Original link: https://www.latepost.com/news/dj_detail?id=1361

Unseen technological innovations may bring great value or destroy wealth.

Buffett joked in a speech 25 years ago that if he could go back to the era of the invention of the airplane, he would have smashed Orville Wright down out of vision and a spirit of “righteousness.” Buffett agrees that the airplane is a great invention, but reminds his audience that virtually all investments in airlines historically have been unprofitable. In fact, in the wave of aviation entrepreneurship that started with the invention of the airplane, a lot of money and ambitious entrepreneurs lost their money, including the Wright brothers themselves.

Autonomous driving in the direction of Robotaxi (unmanned taxis) is one such area now.

Robotaxi’s goal is to build vehicles that don’t require drivers. This will reshape the travel market: Didi, which once had a market share of over 90% in China, will generate more than 130 billion yuan in China’s travel service revenue in 2020, of which 80% is paid to drivers.

Robotaxi may also significantly reduce the number of traffic accidents, avoid a large number of casualties and property losses, and change human traffic and lifestyles: when most people no longer need to drive and commute time is freed up, the space and functions of the car will be very different.

The more exciting the goal, the more difficult it is to achieve. Starting with Waymo, the self-driving project that was born in Google in 2009, Robotaxi has attracted tens of billions of dollars in investment for more than a decade, spawning more than a dozen unicorns around the world, but has yet to show commercial results.

Waymo, which has raised a total of $17.5 billion in capital, now operates the world’s largest fleet of Robotaxi, with just over 800 units, far from enough to share capacity in a large city. Beijing receives about 500,000 online car-hailing orders every month. Waymo’s valuation has slipped to $30 billion from a peak of $175 billion in 2018.

Under the pressure of doubts and short-term sustained losses, a group of companies are still moving towards Robotaxi. In China, one of the companies running in the front row is Pony.ai.

Founded at the end of 2016, it was last valued at $8.5 billion, making it the most valuable self-driving startup in China. It is known for its strong engineer atmosphere and elite technical team, and it is also suspected that this group of highly educated technicians will not learn to make money.

Pony stories are the epitome of a class of technological innovations: they point to a massive change that requires solving unsolved technical or engineering challenges, with high ceilings, as well as uncertainty and commitment. Either a huge success or a tragic failure.

fluctuating confidence

When Xiaoma internally summarizes the development process, co-founder and CTO Lou Tiancheng often shows a photo, to be precise, a point cloud image scanned by lidar.

In the picture is a running figure. In June 2017, in Fremont, California, Silicon Valley, without telling anyone, an investor suddenly rushed into the middle of the road and blocked in front of the moving Pony self-driving car. The on-board lidar recorded this thrilling scene. Two weeks ago, this car just installed the automatic driving system. It is the first real test car of Xiaoma. It is still a long way from being safe and stable. The speed was not low, and the engineers were startled, but the car stopped violently.

A point cloud image formed by LiDAR scanning of objects such as people and cars.

This is a footnote to the self-driving craze, where investor confidence was once higher than practitioners, but now it’s the other way around. The turning point came in 2019.

Before that, commercial companies’ exploration of autonomous driving began with a secretive project Google launched in 2009. In 2012, Google demonstrated its self-driving vehicle, and Silicon Valley startups such as Cruise (2013) and Zoox (2014) were subsequently established. The craze spread outward. Baidu American Research Institute established an autonomous driving department at the end of 2015, and was the first Chinese company to get involved in autonomous driving.

The two founders of Xiaoma, Peng Jun and Lou Tiancheng, met on Baidu. Large companies have the resources, as well as complex layers and higher communication costs, and the outside world is changing rapidly. In 2016, Cruise was acquired by General Motors for $1 billion, and Google’s AlphaGo defeated Go champion Lee Sedol to demonstrate the great potential of AI. The actions of giants and technological progress have accelerated investment in autonomous driving. Peng Jun and Lou Tiancheng both thought that it would be faster to start a Robotaxi business than Baidu. In December 2016, Pony was established in Silicon Valley, with Peng Jun as CEO and Lou Tiancheng as CTO.

Before and after, AutoX, Momenta, Roadstar.ai, WeRide and other Chinese Robotaxi companies were established one after another in 2016-2018, and each of them did not worry about financing. In the past three years, nearly 10 new companies have been born in China’s Robotaxi field, with a total financing amount of nearly 1 billion yuan.

The pony took about 30% of the chips. In March 2017, Xiaoma completed the angel round of financing with the participation of Sequoia China and IDG. In the second year, Colt received two consecutive rounds of Series A and A+ financing of over US$100 million.

Pony has a founding team that makes it difficult for investors to refuse. Peng Jun, who joined Baidu in 2012, graduated from Tsinghua University and received his Ph.D. from Stanford. He once participated in the construction of Baidu’s Phoenix Nest search engine advertising system, which is Baidu’s main revenue base. Before starting his business, Peng Jun was the chief architect of Baidu’s autonomous driving department, responsible for strategic planning and technology development. In his more than ten years of career, Peng Jun has done front-line research and development, and has also managed dozens of technical teams.

