of the last wave of market is 2021-7. At present, this style trend has not yet seen an inflection point. From the perspective of valuation and cost performance, it should not be too far away. If the market returns to quality style, Wu Xingwu may be the most beautiful boy again.

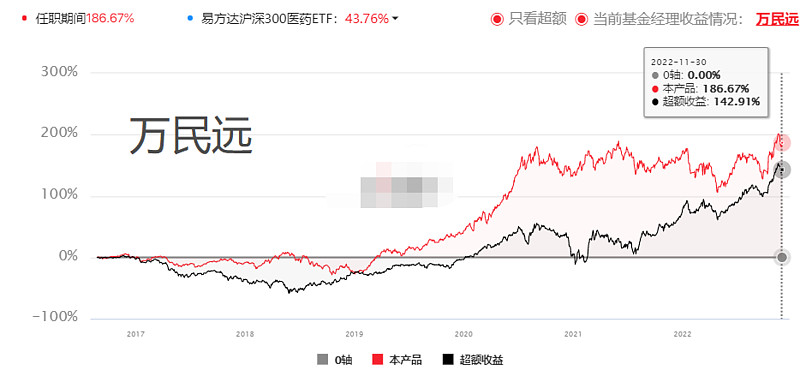

Wanminyuan

From 2016-8 to 2018-6, the excess return was negative. From 2018-6 to now, the excess return is relatively stable, but from 2020-9 to 2021-7, his excess return has a relatively large retracement. The return of Wanminyuan in this period is- 6.2%. During the same period, CITIC Construction Investment Xie Wei had the best income, about 35.5%. Therefore, it can be said that the opposite of Wan Minyuan is Xie Wei.

Xie Wei

The excess income from 2019-4 to 2021-7 is very good and stable, and then the excess income is not so good. The range in which his excess return underperformed was -38.9%, while Wanminyuan’s return was 4.0% in the same period. corresponds to our conclusion above. However, Xie Wei seems to have drifted a bit this year, completely abandoning CXO and innovative drugs.

Jiang Xiulei

Jiang Xiulei, who is also in Rongtong, is actually a senior and leader of Wan Minyuan, and is also one of the earliest pharmaceutical fund managers in the industry. His performance was quite good in the past few years, but after February 2021, it is not so good. I don’t know because of his style. The reason is that I still became a leader and managed the entire market fund.

Lou Huiyuan

He has outperformed since taking office, and has underperformed since July 2021. His style is also very similar to Zhao Bei, but slightly underperformed Zhao Bei.

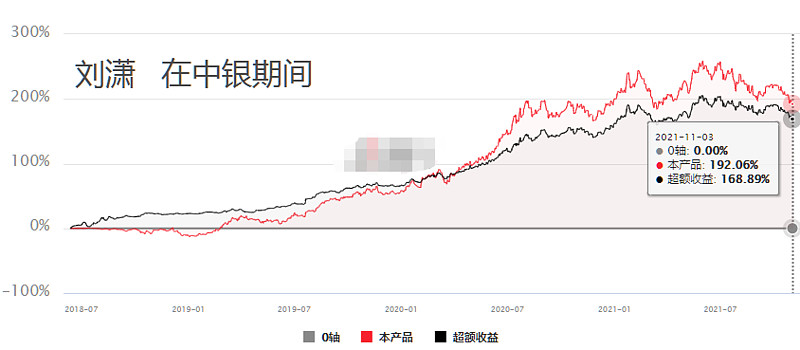

Liu Xiao

When Liu Xiao was in Bank of China, he drew a very beautiful net worth curve, and chose to adjust positions at a relatively high point in the market. After joining Huaan, Liu Xiao now only manages one fund with a scale of more than 800 million, which is very good, and It also outperformed in Hua’an.

However, it needs to be emphasized that Liu Xiao’s excess returns in the first half of the year mainly came from the establishment of new funds, including factors that cannot be replicated. If this range is excluded, Liu Xiao’s performance will not be so outstanding.

Another fly in the ointment is that Liu Xiao is currently managing with Qiu Qianqian. Qiu Qianqian is still a novice, so I don’t know how the two of them divide the warehouse.

Pan Longling

Since Pan Longling took office, only the two boxes in the picture have obvious excess returns, and there is no obvious alpha at other times. I feel unstable and need to be observed.

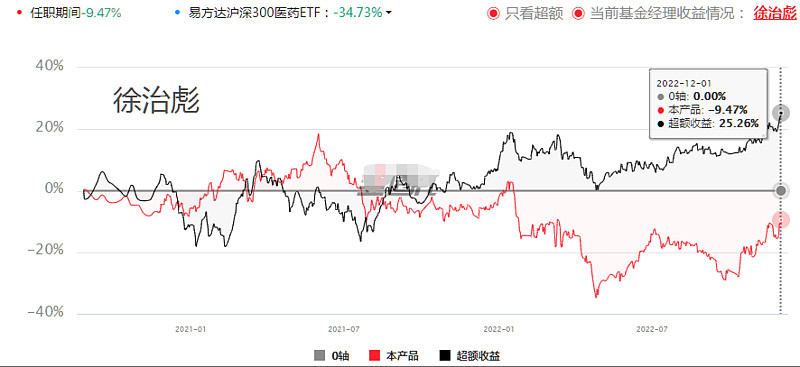

Xu Zhibiao

Xu Zhibiao moved to Cathay Pacific from Agricultural Bank of China, and he has rich experience in the field of medicine. His style is close to that of Wanmin, but not as outstanding.

