To investors who follow this account: On the road of deep value investment, walk with you.

There is a lot of information this week, the European energy crisis, social finance data, reform of Guizhou liquor dealers, take your time.

1. Overall market

The judgment of maintaining stability remains unchanged. If it falls too much, it will rebound, and if it rises too much, it will fall back. The big-level market will not be launched before the conference, but there will never be a stock market crash. I am optimistic about the current stock market for a few reasons:

(1) The current stock-to-bond income ratio (the ratio of the CSI 300 price-earnings ratio to the ten-year government bond) is already at a very low level, reaching 3.21 this week, indicating that the overall investment value of the current stock market is in a very good stage. According to historical statistics, when the stock-to-bond income ratio exceeds 3.2, it has the potential for a strong rebound at any time.

(2) The social financing data for August released on Friday is OK. The scale of new social financing in August was 2.43 trillion, although it was less than 500 billion year-on-year, but the month-on-month improvement was significantly improved; new RMB loans in August increased by 1.25 trillion, an increase of 39 billion year-on-year, and the M2 balance was 259.5 trillion, a year-on-year increase of 12.2% , continue to record highs. It is generally possible to report hope for the relief of the real estate crisis. At the same time, some companies are showing signs of recovery. For the secondary market, the valuation can be maintained at a relatively good level.

(3) After the market peaked at the end of June, many sectors have been in a state of adjustment, and the time and extent of adjustment have already laid the foundation for a round of repairing market conditions.

Finally, I want to emphasize that my optimism is limited to a repairing rebound, and the super-level market is currently unqualified. After the conference, everything will be settled. The planning for the future economy, the attitude towards epidemic management and control, the statement on the private economy, and the guidance on the real estate, platform economy and other industries all need to be observed. However, considering that the economy is currently on the verge of bottoming out, I am optimistic that the recovery of the economy next year should be an important issue for the new team to solve. (Purely personal feeling, only for entertainment).

2. Chemical faucet

The word is not accurate, there are many chemical faucets. To be precise, I am focusing on polyurethane faucets recently. This company is a relatively clear brand. At the same time, because it is a clear brand, don’t expect huge profits. Let me explain it first. Then, one by one.

The company’s main business is : polyurethane (MDI, TDI, etc.), petrochemicals and new materials. Polyurethane is still the bulk of profits, accounting for about 7-8%.

The company’s core competitive barriers :

(1) The technical barriers of MDI are very high .

The process is complex, and the core phosgene platform requires huge investment. The phosgene used in the phosgene method is volatile and highly toxic, and there are huge potential accident hazards. The by-product hydrogen chloride is seriously corrosive to the equipment, so the production equipment is expensive. We often see news such as accidents and suspension of operation of foreign production equipment. It can be basically concluded that it is impossible for new players to enter the market at home and abroad at MDI.

(2) The MDI industry structure is stable .

There are only a few oligarchic players in the world, namely Wanhua Chemical, BASF, Covestro, Huntsman and Dow, with a combined production capacity of nearly 90%. Among them, Wanhua ranks first with a production capacity of 2.65 million tons, and the current global market share is about 27%.

(3) The company has obvious cost advantages and has the strongest expansion capability, and will continue to erode global share in the future.

During the high boom in 2018, the cost of Wanhua MDI was about 10,500 yuan/ton, the global cost was 15,500 yuan/ton, and the cost of Wanhua had a safety margin of 5,000 yuan; in the low boom in 2020, the cost of Wanhua MDI was about 8,900 yuan/ton. ton, the global cost is 11,000 yuan/ton, and the cost of Wanhua still has a safety margin of 2,100 yuan.

At present, Wanhua’s global competitors are facing the problem of aging equipment and relatively difficult capital expansion. Wanhua has cost advantages in all aspects of fixed capital expenditure, manpower, raw materials, and technology research and development, and its global market share will increase to 40% in the long term. Even 50% should only be a matter of time.

(4) The development of petrochemical business lays the foundation for the horizontal expansion of the industrial layout, and at the same time realizes the vertical extension of the industrial chain.

In short, my cost is the lowest, the quality is excellent, and the expansion ability is still strong. It still maintains a capital expenditure of about 25 billion yuan every year. Compared with its peers, the cost advantage and scale advantage are unique. In the future, MDI can only reduce dimensionality to attack opponents, and the market share will further increase.

Company space:

In the polyurethane business, by 2025, the MDI production capacity will increase from the current 265w tons by 220w tons, including 60w tons in Ningbo and 160w tons in Fujian; TDI will increase from the current 65w tons by 15w tons next year. 86w tons, with a long-term plan to add 100w tons of production capacity. Regardless of the price increase factor, from the perspective of new production capacity, it is a reasonable expectation that the performance will double by 2025.

Other businesses, including petrochemical platforms and new materials. There are too many things here, and it is not clear to sort out for a while. The main ones include 100w tons of large ethylene projects, POE projects, ADI projects, etc. As of 2021, Wanhua’s main profit will still come from polyurethane, accounting for nearly 80% by 2021, but the revenue of other projects has accounted for nearly half.