Lou Tiancheng, who worked at Waymo before joining Baidu, was one of the first students in the Tsinghua Yao Class founded by Turing Award winner Yao Qizhi in 2004. Since his undergraduate days, Lou Tiancheng has been at the top of the TopCoder computer programming competition all the year round. Only the top programmers who continue to compete can maintain this score. Later, when he was studying for a doctorate, when he was working, and even after he founded Xiaoma, Lou Tiancheng did not let go of this problem-solving challenge. He has a strong appeal among programmers and is respected as “the leader”.

Peng Jun’s Baidu staff and Lou Tiancheng’s classmates formed the early members of Xiaoma. In 2017, if you went to Pony’s Silicon Valley office, you’d find yourself in a small Tsinghua Yao Class North American Alumni Association. They have similar experiences: being recommended to Tsinghua University for competitions; getting a master’s or doctorate degree from a top North American university, and working at Google, Microsoft or Apple after graduation. A resume that investors are willing to pay for.

In this time of heightened confidence, the metrics for measuring Robotaxi’s progress are clear: see who can go to more cities, get more cars to run longer test miles, and constantly reduce the number of human takeovers.

From the road test of the investor’s “blocking car” in Silicon Valley to the end of 2019, Xiaoma has expanded the road test vehicle from 1 to 100 vehicles in less than 3 years, and the test mileage has reached 1 million kilometers. fastest speed. The test sites cover California (starting in June 2017), Guangzhou Nansha (starting in February 2018), Beijing Haidian and Yizhuang (starting in June 2018).

During the same period, Waymo, which started the earliest, has completed 16 million kilometers of tests, and Baidu has completed 3 million kilometers. At that time, the industry used to measure the quality of the system by the mileage that the system “drives” itself between two artificial takeovers, namely MPI (Miles Per Intervention). The California Department of Motor Vehicles releases data about vehicles tested on roads in California every year. It is not comprehensive, but it can be used as a reference. In 2019, Pony’s MPI ranked fifth at 6,475 miles, followed by Baidu America, Waymo, and GM’s Cruise, and the fourth is AutoX, which is also a startup. However, the test mileage of Baidu and AutoX is lower than that of Pony, about 60% and less than 20% of Pony, respectively.

Throughout 2019, the most important goal of Pony is to promote cooperation with large car companies to prepare for the mass production of L4 autonomous vehicles. At the end of the year, after more than half a year of testing with Toyota, Xiaoma negotiated a large investment of $400 million for Toyota. The recognition of the world’s largest car company is a strong endorsement.

But before it was too late to celebrate progress and the lead, the meaning of the game itself began to be questioned.

In 2019, Waymo has been in development for a decade, and the road ahead for commercialization is still unclear. This is related to the way Waymo achieves autonomous driving: it hopes to achieve unmanned driving in one step, which requires the development of a L4-level autonomous driving system that is safe, stable and can be deployed on a large scale.

In terms of the degree of unmanned driving, autonomous driving is divided into 6 levels of L0-L5. L2 is assisted driving, which requires the driver to control or take over at any time. L3 and above are automatic driving, and the main responsibility for accidents changes from the driver to the system. The difference is that L3 still requires the driver to sit in the driving seat and take over in time; L4 can remove the driver and drive unmanned in a certain environment; L5 is in any Unmanned driving is possible in weather and road conditions.

For safety and compliance, Waymo routes can only be road-tested in government-designated areas with a limited number of licensed vehicles. These vehicles need to be equipped with hardware such as lidar, autonomous driving computing units, etc. They were not needed for mass-produced models in the early years, and were small in scale and expensive. In 2017, a 64-line lidar cost $80,000. The road test itself does not generate revenue, and even a trial-run road test that can charge passengers is far from enough to cover the cost of vehicle modification and operation. Before the critical point of scale arrives, the Waymo route needs to continue to invest and burn money.

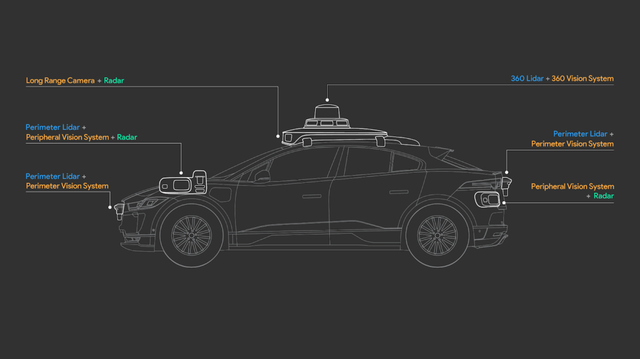

Schematic diagram of the self-driving sensor suite of Waymo’s fifth-generation self-driving car platform, launched in 2020. At this time, the cost of sensors has dropped significantly compared to 3 or 4 years ago. But the overall cost of autonomous vehicles is still higher than that of regular taxis.

What wears more confidence is that Waymo’s pursuit of one-step success requires solving extremely unlikely corner cases to ensure safety. No one can tell where the end point of the road test is: how many vehicles have been used to complete the test mileage, How much test coverage is covered before the driver can actually be removed? It is not enough to just remove a driver. The commercial implementation of Robotaxi needs to be able to replicate this capability in different regions and cities, and it must be cheap enough. This requires the entire automotive supply chain to progress together, and the cost of hardware such as autonomous driving chips and lidars must be greatly reduced.

