Editor / Zhou Ziyi

Tesla CEO Elon Musk pointed out on Tesla’s third-quarter earnings call on Wednesday (19th) local time that even if a recession is imminent, Tesla will still be “full speed ahead.”

As far as Tesla’s market value is concerned, Musk believes, “We can far exceed Apple’s current market value. Tesla’s market value will likely exceed Apple and Saudi Aramco combined.”

As of now, Tesla’s total market value is $695.7 billion; Apple’s total market value is $2.31 trillion, and Saudi Aramco’s total market value is about $2.09 trillion. These two are the top two companies in the world by market value.

Tesla won’t cut production

When asked at the conference how Tesla would respond to a potential recession, the world’s richest man showed little concern and was optimistic about the future.

Musk said, “Frankly, whether the economy is sunny or rainy, Tesla is going full speed ahead.” “We will not cut production in any way, whether or not the economy is in recession,” he added.

The third-quarter earnings report showed that the company’s revenue fell short of Wall Street’s expectations. Tesla’s third-quarter revenue was $21.45 billion, compared with market expectations of $22.1 billion; third-quarter adjusted earnings per share were $1.05, higher than analysts’ expectations of $1.01.

“Making meaningful repurchases”

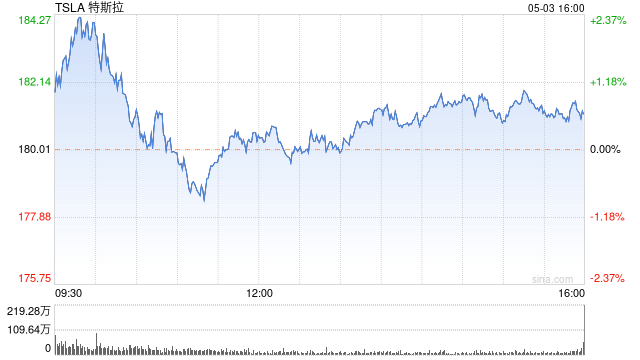

Tesla’s stock price has been “halved” so far this year, and its market value has evaporated by 45%. Shares of the company fell more than 6 percent in after-hours trading after the third-quarter earnings report was released.

Tesla has also missed its expected share buyback program this year. Musk said, however, that Tesla is on the verge of repurchasing shares, “probably $5 billion to $10 billion in buybacks, and we’re likely to do some meaningful buybacks.”

Musk also focused on Tesla’s future long-term trends. Even as the price and cost of electric cars rise, Musk said “Tesla is doing well” as electric cars gradually replace gasoline-powered cars, and said “the residual value of gasoline cars will be very low.”

Criticize the Fed for excessive rate hikes

In addition, Musk on Wednesday criticized the Fed for raising interest rates too far. The Federal Reserve has been raising its benchmark interest rate in an attempt to curb soaring inflation.

Musk has long been critical of the Fed. He has mentioned many times before that the Fed should cut interest rates or face the risk of deflation.

Musk quipped, “The Fed’s decision makes sense if you look in the rearview mirror (backward), not the windshield (forward).”

media coverage

IT Home CNBeta Fast Technology Sina Technology CNBeta

event tracking

- 2022-10-19 Musk: Tesla is “full speed ahead” and the future market value will exceed that of Apple and Saudi Aramco combined

- 2022-08-10 Musk dumps nearly $7 billion in Tesla stock

- 2021-11-08Musk’s “sell shares to pay taxes” vote raises regulatory concerns, securities law experts say his investigation tweets are not illegal

- 2021-07-12 Musk: Tesla doesn’t want to be just a car company, doesn’t set a price for SolarCity acquisition

- 2021-03-26 Musk: Tesla has a chance to surpass Apple to become the world’s largest company

This article is reprinted from: https://readhub.cn/topic/8kfYcjphS7b

This site is for inclusion only, and the copyright belongs to the original author.