Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Zhou Yifei

Source/Connection Insight (ID: lxinsight)

Eight years ago, Mumbai, India welcomed a group of members of the vivo delegation. The sole purpose of their trip was to open up India as an overseas strategic test field.

So, the slogan “Love India, Love vivo” made vivo start to connect China and India.

However, the Indian market did not start as smoothly as expected, and vivo has survived a difficult adjustment period. For example, Chen Zhiyong, the deputy general manager of vivo India at the time, learned the first Hindi sentence in India was “take your time”.

Unlike in the past, vivo has already become the top three “regular customers” in the Indian smartphone market. But it also increasingly feels that it seems more difficult to continue doing business in India without being affected – vivo has become the only Chinese mobile phone maker to come under scrutiny and supervision in India since December last year.

On July 5, the Enforcement Directorate of India raided the Chinese mobile phone brand vivo and related companies on the grounds of suspected money laundering, in Delhi, Uttar Pradesh, Meghalaya, and Maharashtra. More than 40 office locations including state.

Two days later, the Indian Bureau of Enforcement issued a statement saying that about half of vivo’s local turnover (62,475 crore rupees) was remitted abroad, mainly to China. Therefore, they believe that the move has been suspected of violating the Money Laundering Prevention Act, so they blocked 119 bank accounts of vivo and froze about 4.65 billion rupees (about 390 million yuan) in cash and other assets.

What happened to vivo is not an independent event. Although Chinese mobile phone manufacturers such as vivo have achieved good sales results in the Indian market, and have successively established factories there at the request of the Indian government, India has never removed the “big stick” hanging over the heads of Chinese manufacturers.

The uncertain external environment, supply chain issues, and recent tax inspections by India seem to indicate that vivo’s situation in India is not safe.

In this sense, vivo’s domestic base should have become the “pillar” to maintain its fundamental advantages, but at this moment, it is actually under heavy pressure in the Chinese market.

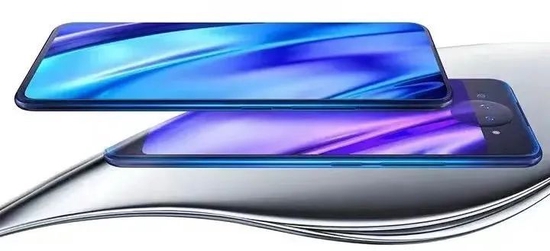

The sluggish environment of the mobile phone industry in recent years has forced vivo to jump out of the comfort zone of the mid-to-low end, but it has not made much splash in the high-end market. Even in April this year, vivo also launched its first folding machine, the vivo X Fold, to explore the high-end game, but the “prosperity” shown in the major lists did not bring about an essential increase in sales, nor did it reproduce the consumption of Huawei’s folding machines. Market recognition.

vivo X Fold, picture source vivo official Weibo

vivo X Fold, picture source vivo official WeiboThe predicament of vivo is that, on the one hand, the transformation of the high-end market is not smooth, and on the other hand, the original strategy of the sea of machines has also failed.

Therefore, in addition to smartphones, vivo has also reached out to new technologies and businesses. Recently, the registered capital of Vivo and OPPO-controlled Long brought small loans to 5 billion yuan, and vivo once again increased its small loan business. It also attracted the outside world to “re-enact Xiaomi’s entry into consumer finance”.

The Indian market is trapped, the domestic market is under pressure, and the exploration of the second curve has just begun. There are still many challenges that vivo will face.

India is also targeting vivo

Clouds are still gathering. After Xiaomi, vivo, which has been operating in India for 8 years, was also raided.

On July 5, local time, Indian law enforcement agencies raided the offices of vivo and related companies in various parts of India on the grounds of suspected money laundering. The search made vivo the latest Chinese mobile phone maker to be scrutinized by an Indian investigation agency. Before vivo, Huawei and Xiaomi were also subject to similar inspections from relevant departments.

The surprise inspection of vivo is not groundless. As early as April, India had begun an investigation into vivo to find out “whether there were major irregularities in ownership structure and financial reporting.”

