Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Xie Zefeng

Source / Jucha WAVE (ID: WAVE-BIZ)

“One day in the currency circle, many years in the world.”

In the magical world of virtual currency, investors can make hundreds of millions of wealth in a few months; they can also lose their underwear in a few days.

In the past, Zhao Changpeng, the new richest Chinese man who was killed by Binance’s diagonal assassination, plummeted 89.3% in just half a year, and his wealth of 570 billion was wiped out, making him the richest Chinese in the shortest reign.

Later, Cai Wensheng, chairman of Meitu, made a high-profile entry into digital currency, and even used bitcoin and ether as strategic value reserves. However, after making a big profit of 100 million US dollars last year, Meitu took a roller coaster ride. In the first half of this year, the “currency speculation” lost 306 million yuan, resulting in the company’s “blood loss” of 275 million-350 million yuan (semi-annual report forecast).

The main business did not make money, and the currency speculation made huge losses. Meitu became a “value meat grinder” and fell from the altar of 100 billion, and its stock price fell 95% from its historical high. Cai Wensheng could only sigh helplessly: “If things backfire, I believe it must be God’s other arrangements!”

This grassroots entrepreneur who made his fortune in the domain name business, broke into the Internet circle with website navigation, and reached the peak of his life with the beauty economy. to his abilities.

As long as you don’t sell it, it’s a loss

For investors, Meitu is already a brutal value grinder.

At the age of 15, he dropped out of school to set up a stall and start a business. For Cai Wensheng, the “fluctuation” of virtual currency does not seem to be a big deal.

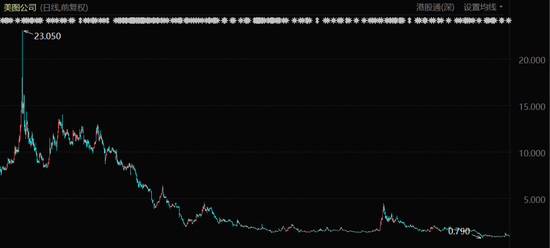

But for investors, Meitu is already a brutal value grinder. When it went public in 2016, Meitu was in the trend of “mobile social networking + beauty economy”. After being included in the Hong Kong Stock Connect, the stock price rose continuously, and the market value once reached 100 billion Hong Kong dollars.

However, Meitu’s share price fell rapidly from a high point after a short period of time, and continued to fall after the plunge. Now the share price is less than HK$1, and it has fallen into a “penny stock”; the market value is only HK$4.1 billion, and the market value has dropped by 95% in more than five years %.

Share price performance of Meitu (since listing)

Share price performance of Meitu (since listing)Meitu is Cai Wensheng’s most important investment so far, and serves as the chairman himself. Under the circumstance that Meitu’s business was affected by mobile phone manufacturers, in order to seize this “most important outlet”, he pushed Meitu’s board of directors to break into the “currency circle”.

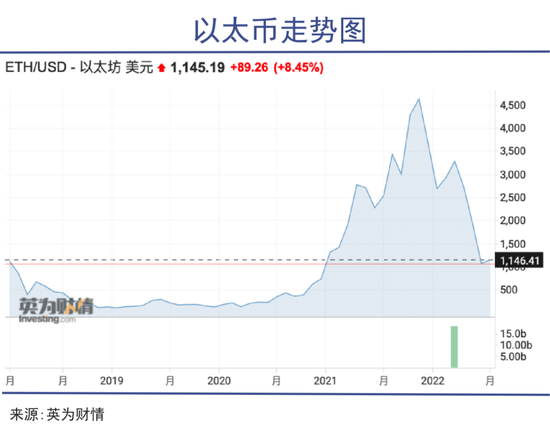

Meitu purchased virtual currencies several times in 2021, pocketing a total of 31,000 ethers and about 941 bitcoins, spending a total of about $100 million. The cost of holding ether for Meitu is about $1,630 per piece, and the cost of holding bitcoin is about $52,700 per piece.

