#fengyunjunlook at the first trading day after the increase of the quantitative index, the index is still green, and the external market during the holiday has repeatedly bottomed out under the negative conditions. However, at the current position of 3000 points, Fengyunjun believes that it is more meaningful to be optimistic in terms of mentality, and to think about the next operation ideas and strategies at the same time. Today, we will talk about some thoughts on quantitative index increase and whether it is possible to “buy the bottom” at present.

$ Yanfu Index No. 3 (P001228)$ $ Zhuoshi Albert (P001037)$ $ Peng Jin Yongning (P001068)$ $ Century Frontier Index Enhancement No. 2 (P001114)$ $ Qilin Zhengxing East Embroidery No. 1 (P666009)$

1. Looking at the current market environment of quantitative index growth from β and α respectively

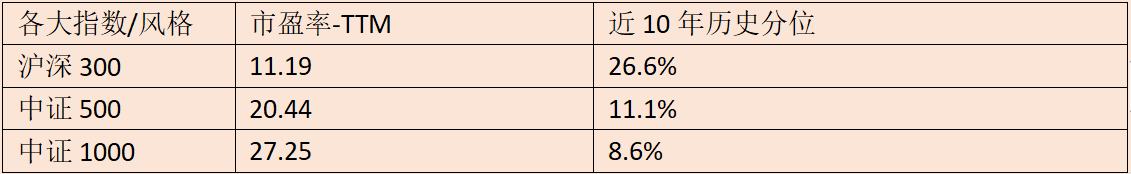

First, let’s look at the current β: index valuation. Generally, we can look at two indicators: one is the valuation quantiles of major indices, and the other is the price/performance ratio of stocks and bonds (also called risk compensation).

The current valuation of the CSI 300 Index has fallen to the low level in April this year; the PE of the CSI 500 Index and the 1000 Index are both at low levels in the past 10 years. In addition, the current risk compensation of A shares is more than 1% , which generally shows a higher safety margin of the index. Therefore, the current quantitative index products have a high margin of safety from a beta perspective.

From the perspective of α, look at whether the current market environment is friendly to index products. Here we mainly look at several environmental factors that affect quantitative overperformance.

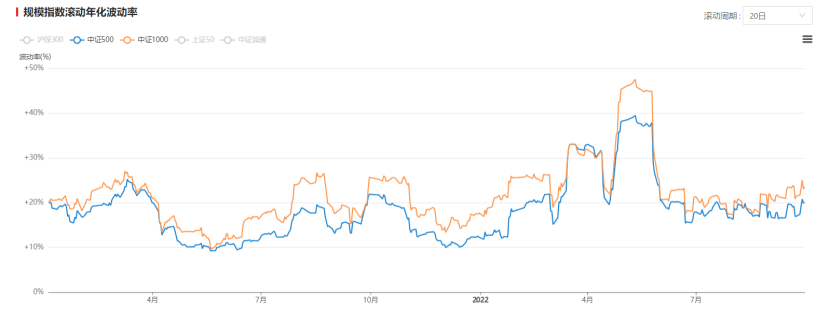

The first is the activity of market trading . We can refer to the turnover and volatility of the index. In terms of turnover, after the market reached its freezing point since April this year, the turnover in May-August has recovered, which has brought about a significant rise in the index volatility. Since September, the market turnover has dropped significantly, but the index volatility has increased. warming trend.

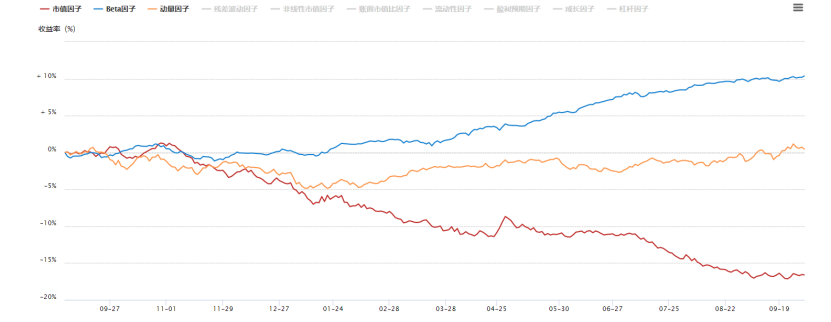

Second, look at the quantization excess from the style switch. We know that in addition to the light trading in the market environment that is not suitable for quantification, another point is that the “fear” style suddenly switches, especially frequent switching, which will bring about excessive and large drawdowns.

The above data comes from Huo Fu Niu.

From the above figure, we can see that since the end of April, the three major style factors have contributed a good positive return to the quantitative excess.

Compared with September-December last year and the beginning of this year, the market style environment has improved significantly, which is relatively beneficial for quantitative institutions to obtain excess.

2. Why can you choose to quantify and increase the price of bargain hunting?

1. The benefits of quantitative index increase mainly depend on the long-term accumulation of α . The essence of quantitative profit is to analyze and mine historical data, and filter out the models that can outperform the CSI 500 Index. Assuming that the top 40% of the stocks can always be selected, then the income of these top 40% stocks outperforming the index is α. . We know that the revenue of index-added products comes from index β and excess α, and the major contribution of quantitative index-added products comes from α created by managers . Let’s take a top 1000 index product as an example. It has been established for 2.4 years. In nearly 85% of the total revenue, the index only contributed 16%, and the excess contributed 80% of the total revenue. The long-term accumulation of α is quite considerable (select important to managers). Unlike subjective long strategies, where quantitative holdings are usually over 1,000 and do not bet on a single sector or style, it is much easier to predict which of thousands of stocks are better/worse, provided the model is valid.

