Since the market entered November 2022, the Hang Seng Internet technology sector, including Tencent Holdings, has come out of a strong rebound. In the first few trading days of 2023, the enthusiasm remains unabated. Tencent’s share price has rebounded more than 80% from the bottom in just two months.

So is this wave of Tencent’s rise a short-term rebound or a complete reversal? How do you view Tencent’s 2023?

In fact, after Tencent released its third quarterly report in November 2022, I published the article “Interpretation of Tencent’s third quarterly report-the inflection point has arrived, and the future can be expected”, which clearly expressed the view that the inflection point of Tencent’s business has arrived.

In the past two months, with the domestic epidemic prevention and control policy fully opened, the game version number in December 2022 exceeded expectations and the commercialization of video numbers accelerated, which also confirmed my judgment that Tencent’s business turning point has reached .

Of course, we cannot be overly optimistic. The current COVID-19 pandemic has not yet completely ended, and the potential for economic growth is far from being restored. The peripheral US economy also has a certain degree of recession risk. Therefore, I think 2023 will be a moderate recovery for Tencent. In this year, it will take some time to re-enter the fast lane of growth.

The content of this issue mainly focuses on the review of 2022, the outlook of key businesses, the latest performance forecast and valuation adjustments.

1. Ups and downs in 2022

As the saying goes, learn the new by reviewing the past. First, briefly review Tencent’s performance in the past 2022.

Tencent’s performance in the capital market over the past year can be described as ups and downs, setting a number of historical records, refreshing the perception of many investors, including the author. Just a few impressive points:

1. On March 16, 2022, after two consecutive days of sharp declines, Tencent Holdings’ stock price soared by more than 23% in a single day, the largest single-day increase since its listing, to 367 Hong Kong dollars. On the news, high-level financial stability maintenance meetings were held, which greatly encouraged market confidence.

2. On October 25, 2022, Tencent Holdings hit a new low of 198.6 yuan for the year, and its share price fell by as much as 60% during the year, which was also the largest annual drop in history. Who would have thought that a guy like Tencent with thick eyebrows and big eyes could plummet by more than 60% within a year? Therefore, any strange things will happen in the capital market, so don’t blindly use leverage.

3. Just after Tencent hit a new low on October 25, 2022, it launched a Jedi counterattack in November and December, and the stock price rebounded by more than 70% from the low level in just two months! It’s also a long time to see you. How many investors who pretend to be smart and wait for the upward trend have seized this wonderful “magic moment”?

For excellent companies that earn real money, when the stock price falls to a certain level, some smart capital will naturally start to buy, thus forming the bottom of the stock price.

On October 24, the author wrote the article “The Market Smashed a Golden Pit, Which Tencent Moutai to Choose”, which was published in the latest issue of “Securities Market Weekly” published on November 2. The article clearly pointed out that Tencent’s stock price is obviously undervalued, and it is an undervaluation that is visible to the naked eye. And by simulating the privatization of Tencent, it shows that it is also obviously underestimated from the perspective of the primary market.

4. The largest repurchase in history: In 2022, with the sharp drop in Tencent’s stock price, Tencent officially launched the largest repurchase since its listing. According to statistics from China Business News, since 2022, Tencent has repurchased approximately 90.9786 million shares in total. The number of repurchases during the year exceeded 100, and the cumulative cost exceeded HK$33.7 billion, exceeding the total repurchase amount of Tencent over the years.

