Welcome to the WeChat subscription number of “Sina Technology”: techsina

text/salad dressing

Source: Value Planet (ID: ValuePlanet)

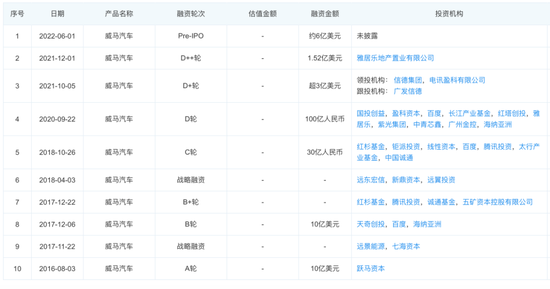

On the occasion of Children’s Day this year, WM Motor submitted a prospectus to the Hong Kong Stock Exchange, planning to be listed on the main board, with Haitong International, CMB International and Bank of China International acting as joint sponsors. This is also the fourth new force in domestic car manufacturing to seek capitalization after “Weixiaoli” (referring to the three companies of Weilai, Xiaopeng, and Ideal).

WM Motor, founded in 2015, was once the “big brother” of the “Four Little Dragons” in car manufacturing. In the early years, it was favored by Baidu and Tencent, and supported by the Wenzhou government, it built its own factories in Wenzhou and Huanggang.

However, in 2020, Weimar was ignited one after another, and the quality of the car was questioned. Its prospectus stated that due to quality problems in the batteries provided by third-party suppliers, WM Motor voluntarily retrieved almost all of the affected 1,282 electric vehicles to replace the batteries. Affected by this factor, WM Motor will pay about 115 million yuan in net compensation to users for this recall in 2020.

Despite this, the sales volume of WM Motor, which was affected by word of mouth, was gradually overtaken by Wei Xiaoli. Since then, the “new car-making force” has replaced the “Four Little Dragons of Car-making”, and the sales, production and self-research strategies formulated by WM Motor have also profoundly affected the company. develop.

In the face of vigorous competition from new and old “adversaries” in the new energy vehicle industry at home and abroad, Weimar’s problems cannot be solved by listing.

Custom “pin crown”

In Weimar’s prospectus, he sealed two “sales crowns” for himself. However, is this really the case?

Let’s take a look at these two “top sales” names. One is the sales ranking of electric SUVs of pure electric vehicle manufacturers in China’s mainstream market from 2016 to 2021, and the other is the sales ranking of Chinese pure electric vehicle manufacturers’ smart electric vehicles during the same period. .

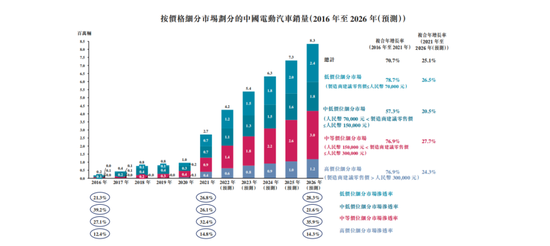

The so-called “mainstream market” is classified according to the price of the vehicle, and the mid-price energy vehicle market with the fastest annual growth rate (150,000-300,000 yuan) is defined as the mainstream market, which directly puts the average price of 400,000 yuan. Yuan’s Weilai and the ideal of a 300,000 yuan SUV are excluded from the comparison.

Source: Weimar Prospectus

Source: Weimar ProspectusAnd emphasizing that the SUV market that he mainly focuses on will also “kick” Xiaopeng out of the ring.

Using a precisely defined word game, he turned himself into a “top-selling” Weimaraner, but in the disclosed financial data, “exposed” the real situation.

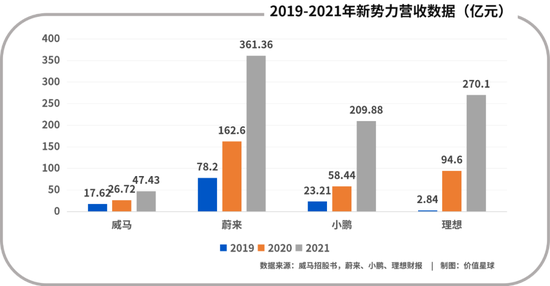

According to Weimar’s prospectus, from 2019 to 2021, Weimar’s revenue will be 1.762 billion yuan, 2.672 billion yuan and 4.743 billion yuan respectively. In contrast, Wei Xiaoli’s revenue in the same period was 7.82 billion yuan, 16.26 billion yuan and 36.136 billion yuan; 2.321 billion yuan, 5.844 billion yuan and 20.988 billion yuan; 284 million yuan, 9.46 billion yuan and 27.01 billion yuan Yuan.

