Tesla’s price cuts will make life difficult for many domestic brands. On the one hand, after the price cut, the gross profit of bicycles is still higher than that of domestic brands. In addition, the release of expectations for the production of models with lower prices will also reduce the growth space of car brands in the range of 100,000 to 200,000.

Author|Wang Tsai

Source | Slightly Larger Reference

The cost king of new energy vehicles, Tesla, has cut prices again, starting the year in 2023, and giving domestic new power brands a critical blow.

Some companies that have already announced price increases, such as Nezha and BYD, will have room to increase first and then decrease in the future, playing digital games. Car companies that have not yet announced a price increase are in a difficult situation. The reverse price increase does not seem to be in line with the tone of the beginning of the year. Following the strategy, for a new power brand that sells a car and loses half a car, it can only “accompany the loss”.

The key is that Tesla has a lot of room to operate in reducing prices, and there is still profit to drop another 50,000. New power brands that are still struggling at the breakeven point dare not be so willful. Weilai can’t even upgrade Qualcomm 8155 for users for free.

01

18% discount for 3 months

In the past 2022, except for BYD, almost all car companies failed to achieve their annual goals. Of course, including Tesla, the annual sales figure of approximately 1.37 million vehicles is one Weilai short of the annual target of 1.5 million vehicles.

No wonder Tesla is in a hurry. A few days into 2023, the price butcher has picked up another promotional tool-cutting prices.

The price cuts for the two models, Model 3 and Model Y, range from 20,000 yuan to 48,000 yuan, and the starting prices are reduced to 229,900 yuan and 259,900 yuan, respectively. This is less than 3 months, Tesla’s second round of price cuts, after the two rounds of price cuts, the starting prices of the above two models have dropped by about 18%, almost one-fifth of the selling price.

The rhetoric of “buy early and enjoy early” is difficult to make up for the psychological imbalance of users. It can be seen on social networks that Tesla owners who have recently picked up their cars have very creative ways of defending their rights, such as, “Go to the Shanghai Tesla Delivery Center to pull a banner together”, “Go to the Shanghai Super Factory and lie down collectively outside the No. 3 gate.” , lie in the import and export of materials and stop the production line.” This way of defending rights has momentum, but for Tesla, which has been reducing production years ago, the damage is limited.

Car owners who cannot go to the Shanghai factory choose to defend their rights at home. At the Tesla Experience Store in Taikoo Li, Chengdu, and the Experience Center in Xiaoshan, Hangzhou, many car owners gathered to discuss claims and demand compensation. There are even users who take away the surrounding gifts, snacks and water prepared by the store, and can earn a little bit back.

The owner’s dissatisfaction was in place, and Tesla only had one reply without any compensation. It is worthy of being the company of “Iron Man” Musk, no heart.

02

produce more than deliver

Regarding the price cut, Musk warmed up several times.

As early as Tesla’s battery event day in 2020, Musk publicly stated that he would launch an entry-level electric car priced at US$25,000 (approximately RMB 161,800) within three years. In the financial report analyst meeting in the third quarter of last year, he also revealed that Tesla is developing a cheaper next-generation car platform, and the cost of the new car will be half that of the Model 3.

According to news disclosed by technology bloggers, Tesla is likely to showcase the next-generation, or third-generation, vehicle platform at the “Investor Day” event in March this year. Well-known Tesla analyst Loup Ventures even revealed that the “Model 2” built on the new platform may be available in 2024.

Tesla’s price reduction is like a bomb that is bound to detonate, but does not know when it will be ignited. It is difficult for Tesla owners to determine the pace of who will come first to pick up the car or cut the price. They can only analyze the subtleties, such as order reserves.

According to data tracked by overseas analyst Troy Teslike, as of December 15, 2022, the reserve order volume in China has dropped to 0. From the perspective of Tesla’s production and delivery volume each quarter, Tesla has produced more than its delivery volume for two consecutive quarters.

In the third and fourth quarters of 2022, Tesla’s production volume exceeded its delivery volume, about 22,000 more in the third quarter and about 34,500 more in the fourth quarter. Tesla has passed the stage of short supply, and even the Shanghai Gigafactory will reduce production before the Lunar New Year.

The production efficiency of Tesla’s Gigafactory has reached 2,000 vehicles per week, and the Shanghai Gigafactory can roll off a Model Y body-in-white in an average of 40 seconds. At the same time, the growth in Tesla’s order demand is slightly weak.