By 2019, Waymo’s self-driving fleet will number about 600, and the main road test and test operation location is in Phoenix, USA, which has sunny weather all year round. Due to technical and regulatory constraints, a safety officer who can take over the vehicle at any time must sit on the test vehicle for the public. No matter the number of fleets, the operating area or the form of operation, it is far from the dream of saving drivers costs and freeing up driving time.

Bad news keeps coming in the industry. Uber self-driving test car killed a pedestrian crossing the street in 2018; Roadstar.ai and Drive.ai ceased operations in 2019; in 2020, Amazon bought Silicon Valley self-driving star company Zoox for just over $1 billion , lower than its previous valuation. Waymo’s valuation has also continued to decline since the end of 2019.

When patience fades a little bit, another way to achieve L4 autonomous driving is considered to be getting better, and the leader is Tesla.

The smart electric vehicle company has provided assisted driving software since 2015, and began to push the FSD (Full Self-Driving) software beta version to some car owners in 2020, hoping that it will evolve into a real driverless car. Tesla founder Musk once said that when FSD matures, Tesla will also launch the Robotaxi service.

When the Waymo route is still burning a lot of money, Tesla, which directly pushes FSD to production vehicles, is already making money, and car owners will spend $10,000 or 60,000 yuan to buy out FSD. The more important advantage is that Tesla’s test vehicles and mileage are orders of magnitude higher than Waymo’s, and there is a lot of real-world takeover data. Data is the nutrient for the evolution of autonomous driving systems.

In terms of cash flow and data flow, Tesla seems to have an advantage. If its method can achieve L4 autonomous driving faster, Robotaxi, which is doing small-scale testing, will gradually fall behind and be out of the game. They have to answer a question: Are they on the wrong track?

make a ruler

Faced with slumping confidence and commercialization, Robotaxi has responded differently. Some people have expanded their business to L4 scenarios other than Robotaxi. For example, WeRide will cooperate with Yutong Bus to develop an unmanned bus in 2020. It will start trial operation in Guangzhou in early 2021. The bus travels on a more fixed route and is considered to be faster. landing. There are also companies that have changed their thinking. For example, Momenta has integrated the Tesla route. Since the end of 2019, it has cooperated with car manufacturers to mass-produce the L2 system to collect more data; while continuing to conduct road tests like Waymo.

Baidu experienced the most adjustments. At the beginning of its establishment at the end of 2015, Baidu Autopilot swayed between L2-L3 and L4. After 2017, Baidu focused on assisted driving in cooperation with car manufacturers, and L4 was relatively marginal. At the end of 2018, Baidu began to develop smart cities and Internet of Vehicles, which are paid for by the government.

The ponies didn’t jump into new scenes anytime soon, and didn’t change course. Peng Jun has so far believed that it is “almost impossible” to gradually realize L4 autonomous driving through mass-produced assisted driving. This is not the battle of routes that people see, but the goal is different: assisted driving can only operate in 80% of the cases, and people can take over at any time; while Robotaxi needs to provide a complete unmanned travel service and pursue 99.999% foolproof. “Assistant driving only needs to learn mathematics and Chinese. Anyway, it does not learn physics if it is not tested. It is of sufficient value if it is good in mathematics and Chinese.” Peng Jun said.

Continuing to target Robotaxi, Pony turned the torture of commercialization into a technical and engineering problem. In the first quarter of 2020, 2/3 of pony engineers jumped on to a new project. This has become an important node in the evolution of the pony autonomous driving system.

At that time, Xiaoma encountered a problem of top students: from the end of 2019 to the beginning of 2020, the number of takeovers of 100 kilometers for Xiaoma was very low. It is difficult to pinpoint the direction of optimization just by relying on engineers to experience and analyze.

“After a threshold is exceeded, you won’t feel the difference after the decimal point,” said Zhang Ning, head of Pony’s global planning and control. He began to reflect on the indicators used in the industry: Can the driver be taken away by making the MPI infinite? Continuous testing in a small area can significantly improve MPI, but this does not mean that the system can adapt to different scenarios and roads.

Lou Tiancheng’s solution is: a quantitative evaluation system should be established, and an objective ruler should be constructed, so that it can statistically judge whether the automatic driving system is getting better or worse, and whether code optimization has really brought about promote.

Before this, Pony had a lot of cars and data, but technology and cognition limited the credibility of the data. If it is raining all week, the road test data will show a safety improvement, which may be a false improvement, since there are actually fewer accidents on rainy days. Human experience and intuition are difficult to eliminate these distractions.

When it comes to methods, building this ruler is a big data modeling problem: first, based on people’s understanding of the automatic driving system, set goals and initial factors, and then continue to inject data to learn some new factors to indicate automatic driving. direction of optimization.

It’s a choice of trusting people or trusting the system. Lou Tiancheng believes in the system more. The system is not only more accurate, but also learns faster. The learning speed determines the speed of the evolution of the autonomous driving system. To this end, he mobilized 2/3 of the engineers to participate in the project together for more than 3 months, and each group was transferred to the virtual development team, even if it required them to temporarily put down their work.

The difficulty in doing this is also knowing that compared to humans, systems are efficient in the long term but inefficient in the short term. In the initial inefficiency stage, it is necessary to restrain human intuition and instinct and learn to trust the machine.