It is not difficult to see from the data that WM Motor is significantly weaker than Wei Xiaoli’s three new car-making forces in terms of revenue and year-on-year revenue growth. From the perspective of revenue growth in 2021, Weimar’s year-on-year increase is only 77.5%, while Wei Xiaoli’s revenue has more than doubled compared to 2020.

While revenue growth is weak, Weimar’s profitability is also “lagging behind”.

According to the financial report, Wei Xiaoli has all achieved gross profit in 2020, while Weimar is still struggling with negative gross profit.

From 2019 to 2021, the gross losses of Weimar for the whole year were 1.026 billion yuan, 1.163 billion yuan and 1.967 billion yuan respectively. In the past three years, Weimar’s revenue has increased by only 46.43%, but the gross loss has increased by 91.71%. It can be said that the more you sell, the more you lose.

“For a car company that integrates production, sales and research, the production cost of each car should decrease with the increase in production capacity to achieve an increase in the marginal effect of new cars, so as to achieve production cost control when production capacity reaches a certain level. Earning more than gross loss shows that the company has not mastered the appropriate production curve.” Lin Mo, an observer of car companies, said.

Previously, WM Motor had hyped up its self-built factories in Wenzhou, Zhejiang and Huanggang, Hubei, and its “customized” and intelligent high-tech production technology. However, judging from the gross loss so far, such high-tech production has not helped WM to control costs better than its peers.

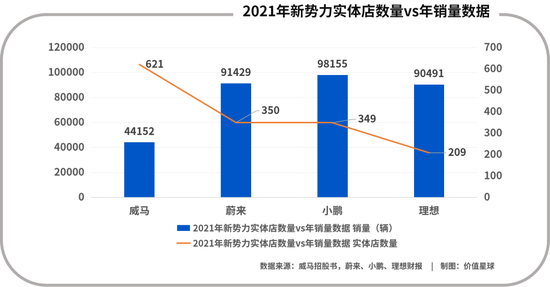

WM Motor’s traditional car sales model is also an important factor affecting its revenue composition. Compared with the online and direct sales model that most new energy vehicles choose, WM Motor still chooses to join stores, which is not fundamentally different from the 4S sales model of traditional car companies.

According to the prospectus, in 2019-2021, Weimar will provide rebates and subsidies of 348 million yuan, 775 million yuan and 1.621 billion yuan to distribution network partners respectively. The revenue of Weimar is recorded after deducting this part of the subsidy.

In addition to increasing the cost of sales, traditional marketing has other potential harms to WM.

“Controlling marketing expenses is only an important reason for new energy vehicles to choose the direct sales model,” said Jason, an automotive industry analyst. “There may be other problems in the dealership system, such as excessive maintenance, uneven service levels and other uncontrollable factors. All these have the potential to damage the brand image of the car company.”

Lin Mo said, “At present, the penetration rate of domestic new energy vehicles is less than 30%, and users have not yet established brand trust and loyalty for energy vehicles. Therefore, most new energy vehicles are used in major shopping malls for direct sales. , a big reason is to grab consumers’ minds through frequent displays.”

The franchise model has allowed the rapid expansion of the number of physical stores of Weimar. By the end of 2021, Weimar has 621 physical stores, almost twice the number of Wei Xiaoli’s 350, 349 and 209 physical stores, but Weimar 2021 Only 44,152 vehicles were sold in the year, while Wei Xiaoli sold more than 90,000 vehicles in the same period.

The unfavorable control of production costs and the poor choice of distribution methods may be the reasons for the double loss of WM Motor’s revenue and profit.

Is “intelligence” the first pain point of new energy vehicles?

Shifting new energy vehicles from the main “electricity” to the main “smart” is the product value that WM Motor emphasizes.