2. The basic disk is as solid as a rock, and QQ Metaverse is worth looking forward to

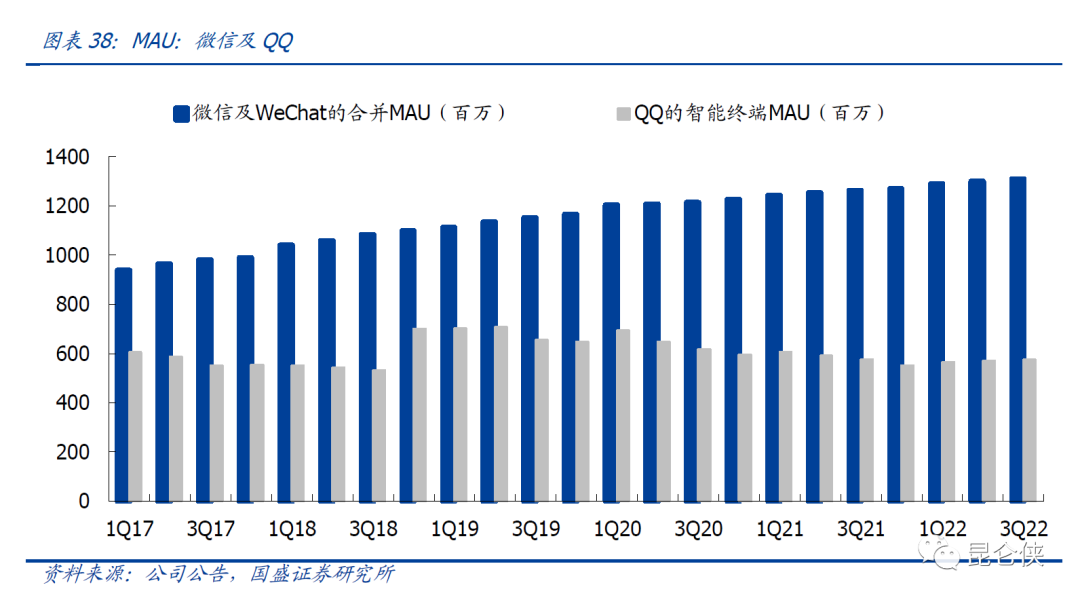

Tencent’s core underlying social communication moat is still solid. According to the financial report for the third quarter of 2022, the latest monthly active users of WeChat increased by 3% year-on-year, surpassing the 1.3 billion mark for the first time, and it is the best among all. QQ has 570 million monthly active users, a slight increase of 0.1% year-on-year, regaining growth.

The author is thinking about a question recently, how important is WeChat to Chinese people? Is it really indispensable?

Some time ago, in the middle and late December, the epidemic peaked in many places across the country, and the whole people fell into a huge panic of the shortage of “ibuprofen”.

It took only 3 days for Tencent to launch the “New Coronary Protection Drug Public Welfare Mutual Aid” mini-program. According to media reports, millions of people have visited this mini-program, and users have independently posted more than 1 million messages for help.

Many users on the platform have obtained urgently needed medicines, and users who have surplus medicines continue to “share surplus medicines” through the platform. A “mutual aid relay” involving millions of people made people once again experience the warmth between people.

Tencent’s timely and warm action has won unanimous praise from the outside world. Some users bluntly said that only Tencent can do this. This gave me a more intuitive understanding of Tencent Technology’s vision for good, and it also made me realize that WeChat has really become a way of life for Chinese people. User stickiness is very strong, and it is difficult for competitors to attack from the outside.

