Welcome to the WeChat subscription number of “Sina Technology”: techsina

Source: Yuanchuan Investment Review

On January 27, 2022, exactly 100 days before the “Lehman Crisis” in the encrypted world, Internet VCs were still moving to Singapore to follow the WEB3 venture capital wave, and a Nobel Prize was sent in the mobile phone push. Recent articles from Economics Laureate Paul Krugman:

How Cryptocurrencies Became the New Subprime Mortgage Crisis.

In his view, cryptocurrencies bear a striking resemblance to the subprime mortgage crisis 15 years ago: Before 2007, many Americans on the fringes were given the opportunity to increase leverage. With the arrival of the real estate bubble, these lucky people became the fuse. Today, the risks of cryptocurrencies are also disproportionately falling on those who do not know what they are doing and cannot handle the risks [9].

It’s just that “co-conspirators” are always more welcome in the investment world than “prophecies”.

Young people who speculate on coins, while laughing at Mr. Paul who dropped his book bag as an antique, follow the “super cycle” of the encrypted world advocated by the mysterious pinyin man Zhu Su.

The 35-year-old, who was born in China and immigrated to the United States at the age of 6, founded the hedge fund Three Arrows Capital, and became one of the three big mountains in front of WEB3 venture capitalists by himself. The other two, one is leading the layout of the encryption field for nearly 10 years, and almost every star project has its A16Z behind it; the other believes in making miracles with great effort, and in the first half of 2022, at an average rate of one company per week” The Sequoia of “Sprinkle Coins” expansion.

Zhu Su and his Three Arrows Capital, just like every version of the investment game must have a man from rough background, started their road to fame with brutal joy.

At the end of the last round of the crypto bear market, Three Arrows Capital confidently bought the bottom and bet on Bitcoin and Ethereum, and became famous as the market turned bullish. Later, Three Arrows Capital also participated in the early investment of star blockchain projects such as Solana and Axie Infinity. According to the calculation of Nansen, a blockchain analysis company, among the assets managed by Three Arrows Capital, the encrypted assets alone are close to 10 billion US dollars.

The rise of Three Arrows Capital is a true portrayal of “one day in the currency circle, one year in the world”.

In mid-June, it was revealed that Three Arrows Capital was facing a liquidity crisis and was insolvent; half a month later, the court received an application for bankruptcy protection. The once banner of the currency circle has become the “strongest water ghost” in an instant: many affiliated companies have also been pulled into the water, and business difficulties have been reported successively.

In a blink of an eye, the building rose and collapsed. This hedge fund, which emerged in 2018, re-interpreted 2008 in front of millennials.

01

Prologue of Glory

On December 21, 2018, a Chinese-Singaporean named Zhu Su posted a highly controversial tweet — “We will soon be out of the (crypto) bear market, leaving other traditional investors trapped in fiat currencies. in [2].”

On this day, the price of Bitcoin is about $3,850, which has fallen by more than 80% compared to the previous bull market. Three years later, the figure had risen to as high as $69,020, an increase of nearly 18 times.

Like every gambler who yells right at the bottom, Zhu Su’s reputation can be built up just once, even if he isn’t a devout crypto believer at all.

In 2012, Zhu Su and his classmate Kyle Davies lost a lot of money around Bitcoin, and they turned around and went to work [3].

Zhu Su, who was still working at Credit Suisse at the time, still preferred the arbitrage strategy of “zero capital and profit” during working hours: they discovered the inefficient NDF market overseas, and made profits through the subtle differences in foreign exchange quotations between different banks. By the end of the year, Zhu Su, who had completed the original accumulation of capital, resigned dashingly, founded Three Arrows Capital with Kyle, and went further and further on the road of “middlemen earn the difference”. In the peak years, Three Arrows Capital once accounted for 8% of the global emerging market foreign exchange trading volume[4].

It can be said that the word “arbitrage” is almost engraved in the DNA of Three Arrows Capital.

As a trader with a keen sense of smell, Zhu Su is still keeping an eye on the crypto market. Finally, at the end of the bear market in 2018, he smelled the smell of oil and water. He found that compared with the slightly old-fashioned foreign exchange trading, the talent siphoning ability of the crypto industry is improving. rise rapidly. Perhaps deeply feeling that traditional finance is still “too conservative in winning”, the two founders of Three Arrows Capital began to fully turn to the encryption field.