Source: Enterprise Check

Source: Enterprise CheckWeimar’s emphasis on the intelligence of its products is directly related to one of its shareholders, Baidu. According to the company’s data, as early as 2017, Baidu participated in the early financing of Weimar, and according to the prospectus of Weimar, Baidu still holds 5.96% of the shares of Weimar.

Since Weimar W6, Weimar has started to use Baidu’s intelligent technology. Weimar W6 debuted Baidu Apollo’s high-end intelligent parking function AVP, and the M7, which is expected to be released in the second half of this year, takes intelligence as its biggest selling point. Baidu ANP2.0, including AVP, will be on the car, enabling high-speed pilot assistance.

Vehicle intelligence has always been WM Motor’s differentiated competitive advantage. However, does this competitive advantage really hit the pain point of new energy vehicle consumers?

Lou Yu, a new energy vehicle analyst, said, “At this stage, the real technical moat of new energy vehicles is battery life, charging pile facilities, and stable operation in extreme weather such as cold winter. The on-board intelligent system is the icing on the cake when the above technologies are perfected. However, before the above-mentioned technologies are stabilized, the in-vehicle system is not enough to support the brand performance of the entire new energy vehicle.”

But at the above-mentioned hard technical level, Weimar’s ability seems to be slightly inferior.

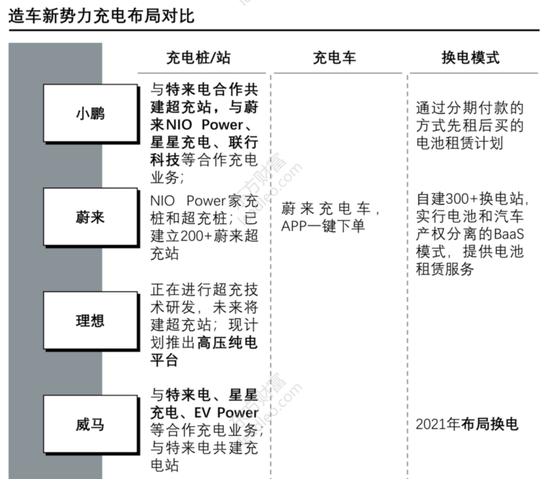

According to the report “2021 New Energy Vehicle Enterprise Comparison Series Report” by the Toubao Research Institute, NIO is the most advanced in the layout of charging piles, has completed the layout of NIO Power charging piles, and built 200+ battery swap stations. To cooperate with Weilai’s charging business, it is ideal to use the extended program technology, but Weimar’s charging pile layout seems to be a step slower.

Source: Head Leopard Research Institute

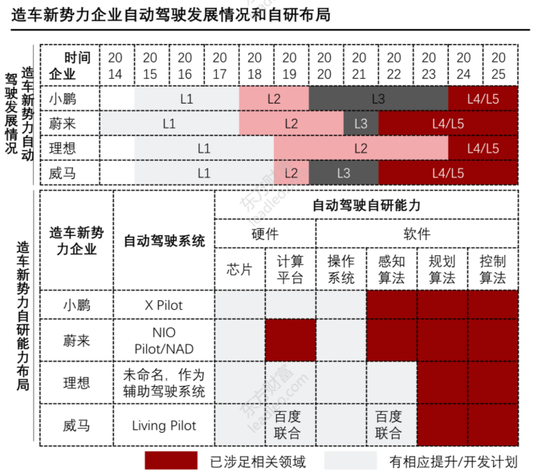

Source: Head Leopard Research InstituteIn terms of the self-research layout of software and hardware, Weimar still relies mainly on Baidu, supplemented by self-research investment. Compared with the self-research layout of Xiaopeng and Weilai, there is still more room for development.

Source: Head Leopard Research Institute

Source: Head Leopard Research InstituteJudging from the investment in research and development expenses of Weimar, in 2021, the research and development expenses of Weimar will drop slightly by 1% to 980 million yuan compared with the previous year. In contrast, Wei Xiaoli’s R&D expenses were 4.6 billion yuan, 4.114 billion yuan and 3.286 billion yuan respectively. The year-on-year increases were 84.6%, 138.35% and 198.73% respectively compared to 2020. The R&D investment of Wei Xiaoli’s three companies is far greater than that of Weimar in terms of capital and growth.

