Welcome to the WeChat subscription number of “Sina Technology”: techsina

Editor: David Joey

Source: Xinzhiyuan

The US “Chip Act” will be signed tomorrow. The chip factory, the car factory and the government held closed-door talks to discuss how to split the money. Why didn’t Intel come?

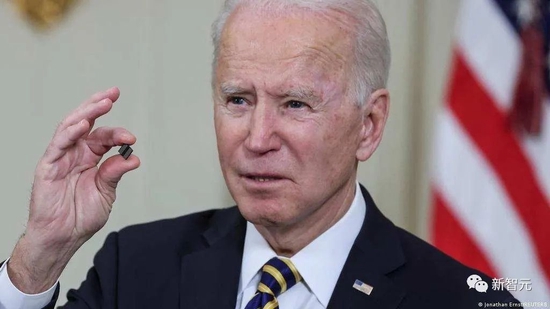

If nothing else, the US “Chip Act” will be officially signed by President Biden tomorrow, local time.

After more than two years of deliberation, negotiation, wrangling, and negotiation, the “Chip and Science Act”, which totals up to 280 billion US dollars and aims to stimulate the US semiconductor and artificial intelligence industries, is about to shiver.

The huge sum includes $52 billion in subsidies for chip manufacturing and research, as well as investment tax credits for chip factories, amounting to about $24 billion.

Of the $52 billion in subsidies, $39 billion is for the construction of new fabs in the next five years, with a maximum subsidy of $3 billion for each project. Another $11 billion is earmarked for subsidizing research and development.

Before the last moment, the CEOs of chip companies and auto companies in the United States are going to talk with the government behind closed doors together. They should discuss how such a large sum of money should be spent and who should be given it.

According to Reuters, the heads of chip maker GlobalFoundries, Applied Materials, which provides materials for chipmaking, and the heads of automakers Ford and General Motors, plan to hold closed-door meetings with U.S. government officials to discuss the government’s plans to invest in semiconductors.

The companies said the meeting will discuss with the administration “how these public investments can accelerate the manufacture of semiconductors and emerging technologies, stabilize the supply of chips, support the electrification of vehicles, and strengthen the U.S. economy, supply chain and national security.”

The chip legislation “protects the U.S. economy, supply chain and national security by accelerating semiconductor manufacturing in the U.S.,” Thomas Caulfield, CEO of GlobalFoundries, the same chip maker as Intel, said in a statement.

Also participating in the closed-door meeting with the chip manufacturers are the automobile manufacturers. As the upstream industry of intelligent manufacturing, chips are indispensable to the implementation of intelligent and assisted driving technology in the automotive industry.

Previously, the shortage of chips caused by the global epidemic that lasted for more than two years has caused these major car manufacturers to suffer. At present, due to the lack of chips, there are still thousands of cars and trucks that cannot be delivered.

“Achieving a reliable domestic supply of chips, including traditional semiconductors for the automotive and defense industries, is key to keeping America’s manufacturing lines running,” said Ford CEO Jim Farley.

Intel: “Qian Dingdie is our family’s, it’s just a matter of taking it”?

Intel, which is widely considered to be the biggest beneficiary of the “chip bill”, was not included in the meeting. Maybe it’s in the bottom of my heart.

Indeed, as a “two-handed” manufacturer that focuses on manufacturing in one hand and design in the other, Intel’s “walking on two legs” in chip manufacturing and design really puts it in a favorable position in this upcoming “penny war” .

Due to the maturity of the supply chain and international cooperation, in fact, most chip manufacturers specialize in one.

For example, Su Ma’s AMD and Lao Huang’s Nvidia basically specialize in chip design by themselves, and the manufacturing is handed over to TSMC and other partners specializing in foundry manufacturing.

Among the huge subsidies of the “Chip Act”, part of it subsidizes chip manufacturing, and part of it subsidizes chip design. If you want to compare, the former is the big one. Subsidies for building new fabs are far greater than subsidies and tax exemptions for chip design.

Intel’s manufacturing and design are not left behind, and according to the distribution method in the bill, it will take a lot of money.