Until about two months ago, after Indian authorities took judicial action against Xiaomi for allegedly violating foreign exchange management laws, a document obtained by Bloomberg from the Indian Ministry of Corporate Affairs showed that the Indian Ministry of Corporate Affairs claimed to have received an anonymous whistleblower letter. , believes that the relevant Chinese-funded enterprises may have irregularities such as fraud, and will carefully review their audit reports.

Two days after the raid, India blocked 119 bank accounts related to vivo’s Indian business, which held a total of 4.65 billion rupees (about 390 million yuan) as part of the suspected money laundering investigation.

In response to this matter, vivo has submitted documents to the High Court of New Delhi, the capital of India, requesting that the freezing of its bank accounts be lifted. Because freezing the account will make “vivo India unable to pay statutory dues and wages, and damage the normal operation of the company.”

Perhaps, vivo also did not expect the surprise inspection. After all, at the beginning of this year, vivo also announced to invest 35 billion Indian rupees (about 3 billion yuan) in India within two years to increase the annual production capacity of smartphones from 60 million units to 120 million units, and start exporting mobile phones produced in India from 2022. to other countries.

Vivo’s business strategy director in India, Paigam Danish, explained that the investment is part of vivo’s Rs 75 billion investment commitment for India, and has already invested Rs 19 billion in 2021.

On the one hand, vivo took out 3 billion yuan to invest in the Indian market, and on the other hand, India froze 390 million yuan of assets.

Judging from India’s actions, the control of vivo in the Indian market may become stricter in the future, but despite this, it is impossible for vivo to give up the Indian market.

For vivo, “the importance and strategic position of the Indian market is unquestionable.”

India is a big consumer of electronics. On every commercial street in New Delhi, the capital of India, the blue brand logo of vivo is plastered on the door of almost every smartphone retail store.

Image source vivo official Weibo

Image source vivo official WeiboIn the first quarter of this year, smartphone sales data in the Indian market released by Canalys showed that Chinese mobile phone brands occupied half of the Indian mobile phone market. In the top five list, vivo ranked fourth with 5.7 million units.

In order to win this market, vivo has made a lot of investment in fixed assets such as talents and factories.

In 2014, Shen Wei, founder, president and CEO of vivo, personally led a team to investigate India in 2014. In addition to the executives of vivo, there were also some core first-level agents selected from China.

Wherever these agents go in India, they will compare with the domestic areas they are responsible for, and where there are many similarities, they will be designated as their expansion areas in India.

Landing does not mean taking root. At that time, the management of vivo and the confident agents did not expect what kind of challenges they would experience in India and what kind of success they would achieve.

In 2015, vivo decided to build a factory in India, and new industrial parks began to rise up on Indian soil. But behind the hot scene, there are also hidden dangers.

Since 2020, India has repeatedly shown an unfriendly attitude towards Chinese companies going overseas, and the consumer electronics industry is the first to be hit positively.

A sign event is that in 2020, in the “Production-Linked Incentive Plan (PLI Plan) for India’s Large-scale Electronics Manufacturing Industry” released by the Ministry of National Telecommunications and Information Technology of India, domestic mobile phone manufacturers that occupy most of India’s mobile phone share and build factories in India. , such as Xiaomi, OPPO, vivo, etc. did not appear in the list. In the following years, the offices of mobile phone manufacturers such as Xiaomi, Huawei, and vivo in India have been raided by relevant Indian departments.

Now that vivo is about to usher in its second 5 years, how will vivo summarize this new stage that has gone through surprise inspections, asset freezes, and later or faces more uncertain external factors?

The importance of India to vivo is self-evident, and vivo is bound to find ways to keep the Indian market.

Sun Yanbiao, chairman of Chaodian Think Tank, explained to Wired Insight: “Although India has been cracking down on and restricting Chinese mobile phone companies, it will not let them out. After all, the Indian people still need cost-effective products.”

But the fact that everything has not yet been finalized, vivo’s India war is still long and has advantages, but there is no absolute victory. Vivo India’s conundrum will take more time to resolve.

Vivo’s dilemma: high-end is difficult to reach, and the folding screen has not become an explosion

While vivo is struggling in the core overseas market of India, its domestic base is also under pressure.