In March 2020, when this evaluation system was first made, it was not as fast and accurate as human analysis. Some engineers will still use experience to attribute problems when they encounter problems during test rides: what is not driving well, how can they be optimized, and most of the time they will find the problem faster than the system. But this new ruler will sometimes tell him that based on statistics, what you think is the problem is not a problem, the car is driving well, and you are unlucky.

Lou Tiancheng told LatePost that by the middle of 2020, the analysis capability of this evaluation system had surpassed that of Pony’s manual team, and by the end of 2020, it had surpassed that of the experienced Toyota analysis team. Pony now has a dedicated team to run the evaluation system. This is a semi-automatic model that learns some factors on its own and also requires human assistance.

The top-level indicators of the evaluation system are safety, comfort, and efficiency. These three are often considered trade off (a balance that cannot be achieved). Some of the comfort or efficiency needs to be sacrificed for safety, such as braking more frequently, or reducing lane changes and overtaking.

But the new ruler proves that the three are not inseparable from the statistical and data level. Lou Tiancheng said: “If a car drives well, it needs to behave like other drivers and enter the flow. If you brake more or drive slower than others, it is very dangerous. Take changing lanes as an example. In the past, everyone believed that as long as you are conservative, It’s always safer to be the same, but it confuses the front and rear cars. You have to change when he wants you, or he’ll get dizzy. Some drivers will even take aggressive action and never let you again, or I don’t want you on purpose.”

At the end of 2020, when the evaluation system had been running for half a year, Lou Tiancheng clearly realized that driving, especially in China, is not a problem of rules, but a problem of car-to-car interaction: “Sometimes two cars meet, who will leave first. Not defined by clear rules, whoever is fierce will go first.”

The car-to-car interaction falls on the code and is a game problem. Pony’s current interactive game program does not involve difficult technical methods. The threshold is that an autonomous driving system needs to evolve to a certain extent and solve more elementary things before realizing that interaction is a problem. At the same time, it needs a system that can objectively evaluate new methods, which is the ruler.

“Our game test involves a dozen or even hundreds of parameter adjustments a day. If you don’t have this system, it’s not just a matter of spending a lot of time, but you may not be able to do it.” Lou Tiancheng said, “What’s even more dangerous is that you make a wrong optimization, and the results are good luck next month and the data is not bad, and you think you have done it well, which will be miserable.”

Today Lou Tiancheng and Waymo’s friends want to interact with each other, but they still don’t agree. Lou Tiancheng believes that Waymo’s biggest mistake was that, for many years, it limited the test area to places with similar environments and relatively simple road conditions, such as Phoenix, Austin and Mountain View, Silicon Valley, where Google is headquartered, which made it “pull out the test area”. In this environment, you will encounter problems when expanding the region. According to the DMV report, the MPI of Waymo’s 2021 California road test is 7,965 miles (about 12,750 kilometers), which has dropped to about 1/4 of the previous year. That’s because it opened a new test site in downtown San Francisco, which has far more complex road conditions than Mountain View.

“If Xiaoma didn’t work in the United States for half a year, but came to China after five years, I’m afraid it would be a lot more painful.” Lou Tiancheng said.

Since the construction of this ruler in early 2020, the number of test vehicles of Xiaoma has increased from 100 to more than 200, and the test mileage has increased from one million kilometers to 16 million kilometers. A quantitative evaluation system allows Pony to use the new data more efficiently and accurately.

Now Lou Tiancheng is going for a test ride, no longer asking why he brakes, why he took over, and no longer evaluating whether the car drives well or not: “I only have a small trip, and my personal experience is not representative. The system judges good and bad.”

He will remind other things: “You made the guests wait too long”, “The air conditioner is not on”, “Don’t forget to take your temperature when you get in the car.”

The new rating system also eliminates internal confusion. It is the basis for Pony’s engineers to understand the status quo and set goals. An ordinary Chinese driver will have an accident every 20,000 to 30,000 kilometers, and a skilled taxi driver will have an accident every 100,000 kilometers. Accidents include small bumps. Zhang Ning said that the overall accident rate of Xiaoma this year has reached the level of ordinary Chinese drivers, and next year, it can surpass that of skilled drivers and reach the state of removing the safety guards in the car.

To a certain extent, the future becomes a computable function.

“No waves, but willing to take risks”

Relying on data rather than intuition; relying on systems rather than people is the natural thinking of an engineer. But to keep doing it, you need to be an engineer of engineers.

Pony gathers the engineer of such a group of engineers. They are problem-solving and are drawn to challenges and puzzles.

Zhang Ning, who is currently in charge of Pony’s global planning and control and Beijing R&D center, is a classmate of Lou Tiancheng’s Tsinghua Yao class and joined Pony in 2017. At that time, he was working at Google in Canada. Knowing that his old classmates had started businesses, he flew to Silicon Valley to see their cars, and met many Tsinghua classmates in the small office.

On the way back to Canada, Zhang Ning felt that there was a high probability that he would come. In Google’s optimized search engine, the days can be seen at a glance. That car that can be touched is a real engineering project, an unsolved problem. Zhang Ning said that he didn’t think too much about how big a business opportunity this was at the time, but was attracted by the fact that it was done.