In order to achieve its goal of achieving annual sales of 20 million vehicles in 2030, it is about the combined annual sales of Toyota and Volkswagen. Tesla still has to find a big piece of cake, at least occupying a market share in the price range of 100,000 to 200,000. The domestic average selling prices of Toyota, Volkswagen and BYD are all in this range. In the first three quarters of 2022, the average price of BYD bicycles is 167,400 yuan.

03

The racing moment of domestic cars

What is the forecast of new energy car companies for the industry in 2023?

From the public statement, Musk’s forecast is a recession, and he believes that the United States will enter a recession in 2023.

Li Bin, the founder of Weilai, made a very cautious estimate. He followed Liu Qiangdong, Ma Huateng, Zhang Yong, Li Yanhong and other entrepreneurs in an open letter, declaring 8 problems in Weilai. The core of the expression is that “the growth rate of delivery volume lags behind the overall growth rate of China’s smart electric vehicle market.” In 2022, the average growth rate of China’s new energy market is estimated to exceed 90%, and the growth rate of NIO is 34%.

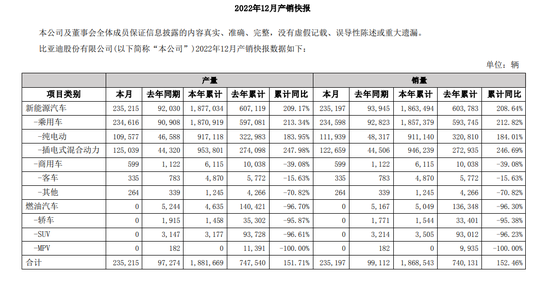

The brand that has enjoyed market growth dividends is undoubtedly BYD, which will be the global sales champion in 2022, with a total annual sales of 1.8526 million vehicles, a year-on-year increase of 208.64%.

BYD has become the world’s number one in sales because it has achieved the number one in the Chinese market. According to official data, in 2022, BYD will export a total of 55,916 passenger vehicles, accounting for 3% of the annual sales. Overseas markets account for a very small market share of BYD.

Brands that can stand out from the fierce market competition have their own housekeeping skills. Ford is assembly line production, Toyota is lean management, and Volkswagen is platform-based and modular. Tesla is a one-piece die-casting, CTC and 4680 battery. Thereby further improving the production efficiency. Diess, the former CEO of Volkswagen, once said that Tesla produces a car in 10 hours, and Volkswagen takes 30 hours, and it is expected to increase to 20 hours.

The cost of new energy vehicles is the king of Tesla, and the production efficiency is too high. It seems that orders can’t keep up.

Because of its cost advantage, BYD grabbed the share of Japanese companies in the lithium battery market in the early years. However, in the competition with Tesla, BYD was unable to take advantage of the cost advantage brought by the “crowd tactics”. Tesla Motors gross margin was 27.9%. BYD is close to 17%. Tesla’s bicycle gross profit is nearly 70,000 yuan. The gross profit of BYD bicycles is about 32,000 yuan.

Often the first place competes with the second place, and the third place dies.

Tesla’s price cuts will make life difficult for many domestic brands. On the one hand, after Tesla’s price reduction, the gross profit per vehicle is still higher than that of domestic brands. In addition, Tesla’s price cuts and the release of expectations for the production of lower-priced models will also reduce the growth space for car brands with prices ranging from 100,000 to 200,000. After all, the brand premium and technical capabilities in this range are not of the same magnitude.

What’s more, the new power car companies are still in the stage of losing money due to the investment in fixed assets in the early stage of production. For example, in 2020 and 2021, Nezha Automobile will have a net loss of over 4.2 billion yuan in two years. It is equivalent to Nezha’s average selling price of 80,000 yuan, and a loss of 40,000 yuan per car.

Nezha Automobile will be the No. 1 sales volume of new power brands in 2022, with sales of 152,000 vehicles. However, judging from recent announcements of 360, which holds a 10.72% stake in Nezha Auto, the latest valuation is 10.8 billion yuan. Compared with the valuation of 25 billion yuan after the D round of financing in July 2022, the valuation has shrunk by a hundred billion.

At present, Tesla’s product pricing is divided into two trends, below 300,000 yuan and above 800,000 yuan. The starting price of model X and model S is close to 800,000 yuan. The remaining price space is reserved for Weilai and ideal “development” opportunities, but I still feel that the profits in this price range are not attractive enough.

After Tesla announced the price cut, new energy brands that have not announced a price increase have to think carefully if they want to raise the price.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2023-01-09/doc-imxzpums8742475.shtml

This site is only for collection, and the copyright belongs to the original author.