For some time, there seems to be a consensus in the domestic mobile phone market: China’s smartphone market, especially the low-end and mid-end market, has been weak, and has entered the era of stock from the era of increments. Whether it is the era dividend or the traffic dividend, it seems that they have left the Chinese market.

But another fact is that although the growth rate of domestic smartphone sales has declined, sales are still growing. It’s just that in the stock era, the competition among mobile phone manufacturers has changed from competing for market share to competing for high-end market share.

Sun Yanbiao’s observation is that “the only way to survive is to go to the high-end, and the epidemic has not so much impact on high-end mobile phones.”

But the high-end is difficult to rush, and the entry speed of vivo is more “slow”. Before 2018, it didn’t have a product line that really focused on the high-end market. It was not until June 2018 that the NEX flagship series was long overdue and became the stepping stone for vivo to enter the high-end market.

NEX dual-screen version, picture source NEX smart flagship official Weibo

NEX dual-screen version, picture source NEX smart flagship official WeiboAfter the NEX came out, vivo invested a lot of resources in marketing and promotion, but its highly anticipated first product, the NEX full-screen mobile phone, only sold 2 million units within half a year – the pinnacle of the entire NEX series.

In the end, the well-received but not well-received vivo NEX series and division were cancelled in March this year, and the “X series served as the flagship task”. Soon after, a new category, the X Fold, was launched.

Perhaps the idea of vivo is that it is difficult to get better with the traditional candy bar machine, and perhaps the folding machine can become another method to rebuild the brand power of the high-end market.

However, in the folding machine market, vivo can also be regarded as a “jogger” among “laggards”. From the launch of the new product to the months it has been released, the market performance of its folding machines has not been ideal.

In addition to Apple, the top 5 mobile phone manufacturers in the world have gathered on the folding screen track, and vivo is both the latest player and the latest one. This is related to the different attitudes towards folding screens in the Huami OV.

Unlike Huawei and Xiaomi, who have been promoting folding screens at the beginning, vivo refused at first. Hu Boshan, executive vice president of vivo, has always been “not optimistic about the short-term prospects of folding mobile phones”.

However, in the end, in the reality of the irreversible mobile phone shipments shrinking year after year, vivo still chose to change its mind, boost its performance through the new direction of folding machines, and enter the high-end mobile phone market that is being redefined.

Even from the launch of the new X Fold product on April 11 this year, vivo has been more than three years behind Huawei’s first folding screen product, the Mate X.

When the X Fold was first launched, a dealer told Wired Insight at the time: “The market size of folding screens in fifth-tier cities is not large, and apart from Huawei, the prices of folding machines from other domestic mobile phone manufacturers have plummeted very quickly. Will sell vivo X Fold.”

It was not until June that X Fold ushered in the first wave of short-lived “prosperity”. Vivo’s 618 super battle report data shows that in terms of single product sales, vivo X Fold won the first place in Tmall’s 618 folding screen mobile phone sales and Jingdong’s folding screen mobile phone sales + sales double first.

Mobile phone manufacturers have used more creativity to summarize the “firsts” of different latitudes, but the problem is that this so-called “first” ranking has not brought an essential increase in sales to vivo.

Even brands don’t seem to have enough influence in consumers’ minds. Wired Insight asked several owners who have two years of experience with folding screens. So far, the other party still believes that “for people who often use mobile phones to handle office affairs, the two brands of folding machines, Samsung and Huawei, are most recognized, and the brand power of vivo folding machines is not high” and other similar views.

In short, the folding machine is a difficult road, but for vivo, it has to go. However, with external and internal troubles, vivo’s pressure is even greater.

The sea of machine tactics are failing, can the second curve save the emergency?

In the tenth year of launching the smartphone business, vivo ushered in its own “top sales” moment.

According to Canalys data, in the whole year of 2021, vivo won the sales champion of the domestic smartphone market with a market share of 22%. OPPO and Apple ranked second and third with a market share of 21% and 16% respectively.

It is undeniable that in the market competition in 2021, vivo chose the sea of machine tactics to have the opportunity to become the “selling champion”.

Last year, “Huami OV” released a total of 141 new models (including its sub-brands), of which 25 models were released by Xiaomi, 24 models were released by Huawei, and 43 models were released by OPPO. The total number of new models released by the vivo series is the largest, with 49 models, which is equivalent to the sum of the Xiaomi series and the Huawei series. On average, new models of vivo are launched almost every month.

