Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Tang Fei

Source/Value Planet Planet (ID: ValuePlanet)

“It’s too difficult,” Jingdong lost again.

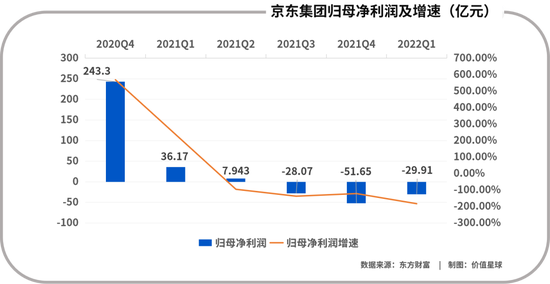

In the first quarter of 2022, although JD.com’s net income increased by 18% year-on-year to 239.7 billion yuan, its net profit was a loss of 2.991 billion yuan, while in the first quarter of 2021, JD.com’s net profit was 3.617 billion yuan. This is the first time after 6 years that JD.com lost money in the first quarter of 2016, and the last time JD.com lost more than 3 billion yuan in the first quarter was back in 2014.

Regarding the loss in the first quarter of this year, JD.com explained in its financial report that it was mainly due to continuous investment in infrastructure, technology research and development, employee compensation and benefits, reducing the impact of the epidemic and ceding profits to consumers. At the same time, since JD.com completed the subscription of Dada Group’s issuance of ordinary shares in February, Dada’s revenue was also consolidated into JD.com’s first-quarter financial report, further increasing the loss.

It can be seen that the epidemic has a great impact on JD.com, and for Xu Lei, who has just taken over as CEO of JD.com, the pressure is even greater.

On the evening of May 23, JD.com’s 618 e-commerce promotion kicked off. As one of the most important e-commerce festivals in the domestic Internet of the year, this 618 is not only the task of boosting sales performance for JD.com, but also the first tough battle after Xu Lei took over as CEO.

Urgently need to rely on 618 to “return blood”

In fact, the loss in the first quarter of this year is not an accident. Since the third quarter of 2021, JD.com has lost three consecutive quarters, and the total amount has exceeded 10 billion.

In addition to the net profit loss, JD.com’s user growth has also experienced a significant slowdown.

According to the financial report, as of the end of the first quarter of 2022, the number of active purchasing users of JD.com in the past 12 months reached 580.5 million, compared with 569.7 million in the fourth quarter of last year, a month-on-month increase of only 1.8%.

You know, during the Spring Festival this year, JD.com spent 1.5 billion red envelopes to sponsor CCTV’s Spring Festival Gala, trying to bring new platform to the platform, but from the results, it seems that it has achieved few results.

With losses and a decline in user growth, JD.com has to pin its hopes on the upcoming 618 promotion.

Xu Lei said at the financial report conference, “Due to the epidemic and other reasons, the sales pressure of brands and merchants is very high, so we see that this year, brands and merchants will participate more actively in JD 618 activities than in previous years. We also hope that the epidemic situation will improve. Under the premise of this, JD.com can make good use of this sales node to improve its operating performance in the second quarter as much as possible.”

But the competition for the 618 is fierce this time around. From the perspective of external competition, both Tmall and Douyin have announced this year’s 618-related preferential activities and spike policies, and red envelope (preferential) activities such as Pinduoduo, Suning, and Vipshop have also begun. Kuaishou, Xiaohongshu, etc. have not been disclosed. Details of the relevant activities, but it is certain that they will not be absent from this mid-year feast.