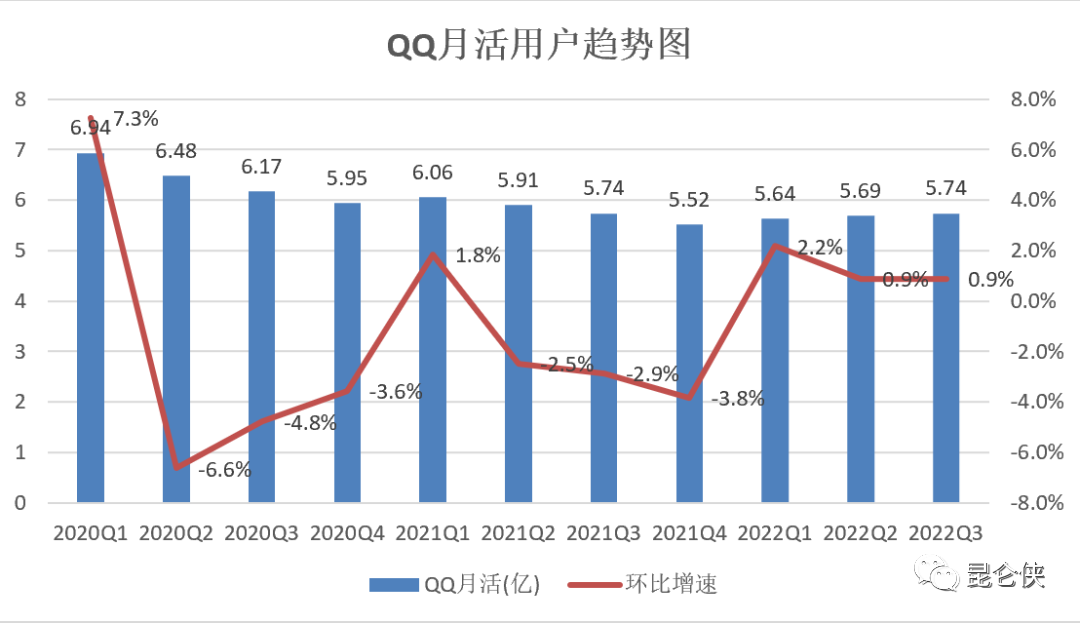

On the other hand, another pillar of Tencent’s social networking, QQ’s monthly active users have been declining for five consecutive years since it was surpassed by WeChat in 2016. It seems that the downward trend is inevitable. However, the data shows that the latest monthly active users of QQ in the third quarter of 2022 was 574 million, a slight increase of 0.9% year-on-year. Beginning in 2022, the number of monthly active QQ users has returned to positive growth for three consecutive quarters.

What changes will happen to QQ in 2022? In fact, as early as April 2021, facing the decline of QQ, Tencent Platform and Content Business Group (PCG) carried out a new round of organizational structure and personnel adjustments.

Yao Xiaoguang, vice president of Tencent and president of Tianmei Studio Group, took over as the head of PCG’s social platform business, in charge of QQ business development. This is also the first time that Tencent has appointed a business leader across business groups.

Tencent’s statement on this is that it “hopes to apply the computer graphics technology and capabilities accumulated in the game field to the imaginary space in the social and video fields.” Soon in July 2021, Tencent reported that Yao Xiaoguang personally led PCG and Tianmei Studio to develop a game social app, and simultaneously explore the Metaverse from both social and game directions.

It should be said that Tencent’s personnel adjustment is still very effective. After Yao Xiaoguang took office, he made a series of big moves on QQ. Let’s see what the official said in the financial report. The 2022 Q1 financial report mentioned that super QQ show and short video sharing are more convenient.

This is mainly because QQ has introduced a function similar to the video account called “Small World”, which gathers two-dimensional anime, games, music and other entertainment videos that young people like. The two-dimensional photo generator that suddenly became popular on overseas social platforms some time ago also comes from the product “Me in Different Dimensions” of the QQ team.

In the next 2022 mid-year report, the official focus is on the super QQ show, and the third quarterly report also talked about the commercial cooperation with Gucci and KFC. It shows that the Super QQ Show is making some progress and has brought back some young users (monthly active users in Q3 increased by 10 million compared with Q1), which is the main reason for the recovery of the number of QQ monthly active users.

Since the low-key launch of Tencent’s “Super QQ Show” on November 30, 2021, after a year of careful polishing, whether it is the fidelity and diversity of avatars, or the exquisite picture quality and playability of virtual spaces, Or the participation of big brand merchants, Super QQ Show is currently one of the prototype products of “Metaverse” with a high degree of completion, the best playability and smooth experience on the market. – It’s just that no one noticed.

Relying on the combination of “Super QQ Show” and “QQ Xiaowo”, Tencent already has a large number of loyal young users (parents with children in primary and secondary schools can ask their children if they have their own QQ Xiaowo). Red Book and other young female user groups are also more popular.

At present, “Super QQ Show” is still in the test experience stage. With the continuous enrichment of product functions and content, it is still worth looking forward to in 2023. After all, the Unreal 4 development engine is self-embedded, and the upper limit of the product is still very high. Potential for blockbuster products.

3. Policy warm wind blows frequently

In the past two years, relevant departments have carried out special governance work on suspected monopoly, disorderly expansion of capital, and illegal data collection in the entire Internet industry. Tencent’s gaming, advertising and financial technology businesses are also subject to governance.

Since last year, officials have stated on many different occasions that the special governance work has ended and that it has shifted to normal supervision. The National Economic Work Conference at the end of the year pointed out that it is necessary to vigorously develop the digital economy and improve the level of normalized supervision. Support platform enterprises to show their talents in leading development, creating jobs, and competing internationally.

On December 18, Yi Lianhong, the newly appointed Secretary of the Zhejiang Provincial Party Committee, investigated Alibaba Group in Hangzhou, encouraging enterprises to show their talents in international competition and benefiting society, striving to be a model student of standardized development and a leader in innovative development.

In the special report of “News Network” broadcast on December 24, “Seize Opportunities and Meet Challenges and Advance Innovation of Private Enterprises in All Regions”, Tencent, as a representative of private digital economy enterprises, has received great attention for its practical explorations in technological innovation and digital-real integration. praise.

