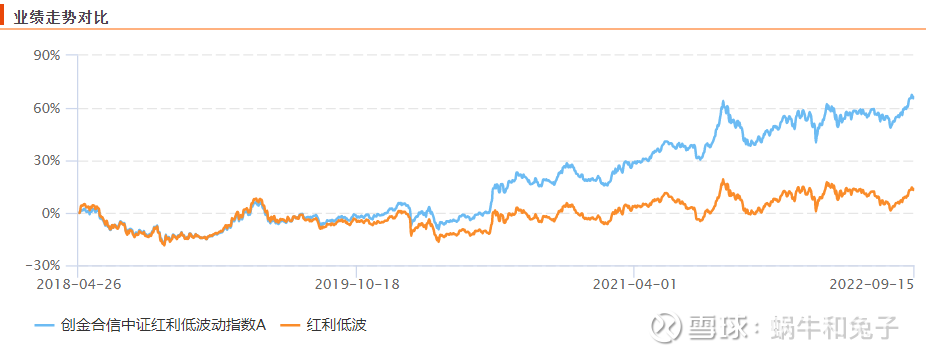

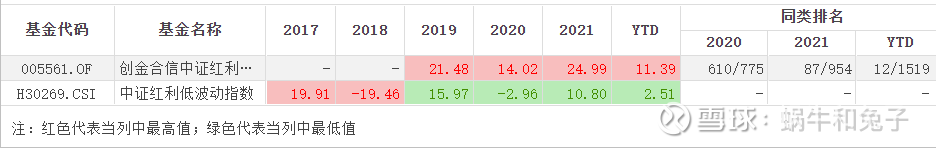

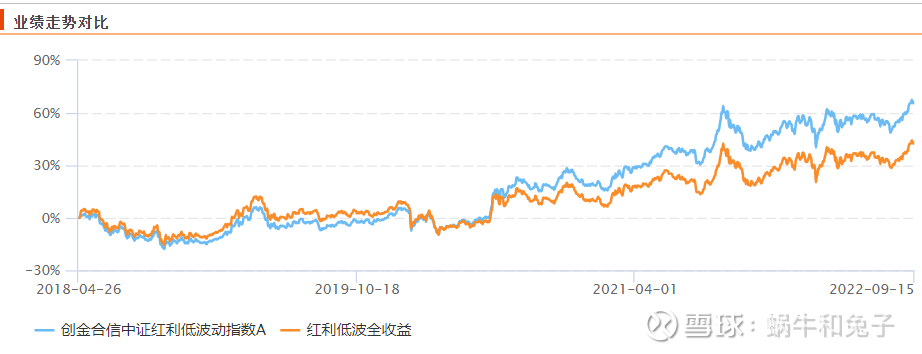

When I wrote about the dividend index fund yesterday, the income of Chuangjin Hexin CSI Dividend Low Volatility Index Fund (005561) aroused my curiosity, because the income of this passive index fund far exceeded the performance of the dividend low volatility index (H30269). , let’s take a look at the excess return of the fund.

Data source: Choice data

Chuangjin Hexin CSI Dividend Low Volatility Index Fund (005561) has a stable excess return every year relative to the Dividend Low Volatility Index.

Passive index funds usually replicate the index and strictly control the tracking error, so where does the excess return of this index come from?

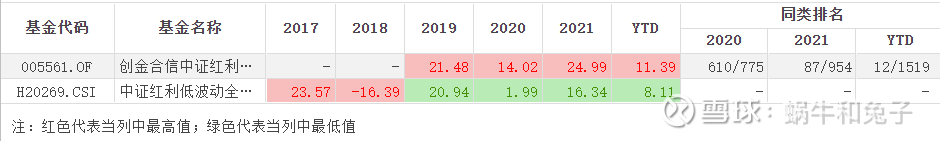

As a dividend index, it is easy to think that dividends are a source of excess returns, but I also listed the dividend yields of major dividend indices in my article yesterday. The latest dividend yield of the dividend low volatility index is less than 4.5%. If If you compare it with the dividend low volatility total return index, it will be more clear.