In this regard, Lou Yu said, “Weimar’s overall revenue volume is not as good as Wei Xiaoli’s, so the investment in R&D is not as sufficient as they are. It is very important to control the cost budget reasonably to ensure that you have sufficient current ratio and cash flow.”

According to the data, Weimar’s cash in 2021 will reach 10.2 billion yuan, which is indeed a year-on-year increase of 92.45% compared with 2020. However, its current ratio is only 1.1 in 2021. Although it is a significant increase from its own 0.7 in the same period in 2020, it is still far behind Wei Xiaoli’s 2.18, 2.71 and 4.33.

In terms of long-term development, less investment in R&D is also potentially dangerous for the technology industry such as new energy vehicles. As Lou Yu said, “New energy vehicles are in the process of ‘burning money’, and the R&D that really changes the competitive landscape has not yet been completed. Appearance and effective R&D investment are also an important part of the competition for new energy vehicles.”

The opponent is not only “Wei Xiaoli”

2021 can be said to be a year of fierce competition for new energy vehicles “Hidden Dragon Crouching Tiger”. And Weimar’s opponents are not only the new car-making forces represented by “Wei Xiaoli”.

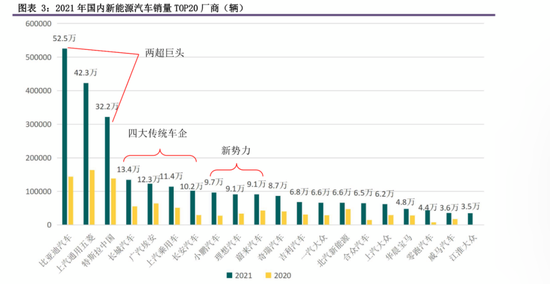

The “New Energy Vehicle Industry Research Report” released by Yingda Securities has revealed that the domestic new energy vehicle market share has formed a situation of “two superpowers and multiple powers + the rise of new forces”.

According to the new energy vehicle market share data in 2020, BYD holds the first domestic market share with 13.1%, and Shanghai General Motors ranks second with 12.98%, slightly higher than Tesla’s 10.06%. The next step is the transformation of traditional car companies represented by Changan Automobile and Great Wall Motors. Then, it is the new car-making force represented by Wei Xiaoli.

Source: Yingda Securities

Source: Yingda SecuritiesAmong the top 20 manufacturers of domestic new energy vehicle sales in 2021, BYD, Tesla, Wei Xiaoli and many companies including FAW-Volkswagen and Geely Automobile are on the list, but WM Motor is not on the list on the single.

“The entry of traditional automobiles into new energy will have an impact on the new forces of automobile manufacturers,” Lin Mo said. “First, traditional automobile companies have a more mature industrial chain in the supply chain, sales channels and other businesses. Second, they have Sufficient funds are fully invested in the research and development of hard technologies. Third, traditional car companies generally have stronger government-enterprise relationships than new forces, and it is easy to get more resources to lean on the national strategy of new energy.”

The competition between traditional car companies and new forces for new energy is very similar to the pattern of new cosmetics consumption and traditional big brands competing on the color cosmetics track. Even if new forces can capture consumers’ minds more quickly through marketing methods, traditional car companies have deeper skills in the “foundation”.

In addition to the competition from traditional car companies, among the new forces, the ideal that also focuses on SUVs has grown rapidly in the past two years, while Xiaopeng, which focuses on mid-priced vehicles, has achieved the lead in vehicle sales through a variety of models. Ma was slightly embarrassed.

New energy vehicles usually have the same suppliers as CATL, Dr., and mobileye. Therefore, the order volume of parts, the solvency of the company, and the brand effect can all determine the order of shipments, which seems to increase revenue. , sales are relatively backward, and the liquidity of funds is also worse than Wei Xiaoli, Weimar is in a dangerous “cycle”.

WM Motor wants to change the “destiny” and finally achieve “overtaking on the curve”. In addition to listing and financing, it is also particularly important to start with the essence of production, research and sales.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-06-07/doc-imizmscu5532083.shtml

This site is for inclusion only, and the copyright belongs to the original author.