On December 28, three days before the end of 2022, the National Press and Publication Administration released the approval information for online games in December 2022. A total of 84 domestic games and 45 imported games were approved.

All the above examples prove that the “Sword of Damocles” hanging over the Internet industry in the past two years has already landed, and various measures to encourage the development of the industry will be launched one after another this year. Another important thing to watch in 2023 is Tencent’s financial holdings The author is optimistic about whether the license can be approved.

4. Both the quality and quantity of the game version number have a good harvest

Originally thought that the game version number in December would be absent again, but on December 28, three days before the end of 2022, the State Press and Publication Administration released the approval information for domestic and imported online games in December. A total of 128 games were approved, and the industry directly called New Year’s Eve ahead of schedule.

This review of the version number can be seen as an important measure for the country to encourage the development of the Internet industry, and it is a signal that the game industry is truly “relaxing”.

First of all, the games that have been reviewed this time can be said to be full of rain and dew. Big companies like Tencent and NetEase, as well as other small and medium-sized studios, have blockbuster games that have been reviewed. The types of games that have been reviewed also include MOBA, shooting and female-oriented versions. No., breaking the rumor that some types of games cannot pass the review.

Secondly, 45 imported games were approved this time. The last time an imported tour passed the review dated back to June 28, 2021, and it has been 548 days since this release. And this round of version number contains a variety of American and Korean IPs, which shows that the Korean restriction order “breaks the ice” and new progress has been made in cultural exchanges between China and the United States. Therefore, the restart of the approval of imported games is of great significance.

And Tencent is the biggest winner this time. A total of 8 self-developed games and agents have obtained version numbers: Among them, 2 domestic game version numbers have been approved, including Kuaishou R&D, Tencent’s agency and distribution of “Westward Journey Burning Soul”, Tencent self-developed Spontaneous “Edge of Rebirth”;

And 6 imported game versions, including “Fearless Contract” (Valorant), “Pokémon Gathering”, “The Age of Discovery: Overlord of the Sea”, “Famine: New Homeland”, “LostArk”, and “Ninokuni: Intersecting Worlds”. The overall version number and quality exceeded expectations.

However, it still takes a few months to a year from the issuance of the version number to the actual performance of the game. Especially considering that both domestic and overseas game markets are currently experiencing sluggish growth caused by the disappearance of the “epidemic dividend” and the macroeconomic downturn, the overall game market is still in the process of bottoming out in 2023.

From the perspective of the domestic game market, gamma data “November 2022 Game Industry Report” shows that in November 2022, the actual sales revenue of the Chinese game market was 19.168 billion yuan, a month-on-month decrease of 3.04% and a year-on-year decrease of 19.23%.

In November 2021, the gamma data report once showed that the actual sales revenue of the Chinese game market in October was nearly 6 months-on-month.

Months later, there was an increase for the first time, but in November, this growth momentum did not seem to continue, and the industry was still in a state of adjustment.

And the foreign game market is not having a good time. According to Sensor Tower statistics, in November 2022, global mobile game players will spend more than US$6.1 billion on the App Store and Google Play, a year-on-year decrease of 11.3%. No signs of stabilization have been seen yet.

For Tencent, the resilience shown is slightly better than that of the game market. The performance of the domestic King of Glory and Peace Elite is stable, with a slight decline; overseas games such as “Valorant”, “Apex Heroes” and “Magic Tower” released by the agent have different performances. vulgar performance.

The “Goddess of Victory: NIKKE” developed by South Korea’s Shift Up and released by Tencent’s overseas publicity brand Level Infinite is the biggest surprise. According to Sensor Tower data, the revenue of “Victory: NIKKE” in the first month of its launch exceeded 100 million U.S. dollars, higher than that of “Diablo: Immortal” ($49 million), “Apex Heroes” mobile games ($11.6 million) and other mobile games. The first month’s income of several popular new games. It is expected to help Tencent’s overseas game revenue exceed expectations in 4Q22.

At present, Tencent’s game reserves are sufficient. According to incomplete statistics, there are more than 50 games, of which more than 20 games have obtained version numbers, and many of them have several explosive potential works. “Fearless Contract”, “Dungeon and Warriors Mobile Games”, “Ark of Destiny”, “Awakening of Dawn”, “Honor of Kings (International Version of Glory of Kings)”, “Dark Zone Breakout International Server”, “World of Kings” and other games Progress deserves special attention.

