Many years ago, a movie based on a novel I wrote was released. Because the investment was too low and the production was rough, the movie had a fairly average reputation on Douban, but the box office was not too bad. The director of the movie was also an investor in the movie and still made money. .

After making money, the director’s rating of the movie obviously doesn’t matter. He even posted a circle of friends saying: “Making a movie is like making braised pork. It’s not delicious. Of course, it can’t be too bad, too bad and the taste will be bad, so a good comedy movie must be bad and just right.”

At the time, I was amused by his heresy and heresy, but I also admitted that he had some truth in what he said, because the works I wrote seriously in the later period, the ones that I thought were not bad at all, would not be able to make it to the theater.

At the end of last year, the convertible bond market was so hot that in the end, there were not many varieties that I could start with. In the end, I chose three convertible bonds as my heavy positions, Jiushi, Vosges and Jiuqi. These three convertible bonds accounted for 40% of my holdings at the highest. For investors with high risk control requirements, I rarely buy single products with such a high proportion.

At that time, many people did not understand how these three convertible bonds were selected. The price was not low, the maturity yield was not high, and the quality was not good. In fact, when I was picking debts, my mind was full of “braised pork theory”. In the face of a market that may turn down at any time, perhaps only these convertible bonds that look “rotten but not too bad” are good choices.

How did the three “rotten” debts behave? The first to start is Jishi Convertible Bonds. In just two months, it was 60% higher, reaching a maximum of 168 yuan. After another two months, the Vosges convertible bond was also launched, and it rose by 30% in one day, reaching a maximum of 158 yuan. Together with the previous income, it brought in 4 months. gain close to 50%. The most insipid is the Jiuqi convertible bond, which only rose to 130 yuan for a short period of time, which is the lowest increase in the three bonds, but the income of more than 20% in a few months is obviously not too bad. I reduced my position for a long time. It left only 2% of the position, but after half a year, the Jiuqi Convertible Bond, which was revised down again, also successfully charged to 150 yuan.

2022 is a bleak year for investment. Even convertible bonds are not easy to do. However, in a horizontal comparison of the entire market, convertible bonds with excellent quality, after barely rushing to a high level, often wait for them to be forcibly redeemed, and the purchase cost will be less. High, so most of the returns are not impressive. Those convertible bonds with high maturity annualized returns fully reflect the defensiveness, and they are only a tepid yield.

Looking at the market, the three “bad debts” that can compete against each other, except for the demon debt legion who are lucky by hot money, there are really not many opponents.

Why should we buy some “bad and not too bad” convertible bonds.

In fact, if we analyze them carefully, we will find that these convertible bonds that everyone despise are actually varieties with outstanding advantages.

Look at the defensiveness first:

The three convertible bonds are all mature and positive-yielding convertible bonds. Except for Vosges, which has a longer maturity time, Jishi and Jiuqi are both due in about 2 years. Such short-term and mature varieties with positive returns are actually the best choice when the market direction is unclear. Once the market turns down, the defensive effect of these convertible bonds will definitely be better than those with a duration of four or five years, because for them, for every 2 yuan drop, the annualized maturity yield will increase by 1%. , and the value of time is clearly reflected in them.

On the contrary, when the market is very floating, buying high-quality convertible bonds with low maturity yields may face a drawdown of more than 10% in the future.

Look at the aggression:

The three convertible bonds have a record of downward revisions. The premiums of Vosges and Ji Shi are not high, and the maturity time of Jiuqi is shorter, and there is the possibility of another downward revision. This also indicates that once the market picks up, the three convertible bonds may follow the underlying stock to go out of a good linkage trend. This is compared to those low-priced bonds that have not been revised down, have a large stock, and have a high premium. They are only slightly less defensive, but far more aggressive than them.

Finally, look at security:

Vosges convertible bonds have the best stock management and have stable cash flow every year. Although Ji Shi’s performance is not high, it is a state-owned enterprise. If the state endorsement does not work, then there is really nothing to trust. Jiuqi is the one with the tightest funds, but they also have more cash to use for debt repayment.

It is also a low-priced bond. I would rather pay a few yuan more to buy these relatively safe varieties. No matter how cheap those fake and insolvent ones are, I don’t want to overweight them.

Which convertible bonds are classified as “braised pork convertible bonds”?

I think they should have the following characteristics:

1. The premium is not outrageously high.

2. The absolute price is relatively low, and there is a certain maturity income. If the time is short enough, it also needs to be near the breakeven price.

3. The business operation should not have major risks, but it is not bad money, and there is a willingness to promote convertible bonds.

4. There are certain downward revision expectations.

And for these three convertible bonds, I lurked a large enough position before the downward revision.

I don’t think it’s appropriate for us to invest in these “braised pork convertible bonds” at any time.

For example, at the beginning of the year, when the market was under the leadership of hot money, the market was very hot, and the market made a lot of money. If we were still blindly waiting for the convertible bonds to be repaired, I thought it would be easy to miss the market.

But now that the market has fallen to 2800 points again and the market is pessimistic, choosing these “braised pork convertible bonds” may be a better choice.

Because the hot money has been tossing around for too long in the last round, it will take time to fully return again, and it will take time for investors to boil over until they collapse and complete the wash before making a comeback.

The stock market is very bad, but the overall price of convertible bonds is not low because of the low market interest rate.

The black swan of convertible bonds still exists. Our interest rate may have to no longer widen the interest rate gap with the United States, blue-chip stocks may collapse, and there may be funds to sell convertible bonds with a high price to hunt for the bottom, causing the market to make up for the decline.

At this stage, we have certain defensive needs, and it is obviously not appropriate to choose those unreliable low-priced bonds. Sote and Zhengbang, which are insolvent, have told us that in the short-term decline process, operating doubtful convertible bonds , yield to maturity is just a number. Even if I think these convertible bonds may bring us benefits in the future, can they definitely beat the “braised pork” sector? I’m afraid not.

