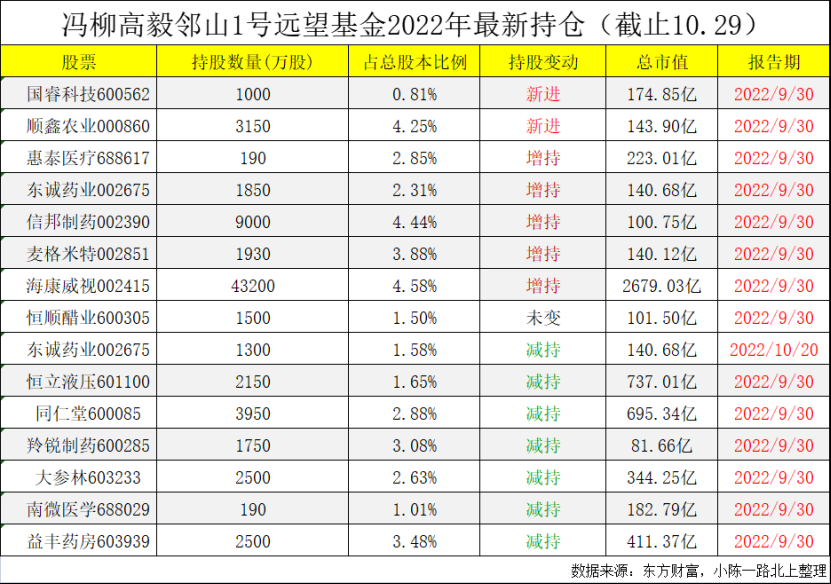

The third quarterly report disclosure is coming to an end. The third-quarter positions of Gao Yi boss Feng Liu have basically surfaced.

①First of all, of course, we must mention Feng Liu’s heavy-holding stock Hikvision. After the increase in the second quarter, it continued to increase its position in the third quarter, occupying more than 50% of the position of the Yuanwang Fund in Lingshan No. 1. This is all in one battle. At present, security has peaked in the global field. Hikvision has lost its growth potential, and the new business cannot support the main beam. I don’t understand his logic of heavy positions.

②Feng Liu slightly lightened up the chain pharmacy stocks , Yifeng Pharmacy and Dashenlin each lightened their positions by 6.5 million shares, and still held 25 million shares after the reduction, which is still a heavy position. In terms of stock prices, the two companies are also near one-year highs.

At the same time, Ms. Ge Lan’s CEIBS Medical and Health also added Yifeng Pharmacy.

The two bosses are optimistic about the pharmacy, and everyone needs to pay attention. Here are 2 points of Xiao Chen’s long-windedness, and there are 2 points of investment logic in pharmacy stocks:

One is the logic of concentration improvement. As of 2020, my country’s CR10 is 27%, the United States’ CR3 is 77.1%, and Japan’s CR10 is 70.34%. There is still a big logic to improve the concentration. Compared with the development model of overseas pharmacies, mergers and acquisitions + franchising are the core reasons for the rapid expansion of enterprises, and domestic enterprises that follow the merger and franchising model are worthy of attention.

The second is the outflow of prescription drugs. The outflow of prescription drugs is the long-term logic of pharmacy investment. The proportion of prescription drugs in Japanese pharmacies is as high as 70%+, the proportion of prescription drugs in American pharmacies is as high as 70%, and the proportion of prescription drugs outside hospitals in China is less than 10%. With the growth trend of prescription drug outflow, pharmacies will continue to benefit.

③Feng Liu newly entered the military industry in the third quarter of Guorui Technology, but withdrew from the newly entered aviation power in the second quarter . The speed of this position adjustment, Xiao Chen wants to say, is really fast. At the same time, does it mean that the upside potential of Guorui Technology is greater than the power of aviation development?

④ The newly entered company, in addition to the military industry Guorui Technology above, also has Shunxin Agriculture, a low-end liquor company. Recently, the mid-to-high-end liquors such as Kweichow Moutai and Wuliangye have plummeted, but the low-end Shunxin Agriculture has been exceptionally strong. The side shows the uniqueness of Feng Liu’s weak system.

⑤ In addition, Huitai Medical and Megmeet, a new energy veteran in the pharmaceutical field of Fengliu Jiacang, have reduced their holdings in Dongcheng Pharmaceutical, Tongrentang, and Lingrui Pharmaceuticals.

Remarks, the positions of Gao Yi, Deng Xiaofeng, Sun Qingrui and others will be analyzed one after another, so stay tuned!

There are 35 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/2764317998/233990476

This site is for inclusion only, and the copyright belongs to the original author.