The author believes that Tencent Games may still be in the process of bottoming out in the fourth quarter of 2022 and the first quarter of 2023. If it is fast, it will be in the second quarter of 2023, and if it is slow, the second half of 2023 will usher in an inflection point for upward performance.

5. Video account – the strategic offensive is about to start

At Tencent’s internal staff meeting last month, Ma Huateng said, “The most eye-catching business of the WeChat business group is the video account, which is basically the hope of the whole audience (the whole company).”

At the same time, he said, “Short videos have had a considerable impact on the entire Internet globally in the past three years, and all platforms and companies have to pay attention to this. It will erode the time of many long videos, games and other products. This is an objective The law of development. This also forces our other businesses to adjust.”

In fact, what Ma Huateng said is true. According to statistics, from 2017 to 2021, with the rise of short videos, the time spent by Chinese netizens on short videos has doubled, from 70 minutes to more than 2 hours.

The proportion of the total usage time of Tencent APP users in the whole network has dropped from 54.3% in 2017 to 35.7% by the end of 2021. During this period, Tencent was in a passive defense stage, tired of coping but with few solutions.

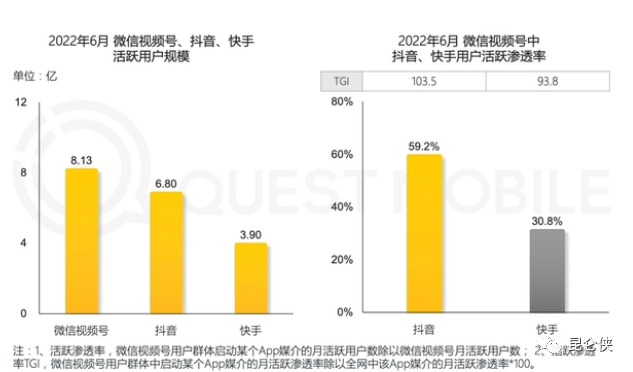

It wasn’t until the WeChat video account was born that the situation changed. According to the “2022 China Mobile Internet Semi-Annual Report” released by the third-party organization Quest Mobile, by June 2022, the monthly activity of WeChat video accounts will exceed 800 million, surpassing Douyin and ranking first, and the second place is Douyin. 680 million, while Kuaishou is 390 million. In the words of Ma Huateng, “The video account has been established!

Of course, the shortcomings of the video account are also obvious. In 2021, the average usage time of the video account is only 35 minutes, which is far from the nearly 120 minutes of Douyin Kuaishou.

What is reflected behind is the lack of high-quality content of the video account and Tencent’s weak operational capabilities.

Ma Huateng stated at the staff meeting that he would focus on core business and actively reduce peripheral non-core business. “How big can your (non-core business) be? What can you do if you make it bigger?” Ma Huateng believes that compared with the management costs and energy paid by the company, it is not cost-effective to spread too many non-core businesses.

The implication is actually very clear, that is, good steel should be used on the blade. The business that should be cut off is cut off, and resources and budget are used on the core business, and the video account is the so-called core business.

Therefore, it is foreseeable that in 2023, Tencent will no longer be in a passive defensive posture in the short video field, but will enter a strategic offensive stage from defense to offense, and will gain unlimited firepower.

So in 2023, if the video account is going to hold high and smash resources, where should it be the most? I think priority should be given to purchasing high-quality content, including but not limited to purchasing the copyright of some large-scale events and signing a group of top stars and content creators.

The 2023 Hangzhou Asian Games and the 2023 Women’s World Cup in New Zealand

They are all good choices, especially for the first time in this Asian Games, e-sports including Glory of Kings and Peace Elite are listed as official competitions for the first time. Tencent can fully operate as a tipping point.

In addition, one of the shortcomings of the video account is that most of the content creators on the platform are artists below the waist, and there is a lack of top leaders. In 2022, Lao Yu’s Dongfang selection was actually a good opportunity for cooperation, but at that time, the e-commerce transaction section of the video account had just started, and finally missed it.

Recently, Li Ziqi, once the top short video player, announced that he has reached a settlement with the MCN company Wei Nian, and will come back soon. There are rumors that Li Ziqi may enter Taobao live broadcast and start the road of live broadcast delivery.