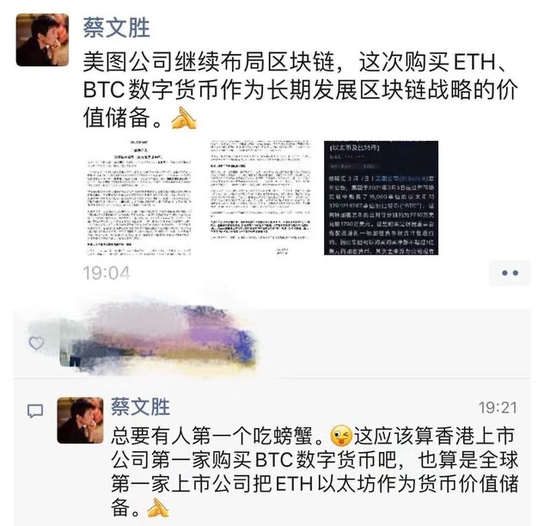

Radical investment will naturally lead to doubts, and the outside world will question its speculation and lack of business. Cai Wensheng responded in a circle of friends, someone must be the first to eat crabs, Meitu deploys the blockchain, and buys ETH and BTC as a value reserve for the long-term development of the blockchain strategy.

However, the deliciousness of the crab soon became a pain in the throat. After experiencing the thrill of doubling in half a year, Meitu quickly turned losses as the currency circle collapsed.

“I wanted to turn around with virtual currency, but I was dragged into a deep pit.” Bitcoin has fallen 71% since its historical peak of $69,000; Ethereum reached a record high of $4,879 in November last year, and is currently nearly $1,145. 77% evaporated.

In addition to the macro aspect, the Federal Reserve raised interest rates and reduced its balance sheet, leading to volatile asset values; cryptocurrency exchange Binance, lending platform Celsius, and cryptocurrency hedge fund Three Arrows Capital broke out “black swan” events such as cessation of transactions and withdrawals, which triggered The chain reaction triggered the death spiral of digital currency.

Unlike other traditional assets, “Bitcoin has no intrinsic value that can be anchored. It has no fixed assets, no income stream, and no underlying business.” A British financial professional pointed out that the value of Bitcoin depends only on supply and demand. “Castle in the Sky” for business.

Moreover, governments around the world generally dislike cryptocurrencies and prefer fiat currencies. The Chinese government has directly designated virtual currency transactions as illegal financial activities.

As a listed company closely related to the interests of investors, the use of cryptocurrencies as a strategic currency reserve may be deeply counterattacked at any time.

This approach has a long history. In June last year, the post-80s president of El Salvador, Bukele, established bitcoin as the legal currency of the country. The government of the country purchased a total of 2,301 bitcoins, with a total cost of about 106 million US dollars. Today, those bitcoins have lost more than 65 percent of their value.

What’s more serious is that the wildly fluctuating bitcoin will cause soaring prices and even social unrest. Its extreme volatility, corruption potential and uncertainty are just the beginning of a long list of problems.

In the face of such a sharp decline, the board of directors headed by Cai Wensheng actually claimed that it is still optimistic about the long-term prospects of the cryptocurrencies held, and the recent fluctuations in Ethereum and Bitcoin are only temporary.

The translation is: “As long as you don’t sell, your losses are just floating losses.”

During the critical period, the beautiful pictures were pitted

Meituben is very likely to turn losses into profits for the first time.

One of Cai Wensheng’s creeds is: “If you like grassroots and millions of users, if you have users, you will have everything.”

Meitu has also had a bright moment. When it went public in 2016, Meitu had 456 million monthly active users. But “owning users is not everything.” Meitu’s applause is not very popular, and the huge traffic has never been converted into “money scene”.

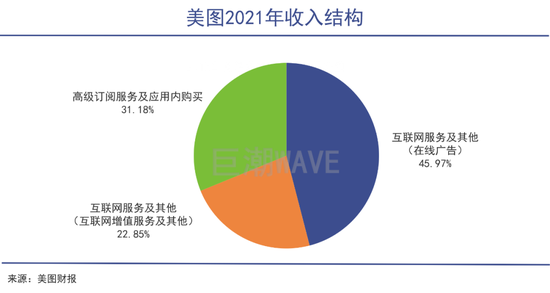

Users only use Meituan as a retouching tool, with a short stay time and few displayable scenes, which makes its business model of relying on advertising to make profits suffers a major challenge.

