A partial debt hybrid fund refers to a hybrid fund with an investment ratio of no less than 80% in bonds and a stock position of no more than 20%. It is the main form of fixed income +.

Its risk-return characteristics are between pure debt funds and partial equity hybrid funds. It is suitable for investors with low and medium risk preference, and can also be used as part of the asset allocation of medium and high risk investors for defensive purposes.

The partial debt hybrid fund is an actively managed fund. Therefore, the relevant investment and research strength of the fund company, the fund manager’s experience and investment research ability, the stability of the management team, the fund’s past performance and its stability are the main reasons for choosing a partial debt hybrid fund. The main indicators considered.

Let’s take a group of partial debt hybrid funds selected by Xueqiu topic as an example to see how to use these indicators to select partial debt hybrid funds.

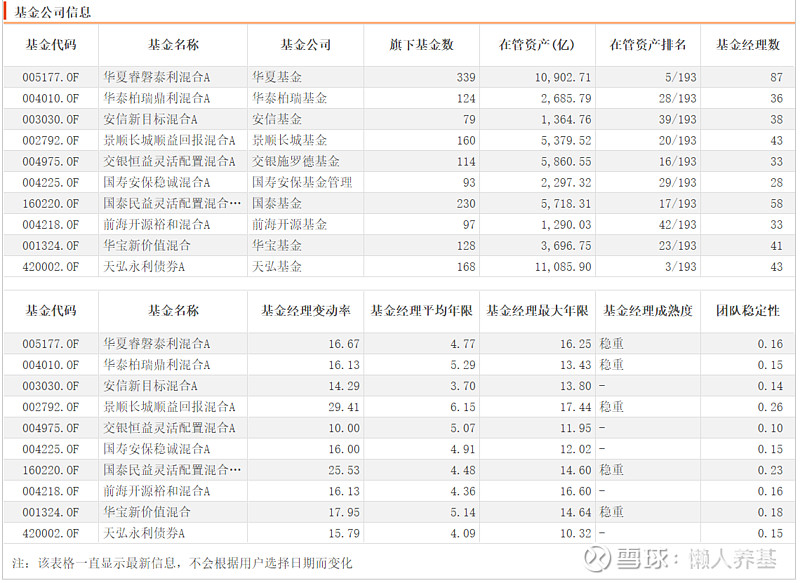

First look at the fund company level.

Indicators such as the size and ranking of assets under management of fund companies, the number and average working years of fund managers, and team stability are worthy of key consideration.

The higher the ranking of these indicators, the stronger the investment and research strength of the fund company.

Under the same conditions, priority should be given to the top-ranked relevant funds.

As can be seen from the table below, although the assets under management of the fund companies involved in this group of partial debt hybrid funds are quite different, they are all within the top 50 companies with a management scale of more than 100 billion yuan. Not weak.

Next, look at the fund manager level.

The longer the current fund manager manages the fund, the better, preferably more than 3 years.

The longer the current fund manager has been a fund manager, the better, preferably more than 5 years.

The type of fund that the current fund manager has managed in the past or at the same time is conducive to managing the current type of fund.

It is better that the current fund manager manages the fund’s holding stocks with a lower turnover rate, and the selected stocks are more likely to remain stable than the excess returns brought by trading.

According to the above principles, we will analyze this group of partial debt hybrid funds one by one.

1. Song Yang, the fund manager of Huaxia Ruipan Taili, has managed the fund for more than 4 years and has been the fund manager for nearly 6 years; currently, he manages hybrid debt funds, partial debt hybrid funds and stock funds, indicating that the fund manager has both investment bonds and equity funds. The ability of stocks; the turnover rate of stocks held during the management of the Fund was 28-86%, which was lower than once a year, indicating that the excess returns mainly came from stock selection rather than trading, and the sustainability of performance is worth looking forward to. (no deductions)

2. Zheng Qing and Dong Chen, managers of Huatai Pineapple Dingli Fund, have managed the fund for more than two years, which is a little shorter; Zheng Qing has been the fund manager for more than 10 years; the types of funds managed in the past are mainly currency funds and short-term debt funds. It shows that the fund manager has rich experience in the use of currency-like investment tools, and whether the ability to expand stock portfolio management is smooth depends on the performance during the management period; the turnover rate of stocks held during the management of the fund is 47-181%, and among the 12 partial debts in this group Among the hybrid funds, it is at a high level, but it is not high in absolute value. ( basically no deductions)

3. Nie Shilin, the new target fund manager of Essence, has managed the fund for more than 5 years, and has been the fund manager for more than 6 years. Zhang Rui has only been the fund manager for more than a year. Fund, indicating that the fund manager has the ability to manage both the bond portfolio and the stock portfolio; during the management of the fund, the stock turnover rate of positions held is 7-90%, and the turnover rate is less than once a year. (no deductions)

4. Chen Ying, manager of the Invesco Great Wall Shunyi Return Fund, has managed the fund and served as a fund manager for more than two years, which is a bit short; currently manages partial debt funds; The turnover rate is 20-36%, and the turnover rate is low.