But compared to other crypto adventurers, Zhu Su, who came from arbitrage, prefers to pursue “stable happiness”.

In 2020, the entire crypto market experienced a few-hour flash crash, with the LINK token issued by a popular blockchain project dropping from $14 to $12. Taking advantage of this gap, Three Arrows Capital purchased $10 million worth of LINK tokens within an hour. That night, the entire crypto market rebounded.

Zhu Su also personally ended up shorting the market. In November 2021, he tweeted that the founders of ethereum had “forgot their original ideals,” slamming ethereum’s expensive fees. Half a month later, they were found to have secretly bought about 100,000 ethers while taking advantage of the danger.

Speaking of which, although Zhu Su was born in China, he did not follow the path of “making a fortune in silence”. He obviously enjoys being an internet celebrity in an encrypted community – sunning his abs, doing podcasts, and connecting with celebrities on live broadcasts, and he is well versed in the traffic passwords that are not astonishing to death.

Similar to “Gold will be brutally demonetized, your children and grandchildren will think that gold rush is a person who picks up metal scraps in the dumpster and sells it for money”, I am afraid that Changpeng Zhao will shake his head after reading it, but it brings Zhu Su over 50 million twitter feeds.

In this century of language, Zhu Su not only dares to speak, but also speaks systematically and theoretically.

In recent years, he has been promoting his original “super cycle” theory to the outside world. Simply put, he believes that as long as enough institutional money comes in, the crypto market will no longer have a bear market like it has in the past. Even short-term fluctuations will be much more moderate than in the past. This kind of elegant saying of carrying a sedan chair made the Ningbo Death Squad feel scared when they heard it.

Another of his crypto investing philosophy is to “reduce investment diversification” – since most projects have far less ROI than a few mainstream cryptocurrencies. Translated into the A-share language, only buy liquor in the currency and Maotai in the wine.

“Internet celebrity” Zhu Su

“Internet celebrity” Zhu SuWhether it is original theories or concentrated bets, generally those who dare to do so have extremely high self-confidence. Obviously, having successfully predicted the potential of Bitcoin and Ethereum, as well as a new round of crypto bull market, gave Zhu Su great confidence on the road.

But in the investment world, the saying that failure is the mother of success is usually the other way around—success is often the mother of failure. The methodology that used to be successful is now slipping into the abyss with Three Arrows Capital.

02

Chain of Destruction

At the end of 2021, Zhu Su, who has been consecrated by crypto believers, confidently predicted the price of Bitcoin in two months on Twitter – $88,888, and all the horses in the currency circle cheered. Zhu Su himself did not forget that while stepping on Ethereum, the new camp of All in virtual currency – Terra public chain.

But this time he miscalculated. In the volatile crypto market, the backhand is rewarded with a dip. After the high of $69,020, Bitcoin plummeted, and its market value has shrunk by more than 70%.

Terra was born in 2018 and is famous for its unique dual-token economic system: the price of the project currency Luna fluctuates with the market and is linked to the stable currency UST, which is directly linked to the US dollar. Before May 2022, the price of a single UST has always been maintained at around $1, and there has never been a serious de-anchoring. This keeps UST in the top 3 in the global stablecoin market all year round and in the top 10 in the entire crypto market.

The mechanism of UST is different from other stablecoin projects on the market: when the traditional coin issuer ICO, each additional stablecoin will deposit 1 USD into the account as an asset anchor; but Terra does not have an anchor, but relies on Algorithms artificially stabilize the value of UST around $1 by destroying tokens and other means.

This kind of gameplay that makes traditional investors in the secondary market confused after hearing it, has long been sought after by encrypted KOLs. Zhu Su even called it “an essential part of the next super cycle [6]”. Three Arrows Capital also made a big bet on Terra: $560 million in media exposure alone.

The method of Three Arrows Capital’s investment in Terra has a strong personal color of Zhu Su, that is, “stable arbitrage”.

There is a cryptocurrency lending protocol called Anchor on the Terra public chain, which quickly became popular by promising an ultra-high annual yield of 19.5%. When the cryptocurrency market turns from bull to bear in 2022, this is also seen by many investors as almost the only way to obtain stable returns.

When Zhu Su saw it, I was familiar with it.

He immediately borrowed money everywhere under the name of Three Arrows Capital. As long as the loan interest of other institutions was lower than 19.5%, Zhu Su converted all the borrowed money into UST tokens and deposited them in the “crypto bank” Anchor. After completing this preschool-level math problem in Haidian District, Zhu Su and Three Arrows Capital can lie down and reap the difference.