But I think Li Ziqi’s idyllic style is more compatible with the temperament of the video account. If the video account can exclusively sign Li Ziqi, Li Ziqi will become a well-deserved first sister of the video account. The pinnacle is not impossible, and Li Ziqi’s entry will definitely stimulate more outstanding creators to join the video account, which is a good thing for both parties.

In terms of video account revenue, Tencent executives previously stated in a conference call that the demand for video account information flow advertising is strong, and related revenue (mainly advertising) is moving towards the direction of 1 billion yuan per quarter, and this growth has not encroached on Tencent’s ecology Advertising revenue from other businesses within the company. Therefore, in 2023, video account advertisements will contribute more revenue and help the advertising business recover.

For the video account business, the market is now most concerned about the advertising business, but expectations for the e-commerce business are low, and Tencent’s official emphasis on the e-commerce business clearly exceeds market expectations.

Ma Huateng recently said that he hopes that the video account will be closer to transactions in the future and do a good job in closing the loop of e-commerce. But he also stressed that this part is unfamiliar to Tencent. For e-commerce transactions, Tencent still has to play the role of assistant and connection. How to do a good job in the closed loop of e-commerce without ending up in e-commerce is the future challenge of video accounts.

And just at the beginning of the new year, the video account announced that it will charge merchants a technical service fee of 1%-5% from January 1, 2023.

As an industry comparison, Kuaishou has previously charged merchants technical service fees since 2019, and Douyin will charge merchants a technical service fee of 1%-10% from February 1, 2020. The video account is currently charging technical service fees, which means that the e-commerce business is about to start on a large scale.

In a channel research summary circulated recently, an anonymous insider disclosed:

In 2022, the scale of video account e-commerce will actually be about 130 billion yuan, and live broadcasts will account for 95%. Among the 900,000 merchants attracted, men’s and women’s clothing (28%), skin care (12%), jewelry accessories (10%), general merchandise (9%), and gourmet drinks (8%) ranked the top five. The minutes also predict that the scale of video account e-commerce will reach 400 billion yuan in 2023.

According to this scale, if the calculation is based on a 2% commission, the scale of the video account technical service fee revenue in 2023 will be at least about 8 billion yuan. Therefore, I predict that the e-commerce business of video accounts will also usher in a big development in 2023. After all, only by providing content creators with a better way to monetize can they attract the continuous creation of high-quality content.

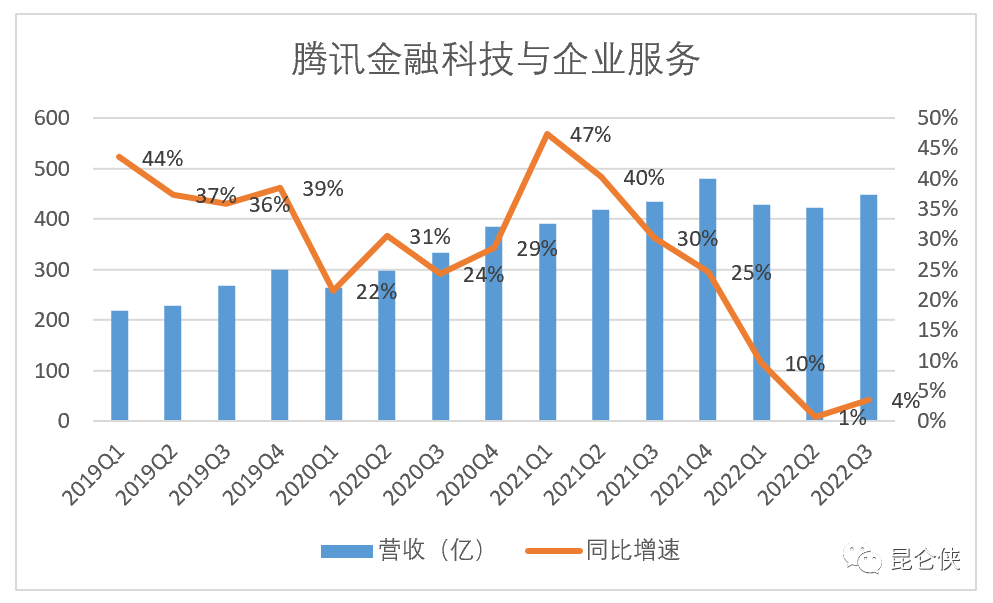

6. Tencent cloud business is expected to turn losses into profits

The cloud computing business was once placed high expectations by the outside world, and it was regarded as Tencent’s new growth engine in the next ten years. However, in the past two years, the development of Tencent Cloud has experienced a rapid decline. The market share of Tencent Cloud has also been surpassed by Huawei, ranking third.

