From the last book, semiconductors and chips detonated the market on Friday, leading the Kechuang 50 to rise by more than 4%, leading the broad-based index to rise. The discussion of semiconductor chips is getting hotter. Some people believe that semiconductors will replace new energy and become the next main line of the market through the logic of domestic substitution. Some people think that semiconductors are compensatory growth, not sustainable, and the main line is new energy. Today we will discuss this issue.

We mainly study growth stocks, and the weights of ChiNext and Science and Technology Innovation Board – new energy, semiconductor and medical.

Let’s start with the conclusion: comparing valuations, semiconductors are not as good as medical care. Compared with certainty, semiconductors are not as good as new energy sources. So there is absolutely no need to chase up semiconductors. What’s more, semiconductors have already rushed very high in the short-term.

Before we start, let me explain that I am not running out of steam. At that time, the chip and medical positions were each increased by 1/4.

Looking back on history

As we mentioned in the previous article, here is a review of the history of new energy, semiconductor and medical sectors.

Medical care is weighted on both the Growth Enterprise Market and the Science and Technology Innovation Board, new energy is mainly on the Growth Enterprise Market, and semiconductors are mainly concentrated on the Science and Technology Innovation Board. Over a long period of time, the ups and downs of each of their bands are basically similar:

The biggest increase in the 2019-2021 bull market: medical +244%, semiconductor +398%, chip +203%, photovoltaic +233%, new energy +383%

2021-2022 bear market maximum drawdown: medical -50%, semiconductor -50%, chip -40%, photovoltaic -37%, new energy -45%

It can be seen that these growth stocks turned several somersaults in the bull market, and the bear market was directly adjusted by the halving, and then continued to double. The attributes of their growth stocks are determined to be a concentration camp for bull stocks.

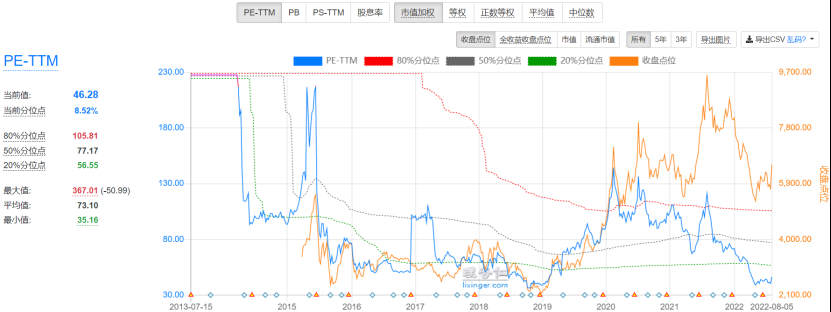

Valuation

Valuation of the new energy sector: mid-low

Valuation of the medical sector: extremely undervalued, even lower than the gold pit at the end of 2018

Semiconductor sector: undervalued, but not as undervalued as medical, also close to end-2018 valuation

Semiconductors are undervalued, medical care is very undervalued, and new energy sources are moderately low.

The valuation data is objective, and do not have some prejudice against new energy that has rebounded more. Leaders of new energy, such as CATL and BYD, have high valuations, but there are not only these two in the entire new energy sector, and the average valuation of the overall sector is not high. I hope everyone realizes this. This data exists objectively, not my nonsense.

Therefore, in terms of valuation, medical valuation is the lowest, followed by chips, and new energy with the highest valuation.

In terms of valuation, chips are not as good as medical care.

Logical strength, certainty

The main logic of the chip is high-tech growth stocks + domestic substitution + power semiconductors for new energy + semiconductors for iPhone 14 to stimulate consumer electronics. But this logic is not very deterministic.

First of all, chip research is relatively backward, unlike new energy that has already achieved the world’s first. Research itself has risks, it may not be successful, and there is no certainty compared to new energy. Now many companies are coming to take advantage of the popularity of new energy and develop new energy, the reason is that new energy can really make money.

In addition, the medical device sector in medical treatment can also be replaced by domestic products. Moreover, the risk of centralized procurement of medical devices is lower than that of drugs. Compared with innovative drugs, the research and development of innovative medical devices is a spiral, with a higher success rate and a shorter development cycle. At the same time, it also benefits from the new demand for medical equipment in new medical infrastructure. There is also the logic of domestic substitution of medical equipment: some types of equipment in hospitals, such as medical imaging, are imported from abroad. Moreover, the valuation of medical devices is only in the early 20s, the historical percentile is seriously underestimated, and the adjustment range and duration are more sufficient than chip semiconductors. Therefore, if we talk about domestic substitution, I think that medical devices have obvious valuation advantages over chips, and chips have risen sharply in the last three trading days, which has overdrawn its logic to a certain extent. And medical devices don’t.

Then, new energy needs power semiconductors, such as Silan Microelectronics, New Clean Energy, Star Semiconductor, and Yangjie Technology. They led the chip sector in the market on Friday, and many directly rose by the limit, and their valuations are not low. So why not just buy the adjusted new energy? If the chip absorbs funds from new energy sources tomorrow and switches between high and low, then the new energy after the decline is obviously more attractive.

Next is the recovery of consumer electronics. The big drop in chips is actually because of the wave of consumer electronics slashing orders, which is still in a downward cycle. I will not seek a predicament reversal. It would be better to directly buy consumer electronics ETFs or the leading shares of Goertek. Why take a detour to invest in consumer electronics?

Finally, the recent series of news about the chip is both good and bad. Is the chip development lack of money? Obviously not. Have you really weighed the R&D risks involved?

Therefore, if it is an underestimated fixed investment, I am more willing to ambush medical devices, and when the news of domestic alternatives is fermented and the development of new medical infrastructure is stimulated, medical devices will be able to eat a whole wave.

Secondly, if the same valuation is relatively high, the certainty of new energy is far greater than that of chips. If you are doing trend trading, it is not as good as new energy.

Of course, if you are in the chip industry or are very confident in the chip, you can consider it. But I don’t think it’s that deterministic. It depends on each person’s opinion.

Chip semiconductors are still good

Although I have said so many bad things, chip semiconductors still have investment value, but this value is not attractive enough to me. In other words, the chip is a good guy, but I already have better ones.

Now their valuations are still in the undervalued area. Buy them now. From a 3-year perspective, it is not a problem to encounter a bull market doubling, but there will be bumps in the middle.

I personally feel that medical and new energy can see more clearly and hold positions more firmly. So don’t intervene in the chip.

However, there are a thousand Hamlets in the eyes of a thousand people, and there are also a thousand chips. If you are very confident, optimistic about chip development, buy in the bottom area, no problem, I support you.

Summarize

1. Comparing valuations, semiconductors are not as good as medical. Compared with certainty, semiconductors are not as good as new energy sources. So there is absolutely no need to chase up semiconductors. What’s more, semiconductors have already rushed very high in the short-term. I’m getting ready to come out of the chip next week.

2. Trend traders: new energy. Undervalued Fixed Investment Traders: Medical.

3. The market is in the bottom area, and chip semiconductors still have investment value. It is not a problem to double long-term holdings, but we must persist.

4. New energy, medical care and semiconductors are not enemies. We are all heavyweight growth stocks for entrepreneurship and innovation. It is most important for everyone to go hand in hand and rise together.

$Medical ETF(SH512170)$ $Semiconductor ETF(SH512480)$ $Chip ETF(SZ159995)$ #Chip industry chain outbreak across the board# #Semiconductor sector opened higher, Dagang stock quadruple board#

This topic has 62 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5760078642/227377017

This site is for inclusion only, and the copyright belongs to the original author.