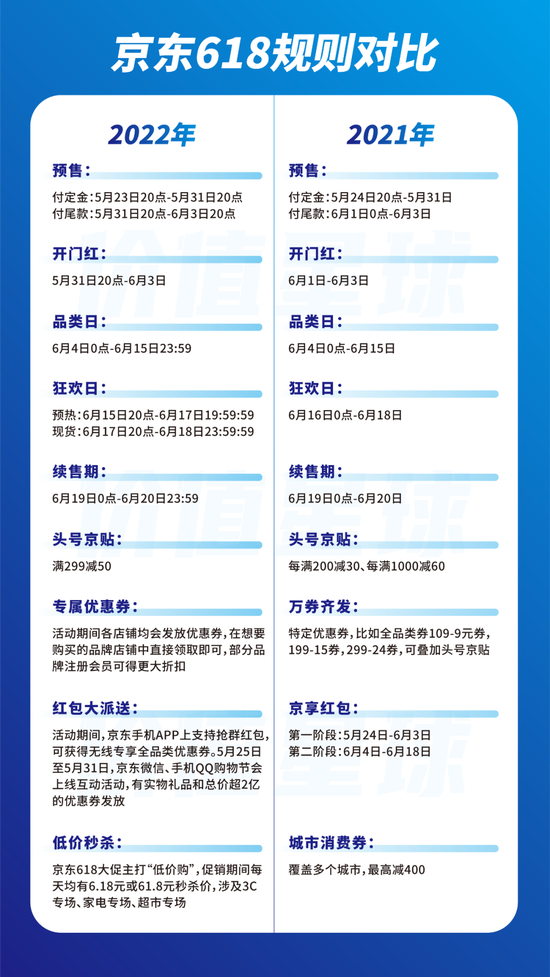

Within JD.com, this year’s 618 offers have been greatly improved compared to last year. From the time point of view, this year’s 618 started on May 23, one day earlier than last year; the Beijing post event has also increased from last year’s 200 deductions to 50 per 299 deductions this year; it also launched a daily spike price event, involving 3C session, home appliance session, supermarket session.

In addition, during this year’s 618, JD.com also joined millions of offline physical stores to achieve the same frequency online and offline. These stores include two types, one is JD’s self-operated stores, such as JD Home, JD Electric Super Experience Store, JD Mall, etc.; the other is instant retail stores, such as Wal-Mart, China Resources Vanguard, Apple Authorized Reseller Stores and other entities Brand stores can achieve minute-level delivery of 150,000 categories of goods in 1,700 counties and districts.

In order to better sprint performance, Jingdong strives to “win” merchants to participate in this year’s 618 event. JD Retail has released as many as 30 “three reductions and three excellent” merchant support measures, namely reducing costs, reducing assessments, reducing risks, optimizing rules, optimizing efficiency, and optimizing services, hoping to help merchants in JD 618’s input-output ratio at least increase 20%.

Lao Xu’s burden is not light

In an earlier earnings conference call, Xu Lei said bluntly, “This epidemic is a double kill for both online and offline companies.”

The implication is that JD.com is also deeply affected by the epidemic, so JD.com has started to “reduce costs and increase efficiency” since the beginning of the year, and this action is also reflected in the financial report.

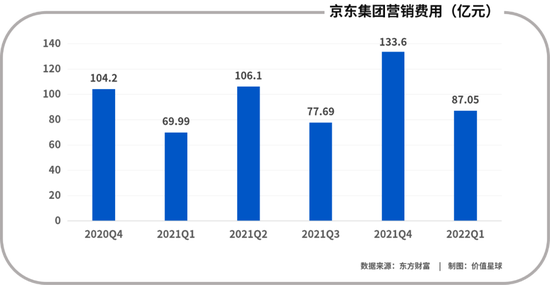

In the first quarter of this year, Jingdong Group’s core management expenses, research and development costs and marketing expenses were greatly controlled.

In the first quarter, JD.com’s management expenses were about 2.5 billion. Compared with the growth rate of 200%-300% in the previous quarters, this figure slowed down to 11.2% in this quarter; R&D expenses were about 4.4 billion, down 3.2% year-on-year; marketing expenses were about 8.7 billion yuan, a year-on-year increase of 24.4%, but excluding the 1.5 billion yuan spent on the Spring Festival Gala, the net increase is actually not much.

In addition to the reduction of the above-mentioned core expenses, JD.com has also taken measures to reduce costs and increase efficiency such as layoffs and new business reductions.

At the end of March, JD.com’s social platform released a “Graduation Notice” to employees, which caused heated discussions. According to information exposed on the Internet, JD.com’s personnel called the layoff letter “Graduation Notice”. A document circulated on the Internet shows that the layoffs cover a wide range of business lines. Many business units in multiple sectors such as Jingxi, Jingdong International, Jingdong Retail, Jingdong Logistics, and Jingdong Technology have set layoff ratios, most of which are 10%. -30%.

In addition, the new business “Jingxi Pinpin”, which had been highly anticipated before, also underwent a major contraction. It is reported that the proportion of Jingxi Pinpin layoffs may be 10-15% or even more. Synchronized with the shrinking of personnel, there is also the shrinking of strategic areas-Jingxi Pinpin has shrunk to the point where only 4 provinces with good performance of the UE model (single economic model) remain, and the rest of the provinces have been shut down.

One side is to reduce costs, and the other side is to lay off business and manpower, but it still seems that the dilemma of large losses has not been reversed. As the new CEO who just took over in April, Xu Lei’s burden is not light.

On the other hand, more and more new uncertainties appear, which also makes the prospects of this 618 less clear.

First of all, Xu Lei admitted at the first-quarter earnings conference that the first-tier cities are affected by the epidemic, especially the proportion of JD.com sales in Beijing and Shanghai is higher than most cities in the country. “We saw a marked increase in the cancellation rate of orders in April due to longer (fulfillment cycles) and improved in May, but it was still higher than last year.”