In fact, in the past two years, the growth rate of almost all local Internet cloud vendors has continued to slow down. In stark contrast, the cloud service business of the three major domestic operators has performed strongly in recent years, especially in the government and enterprise market.

In the first half of last year, Telecom Tianyi Cloud, Mobile Cloud and Unicom Cloud had revenues of 28.1 billion, 23.4 and 18.7 billion respectively, with year-on-year growth rates of 101%, 104% and 143% respectively.

Regarding Tencent Cloud’s “stall”, Ma Huateng recently pointed out at the staff meeting that in the past three years, CSIG (Cloud and Smart Business Group) has done a lot of impulsive things, pursuing front-end integration and pursuing big digital revenue. Tang Daosheng (CEO of the cloud and smart industry business group) did not want to do this before, but Tencent is often coerced by market share and public opinion, and is forced to be the general contractor to gain market share. What is the rank?”

Ma Huateng said, “Don’t be ridiculed by others, saying that your cloud is surpassed by Huawei, you are only the third child (you can’t help it).” He encouraged CSIG employees not to care about external public opinion: “It doesn’t matter! We don’t Don’t worry, don’t be fooled.”

At the same time, Ma Huateng also gave his own suggestions: “No company in the world that is doing well in To B is made big by system integration. The core is to make products . Do a good job in products and then play the role of being integrated. What Tencent wants to do for a long time.”

Ma Huateng believes that Tencent’s advantages lie in the collaborative office capabilities of the representatives of the “three elites” (enterprise WeChat, Tencent Conference and Tencent Documents), as well as the closed loop of TO C and TO B business connected by small programs.

“These are very good. They don’t exist in the whole world. Why not take advantage of this advantage?” Ma Huateng believes that it is meaningless to compete with others for things that are “not bad for Tencent”.

Unlike the severe criticism of the PCG business department, we can clearly feel that Ma Huateng is still very optimistic about the future development prospects of the cloud computing business and has high hopes. Therefore, it is more to encourage employees to put their minds right, not to be coerced by public opinion, and to give full play to their talents. With its own unique product advantages, it makes excellent differentiated products.

In connection with the establishment of a cloud computing joint venture between Tencent and China Unicom last year, and Ma Huateng’s statement that he is willing to be integrated, it is not difficult to see that Tencent’s cloud computing business strategy has undergone a significant change: gradually withdrawing from direct competition with peers at the IaaS layer, and more More rely on China Unicom’s state-owned enterprise advantages to jointly carry out business.

Make full use of its own product advantages, focus on the “one family and three heroes” (corporate WeChat, Tencent Conference and Tencent Documents) and small programs, and further increase the continuous expansion and realization of products at the PaaS and SaaS layers.

Take the Tencent document that the author often uses as an example. At present, most of the writing has been transferred from local Word to Tencent document, which is very convenient and easy to use. In the first half of 2022, Tencent Docs quietly launched ordinary member and super member plans to start commercial monetization. The prices are 9 yuan per month and 30 yuan per month,