5. Wang Yiwei, manager of BOCOM Hengyi Fund, has managed the fund for more than two years, and has been a fund manager for nearly three years, and his working experience is also shorter; currently, he manages partial debt funds; during the management of the fund, the stock turnover rate of 26 -68%, the turnover rate is low.

6. The fund manager of China Life AMP Wencheng has managed the fund for nearly 4 years and has been the fund manager for more than 8 years; at the same time, he manages partial equity and partial debt funds, indicating that the fund manager has the ability to manage both bond portfolio and stock portfolio; manage the fund During the period, the turnover rate of the stocks held is 19-66%, and the turnover rate is relatively low. (no deductions)

7. The managers of Cathay Minyi and Cathay Pacific Rongfeng Extended Growth Fund have both managed these two funds for more than 5 years, and have served as fund managers for more than 8 years. They also manage partial equity and partial debt funds, indicating that the fund managers have the ability to manage bond portfolios and The ability of stock portfolio; the turnover rate of holding stocks during the management of two funds is 4-454%. The ultra-high turnover rate occurred in 2019, but the turnover rate has declined since then, and the turnover rate in the past two years has been lower than one year. once. ( basically no deductions)

8. Lu Qi and Lin Hanyao, managers of Qianhai Kaiyuan Yuhe Fund, have been the fund managers for less than 3 months, Lu Qi has been the fund manager for less than two years, and Lin Hanyao has been the fund manager for less than one year, with a short working experience; Debt funds and stock funds; the management time of this fund is too short, and there is no relevant turnover rate data (the turnover rate of the stock funds managed by Lu Qi is 380-975%, and the transaction characteristics are more obvious).

9. Lin Hao, manager of Huabao New Value Fund, has managed the fund and served as a fund manager for more than 5 years; at the same time, he manages long-term debt funds and partial debt hybrid funds; during the management of the fund, the stock turnover rate of positions held is 24-83% , the turnover rate is low. (no deductions)

10. Hu Yongqing, the manager of the Harvest Strategy Priority Fund, has managed the Fund for more than 5 years and has been the fund manager for more than 10 years; currently, he manages all hybrid funds with partial debt; during the management of the Fund, the stock turnover rate of positions held is 24-92%, and the turnover rate lower. (no deductions)

11. Tianhong Wynn Bond Fund Manager has managed the fund and served as a fund manager for more than 10 years; currently manages both hybrid debt-based and partial debt hybrid funds; the turnover rate only exceeded 100% in the first half of 2020, and the rest of the time The turnover rate is lower than once a year, and the overall turnover rate is low. (no deductions)

Finally, look at the past performance of the fund.

Take a look at cumulative and annualized returns over a longer period of time.

Second, look at the Karma ratio of the maximum drawdown during the period and the evaluation of the cost-effectiveness of returns.

Third, look at the performance of each year.

All of the above indicators are compared with the partial debt mixed fund index to see how the winning rate is.

For the sake of fairness, the performance starting date of all 12 funds is set as the establishment date of Huaxia Ruipan Taili, which was established at the latest, on December 27, 2017, and the performance end date is set as November 3, 2022.

The relevant statistical results are shown in the table below.

1. The cumulative returns since December 27, 2017, except for the extension growth of Cathay Pacific Rongfeng, all other 11 funds have beaten the partial debt hybrid fund index.

2. Both Cathay Minyi and Cathay Rongfeng, managed by the same fund manager Fan Li’an, had a maximum drawdown of nearly 20% during their extended growth period, far exceeding the debt-biased hybrid fund index, and the large losses of these two funds in 2018 also greatly dragged down In addition to their overall performance, it is difficult to make up for the losses in 2018 after the dazzling performance after 2018. But the good news is that since 2022, these two funds have performed well under the market conditions where the stock market fluctuated and fell, and there has not been a sharp decline similar to that in 2018. It is very likely that the fund managers have learned the lessons of 2018, and their future performance will still be It is worth looking forward to.

