“I didn’t dare to increase my position at the previous low point, and I was short. Can I still buy now? What should I buy?”

In recent days, more than one friend has asked me such a question.

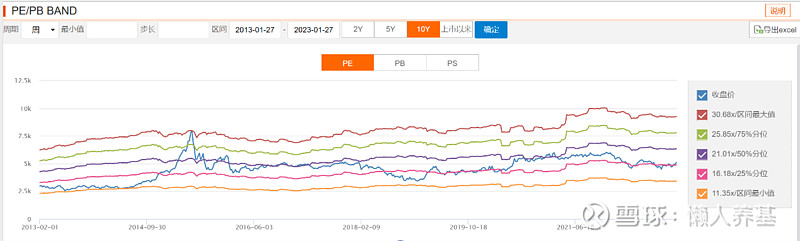

It seems very simple to answer this question, because the current valuation is not high. The current rolling PE of CSI All Index on January 20 is 16.88 times, which is at the quantile level of slightly more than 25% in the past ten years.

Data source: Oriental Fortune Choice data

However, the current points of the CSI All-Shares Index and the Partial Stock Hybrid Fund Index are still below or within the monthly K-line long-term moving average group.

From past history, if the CSI All-Indices fell below the monthly K-line long-term moving average group, or the partial stock hybrid fund index fell into the monthly K-line long-term moving average group, it is an excellent opportunity to buy active equity funds, and such a big opportunity It has only appeared 4 times since 2006.

Compared with the lows in April or October last year, it is certainly not the best time to buy, but it must still be a good time to buy. However, there is a prerequisite for this, that is, from a long-term perspective, after buying, you can hold it for a long time without fear of fluctuations.

If you can’t bear the volatility, it is actually very difficult to invest. Because we don’t have a God’s perspective, we can never buy at the lowest point.

Although we can’t buy at the lowest point, we can buy in a relative bottom range, and regular fixed investment can do this. For example, divide the funds that need to be invested into 6 equal parts, and buy one part at a fixed time every month, so that you can buy the average market cost in the first half of this year.

Some investors may worry about what to do if the price rises every month in the first half of the year? It should be said that this probability is not high. Because what is being traded now is the expectation of economic recovery, the actual recovery of real estate and large consumption will be continuously verified in the next few months, and economic development is inertial, and recovery is unlikely to be achieved overnight. If the recovery falls short of expectations, the market will also fall into a correction.

So, can you wait for adjustments before buying? My answer is that it doesn’t work. When can it be adjusted? How big will the adjustment be? How much adjustment can I buy? If it is adjusted to be higher than the current point by then, should I buy it?

This is the difficulty of short-term timing.

For friends who are too entangled in “buy or not to buy, what to buy”, there is another solution, which is to buy at one time with an equal allocation of stocks and bonds, and then respond to market fluctuations through dynamic rebalancing.

That is to say, buy half of equity funds and half of bond funds (bond funds can also be replaced by money funds this year). half of the ratio; if the market adjusts significantly after buying, some bond funds (money funds) can also be directly converted into equity funds, and the proportion of stocks and bonds (money funds) should also be restored to half.

If you have a strong risk tolerance, you can also adjust the ratio of stocks to 6 bonds and 4 bonds, and respond to market fluctuations through dynamic rebalancing after one purchase.

Note that dynamic rebalancing is to return to the original stock-to-debt ratio, rather than a large-scale adjustment of a shuttle with large inflows and large outflows.

In view of the rapid rotation of industries and styles since 2021, don’t gamble on the direction of the funds you buy. It is best to use active equity funds or broad-based index funds with a relatively balanced industry allocation, and at the same time appropriately allocate some Hong Kong stock funds.

All opinions and funds involved in this article do not constitute investment advice, but a true record of my own thinking and practice, and invest in the market based on this, at your own risk.

@雪球创作者中心@今日话话@雪球fund@ ETF Star Push Official

$Fuguo Tianhe Steady Mix(F100026)$ $Harvest Research Alpha Stock(F000082)$ $Xingquan Herun Mix(F163406)$

This article was first published by Lazy Raising Foundation , and the copyright belongs to the author. Reprinting without permission is strictly prohibited. Friends are welcome to forward Moments.

For more past articles, please click:

【Catalogue of Lazy People’s Foundation Snowball Column】

There are 8 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/2356382715/240662794

This site is only for collection, and the copyright belongs to the original author.