Original link: https://blog.forecho.com/short.html

introduction

This year, the US stock market has been full of twists and turns. It has been in a downward trend since November last year. No one knows when this bear market will end. Today, let’s talk about the basics of shorting and the risks of shorting.

What is shorting?

If we are bullish on a stock and expect it to rise, then you buy it, and when it rises, you sell it. This situation做多, or Long .

When a stock goes up, it goes down. On the contrary, if you are not optimistic about a stock and expect it to fall, then you buy it, and when it falls, you buy it. We做空this situation short, which is Short . .

To go short, you first sell the stock. Just like buying a stock long, you can just sell it directly. Take the recent decline in demand in the semiconductor industry. If you think that semiconductor stocks will continue to fall recently, then you can sell 100 AMD, and the stock sold is equivalent to borrowing 100 AMD shares from a brokerage. The borrowed stock is needed. Pay a certain amount of interest (see individual stock details for details), when the stock falls, you buy 100 shares of AMD, and the brokerage will automatically repay 100 shares.

Features of shorting

Limited gains, unlimited losses

Because the stock has no upper limit to rise, but the maximum fall is 0. Therefore, in theory, the short-selling profit is limited and the loss is unlimited.

One of the most famous short sellers is Jim Chanos . In 2001, he discovered Enron’s financial problems through his own analysis, and then he went short and became famous. After that, there are also successful cases of short selling, such as Ruixing Coffee.

Of course, he also has a case of failure. In 2016, he passed some research and felt that Tesla was seriously overvalued, and then he sold Tesla aggressively. As a result, we all know that he lost miserably. During his short Tesla alone, Tesla has doubled 18 times.

The risk of simply shorting individual stocks is very high, so few people play like this.

shorting strategy

long-short strategy

This is the most common use case for shorting. Usually, it is to long one stock and then short another stock or a broad market index, so that it can play a role in hedging. This strategy is called a long-多空策略, that is, a Long-Short Strategy .

This strategy is the most common operation in hedge funds. The most representative figure is Julian Robertson and his Tiger Fund. Starting in the 1980s, it took 15 years to earn 7 billion in assets from 8 million. In the 1990s They are godlike beings.

In 1995, the Internet began to develop, and a bunch of unprofitable Internet companies went public to “money” one after another. The U.S. stock market also entered a rising trend, and the stocks of Internet companies skyrocketed. By studying the fundamentals of Internet listed companies, Robertson found that they were seriously overvalued, and then he began to short Internet companies and long blue chip stocks, that is, using the Long-Short Strategy .

But the result is that Internet companies are still rising all the way, and the bubble is growing rapidly. Faced with losses, investor skepticism and pressure to sell the fund, Robertson closed Tiger Fund in early 2000. But the interesting thing is that just half a year after his exit, the stock market crashed and the互联网泡沫came.

It is not easy to judge the direction of the market, and it is even more difficult to seize the opportunity.

research report

The general short-selling process of short-selling institutions:

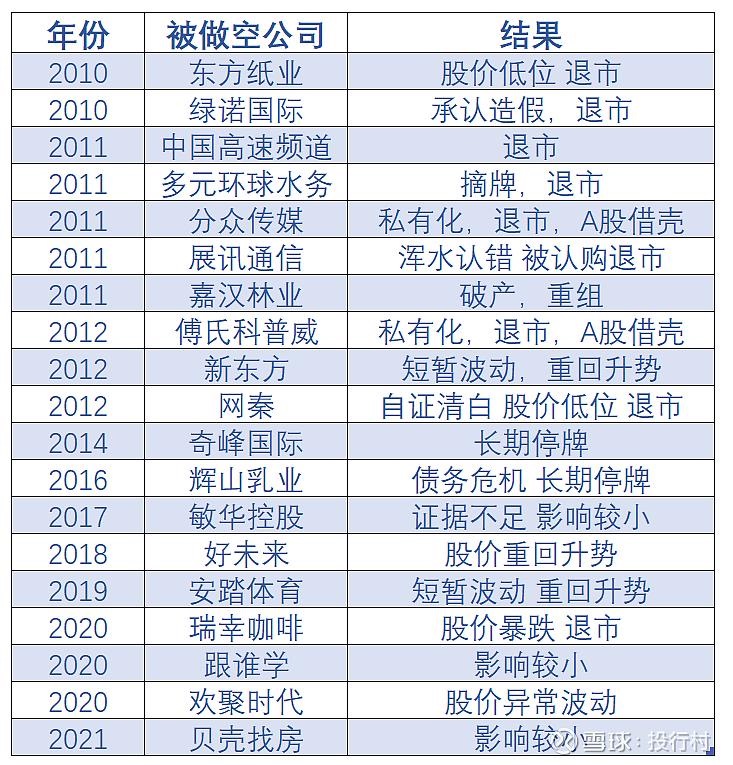

秘密走访-> 财务调查-> 做空-> 发布研究报告-> 股价跌-> 平仓获利The most famous of these is the American company ” Muddy Water”, which specializes in short-term stocks. The following are their short-selling cases in recent years:

Of course, they are not correct every time, because sometimes they even guess the data. The short report is also for everyone to go short together, and they will only make money if the stock falls.

capital attack

Some wealthy bigwigs, under the sentiment that the market is overvalued, aggressively shorted and took the lead in shorting, causing a wave of “stampede events”. Among the more representative figures are:

- Jesse Livermore

- George Soros : The man who specializes in shorting foreign exchange

Risk of shorting

Subject matter is limited

Short-selling institutions usually select short-selling objects based on the following three points:

- A subject with a large market value: If you spend so much energy on research, you must find a big target to do it, otherwise it will not be cost-effective.

- Good liquidity: good liquidity and low borrowing cost

- fraudulent

Margin Interest

Margin interest can be a huge expense when trading stocks on margin. Since short selling can only be done through a margin account, the interest payable on short trades can increase over time, especially if the short position is long open.

Squeeze

When we short a stock, we have to borrow the stock from the brokerage. In order to ensure that you will return the stock, the brokerage requires you to pay a deposit. If the stock you are shorting keeps going up, you need to keep making up the margin, until you have no money to pay the margin, you need to buy the stock to close the position, and the stock purchase will naturally make the stock price continue to rise. This phenomenon of skyrocketing stock prices due to forced liquidation of stocks is called a “short squeeze.”

moral pressure

When the market goes up, everyone goes up together, and when the market goes down, everyone loses money together, that’s all right. But when you’re losing money, those shorts are making money, and you must hate them, which is one of the reasons for the GME short squeeze.

at last

To put it simply, shorting is an operation in the direction of longing. One hopes that the stock will fall, and the other hopes that the stock will rise.

The most commonly used strategy for shorting is a long-short strategy, which is to go long on one target and short another to hedge risks.

This article is reprinted from: https://blog.forecho.com/short.html

This site is for inclusion only, and the copyright belongs to the original author.