Zhu Su, who was full of calculations, never expected that Anchor left a bunch of sassy operations and directly bankrupted himself. Sanjian has not yet become a middleman who earns the difference, so he first exchanged the red code.

Just like Zhu Su, the sharks in the currency circle who smell the arbitrage opportunity will not borrow money from Anchor foolishly. Everyone is comparing prices all over the market, looking for lower loan interest rates. Anchor, who thought he could absorb savings and lend through high yields, was caught in the backhand by his high loan interest rate, and the borrowing rate was less than 30% all year round.

Even in the WEB3 world, after all, the business model of banks still earns interest margins.

Anchor can’t just provide high returns, and it can’t give out enough loans, so they came up with a very “WEB3” solution – issue coins first in case of indecision. Any user who borrows from Anchor will receive the newly launched “gift” token, ANC.

The beauty of this move is that it directly attracted a vote of ruthless people in the currency circle who were not interested in deposits, but were interested in speculating on ANC tokens – I borrowed you money for ANC, what 19.5% The deposit income is not as fast as the “gift”.

This contemporary story of “buying a casket for a pearl” maintains everything on the belief that “the price of the box will go up”.

Everyone wants to make money out of thin air: borrowers bet on ANC tokens soaring, Anchor bet on a surge in loan volume, Zhu Su bet on Anchor’s stable interest payments, and other borrowers bet on Three Arrows Capital to make more money.

It is a pity that the ANC token has not been the life-saving straw, and Anchor has been in a state of loss. The fragile ecology only needs to be the first to retreat, and the prosperity will end.

The price trend of ANC tokens in the past three months, data source: Binance

The price trend of ANC tokens in the past three months, data source: BinanceIn May, individual “large depositors” began to cash out. Investors who smell the crisis have followed suit and withdrawn and sold. Affected by extreme panic, the stable currency UST has an unprecedented de-anchor and began to plummet. As for LUNA linked to UST, the price dropped from $100 to near zero.

The UST token under the Terra algorithm seems to be stable, but it is not completely stable. In the past, the UST token has been able to maintain its anchor for several years, and the biggest contributor is the confidence brought by the bull market to investors. However, with confidence supported by cyber ideas, in 2022, when Bitcoin “falls and does not recognize it”, UST tokens have no reason to be an exception.

After the collapse of LUNA, all major foreign encryption forums put up free psychological counseling calls, “If you have suicidal impulses, please call the hotline.” For Zhu Su and Three Arrows, the situation has become a bit awkward: Terra assets, which had previously borrowed $560 million to invest, are now only worth $670, a six-figure loss overnight.

At that moment, I don’t know if Zhu Su misses the days of controlling thunder and lightning in the traditional financial field.

03

history repeats itself

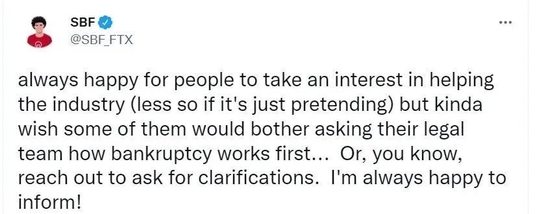

The last tweet of the chattering internet celebrity Zhu Su stayed on June 15: “We are communicating with the relevant parties and are fully committed to resolving this issue.” There has been no news since then.

This made the WEB3 company that lent money to Three Arrows Capital almost burst into tears.

In mid-June, the cryptocurrency lending platform Celsius announced the suspension of withdrawals, and there was a problem with the capital pool; on July 8, Voyager Digital, which lent about $666 million in encrypted assets to Three Arrows Capital, also filed for bankruptcy protection in the United States. In addition, a large number of institutions, including FTX, BitMEX, Binance, etc., have bad debts of Three Arrows Capital, so they have to go to the office door to pull a banner. The resulting extreme panic caused a large number of unrelated “encrypted banks” to rush out to “deny the three companies” to clear the relationship and appease users.

The founders of the world’s two largest exchanges even had a fight over it

The founders of the world’s two largest exchanges even had a fight over itEven with most businesses liquidating Three Arrows’ collateral, the crisis is not over.