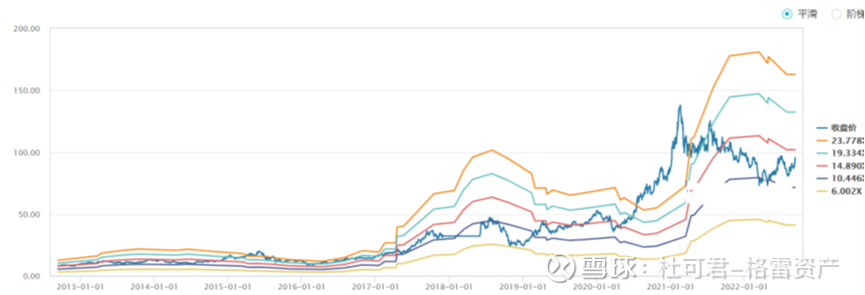

Considering the company’s excellent governance and the industry’s leading position, I take polyurethane as the foundation for the company’s performance and other businesses as a thickening of the margin of safety. It is cautiously estimated that the profit in 2022 can reach 20 billion, 38 billion cautiously in 2025, and 45 billion optimistic. Considering that the company’s valuation center in the past 10 years is around 15 times, this year’s market value is a reasonable valuation with reference to 300 billion, and a reasonable valuation in 2025 is 570 billion-680 billion.

Exceeding expectations

The European energy crisis has led to an increase in the price of chemical materials. In the short term, it is the time window for transmission. The price of MDI began to turn head in September. In the medium term, due to the instability of the European supply side and the completeness and maturity of China’s chemical industry chain, the global chemical industry will tilt toward China in the future, and the results of the rapid increase in the concentration of domestic chemical leaders may exceed expectations. If the domestic, European, and American economies recover in some regions in the future, and the advantages of the supply side are superimposed, it may lead to a situation in which both volume and price rise.

risk

In the global economic downturn, the application of MDI is closely related to major industries such as construction, home appliances, and automobiles. If the global industry enters a recession period for a long time and the demand side is sluggish, it will bring pressure to digest chemical materials including polyurethane. In extreme cases, it may result in a situation where the price is cut and the goods are sold. Although Wanhua has enough security costs, when its own profit is small, its competitors will lose money in an all-round way, so the probability of developing to this stage is not high, but if the demand continues to be sluggish, there is also a risk that profits will be affected. In extreme cases, the increase in revenue does not increase the profit. The market value has not risen for a long time.

3. Consumption

Over the past period of time, consumer stocks have continued to adjust, mainly based on the recent repeated epidemics and people’s flat expectations for Mid-Autumn Festival consumption. However, taking Baijiu as an example, after all, it has been adjusted for more than 2 consecutive months from the high point at the end of June. At present, the stock price has reached a reasonable position with the switch of valuation, and the repair rebound will start at any time.

The leading Moutai, considering the degree of loose liquidity, I think it can still maintain a valuation of about 40 times next year, superimposed profit growth, and the probability of seeing a 25% return in one year is relatively high. Recently, the reform of the Guizhou liquor dealer system has begun to be reported. If there is a price increase, it is still very sweet.

Wuliangye’s dealer system has always been criticized by everyone, but its brand power is too strong, and sales are not worrying. At present, the valuation has dropped to around 23 in the dynamic position. I don’t know what else to lose in long-term investment, that is, whether it can fall another 10 or 20 points in the short term. Only God knows this matter.

In the regional leader, although Huijiu is good, it is expected to play relatively slowly. I am more optimistic about Shanxi Fenjiu. This year, I was planning to launch the high-end blue and white series, but seeing the economic downturn, I directly changed it to focus on the glass Fen series. The high-end products have been strictly controlled, and the prices are firm, so the subsequent performance is inevitable.

The valuation of popular consumer goods and dairy products has historically seen the probability of losing money by 20 times the dynamic investment. We only need to analyze whether it is a problem of the economic cycle or its own problems (such as the Internet) faced by enterprises or industries. Obviously, companies are still bug-like, and the industry is becoming less and less competitive. If you don’t buy at the freezing point of the economic cycle, what are you waiting for? However, objectively speaking, the outbreak period of the rapid penetration rate increase of the leading dairy products has passed, and maintaining an annualized income of around 15% in the future is an objective and rational choice, and it will only be realized if it is held for a long time. Investors hoping for huge profits, this is not a good target.

In general, I maintain my judgment on consumption: this year will be flat (it will be repaired if it falls a lot), next year will be a calf, and the next year will be a big bull. Now is the time to accumulate a lot, choose a target, and make a gradual layout.

3. Internet

Many friends criticized us for selling it last year, and we accept all kinds of criticism. I have explained the reasons many times during the live broadcast, and I will not repeat it.

If you continue to read my article, you will understand that this year we have a mentality of starting from scratch and re-examine the tracking. The current judgment is that policies and performance are in the stage of transition from the left to the right of the bottom. If you like to gamble, go for stud, and if you don’t like to gamble, proceed step by step. Those who have been deeply trapped, lie down and do not move, but pay attention to the balance of new funds, do not fill in any more, you can choose other industry configurations to achieve balance. After all, no one knows when the right side will come out. It’s not entirely a matter of the market and the economic cycle itself, you all understand.

4. Medicine

It has fallen deeper, and it is recommended that the standard ETF is more worry-free. By the way, homogeneous competition does not require ETFs, but leaders, such as liquor and brokerages. The layout of the industrial chain has relatively little mutual influence. It is completely possible to buy ETFs, which is equivalent to buying the entire industrial chain, such as new energy vehicle ETFs, pharmaceutical ETFs, and chip ETFs.

This topic has 5 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/8258019402/230500507

This site is for inclusion only, and the copyright belongs to the original author.