A former Pony employee told LatePost that the portrait of Pony engineers is smart and humble. A considerable proportion of them have competition experience. They have experienced many challenges during their school days, and they know that a mountain is higher than a mountain. For this group of people, the “peak experience” of getting the vehicle and technology to an amazing state is more exciting than many other things.

It is not enough to solve a problem and solve a problem in one way, they want to use a systematic method to continuously approach the optimal solution.

One of the questions in an interview of Pony was to prove a theorem. Many people know the conclusion of the theorem, but they have not necessarily thought about how it came. The candidate did not come out, the interviewer brought several people from the same group to testify, and the derivation process was written on the whiteboard in the conference room. Everyone still felt that the solution was not concise and beautiful, so they hired a mathematician from the company. ”, ask him to talk about different proofs.

A Pony engineer said that Pony’s colleagues were stubborn and “dead.” They are not satisfied with those mathematically imprecise, “make-it-yourself” code, which increases the difficulty of implementing the code and is inefficient in the short term, but makes the code “more time-tested” and more scalable in the future sex.

Discussions and even debates around technology happen from time to time. A Pony engineer said that, unlike his past work experience, Pony encourages everyone to “challenging” each other: “Someone doesn’t make it clear, or if you think he’s wrong, you must argue with him, It’s more important to argue that it’s more important than maintaining relationships.”

Debates span tiers and positions. “When discussing code, no one cares whether you are a senior (senior engineer) or a manager (manager), you just need to present the facts and argue with reason. You can even ask the teacher (Lou Tiancheng) to discuss it directly.” Another engineer said.

When Lou Tiancheng was discussing a convex hull algorithm problem with everyone, he was refuted by an engineer to the point of being speechless.

Five years after its establishment, most of Xiaoma’s engineers still do not have KPIs. They will set and update OKRs by themselves, and push them to complete by themselves. The pony has no set commute times and does not require overtime. An engineer told “LatePost” that some people will be busy in the company until midnight, and some people will go home early, “both kinds of people can exist in the pony.”

Another engineer’s observation is that in the planning and control department, it is common for colleagues to work overtime on their own initiative: “When you want to make a new function or solve a problem, you will be happy when you are doing it, and you will keep doing it. .”

An engineer who was recruited by other companies with twice the pay, later stayed in Pony. One of the main reasons is “happiness”: “It’s relatively free to schedule time here, the atmosphere is good, and everyone wants to make technology better.”

When asked about the uniqueness of Pony, Peng Jun said that “Pony is really a technology-driven” company. Technology and engineering awareness are integrated into the way everyone does things and thinks. Today, there are many companies with technology in China, but not many people really believe that technology can bring core value.

A high percentage of R&D personnel, similar visions and experiences, has for a long time put Pony somewhere between a commercial company and a flat R&D organization assembled of interests.

When there were not many people in the company, ordinary employees had a lot of contact with Peng Jun and Lou Tiancheng. There was a time when my colleagues often played poker during their lunch break. Poker can be said to be a culture of pony. Peng Jun and Lou Tiancheng are both at a good level. They win more and lose less. Playing poker is jokingly called the “wage recovery plan”.

Lou Tiancheng said that the wind energy of poker cards reflects people’s values and way of doing things to a certain extent.

According to the limited cards in hand and off the field and the opponent’s bet, constantly adjust and optimize one’s own actions. This is both like starting a business and solving an engineering problem. It is all in uncertainty, trying to find a better way to win. many ways.

The common style of the pony management is summarized by Lou Tiancheng as “no waves, but also risk taking (willing to take risks)”: he will not take risks casually, but if he is raising, he must have a card in his hand.

It’s not just the technology

The strong atmosphere of engineers and the elite technical team have attracted financing and talents for Xiaoma, but it also caused doubts when it was commercialized: it is one thing to develop a system, and it is another to survive in the cruel business world.

In fact, like all startups, in the stage of building a product prototype, the early members of Pony, who are mostly engineers, have to deal with various situations outside the technology from the beginning.

Because it was suspected of being a potential rival, Velodyne had refunded Colt’s lidar order. This is the beginning of 2017. If lidar is not available, it will delay the pace of prototype development. Wang Haojun, now Pony’s COO, managed to get in touch with Velodyne executives and invited them to visit Pony’s Silicon Valley office, so that they could see for themselves that Pony was a customer, not a competitor.

Li Hengyu, who built an office in Beijing with front and back feet, single-handedly found venues and recruited people. He is now the head of Pony’s unmanned heavy-duty truck business. The first financing was in US dollars. It took time to exchange foreign currency. Peng Jun and Li Hengyu used their deposits to top the domestic team’s salary for 3 months. The happy moment is when Li Hengyu came to the Lincoln 4S store in shorts and slippers: “I want MKZ, top-spec, how many cars are there. Do you have any? I’ll go to the next one without me.” In 2017, there was only Lincoln MKZ The top configuration can be changed to a wire-controlled platform for autonomous driving development. Importing a MKZ of 400,000, the autonomous driving company supported the sales of MKZ in those two years.