Moreover, after coming to Cathay Pacific, he has gradually expanded his circle of competence. He currently manages 7 funds, of which 6 are all-market funds. In terms of concentration, it is unavoidable to be a little worrying.

Chi Chensen

Chi Chensen is a newcomer who emerged recently, his style is very similar to Wan Minyuan, and he outperformed Wan Minyuan. His scale has grown rapidly in the past year, and now he has started to restrict purchases, and declined institutional funds. I don’t know if he can continue his excellent performance in the future.

Yang Ke

Yang Ke’s strength lies in that she not only grasped the previous market growth market, but also realized the change in a timely manner after the style switch. Ming Kangde, Mindray Medical, Pharmaron, Changchun High-tech, etc., and her fund can invest in consumption, which is also a certain advantage.

Wang Xiaoyin

Yi Xiaojin

Yi Xiaojin used to work in Zhonghai and studied under Xu Dingqing (Zhonghai also trained Zheng Lei). During his stay in Zhonghai, his performance was relatively mediocre, with a return of 45.12% in more than 2 years, ranking only 24th in the aforementioned performance comparison . After coming to Caitong Asset Management, it is doing well so far.

V. Proportion of institutions

The following table shows the proportion of institutions in the 2022 mid-term report. Wang Xiaoyin, Chi Chensen, and Pan Longling funds accounted for the highest proportion; in terms of capital scale, it should be that Tan Donghan, Wan Minyuan, Xu Zhibiao, and Chi Chensen have more institutional funds. many.

6. Professionalism and Concentration

Investing in medicine requires high professionalism, the industry is relatively large, and there are many types of medicines. Getting started for non-medical majors may be slower and takes time to accumulate. Moreover, the industry is changing rapidly. If you are not focused enough, it may be easy to track poorly.

From the perspective of concentration, it is gratifying to see that in recent years, more and more fund managers have begun to refocus on the pharmaceutical sector, which is good news for our investors.

For fund managers, it is also very good, because the pharmaceutical sector is already big enough, and it is also a track with long slopes and thick snow, and there is a big enough stage for fund managers to show off.

From a professional point of view, most of the fund managers are born in medicine, only a few are not. Even if they don’t, they basically have medical experience and research experience. It is a compound education of medicine + finance.

From the perspective of educational background, all of them have a master’s degree or above. Among them, Wan Minyuan, Ge Lan, Xie Wei, Tan Donghan, Hao Miao, Wang Dapeng, Fan Jie, Yang Zhenxiao, Hu Youqiao, and Wang Xiaoyin are all doctors!

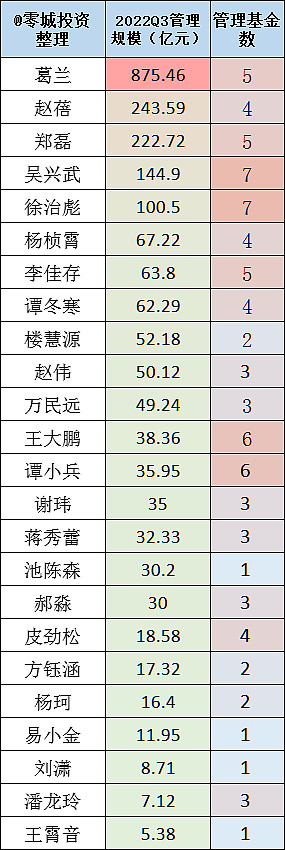

7. Fund Management

In the past two years, with the adjustment of medicine, the management scale of medical fund managers has also shrunk significantly. The scale of most managers is acceptable, and some scales are even very suitable.

The following figure shows the comparison of the management scale of the above fund managers

Gu Lan is actually very strong, but now she is obviously managing too much, affecting excess returns. Most of the other managers are under 10 billion, which I think is acceptable.

8. Investment style

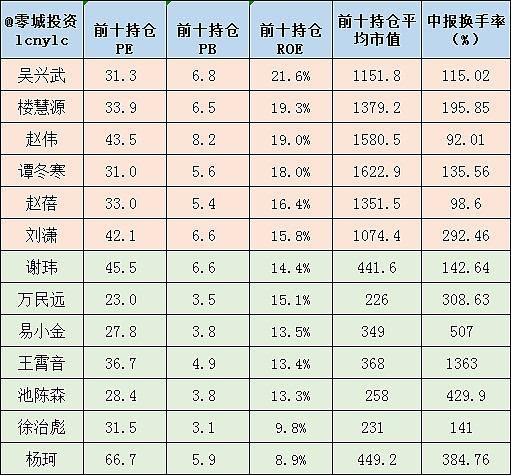

The picture below shows the position style of some fund managers in the third quarterly report of 2022, as well as the turnover rate in the mid-term report.