In addition to the accelerated pace and frequency of new promotions, which to some extent attracted the attention of consumers, the wide range of price ranges covered by prices and the satisfaction of consumer demands in different markets are also one of the advantages of vivo’s use of the sea of machine tactics. The models launched by vivo last year range from 1,000 yuan to 7,000 yuan of high-end models.

It’s just that the machine sea tactics mobilize the enthusiasm of consumers to change machines, can they really try Bailing?

In the first four months of 2022, the vivo series released 14 models, exceeding the level of the same period last year. If the models released in May for the “618” are added, the number is even more exaggerated.

However, after launching so many new phones this time, vivo’s situation is no better than before.

According to the first quarter data released by Canalys, in addition to Apple’s shipments which increased by 17%, the shipments of various domestic mobile phone brand manufacturers have declined, of which vivo’s shipments fell the most, about 44%.

Minsheng Securities’ explanation for this situation is that various mobile phone manufacturers released more new phones in the fourth quarter of 2021, but the sales in Q4 and 2022Q1 were not satisfactory, resulting in a backlog of inventory. Until the second quarter of this year, there are still destocking on the channel side of mobile phone manufacturers. pressure.

In this case, it is not surprising that vivo’s shipments have dropped the most. Because in order to meet the market demand, vivo has started to implement “machine sea tactics” since its establishment. For example, it is a mobile phone manufacturer with the most abundant 5G product lines and a wide range of product price ranges, ranging from low-end phones of a few hundred yuan to high-end phones of thousands of yuan, including NEX, X, S, Y, etc. With nearly ten product lines, the destocking pressure is bound to be higher than that of others.

The domestic mobile phone market is sluggish, and the days of vivo may not be “easy” in the future. In this context, maintaining the basic market or expanding advantages, trying to expand business boundaries, such as financial layout, seems to be the second curve of vivo’s attempts.

After all, for mobile phone manufacturers who have mastered the advantages of traffic and data, finance is an excellent way of monetization. The advantages of mobile phone itself, such as rich consumption scenarios and a large number of active users, can give mobile phone manufacturers a lot of room for imagination to develop consumer finance business.

On June 28, 2022, Chongqing Longxie Small Loan Co., Ltd. (hereinafter referred to as “Longxie Small Loan”) underwent an industrial and commercial change, and its registered capital increased from 3.5 billion to 5 billion yuan, becoming the tenth company in the industry with a registered capital of 50 million. An online small loan company with a scale of 100 million yuan.

It is worth noting that, unlike other online small loan companies with the same registered scale, which are controlled by Internet companies, the actual controllers of Long and Small Loans are vivo and OPPO. loan company.

The direct reason for changing the registered capital to 5 billion yuan is to meet the registered capital threshold for online micro-loans across provincial administrative regions established by the China Banking and Insurance Regulatory Commission, but to a greater extent, it may be directly related to the anxiety of the vivo mobile phone business.

In addition to capital increase, Long and Small Loans are planning to issue debt financing.

According to information on the official website of the Shanghai Stock Exchange (SSE), a bond named “CITIC Construction Investment-Longhang Small Loan Huanying Series 1-10 Asset-backed Special Plan for Consumer Loans” was approved on February 21, 2022. It has been accepted by the Shanghai Stock Exchange and is currently in the “feedback” stage.

It is worth noting that the bond variety is ABS. ABS can activate the future cash flow of the enterprise and use it for current production, which is more like a “credit card” for the enterprise. However, ordinary personal credit cards are based on the credit of the lender, and ABS is based on the future cash flow of the assets sold by the business. Long carried the ABS of small loans and chose to use small loans as the underlying assets.

Whether it is capital increase or ABS issuance, Vivo’s shareholding Long and Micro Loans are more and more undisguised about their ambition to further develop financial business, but whether this business can really become vivo’s second growth curve is not yet conclusive. And vivo’s main business anxiety also needs a certain amount of time and game or can be solved.

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-07-13/doc-imizmscv1366952.shtml

This site is for inclusion only, and the copyright belongs to the original author.