The founder of the BitMEX exchange mentioned in a public article that a large number of “encrypted banks” are eager to expand, and at the same time they are full of confidence in the huge asset pool of Three Arrows Capital, so they have opened up the loan mortgage: not only allows Three Arrows Capital to take volatility Large altcoins are used as collateral, and some institutions even default to repeated mortgages and zero mortgages [4].

In the end, when the deadly bullet was fired at an explosive barrel, the aftermath ignited one detonator after another with the leads, and a grand “collapse fireworks show” was staged.

Of course, if it is possible, Three Arrows Capital does not want to be an old man.

In addition to the “borrowing chicken to make an egg” Terra investment, the rest of Three Arrows Capital’s investment is mainly in the two major fields of Bitcoin and Ethereum. In the past, Three Arrows Capital used Bitcoin to purchase GBTC, an “ETF-like fund” launched by Grayscale Trust. According to information disclosed by relevant media, in 2020, Three Arrows Capital once relied on this to earn double-digit asset growth.

Unfortunately, in 2021, GBTC started to halve due to the competition from Bitcoin EFT that emerged later. Three Arrows Capital did not sell directly, but has been waiting for the only possibility of a turnaround: Grayscale Trust intends to apply to the SEC (US Securities and Exchange Commission) to convert GBTC into a formal ETF. If approved, the liquidity will be greatly improved, and even It will give the price a chance to surpass its previous highs.

“Wait the party” Zhu Su misses the best stop loss opportunity

“Wait the party” Zhu Su misses the best stop loss opportunityIt’s just that people are unlucky to drink cold water. At the end of June, the SEC rejected this proposal, so angry that Grayscale Trust directly sued the other party in court – which means that Three Arrows Capital will have to wait at least another year for the litigation period. Seeing that the debt collectors were about to call on the door, Zhu Su decided to sell another major asset on hand – the stETH token directly linked to Ethereum.

As a result, the same script played out again: the panic caused by the massive selling brought stETH to collapse.

Three Arrows Capital is like sinking into a swamp. The harder it struggles, the faster it sinks.

In July, it was discovered that Zhu Su was preparing to sell a $35 million Singapore mansion. When everyone thought that Three Arrows Capital was going to work hard to repay the debt, the lawyer in charge of the bankruptcy case found that the two founders could not be contacted, and they were suspected of fleeing from Singapore. This time, the creditors who thought they were waiting for the full stop left another big question mark.

When the story goes all the way here, you will find that the first crash drama in the WEB3 world is not really “WEB3”, but more like another repeated rhyme in history.

04

At the end of the subprime mortgage crisis in 2008, a mysterious person named Satoshi Nakamoto released a white paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System” and personally mined the world’s first cryptocurrency.

This cross-epoch invention deeply moved a large number of idealists around the world. In their view, the root cause of the catastrophic subprime mortgage crisis is the self-serving centralized institutions and their inexhaustible guilt. And a decentralized currency will solve the subprime mortgage crisis from the root and bring about a new economic order.

But I don’t know when it started, the idealist who once talked about decentralization, also combed his hair into an adult appearance, put on a patagonia, and opened his mouth to say “how many waves Bitcoin has risen to”.

This “hero” who was once hoped for has become a new dragon before he could defeat the Demon King.

References

[1] The Big Dipper in the Encryption World: A Brief Analysis of the Layout of a16z, Sequoia Capital and Three Arrows Capital, Ostrich Blockchain

[2] Fund Manager Who Called End of Last Crypto Winter Remains Bullish, bloomberg

[3] Another Big Crypto Player Just Blew Up, Intelligencer

[4] Number Three, Arthur Hayes

[5] Looking for DeFi trend-setters: Su Zhu tells you how good crypto traders are made, Winkrypto

[6]Crypto Hedge Fund CEO Zhu Su Outlines Why ‘It’s Hard To Be Too Bearish,’ Says These Three Altcoins Are Showing Strength, The Daily Hodl

[7] UST Faith Collapse? In-depth interpretation of Anchor lending mechanism, Oukechain News

[8] The “Lehman Crisis” in the currency circle has worsened! How the tens of billions giant Three Arrows Capital went bankrupt, Wall Street News

[9] Success or failure is arbitrage, how Grayscale GBTC “killed” three arrows capital, BlockFi and other injustice institutions, Deep Tide TechFlow

[10] How Crypto Became the New Subprime, PAUL KRUGMAN

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-07-15/doc-imizirav3547642.shtml

This site is for inclusion only, and the copyright belongs to the original author.