At this stage, the anti-epidemic efforts in Beijing and Shanghai are still in the critical period of “going against the current, not advancing or retreating”, and the performance cost of JD Logistics is still facing challenges. North China, which relies on warehouses in Beijing, and East China, which relies on warehouses in Shanghai, are shrouded in a shadow of uncertainty.

Second, the consumption habits of young consumers are also changing. In 2020, the School of Journalism and Communication of Beijing Normal University will hold the 2020 seminar on “The ‘Fighting’ Life of New Youth in the New Consumption Era”. At the meeting, the research group of Beijing Normal University believes that in the use of online media and online consumption, there is an influx of people. A large number of post-95s new youth groups. The “2020 New Youth New Domestic Products Consumption Trend Report” released at the meeting shows that among the three current e-commerce platforms, Pinduoduo has the highest proportion of young people, of which the proportion of post-95 users has reached 32%.

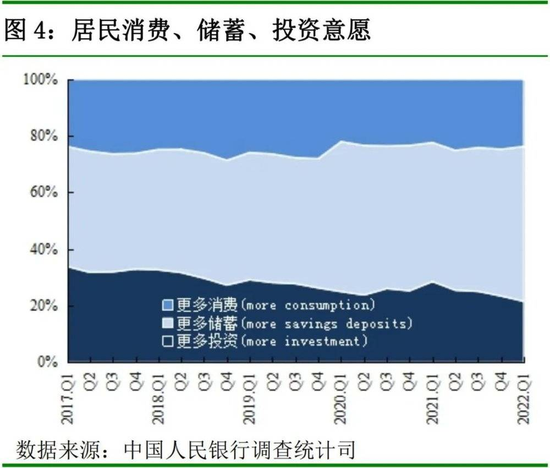

Source: Questionnaire survey of urban depositors by the People’s Bank of China

Source: Questionnaire survey of urban depositors by the People’s Bank of ChinaFinally, even if the 618 promotion is not small this time, it seems more and more difficult to really get money from consumers’ pockets. As we all know, the basic disk of Jingdong is 3C home appliance digital products. However, in the first quarter of 2022, the retail sales of home appliances in China was 143 billion yuan, a year-on-year decrease of 11.1%; the total mobile phone shipments in the domestic market totaled 69.346 million units, a year-on-year decrease of 29.2%. Moreover, the People’s Bank of China survey of urban depositors shows that as of Q1 2022, 54.7% of residents prefer “more savings” rather than “more consumption”, an increase of 2.9% from Q4 in 2021.

So it may not be as easy as you think to rely on 618 to quickly boost JD.com’s sales.

Summarize

In 2013, Xu Lei took over the marketing department of Jingdong. The first big exam he ushered in was the mid-year promotion the following year.

At that time, the “Double 11” created by Zhang Yong had evolved from the behavior of the Taobao family into a carnival almost on the entire network. In order to respond, JD.com simply organized a mid-year promotion that lasted throughout June. It turned out afterwards that it was unrealistic to try to use 30 days to compare Ali for 1 day, and JD.com needed a “festival” of its own.

In the internal seminar of JD.com, Xu Lei strongly supported the selection of “618” as JD.com’s big promotion node, and strengthened its contrast with “Double 11”. It’s a pity that the results of the meeting on the day were not ideal. Including Xu Lei himself, only 3 people in the whole venue supported 618.

However, Xu Lei finally persuaded Liu Qiangdong and put the idea of 618 into practice. This difficult decision laid the foundation for the future split between Ali and JD.com in the e-commerce field, and also allowed consumers to enjoy the “biggest discounts” in June and November.

According to JD.com’s investor website, Xu Lei’s main work achievements in JD.com also include leading the company’s transformation from 360buy to JD.com, launching JD.com’s mascot Joy, launching e-commerce membership service JD.com Plus, super brand day strategic marketing projects and third-party E-Commerce Solutions Kepler.

The above achievements have helped Xu Lei successfully become Liu Qiangdong’s successor, but now, what Xu Lei has to do is to help JD.com make a profit.

*Cover source: JD.com 618 promotional image.

References:

[1] “JD.com: Performance remains strong despite multiple headwinds”, China Merchants Securities International

[2] “The “618” Shopping Festival has different rules for each platform, and beauty brands are fighting with all their strength, Minsheng Securities

[3] “What can you use to save JD.com’s profit? “, outside and inside

*This article is based on public information and is only for information exchange and does not constitute any investment advice

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-05-30/doc-imizirau5609689.shtml

This site is for inclusion only, and the copyright belongs to the original author.