With this condition, it will be hard to speak and act. Previously, due to the delay in the implementation of the bill, Intel had announced the cancellation of the groundbreaking ceremony for the construction of a large-scale 20 billion fab in Ohio.

In the face of the olive branch thrown by Europe, Intel also received it correctly.

Previously, in order to attract Intel to build factories in Germany, a subsidy of 6.8 billion euros has been written in the local government budget. Not long ago, it was reported that Intel plans to spend 5 billion to build a fab in Italy, and the government will directly subsidize 40%.

Intel CEO Pat Gelsinger said: “The Chip Act may be the most important industrial policy introduced by the United States since World War II, aimed at reversing the decline of the United States’ share of global chip manufacturing from 38% in 1990 to 10%.”

In addition, TSMC founder Zhang Zhongmou said frankly in an interview: For decades, the US chip market share has continued to decline, and it is difficult to regain global competitiveness, which may make the chip bill go to waste.

Intel hopes that it can get a total of 12 billion US dollars in factory construction subsidies this time, which is close to the “nearly one-third of the 39 billion US dollars in factory construction subsidies” in the chip bill.

Appetite is not small.

Intel’s “little life” is actually not easy

The appetite is not small, it is a matter of the future after all, the money has not been distributed yet, no matter how many billions can be obtained in the future, it is necessary to focus on the reality at present.

When it comes to reality, Intel has faced quite a few problems lately.

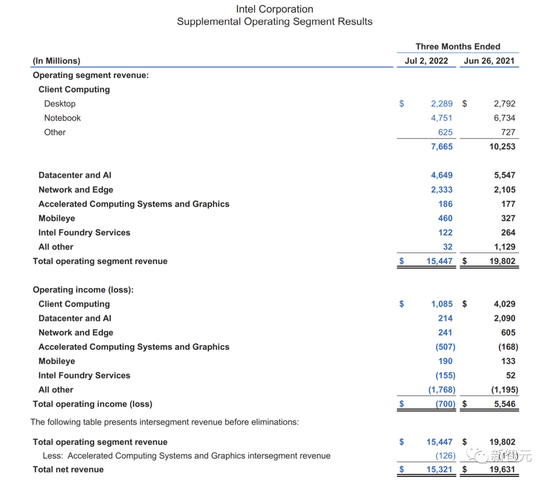

On July 29, Intel announced its second-quarter 2022 financial report, with revenue of $15.321 billion, down 22% from the same period last year.

Intel’s Q2 earnings per share were adjusted to just 29 cents, compared with analysts’ expectations of 70 cents per share. Revenue for the quarter was $15.32 billion, compared with analysts’ expectations of $17.92 billion.

Intel posted a net loss of $454 million for the quarter, its first quarterly loss in history.

As soon as the news came out, Intel’s stock price plummeted 11% that day.

The reason for the loss is that Intel blamed the decrease in demand for data center chips and the decrease in the market demand for PCs.

Intel CEO Pat Gelisinger expects revenue to decline in the next third quarter due to lower customer demand, but expects the situation to improve in the fourth quarter of this year.

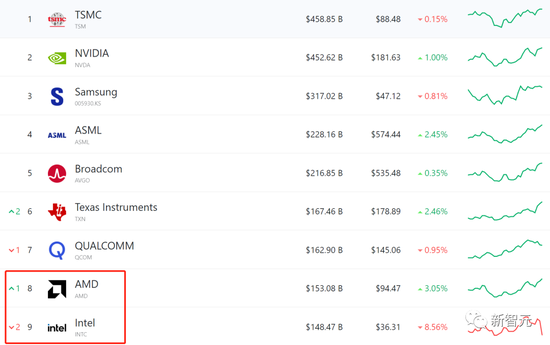

Intel has fallen sharply here, and old rival AMD will not miss this good opportunity.

AMD stock rose more than 3% that day, with a market value of $153.08 billion. Intel, on the other hand, fell nearly 9%, with a market value of $148.47 billion at the close of trading on Friday.

AMD’s market value has (again) surpassed its old rival Intel.

