$Hua Medicine-B(02552)$ $Ascentage Medicine-B(06855)$ $Yenting Xinyao-B(01952)$

The innovative drug segment is a good track in a good industry

The domestic innovative drug market will become larger and larger, accounting for a higher and higher proportion of the total drug expenditure for a long time. The total market volume has been growing rapidly in recent years, and the market is rapidly undergoing import substitution. Therefore, the domestic innovative drug industry is even hit three times: the growth of the total amount of medicine + the excess growth of sub-sectors + import substitution.

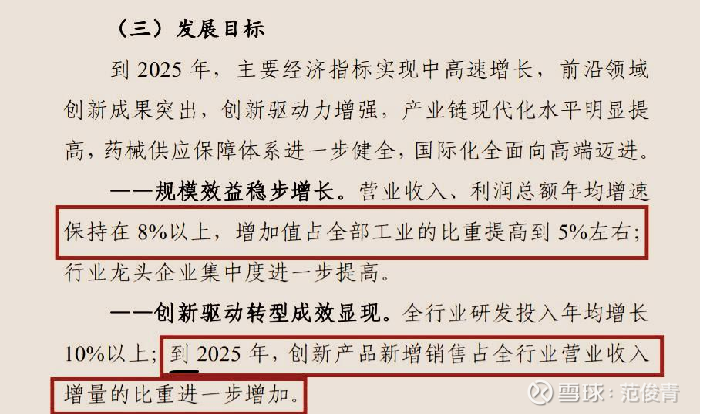

The National 14th Five-Year Plan defines the pharmaceutical industry as a strategic industry related to the national economy and people’s livelihood, economic development and national security, and is an important foundation for the construction of a healthy China. Among them, innovative drugs are the top priority, and the growth rate of innovative drugs is clearly planned to be higher than that of the industry.

Among the most dynamic sectors in the Hong Kong stock market, there is a place for the 18A Hong Kong stock market. In the pharmaceutical sector, the most valuable future investment is the innovative drug and innovative medical device sector. Most of these domestic innovative companies are concentrated in the Hong Kong stock market 18A, A-share companies. rare. After the establishment of the 18A section of the Hong Kong stock market, a group of listed companies received a lot of funds, including Hillhouse, which participated in the cornerstone investment. It is still deep-set, and now it is in a typical situation where the primary market is more expensive than the secondary market. In the past two years of decline, many companies have lost 50-80% of their market value, and some companies have even fallen by more than 90% from the highest level, which is enough to digest the valuation. At present, the valuation of many companies is lower than the valuation before listing. Some companies’ valuations are even far lower than the financing amount. At present, the average valuation of 18A Hong Kong stocks is still at a low level, but the product has already started commercialization or is close to commercialization, and is still in a good investment stage.

Many of the founders and executives of Hong Kong Stock 18A were former executives or senior scientific officers of large foreign pharmaceutical companies. They have rich experience in the development of innovative drugs or devices. China has also created the soil for the growth of innovative drugs. They have the ambition to serve the country while It is also to open up a new era of innovative drugs in China for the sake of its own ambitions. Overlaying China’s engineer bonus and the production capacity of the pharmaceutical industry, the development of domestic CRO and CDMO has also given the soil for the growth of innovative drugs. Our country’s future innovative drug industry chain has the potential to lead the world. Some of these companies have already begun to produce after a long period of intensive cultivation. The next few years will happen to be the best stage for commercialization and realization. Overseas equity can be BD. In the past year, Akeso, Kelun, Hutchison and other large overseas equity BD Appears repeatedly. 18A companies will surely have some world-class pharmaceutical companies born.

Lao Fan’s understanding of investing in 18A companies is as follows :

1. Portfolio investment. Pharmaceutical innovation, especially innovative drugs, has relatively high risks. However, if you choose an excellent specialty product portfolio investment, you will relatively diversify the risk. The companies in the portfolio have their own strengths, and among them there must be companies that can stand out and earn excess Income, even if some of the companies fail to invest, they can still obtain good returns as a whole. So screening companies as investment portfolios is a very important job, which requires us to study the fundamentals of the company and keep track.

2. At this stage, why not invest in comprehensive medicines, but invest in specialty medicines, first of all, comprehensive medicines such as Innovent Biologics and Zai Lab have relatively high valuations compared to other innovative drugs, and the relative growth potential may be small. And the vast majority of 18A companies have not yet reached the stage of full production. Therefore, we think it is appropriate to invest in specialty students at this stage. Most of the 18A companies are still in the stage where their products have just launched or are about to be launched. This is obviously not the time to judge whether they have strong domestic commercialization (sales) capabilities, production capabilities and other comprehensive capabilities. Focus on products, R&D capabilities or other specialties. Therefore, we focus our investment on companies with excellent products or platforms or other specialties.

3. It is best to invest in a combination of companies with different characteristics among specialty students, so as to better diversify risks and have greater confidence in buying super bull stocks. For example, in our stock pool, Hebo Medicine has a super platform, Hua Medicine has a super single product, Genting Xinyao has the world’s top MRNA platform, Yasheng and Akeso have global BIC products and super R&D capabilities.

4. When we want to invest in other 18A companies, if there is a company similar to our stock pool, we can make a comparison. When it has its unique advantages, we can include it in the investment scope. If it is obviously inferior, we can Eliminate or don’t pay attention for a short time. After all, human energy is limited, and it is impossible to research and track too many companies.

Even if 18A is used as a portfolio investment, there are still risks, so it is necessary to control the overall position ratio of the sector.

Briefly comment on several 18A companies in the stock pool:

Hua Medicine: The large single product Huatangning will enter the hot selling period this year, and the normal supply has resumed at the end of January. I am very optimistic about the future market and the overseas BD of the second-generation drug. An important node in this year and next is the 2023 medical insurance negotiations. In addition, we must focus on the progress of the second-generation Huatangning patent and clinical applications in the United States.

Harbor Biomedicine: Transformation platform to export biomedical companies, and continuously export cooperation projects. The platform will announce six export projects in 2022, with a total amount of more than 15 billion yuan. The platform value is very large, compared with the existing mouse human source platform of Harbor Biomedicine The worse rat platform will be acquired by Amgen for $2.5 billion in 2021. Moreover, the cash in hand and potential cash income far exceed the existing market value. The self-owned pipeline focuses on the original 4003 and 7008 with global rights and interests, which have good potential.

Ascentage Pharma: 24.45 Hong Kong dollars allotment of 500 million Hong Kong dollars has been completed, and Nalike has entered the medical insurance at a very ideal price of 174,000 yuan per year. Strong in research and development, with 16 orphan drug certifications, second to none in China, and its own pipeline will gradually enter the harvest period. Focus on 1. The second indication of Nalike will be approved in the first half of this year, and 2. Overseas Nalike and 2575’s potential large overseas BD.

Yunding Xinyao: In the early stage, it was a license-in-based company with a good vision. Several BDs were introduced at low prices before being approved, and the follow-up proved that the vision was ahead. Through the introduction of localized MRNA platform, including three major technologies 1, antigen design 2, delivery system 3, localized production. This platform is among the top five in the world. In addition to the potential of the new crown vaccine, it can also do many things such as cancer vaccines and rabies vaccines. Relying on this platform, Yunding can also develop some self-developed pipelines in the future. The cash in hand and the future cash are very high, and the IGA nephropathy drug is also a drug with a large indication that is especially suitable for the Chinese market, and there are two other drugs that are both good.

The article was published at the same time: please pay attention to the web link !

There are 22 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9247917663/240625277

This site is only for collection, and the copyright belongs to the original author.