Data source: Choice data

Although the excess return of Chuangjin Hexin Dividend Low Volatility Index Fund (005561) relative to the Dividend Low Volatility Total Return Index has been significantly reduced, there is still a stable excess return. The excess returns from 2019 to 2022 are 0.54%, 12.03%, 8.65 %, 3.28%.

After analyzing the samples of fund positions and indexes, there is no big difference. I guess another big excess return should come from new income.

According to the announcement of the results of the offline inquiry and placement of stocks, the number and amount of new shares placed by the fund offline can be counted, and then the fund’s new revenue can be estimated.

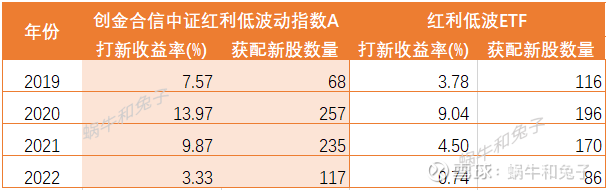

Data source: Butterfly data

It can be seen that the Chuangjin Hexin CSI Dividend Low Volatility Index (005561) does have stable and considerable new returns, which can explain the source of excess returns of this passive index fund.

Looking at the fund’s 2022 interim report, there is also an explanation for the tracking error of the fund’s returns:

The underlying index tracked by the Fund is the CSI Dividend Low Volatility Index, and the performance benchmark is the CSI Dividend Low Volatility Index Yield × 95% + Bank RMB Current Deposit Interest Rate (after tax) × 5%. The CSI Dividend Low Volatility Index selects 50 stocks with high dividend yield and low volatility in the A-share market as sample stocks, aiming to reflect the overall performance of stocks with high dividend levels and low volatility.

The investment strategy of the Fund, under normal circumstances, mainly adopts the full replication method for investment, and strives to control the annualized tracking error within 2%, and the average daily tracking deviation absolute value within 0.20%; in order to better realize the investment Target, when there are special circumstances that prevent the Fund from effectively replicating and tracking the underlying index, the Fund will use optimized replication methods including substitution, sampling and other technical means to construct a stock portfolio.

During the reporting period, the fund operated smoothly, and the daily average deviation and annualized tracking error were both controlled within the scope agreed in the contract. The main source of the error was that the new shares subscribed by the fund increased significantly after the listing, resulting in the deviation of income, as well as the daily fund redemption. lead to changes in positions . The fund has achieved certain excess returns, mainly from new stock returns and dividends from index constituents.

Do you think there is a bit of that Versailles flavor? I want to control the tracking error, but my new stock returns are high, and the dividends of the index components are also high.

Another index fund that tracks CSI Dividend Low Volatility is the Dividend Low Volatility ETF (512890). The excess return of this fund is a little weaker than that of Chuangjin Hexin CSI Dividend Low Volatility (005561).

From the performance trend, Chuangjin Hexin’s dividend low volatility is stronger than the dividend low volatility ETF, and both perform better than the dividend low volatility full income index.

Data source: Butterfly data

Comparing the two funds, the Chuangjin Hexin CSI Dividend Low Volatility Index is stronger than the Dividend Low Volatility ETF in terms of both the new yield rate and the number of new shares allocated.

The dividend index funds established by the market before 2020 were screened, and their new income was estimated in the time interval from 2020 to the present. The results are as follows:

Data source: Butterfly data

It can be seen that the difference in yields between different funds is quite large. On the one hand, it shows that new launches are also an important ability. On the other hand, it should be noted that if the market does not have sustainable returns due to policies or other reasons, these funds with higher returns from new launches will also face the risk of declining returns.

Note: All views and funds involved in this article do not constitute investment advice, and investment in the market is at your own risk.

#雪球星plan public offering master# #When the market falls, how should Christian Citizen respond to the # #deposit interest rate cut, which stable funds are worth entrusting? #

@Today’s topic @snowball creator center @snowball fund@ ETF star push officer

$ Chuangjin Hexin CSI Dividend Low Volatility Index A (F005561)$ $ Chuangjin Hexin CSI Dividend Low Volatility Index C (F005562)$ $ Dividend Low Volatility (CSIH30269)$

This topic has 1 discussion in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9411213320/230929014

This site is for inclusion only, and the copyright belongs to the original author.