It is undeniable that Meitu has ushered in the era of beauty economy. He created an easy-to-use tool that captured a large audience and extended from PCs to phones. But the problem is that, in addition to the disadvantages of the business model, this advantage has a low threshold and a single function, and mobile phone manufacturers can quickly launch this function in a short period of time. In short, beauty is not a “patent” of Meitu.

Meitu is always facing the ultimate question: as a Meitu tool, how does it make money?

Over the years, under the leadership of Cai Wensheng, Meitu has entered a lot of tracks – mobile phones, beauty e-commerce, beauty social, SaaS, etc.

Mobile phones once made Meitu taste the sweetness. In 2017, Meitu reached a peak of 4.527 billion yuan in revenue, of which 3.74 billion yuan was contributed by the mobile phone business. But even this year, the company still lost 46 million yuan (adjusted).

With a single function and a narrow user base, Meitu mobile phones have never been able to break the circle. In 7 years, the total sales volume was only 3.5 million units. In the end, Meitu mobile phones were sold to Xiaomi. Since then, Meitu has entered the beauty APP and entered the beauty e-commerce field. But after operating for just over a year, it was resold to Secoo.

In 2018, on the occasion of the tenth anniversary of Meitu, the company released the “Meitu Social” strategy, aiming to be the Chinese version of Instagram. Meitu also spent HK$395 million to buy about 57.09% of Dajie.com.

However, social networking has long been a competition in the red ocean. Facing powerful enemies such as WeChat, Douyin, Kuaishou, and Xiaohongshu, Meitu does not have much advantage. Although Meitu’s monthly active users reached a peak of 308 million in 2019, it was still unable to recover the decline, and the stock price fell endlessly.

And you know, Xiaohongshu did not break through 200 million MAU until the beginning of this year. The outside world even ridiculed, “Meitu has hundreds of millions of traffic, but it has become the most unprofitable company.”

At this time, the traffic that Cai Wensheng relied on began to decline, and Meitu’s MAU fell from more than 300 million to 246 million by the end of 2021.

After going around, Meitu finally decided to concentrate its forces and focus on its core business. Starting from 2020, Meitu has launched VIP subscription services based on its main businesses such as Meitu Xiuxiu and Meiyan Camera, and based on its own accumulation, it provides targeted SaaS services for vertical industries such as imaging.

So far, this transformation has paid off. In 2021, Meitu’s VIP subscription service will gain revenue of 519 million yuan, a year-on-year increase of nearly 1.5 times, and it has become the second largest business after advertising revenue. There are about 4 million VIP members, doubling year-on-year.

Thanks to the subscription service, Meitu’s adjusted net profit attributable to the parent company in 2021 is 85.1 million yuan, achieving adjusted profits for two consecutive years. At this moment, the management headed by Cai Wensheng could not resist the temptation of virtual currency.

After experiencing the one-word soul-breaking knife, not only did the currency speculation fail to make any profit, but instead, it cheated Meitu when the business was just getting better. According to the announcement, in the first half of this year, Meitu’s “currency speculation” lost 306 million yuan, while the company expects to lose 275 million to 350 million yuan in the first half of the year.

That is to say, if the losses caused by the two cryptocurrencies are excluded, Meitu is very likely to achieve the first turnaround of the net profit attributable to the parent.

Alternative “Gamblers”

“Fortune favors the brave.”

In the investment world, Cai Wensheng “is a strange person”.

Lin Jun, founder of Leifeng.com, once commented on Cai Wensheng: “Every time I go to Beijing, I hear stories about Cai Wensheng in various bureaus. Xue Manzi is his angel, Lei Jun is his friend, Huang Mingming is his partner, Wang Feng He was peddling domain names, Feng Xin and him were planning a storm, Jiang Tao invited him as a guest, and Liang Ning discussed Feng Shui with him.”

When Meitu was listed, Cai Wensheng once wrote “An Unread Thank You Letter”, in which he thanked more than 50 friends since his establishment. He also initiated the establishment of the Angel Club with his friends Lei Jun, Kai-Fu Lee, Bao Fan and others in the circle, which shows that he has a wide range of contacts.