In addition, Intel’s aging 10nm process and power-hungry desktop CPUs have made people unable to complain, and the carefully launched GPUs have only received a mediocre response in the market. Recently, optane, which is called “the most promising in recent years”, has been killed. product line.

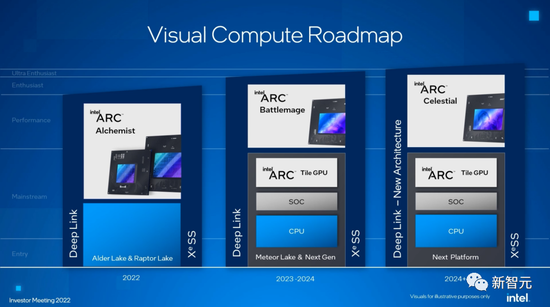

A year ago, Intel announced that it would enter the dedicated graphics card business.

Its Intel Arc also claims to compete with Nvidia’s GeForce and AMD’s Radeon GPUs.

However, just a year after the launch, problems followed.

First, Intel was unable to meet its initial release expectations, failing to launch a widely available desktop graphics card in the second quarter after narrowly completing the release of two low-end laptop graphics cards in the first quarter.

Also in terms of user experience, Arc has the worst performance in older games that don’t support DirectX12 or the Vulkan API.

This shows that Intel has publicly acknowledged a huge problem: the company is struggling with its GPU drivers.

To make matters worse, with Intel’s market performance and financial situation both in distress, investors have lost confidence in Intel.

The performance of its own products is worrying, the performance of the secondary market is even more bleak, and competitors are chasing after each other. It can only be said that Intel’s life is really difficult.

The government’s money is about to start, how much will Intel get in the end?

Subsidies are not in vain: we must pinch China together

With Intel, back to the bill itself.

In addition to the “big money” this time, the bill also contains an important clause as a necessary condition for obtaining subsidies from the US government: the most advanced fabs must not be located in China.

Whether it is a hidden murderous intention or a dagger to see it, perhaps this is the ultimate purpose of the repeated wrangling of this bill in the United States in the past two years:

contain China.

Due to China’s shortcomings in chip manufacturing, taking chips as a breakthrough has become a tried-and-true choice for the United States in recent years.

From more and more Chinese semiconductor and chip companies on the US “entity list”, to more and more chip industry technologies and component supply cuts, and then to the beginning of this year, it is directly preparing to pull up China’s neighboring countries and regions to organize bureaus contain China.

According to a report by South Korean media “Seoul Economy” in March this year, the US government proposed to form a “chip 4 alliance” (Chip 4) with South Korea, Japan and Taiwan. The intention behind it is to use this organization to exclude mainland China from the world. outside the semiconductor supply chain.

The wishful thinking of the United States is that if it can unite South Korea, which has a world-class level in the chip field, TSMC, the world’s largest foundry company, and Japan, which has a strong presence in semiconductor materials, components, and equipment technology, it will Build a “semiconductor barrier” to surround China.

However, the report believes that the South Korean government and companies may find it difficult to accept the US proposal. China is a very important market for Korean semiconductor companies. Samsung and SK Hynix have established factories in China, and their products have an important share in the global market.

Samsung has the only overseas production base for memory chips in Xi’an, mainly producing flash memory chips, with a monthly production capacity of 265,000 12-inch wafers, accounting for 42% of Samsung’s overall flash memory output and 10% of the global flash memory market output.

Another chip maker, SK Hynix, is more reliant on China for production capacity. The company’s NAND factory in Wuxi accounts for 47% of the total production capacity.

Unsurprisingly, South Korea is cautious. The United States recently proposed to the South Korean side to hold a preparatory meeting on whether South Korea will participate in the “Chip Quartet”. The South Korean government stated that it is discussing the meeting plan and decided to propose to the U.S. that the “Chip Quartet” should be based on “Participating countries should respect China. The emphasis is on the one-China principle” and “no mention of export restrictions to China”.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-08-09/doc-imizmscv5473575.shtml

This site is for inclusion only, and the copyright belongs to the original author.