It can be seen that their investment styles are clearly divided into two factions:

· Managers with good performance in the past few years, represented by Gu Lan, Zhao Bei, Wu Xingwu, Lou Huiyuan, etc., mainly rely on innovative drugs, CXO, medical and other sub-sectors. Yes, grouping is more serious.

·Managers with good performance in recent years, represented by Wan Minyuan, Chi Chensen, etc., mainly rely on traditional Chinese medicine, chemical medicine, pharmacy and other industries, reverse investment, partial to small and medium-sized caps, and prefer to do some transactions.

The difference in performance between them mainly appeared in the collapse of the core asset market in February 2021 and the centralized purchase of medicine in July 2021.

I use the 300 pharmaceutical index (representing pharmaceutical large-cap stocks) and the pharmaceutical 100 index (representing pharmaceutical small-cap stocks) in the figure below to show the market style changes in the pharmaceutical sector. At present, the small-cap market is still continuing, but it has continued 21 months, how long will it last?

9. My conclusion

As investors, we definitely hope to find a fund with good performance, stability, and low volatility. After buying, we can invest and hold it all the time instead of trading it back and forth.

However, the pharmaceutical industry fluctuates greatly, there are many subdivided industries with great differences, and it is also greatly affected by policies. There are also style changes.

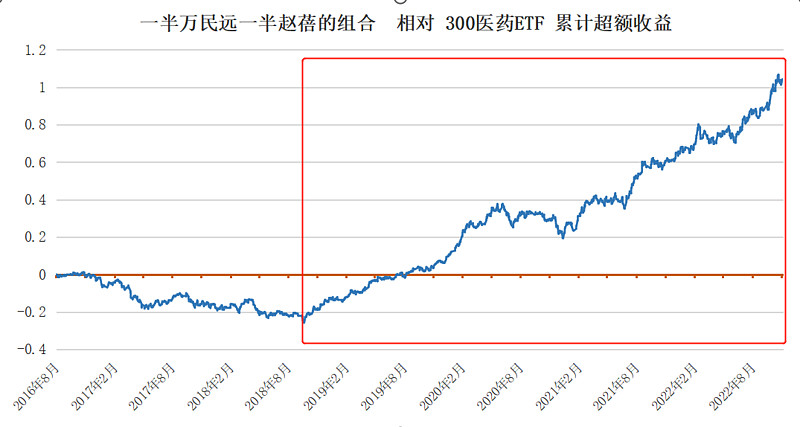

There is a way to improve this problem – building combinations.

To give an example, we mentioned earlier that the opposite of Wan Minyuan is Xie Wei. The two have very different styles, but both have good long-term performance. Then using these two people to build a combination can improve the stability and volatility of income without losing income.

Let’s test it back and forth: Considering that Xie Wei’s tenure is not long enough and his style has drifted, I replaced him with Zhao Bei, who is more stable and has a longer performance.

It can be seen that with this combination, has the excess return been much more stable since September 2018? !

The following is the medicine combination I constructed

I did not adopt a half-and-half strategy for this combination, but it included my personal style , because I personally prefer the stock selection style of Wu Xingwu and Zhao Bei that is biased towards quality and growth, and I do not like the reverse of Wan Minyuan. Investment style, so the configuration of Wan Minyuan and Chi Chensen is relatively small.

However, you can build a combination according to your own style understanding based on the above screening and introduction.

Finally, I would like to talk about the necessity of allocating medical funds: medicine is one of the most competitive and professional industries in investment and research. Many market-oriented managers do not understand medicine because they are not from medicine, so they dare not invest in it. Allocation of medicine, so the overall allocation of public funds to the pharmaceutical sector is relatively low.

If you want to obtain a reasonable medical beta or even alpha in the portfolio, you may wish to consider allocating some pharmaceutical themed funds in the portfolio.

There are also managers such as Dongfanghong Jiang Qi, Hongtu Innovation Liao Xinghao, Xingye Chen Xu, Puyin Ansheng Hu Youqiao, Fuguo Zeng Xinjie and other managers. This article does not analyze it, and we will analyze it next time. Welcome everyone to continue to pay attention to our Princess Zero City Investment, this article took me a lot of energy, I hope everyone will like, bookmark, and repost three times! ! !

We will regularly sort out funds of different industries and styles. The background of Princess will reply “consumption, technology, new energy, Internet, manufacturing, military industry” or “value, growth, quality, balance, small and medium-sized caps”, and you can get more screening articles .

Which fund manager do you like? Welcome to leave a message for exchange and discussion

Risk warning: This article is only a personal opinion, and readers operate at their own risk.

@今日话题@雪球基金@雪球达人秀@球友福利#老基基hard core evaluation#

$ICBC Frontier Medical Stock(F001717)$

$Rongtong Health Industry Mix(F000727)$ $China Europe Medical Health Mix A(F003095)$

There are 14 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9290769077/237091206

This site is only for collection, and the copyright belongs to the original author.