The launch of the Guangzhou Nansha road test before the Spring Festival in 2018 was particularly turbulent. Xiaoma was established less than a year ago, and the company had only a few dozen people. Half of the engineers rushed to Nansha to fully fulfill the promise to the district government: let the citizens of Nansha ride on Xiaoma’s Robotaxi vehicles before the Spring Festival.

Bicycles running in the wrong direction, trash cans placed on the motorway by sanitation workers, traffic lights with countdowns, other cars running red lights, continuous rain in southern China… This is a situation that Xiaoma has never seen during the road test in Silicon Valley. Dealing with these technical issues is already tricky. The bigger test was that Xiaoma only learned two weeks before the road test ceremony that Nansha District wanted their car to pass the district government on the day of the ceremony so that they could directly connect with the district leaders, which involved a road that had not been tested before. Colts didn’t discuss different options. They knew the proper attitude to win government support in China: seize the opportunity and try to show strength.

The Nansha District Government also helped Xiaoma to coordinate the strategic cooperation with GAC, and Xiaoma needed to complete the debugging and testing of GAC vehicles before the ceremony. When he went to GAC to pick up the car, Wang Haojun found that there was more than one self-driving company, and GAC also had other partners. A pony engineer sat in the car and said, “I won’t leave if you don’t give me the car today.” Wang Haojun was surprised and relieved that his colleague never showed anyone’s arrogance. After all, if you get the car one day earlier, you can test more In one day, you can increase the success rate of your impressions.

On the day before the Spring Festival in 2018, when the road test started before the Spring Festival, when the mayor of Nansha District got into the self-driving car of Xiaoma, Lou Tiancheng, who was riding with him, even thought that everything went too smoothly, “it was a little boring” – when they crossed the intersection that day, it happened that It’s all green lights, and the pony doesn’t get a chance to show more.

In February 2018, Pony.ai launched an autonomous driving fleet in Guangzhou and conducted road tests.

While continuing to advance the road test, in mid-2018, the management of Pony was already thinking about the direction of commercialization in advance, when the high expectations of the outside world for autonomous driving had not yet subsided. From summer to autumn, they scanned some new scenes one after another, covering unmanned delivery vehicles, sweepers, and unmanned mine carts.

Peng Jun’s overall logic is that if a new direction is made, it should be consistent with the main line of Robotaxi technology, the market space is large enough, and it should be an emerging market suitable for startups.

Supplying traditional L2 driver assistance systems to automakers was the first to rule out. Peng Jun told LatePost that traditional L2 functions, such as lane keeping and assisted parking, “cannot be done by any startup company”. It is a Red Sea market with mature suppliers such as Bosch and Desay SV. Moreover, the technical routes of L2 and L4 are different, and the hardware environments such as sensors and computing units used by the two are inconsistent.

Peng Jun was firm at the time, and Li Hengyu recalled: “He said my decision was not to do it, and there were other objections, he just insisted not to do it.” Li Hengyu believed that if he forked too early to do other technologies, he would give up becoming a towering tree. It is impossible to maintain the leading position of L4. The best outcome is to become an excellent intelligent driving supplier and “lose the possibility of becoming a great company”.

Pony also excludes unmanned logistics trolleys, mining trucks, sanitation vehicles, buses and other directions. Although L4 technology can be reused in these scenarios, Peng Jun believes that the market space is too small.

The direction to pass the screening is unmanned heavy trucks, which require both L4 technology and a high enough ceiling. According to a report from the Boston Consulting Group, China’s annual road logistics freight is 5.6 trillion yuan, of which 4.6 trillion is the intercity trunk logistics borne by heavy trucks. At the end of 2018, Xiaoma started to develop unmanned heavy trucks with a small team of less than 10 people.

After completing the technical verification in more than a year, Peng Jun made a clear judgment: to do unmanned heavy-duty trucks, you need to do the logistics business yourself, and you can’t just provide technology. This is to collect and process data by itself, and build a cycle of operation-data-system upgrade. At the end of 2020, Trucks officially became a new division of Pony. In 2021, Pony released the independent “Pony Smart Card” brand; it actually shipped more than 10,000 tons of cargo and ran nearly 40,000 kilometers of operating mileage.

After deciding to run the logistics business, Xiaoma showed more business stature in large companies. Peng Jun and Lou Tiancheng have become the company’s biggest sales, selling the concept and future of autonomous driving.

In order to promote cooperation with China Merchants Group, a central enterprise with numerous transportation businesses, Lou Tiancheng went to China Merchants Group to give an internal sharing in May last year. More than 2,000 executives from China Merchants Group and its second-tier subsidiaries participated. Four months later, Song Rong, general manager of Sinotrans, a logistics company under China Merchants Group, and Peng Jun interviewed for specific cooperation intentions. The result of these contacts is Qingyi Logistics, a joint venture between Pony and Sinotrans. Qingyi started its official operation in April this year, and Sinotrans assigned more than 100 logistics trucks and corresponding container transportation business under Qingdao Branch to Qingyi.

At the same time, there is also the cooperation between Xiaoma and Sany Group. Last spring, Peng Jun met with Liang Zaizhong, a director of Sany Group. Liang Zaizhong, born in the 1980s, is the son of Liang Wengen, founder of Sany. More than half a year later, Pony and Sany Heavy Truck, a subsidiary of Sany Group, established a joint venture to jointly develop mass-produced L4 trucks. The first batch of customers is Qingyi.