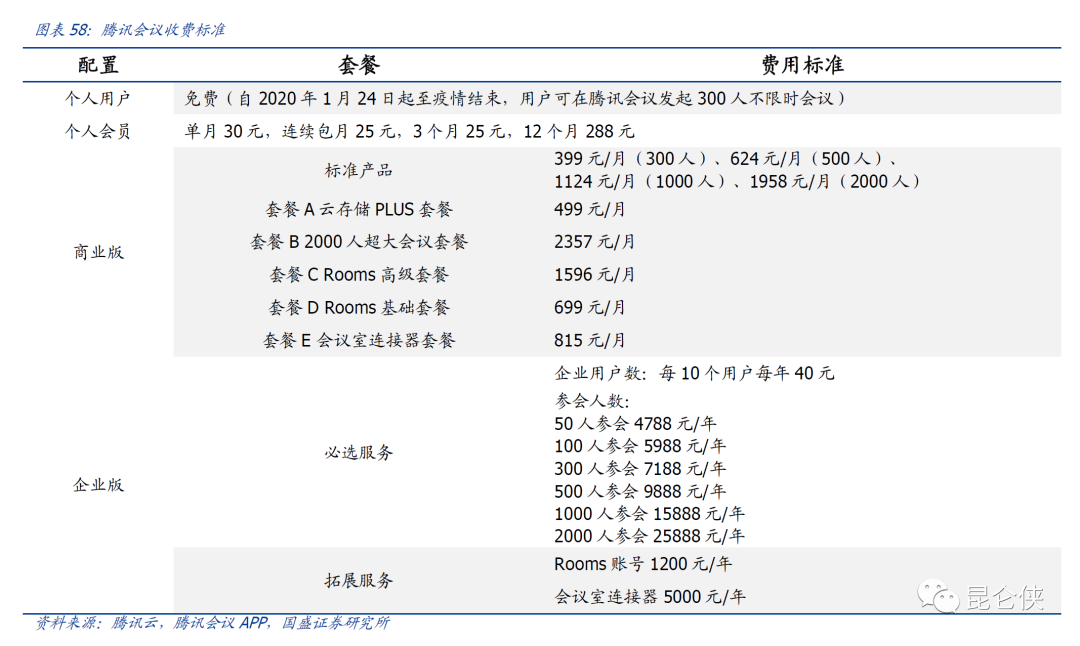

In September 2022, Tencent Conference, known as the “National Conference APP”, announced the start of charging, and launched three configurations of charging standards for individual membership, business version, and enterprise version. Individual membership is 30 yuan per month, and corporate users have a minimum of 399 yuan. per month.

Therefore, I believe that Tencent Cloud’s business is still undergoing deep adjustments, and expectations for 2023 should be lowered. Due to Tencent’s product structure adjustments and service price increases, Tencent’s cloud business is expected to continue to maintain low-speed growth in 2023, while business losses will be greatly narrowed, and it is expected to achieve its first profit in 2023. Forward Healthier long-term profit growth is expected as subscription revenue increases.

7. Strategic contraction is still the main theme

Through Ma Huateng’s speech at the staff meeting, we can clearly perceive that Ma Huateng is still not optimistic about 2023, and requires all departments to focus on the main business, reduce costs and increase efficiency. Except for the video account, most of the businesses are in a state of strategic contraction rather than expansion.

Judging from the current market environment, it is not difficult for Tencent to make this choice. After all, most areas of the C-end consumer Internet have entered the stage of stock competition, and the era of staking land is gone forever. However, the application scenarios of the B-end industrial Internet are different, and business development is far from a one-day effort.

In this case of limited external open source, internal throttling has become the main task. It is expected that various operating costs and expenses still have room for downside.

On the one hand, in 2022, almost all business departments of Tencent have carried out business streamlining and personnel optimization, and it is expected that more obvious optimization effects will be reflected in 2023. On the other hand, benefiting from the rectification of internal corruption, the purchase cost and sales expenses are expected to continue to decrease.

8. The latest performance forecast and valuation adjustment

Overall, I still maintain my judgment when commenting on the third quarter report in 2022: Tencent’s performance turning point has arrived, and the weak recovery trend in the third quarter will continue in the fourth quarter. 2023 will usher in restorative growth under the influence of a low base, and the growth rate of the profit side will be significantly higher than that of the revenue side.

Maintain the forecast of adjusted net profit of 33 billion in the fourth quarter of 2022, and the adjusted net profit of 118.9 billion in 2022. It is expected to achieve 15% and 15% growth in 2023 and 2024, that is, the adjusted net profit from 2022 to 2024 will be 118.9 billion, 136.7 billion, and 156.2 billion.

In terms of valuation, Tencent’s stock price has risen by more than 80% from its low level in just two months since November 2022. The current market value of 3.3 trillion Hong Kong dollars corresponds to 21 times the dynamic PE in 2023. The past increase is more from Serious underestimation returned to the state of reasonable underestimation. The cheap valuations visible to the naked eye like last year are no longer there, and what will be earned in 2023 is more money for the recovery of performance growth.

[Reading reminder] The content of this article is only for personal investment and research purposes, and is not intended as any investment advice or suggestion. Buy and sell accordingly, at your own risk.

—————————

If you think the article is good, please like/forward it, this is an important driving force for the birth of the next article.

@今日话题@宁又加传-Liu Chenggang $Tencent Holdings (00700)$

There are 57 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/7815672011/239494704

This site is only for collection, and the copyright belongs to the original author.