In fact, convertible bonds are considered an alternative existence in A shares. Due to the existence of downward revision clauses and the bond property of repaying principal and interest at maturity, low-level convertible bonds are not afraid of the bear market, no matter how the stock is. Being pressed on the floor and rubbing against it, as long as there is a downward revision, no matter how much the decline is, it will be resurrected with full blood. Convertible bond investment does not even need a bull market, and it can achieve huge returns.

Some time ago, a friend from private equity, Dr. Bohuhubo , posted a video and talked about the opinion of “listing to the secretary of the board of directors loses half, and listening to the chairman of the board loses all”.

He said: “Actually, the chairman is not trying to deceive everyone. They really think that their company is good and has unlimited prospects. It’s just that we can see things clearly, but they can’t see it clearly.”

I think what he said is quite reasonable, but the bear market can help us educate these arrogant chairman, they will find in the tragic decline that their proud posture will not boost their stock price, but will be losing. The stock price will let them know that they are not Britney, but the wrinkled Mrs. Niu. In this way, we can make the most correct decision, revise down the conversion price, and invest more shares in our convertible bonds, instead of returning the hundreds of millions and billions of hard-earned financing to investors with real money.

A few days before the last revision of Jiuqi, a friend, Mr. Z, came to me. He is the top ten holders of Jiuqi’s convertible bonds and the holder of Jiuqi’s main shares. He then participated in the development of Jiuqi’s software. At the general meeting of shareholders, although the holders of the convertible bonds had to refrain from voting on the underlying shares, he still went to the scene to do the final lobbying for the downgrade of Jiuqi’s convertible bonds to ensure the smooth downgrade of Jiuqi’s convertible bonds.

We discussed the content of the speech at the shareholders meeting, and finally Mr. Z became the only investor present who was not a shareholder of the company. Although he cannot influence the final decision of the board of directors, Mr. Z, from the perspective of small and medium-sized investment, analyzed the macro economy and historical data of convertible bonds on the spot, and even told the management of the company who are not familiar with the work of converting convertible bonds to shares. some cases. These are things that company management rarely understands.

The management of Jiuqi, who was under pressure, listened to the suggestions of investors very seriously, and finally made a fairly reliable decision to reduce the conversion price of Jiuqi’s convertible bonds to five yuan. We don’t know how useful Mr. Z’s remarks were. However, the voice of small and medium investors may really become more important, at least there has been no inexplicable downward revision of prices for a long time. Or without his remarks, maybe the price this time is 5.2, 5.5, or even 5.97 yuan.

As the bear market gets longer and longer, and the number of downgrades of convertible bonds increases, our winning rate of buying “braised pork convertible bonds” increases. A big factor is that the voice of small and medium investors like us is increasing With strong growth, small and medium investors began to deeply participate in the downward revision process of many convertible bonds. From last year to this year, retail investors have fought against listed companies in the game of debt repair, and the results are obvious to all.

When the chairman and board secretaries describe the company’s bright future to investors in a high-pitched tone, there will always be some small and medium-sized investors sitting in the corner of the venue and sneering, so that they can wake up from the state of beating chicken blood. a bit.

The shareholders meeting cannot be just an internal meeting of the company’s management, otherwise they will always be so confident. Someone always has to take out a small mirror and tell them according to the wrinkles on their faces that the little princess you think should accept the truth that she has become an old girl. .

We are all small and medium investors, and we cannot influence the decision-making of listed companies, but we fully advocate the right to speak out. When listed companies find out that we are not vexatious, we are not wandering, but use professionalism and win-win ideas to inform listed companies When we think about it, in the end, we may push the decision to develop in a direction that is more inclined to the interests of small and medium investors.

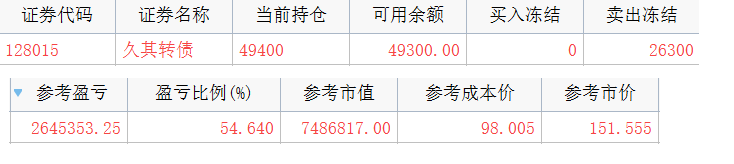

After Jiuqi took off, Mr. Z posted a screenshot to me. I remember that after the revision, he added a lot of Jiuqi. Looking at the account, there are not many Jiuqi left.

Mr. Z said: “The other accounts have been emptied, and there is still one account left. Most of them are hanging around the daily limit. My target is 130 yuan, and it has exceeded expectations now.”

We had a good view together before, and we took it back from a high position together, so my long-term stock was cleared at 133.999 yuan. But this time he was clearly right.

Thinking of the eve of his attendance at the Jiuqi shareholders meeting, I wanted to ask him a question.

I said, “Why did you come to me to discuss the meeting? After all, I am just a very ordinary small and medium investor in terms of financial strength.”

After asking this question, I laughed at the other end of the phone. Because this question has a standard answer.

I know that Mr. Z will say: “Although you are not a big family, Uncle Ka, you are a spokesperson for small and medium investors. You represent the weakest group and you are our favorite person.”

But Mr. Z said: “Because I know that going to Jiuqi to hold a meeting is a tough battle, and facing Jiuqi’s bosses who are used to seeing big scenes, I am worried that my gentleness, elegance, kindness, and stability will make me at a disadvantage, and my lobbying will fail. . So I must find you, because among my friends, only you are the most tricky, and you can only complete the task of tearing with your mean and piercing ways.”

I said, “You bullshit, you go, don’t talk to me again.”

If he is not the hope of our whole village, I really don’t want to forgive him.

This topic has 61 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9508203182/234203585

This site is for inclusion only, and the copyright belongs to the original author.