Double-headed cooperation with logistics and truck companies is not unique to Pony. Unmanned truck companies Tucson Future and Aurora have similar layouts. Colt opted for a deeper form of binding, a joint venture. Pony hopes that both parties to the joint venture will hold a significant share of more than 30%, and both joint ventures have achieved this goal.

Qingyi logistics heavy truck departed from Qingdao to Tibet to deliver anti-epidemic materials, passing through Zuoquan, Shanxi.

After the truck, Pony’s next big business decision is to enter the L2++ market by the end of 2020.

L2++ is an advanced driver assistance system sold with production models. Peng Jun believes that L2++ can at least achieve unmanned driving on main roads in urban areas. The FSD beta version launched by Tesla and the NGP (Navigation Guided Pilot) just released by Xiaopeng all provide similar functions.

Unlike the L2 business that was denied by him in 2018, Peng Jun believes that the demand for L2++ did not exist before. It is a new market brought up by Tesla around 2020. It lacks mature suppliers and is suitable for startups.

L2 and L4 are two sets of technology stacks, while L2++ is very close to L3 and even L4. They all use the same high-power autonomous driving chips and sensors such as lidar, and have strong technical synergy. However, according to the legal definition, the main responsible party for L3 and above autonomous driving is the machine system rather than the human driver. Therefore, few car companies now define their own intelligent driving systems as L3.

In June of this year, Pony released a car-level domain controller based on NVIDIA’s Orin autonomous driving chip, which is an important part of the L2++ solution. Xiaoma hopes to give car companies a combination of software and hardware solutions to sell products and avoid outsourcing services.

Robotaxi is already a big enough space and difficult enough to realize. Why should startups with limited resources devote their energy to other things?

Peng Jun believes that doing these businesses is always because Xiaoma has not given up on the idea of becoming an independent technology company. The trunk logistics market corresponding to unmanned heavy trucks has a huge market space. The concentration of road logistics in China is lower than that of the more mature European and American markets. With the help of technological upgrading, there are opportunities to grow large businesses here; L2++ and Robotaxi’s L4 have strong technical synergy. Entering the L2++ market, Xiaoma can also accumulate experience in mass-producing L4 vehicles.

Of course, these businesses can all bring in more revenue, but Peng Jun doesn’t think that will happen anytime soon.

After contacting car companies, Peng Jun believes that the timing of large-scale adoption of L2++ by car companies is still unclear. One of the major variables of unmanned heavy trucks is the policy: trunk logistics does not cross cities and provinces, and has no commercial significance. The current autonomous driving policy is promoted by the governments of one district and one city, and there is no linkage yet. The truck’s wire-controlled platform and control accuracy also lag behind the passenger car, and the challenge is only a lot more than that of the Robotxai.

Peng Jun poured cold water on the revenue potential of these new businesses, and refuted a popular narrative: Pony and these companies are doing other things because they can’t do it or don’t believe in Robotaxi. But this also puts him in a more serious torture: If all the current businesses of Xiaoma can’t make money in the short term, how long can the company survive?

Today is better than yesterday

To keep a company alive, cash is more important than profit. Pony now has more than 1,000 people, has raised more than 1.1 billion US dollars in total, and claims to have 1 billion US dollars in cash. Including manpower, computing power, fleet operation, mass production preparation and other expenses, Peng Jun said that the money is enough for the company to spend at least 3 years.

If the pony cannot make enough money by himself in the short term, he has to rely on external financing to supplement the cash. Whether money is willing to come in depends on factors such as company valuation, financial environment, and the most fundamental thing is confidence.

Disbelief and suspicion are the prevailing sentiment around Robotaxi and autonomous driving right now.

Pony began preparations for listing in early 2021, and originally planned to land on the US stock market last summer. Due to uncontrollable changes in the external environment, the listing plan was terminated in August last year. However, even if it is successful, the current financing environment for Xiaoma will not be better. The self-driving companies that have gone public in the past two years have generally lost 70%-90% of their market value compared to when they were issued. Although Mobileye, Intel’s self-driving chip and system company that just went public on October 26, rose nearly 40% on the first day, its total market value of about $23 billion is still half the target market value of $50 billion when it launched the listing. On the premise that Mobileye has hundreds of millions of dollars in assisted driving revenue. Wall Street no longer likes short-term tech stories that only burn money and don’t make money, and now they care more about profitability.

The listing failure brought a series of changes to the pony. In September last year, the truck R&D team that was still actively expanding in the first half of the year was merged into Robotaxi R&D, and the truck division retained an independent logistics business and logistics scheduling system team. From the perspective of a front-line engineer, the change was sudden and morale was hit. Pan Zhenhao, the former CTO of Pony Truck, Sun Haowen, the head of domestic planning and control of the truck, and others learned about the adjustment earlier. They left in the middle of last year and participated in the creation of two new unmanned vehicles, Qingtian Zhika and Qianhang Technology. Heavy truck company.

Pony also adjusted the layout of L2++. Peng Jun originally had an idea that was extremely risky in business but in line with the essence of technology: Xiaoma would build its own car and carry its own L2++. It’s the same logic: “software + data + hardware + operation” needs to form a cycle so that the software system can iterate faster and give users the best experience. Pony even hired part of the car-building team for this.