Whether it is in the Internet entrepreneurial circle or the investment circle, Cai Wensheng is definitely an “alternative”: he went to sea to do business before graduating from high school.

Cai Wensheng is one of the early investors of Feng Xin of Baofeng Group

Cai Wensheng is one of the early investors of Feng Xin of Baofeng GroupBut just like this, Cai Wensheng has cultivated the ability to mix rivers and lakes, and his youth and poverty have made him accumulate a strong desire for wealth. Throughout its 30-year entrepreneurial history, domain names, investments, stocks, and bitcoin are all high-risk, high-yield businesses.

Once he smelled a business opportunity, he made a big bet decisively. He was used to seeking success at great risk.

Cai Wensheng claims to be “a bridge between grassroots and elites”, which makes his glory stay in the PC era. Today, the companies involved in the investment are mixed, and most of them are the old days and no longer the light of the past.

Kuaiche, CNZZ statistics, and ZCOM disappeared in the dawn of the mobile Internet; Baofeng Group was delisted due to financial fraud, and its founder Feng Xin was arrested and banned from the capital market for life.

58.com is no longer magical. It will be delisted after privatization in 2020. At that time, Meituan was 23 times the value of 58.com, and 58’s revenue had declined for four consecutive years.

Meitu, who is the chairman himself, was once at its peak, but it is declining. And just when Meitu ushered in the dawn of a turnaround, the loss of speculating on the currency pulled it into the water again.

Cai Wensheng mocked himself as a “Fomo”, that is, a patient with “fear of missing out”, which means the anxiety caused by the fear of missing a certain stock, outlet, or hot spot.

As early as 2014, Longling Investment, which he founded, took a stake in the cryptocurrency exchange OKCoin; in May 2018, Cai Wensheng also revealed that he owns 10,000 bitcoins. It has also invested in more than 10 blockchain projects, including Theta, Ontology (ONT), and Zipper (ZIP).

Cai Wensheng is also a heavy believer in collecting NTF artworks. He once bought BAYC#8848 Boring Ape for 187 ETH (about 560,000 US dollars), and he also bought a number of “Crypto Punks” series NFTs .

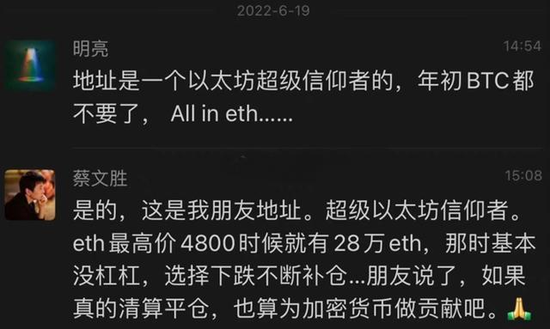

On June 19th, an Ethereum super account suspected of Cai Wensheng was exposed in the currency circle. Cai Wensheng commented below, “This is my friend’s address, and the position is constantly being replenished when it falls… My friend said that if it is liquidated and closed, it is also regarded as encryption. Contribute money.”

Many people speculate that the owner of this account is Cai Wensheng himself. He bought 280,000 ether at a price of $4,800, totaling 9 billion yuan; on June 18, the ether fell below the $900 mark, and the account was only 1.1% behind. Reaching the liquidation price can be described as a close call. However, this investment has lost 77%, which is equivalent to evaporating nearly 7 billion yuan.

write at the end

At the 2022 Super Bowl, Hollywood star Matt Damon appeared in a cryptocurrency ad with the tagline: “Fortune favors the brave.”

Cai Wensheng is indeed a brave man. He tried his best to chase the trend, and then made heavy bets, expecting a miracle with great force. Relying on his daring and gambling personality, he fought in the commercial sea, and personally accumulated a huge wealth that was unattainable for ordinary people.

But looking at his entrepreneurship and investment in the past 30 years, it can be said that speculation is greater than actual combat, and reputation is greater than strength. Rather than having a career in his life, it is better to say that his life was a farce of the naked pursuit of wealth.

Just like the reduction of the son’s account at the high point of Meitu in 2017, it is like the fanatical pursuit of Bitcoin and Ethereum.

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-07-07/doc-imizirav2297515.shtml

This site is for inclusion only, and the copyright belongs to the original author.