3. None of the 12 funds outperformed the debt-biased hybrid fund index in all 5 years, indicating that there are no generals in the market. We are often behind when the debt-biased hybrid funds selected or held by ourselves have fallen behind each year. A patient, rational and calm acceptance of their temporary backwardness.

4. In 5 years, three funds lagged behind the debt-biased hybrid fund index (shown in green font) in 2 years. They were Huaxia Ruipan Taili, Invesco Great Wall Shunyi Return and Tianhong Wynn Bond, but the lag was both. Not too big.

The remaining 8 funds all lagged behind the partial debt hybrid fund index for 1 year.

5. The current fund manager of Huatai Bai Rui Dingli has achieved good performance for more than two and a half years after taking over the management in July 2020. Bank of Communications Hengyi also performed well after the current fund manager took over management in July 2020, and both beat the debt-biased hybrid fund index.

6. The ranking order of the Karma ratio of the 12 funds since December 27, 2017 is as follows:

Huatai Bai Rui Dingli> Huabao New Value> Anxin New Target> Huaxia Ruipan Taili> Harvest Strategy Priority> China Life Security and Trust> Tianhong Wynn Bond> Invesco Great Wall Shun Yi Return> Qianhai Kaiyuan Yuhe> Bank of Communications Heng Benefit > Cathay Pacific Minyi > Cathay Pacific Rongfeng Extension Growth.

summary:

Although the above indicators are all quantitative, qualitative analysis is equally important.

The poor performance of several funds in 2018 caused a drag on the overall cumulative performance. Although it is a fait accompli, it may also have certain contingency.

What we need to see is that in 2022, when the market environment may be worse than in 2018, all 12 funds have not experienced a major decline. Maybe they all grew up after paying tuition in 2018!

Practically speaking, half of the 12 debt-biased hybrid funds in 2021 will far outperform the performance of equity-biased hybrid funds. This is likely to benefit from the bull market of convertible bonds caused by the mid-to-small-cap style in 2021. This is not the case either. normal and sustainable phenomenon.

Based on the above analysis, the 12 funds are actually excellent hybrid funds with partial debt. After all, they are all winners selected through certain procedures.

In order to rank among the 12 funds, I thought about it like this:

1. Qianhai Kaiyuan Yuhe has deduction items at the fund company level (the bottom of the scale) and the fund manager level (the current fund manager manages the fund and has the shortest time as a fund manager). Combined with the Karma ratio ranking, it should be at 12. Only the outstanding partial debt hybrid funds are in the bottom position.

2. Bank of Communications Hengyi and Invesco Great Wall Shunyi were awarded the penultimate place of 12 outstanding partial debt hybrid funds because of the deductions at the fund manager level (the tenure was short) and the Karma ratio ranking. 3rd place.

3. The current fund manager of Huatai Bai Rui Dingli has managed the fund for a short period of time, which is a small flaw. Combined with the Karma ratio ranking, it ranks second after Huabao New Value.

4. The remaining funds are ranked according to the Karma ratio.

5. The final ranking order is as follows:

Huabao New Value>Huatai Bai Rui Dingli>Anxin New Target>Huaxia Ruipan Taili>Harvest Strategy Priority>China Life Security and Trust>Tianhong Wynn Bond>Guotai Minyi>Guotai Rongfeng Extension Growth>Invesco Great Wall Shunyi Return > Bank of Communications Hang Yi > Qianhai Kaiyuan Yuhe.

Of course, this ranking is based on my subjective judgment and does not indicate future performance, nor does it represent an investment recommendation.

If you don’t like it, you can laugh it off; if it inspires you, don’t forget to like and forward it.

All the opinions and funds involved in this article do not constitute investment advice, but are only a true record of my own thinking and practice. I invest in the market based on this, at my own risk.

# Lao Siji Hard Core Evaluation# $ Huatai Bai Rui Dingli Mixed A (F004010)$ $ Huaxia Ruipan Taili Mixed A (F005177)$ $ Anxin New Target Mixed A (F003030)$ @Today’s topic # Snowball Star Project Public Offering Talent # @snowball creator center @ETF star push officer @snowball fund

This article was first published by Lazy People , and the copyright belongs to the author. Reproduction without permission is strictly prohibited. Friends are welcome to forward the circle of friends.

For more past articles, please click:

[Lazy people support snowball column article directory]

This topic has 7 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/2356382715/234587613

This site is for inclusion only, and the copyright belongs to the original author.