But after resource expectations changed, Pony gave up the idea of building a car. “The ship has already left.” Peng Jun said that Xiaoma will cooperate with car companies as a supplier and will not “turn around”. Apple was better, but Android survived too. Leading car companies will try to develop L2++ by themselves, but Peng Jun believes that there will be room for third-party suppliers in the market.

Among the many turbulences, changes, and ebb and flow expectations, the one thing that has not changed in the past 6 years is that the core team of Pony has always believed that Robotaxi and autonomous driving are the future. year.

In the turbulent environment last year, Zhang Ning, who was in charge of the planning and control of the pony, the core part of the autonomous driving system, felt “more and more certain”. He did not take any entrance exams and was sent all the way to Tsinghua University. People expect to see the confusion of smart people, Zhang Ning has no confusion, he has solved it. Since setting up the evaluation system in 2020, he can see the curve of the evolution of Pony’s autopilot system day by day from numbers and models. The reason why 2025 is a turning point is that the evaluation system can measure that the pony’s autonomous driving system can evolve to a state where safety officers are no longer needed before that, and this state can be migrated to different environments. This is the core condition of Robotaxi’s commercial landing: large-scale unmanned.

Around this center, other things are being planned. In April of this year, Pony and Baidu were among the first to obtain a new type of test license, which can move the safety officer from the driver’s seat to the co-pilot in Yizhuang, Beijing. The next step is to move the security guard to the back row, and finally remove the security guard.

In June of this year, Peng Jun (left) and Lou Tiancheng (right) rode together a Robotaxi, a pony with no safety officer in the main driver’s seat, and drove on Guangzhou roads for more than an hour in a row.

Peng Jun told LatePost that Pony is already preparing to cooperate with car manufacturers and will enter mass production in 2025. “Large-scale” refers to the annual production of thousands or tens of thousands of units.

Pony is also continuing to build operational capabilities. When there are thousands of unmanned taxis in a city, Xiaoma not only needs to plan stations, routes, dispatch vehicles, and serve passengers well, but also solve a series of vehicle management problems: where to park the car, how to repair it if it breaks, How to change tires, recharge or refuel, how to deal with accidents. Peng Jun said that in the future Robotaxi network, Xiaoma can be a platform itself or access other platforms, but it must operate its own fleet. Since the launch of taxi-hailing mini-programs and mobile applications in 2018, Xiaoma has carried over 700,000 passengers.

In the history of autonomous driving development, some companies fell apart due to conflicts between partners, some founders quit due to disputes with their former owners, and some companies left important co-creators. The core members of Pony have been relatively stable. Zhang Fei, a partner of Wuyuan Capital who has invested in Xiaoma Sanluan, commented that Xiaoma is characterized by stability, integrity, and systematization and engineering. “Last year, the market was very frenetic. This year, everyone was scared to death, but has the company’s fundamentals changed? Technology is iterating, and business is also iterating.” Zhang Fei said. When the industry is noisy, Xiaoma does not expand aggressively. When it is pessimistic and depressed, it can be less panic. They believe that driverless cars will not fail to come, but they will not come soon.

“In 2016, everyone thought it could be done in 2 or 3 years, but we thought it was impossible; now everyone thinks it can’t be done in 20 years, and we also think it’s impossible.” Peng Jun said.

However, because the technical details are difficult to explain to outsiders, and because the unmanned driving that no one has realized lacks comprehensive and intuitive evaluation criteria, Pony and all Robotaxi companies are in a common danger: it is difficult to convey confidence and strength to the outside world. It is impossible to make people believe that the huge change is not far away from imagination, and it is impossible to prove why the one who wins is me.

Whether they’re valued at $3 billion, $5 billion, or $8 billion, these companies face serious survival challenges once confidence fades, investment stalls, and funds run out before a commercial turning point.

Just yesterday, with a cumulative financing of $2.6 billion and a valuation of $7 billion, investors including Volkswagen and Ford’s L4 autonomous driving company Argo AI announced the cessation of operations. On the other hand, the two-year-old Tesla FSD still hasn’t removed the “beta” suffix, falling behind Musk’s expectations. At an earnings call this year, he said that no technology had ever given him so much false hope like autonomous driving. Both paths are bad.

In that speech 25 years ago, Buffett talked about the invention of the airplane because there was a group of hot Internet upstarts in the audience, and he wanted to remind them not to get too excited, a great new idea does not necessarily lead to business success .

The warning was prescient, as most of the companies founded by the upstarts died in the dot-com bust six months later. But it’s not entirely true, because those survivors of the big waves, such as Amazon and Google, later became the cornerstone of the Internet economy, and they themselves grew into towering trees.

Will Robotaxi companies like Pony die before dawn, or will they become big trees as they wish? Business success or failure is inconclusive. One thing is certain: over the past decade, a group of very smart people has invested their time, bet their pride, and explored a significant direction together. They are still insisting, so today than yesterday, tomorrow than today, the possibility of human beings to achieve autonomous driving is a little more likely.

This article is reprinted from: https://www.latepost.com/news/dj_detail?id=1361

This site is for inclusion only, and the copyright belongs to the original author.