2. After selecting the right manager, there is no need to select the time for α. We know that timing is a challenge even for professional investors, and even more difficult for ordinary investors. We observe the monthly excess of the quantitative index increase of the head, and the monthly winning rate of the excess can reach the level of 80%, that is, in 12 months a year, almost 10 months of monthly excess can be positive. In this case, the investor’s operation method becomes relatively simple: first, buy at the relative bottom area of β; second, lengthen the holding period (2-3 years), which is very important. The quantification relies on the continuous selection of “top students”, α’s accumulation of sand into a tower, its methodology is different from that of subjective longs, but it is also possible to buy during the retracement period of α. At this time, it is necessary to lengthen the holding period in order to harvest better. income.

3. Selecting the right management talents is the top priority

The excess returns of quantitative index increase have obvious cyclical characteristics, that is, in the large and small years of quantification, the excess will be significantly different. The past 1 year has been the hardest full year for overbooking since 19 years. Fengyunjun counted 37 mainstream quantitative private equity 500 index products (as of September 16) that 35 had positive excess in the past year. Among the managers with positive excess, the excess distribution is not concentrated, and the excess is 20% ( There are only 7 managers with above, namely Si Xie, Yanfu, Mengxi, Probabilistic Theory, Zhuozhi, Zhiyuan, and Qianxiang; half of the managers have single-digit excess. Therefore, we can see that if you choose the wrong and the right quantitative index increase manager, the income and holding experience are far from each other. For those managers with very stable excess, the excess drawdown is controllable, and the number of days that the excess does not reach a new high is 20-40 days . For those managers with an excess of instability, the excess drawdown is large, and the number of days that the excess does not reach a new high is often more than 200 days. In this process, the holders experience the double drawdown of the index and excess, which can be described as miserable.

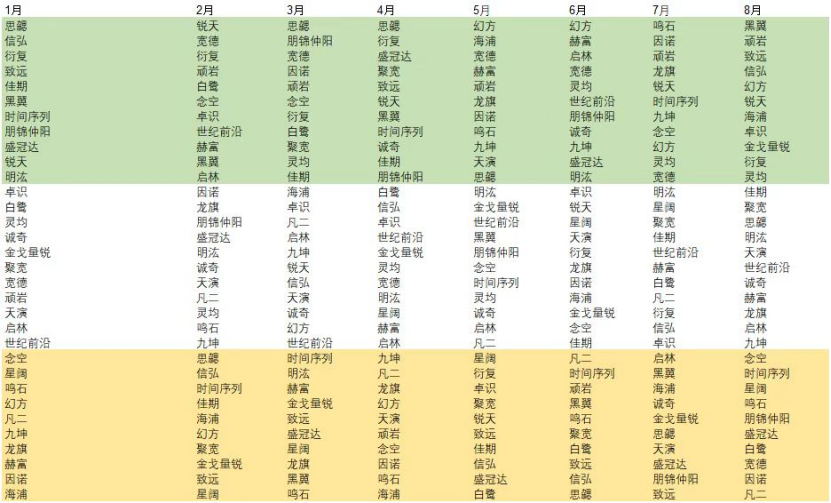

Let’s take another look at this year’s situation. The following picture shows the monthly excess of the 500 index increase of mainstream quantitative institutions from January to August this year.

We exclude some managers whose excess performance is in the back row in each month of this year, and we will find that the excess performance shows a relatively obvious rotation effect, that is, managers who performed outstandingly in January-April may rebound in May-July. Average; and some of the poor performance in January-April, but in May-July increased significantly. The more extreme representatives of the two stages are Si Xie and the magic square. During the period from May to July, the excess increase of Si Xie was relatively small, while the magic square experienced an excess and substantial rebound after the previous excessive retracement. For these two managers, we will not do too much analysis here. The key point is: excess rotation is a normal phenomenon. It is difficult for us to find managers who are in the front row every month or in different excess periods. This is due to The matching degree of managers’ different strategies, style exposure, etc. with the market .

For example, Yanfu tends to perform better in periods of poor market conditions. The main reason is that low-frequency strategies have a relatively high proportion of fundamentals and alternative factors. These factors have low turnover and homogeneity, and do not depend on the market. The transaction situation makes the excess relatively stable; another example is Zhuozhi, a high-frequency quantification company, which controls excess volatility and excess drawdown very conservatively. It may not be the most dazzling performance in each cycle, but However, most of the time it can be stable in the middle and upper reaches, and the long-term excess stability reflects the pure alpha ability of the manager. We take a comprehensive look at this type of super-stable managers. The performance of extending the holding period to more than one year is often not disappointing. For this type of manager, investors can feel at ease when they buy at the relative bottom of β. hold .

To sum up, it is undoubtedly a bargain-hunting strategy to choose index-added products at present, but the difficulty of choosing a quantitative manager is no less than that of a stock-picking multi-strategy manager. The next few years will still belong to the domestic quantified dividend period, but there will undoubtedly be more intense competition. In the end, managers with rich strategies, emphasis on risk control management, and more meticulous and perfect details will be the important difference between each company. factor.

This topic has 7 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9047540546/231745869

This site is for inclusion only, and the copyright belongs to the original author.