Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Chen Yan

Source/Zinc Finance (ID: xincaijing)

Large-scale dream break scene.

Recently, the Shenzhen Stock Exchange disclosed information that, due to the application of Think Creation to withdraw the application documents for issuance and listing, according to the review regulations, it has decided to terminate the review of its initial public offering and listing on the Growth Enterprise Market. For a time, the whole network of news swiped, and sighs swept over.

In order to win the title of “the first share of knowledge payment”, Mind Creation has taken great pains. Since submitting the application for listing on the ChiNext Board on September 25, 2020, I have been waiting in line for nearly two years. During this period, seven versions of the prospectus have been updated. After three rounds of exchange inquiries, a total of 67 questions were asked. Data issues were suspended for review.

The vests of the listing application were changed again and again, but the IPO trip came to an abrupt end.

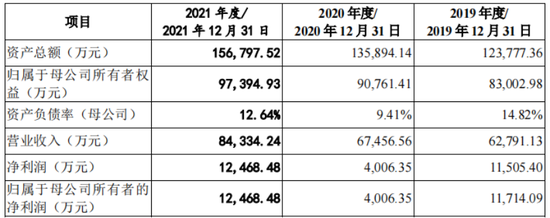

This time, it may be the closest moment in the past few years to the IPO bell. The financial report data shows that from 2019 to 2021, Think Creation achieved revenue of about 628 million yuan, 675 million yuan, and 843 million yuan respectively, with a compound annual growth rate of 15.89%, and net profit attributable to the parent was about 115 million yuan and 40.0635 million yuan. , 125 million yuan, a record high in 2021.

Source: Mind Creation Prospectus

However, the upsurge of the era of knowledge payment has passed, and the rise of short videos has made the dissemination of knowledge more diverse. Under the mainstream rhetoric of anti-involution and lying flat, young people’s crusade against Luo Zhenyu’s “selling anxiety” is endless. Knowledge payment may be a pseudo-concept, and there is no need to spend money to buy classes to reduce anxiety.

The failure of the IPO also means that the imagination of Mind Creation in the capital market is limited, and the ceiling of knowledge payment is too low. As the founder of Mind Creation, Luo Zhenyu urgently needs to find new stories.

Missed the IPO, not wrong

Thinking Creation has been submitting the form and changing the form in the past two years. After so much tossing, how could it voluntarily withdraw the application?

The official statement of Thinking Creation is that the company decided to withdraw its listing application based on comprehensive consideration of various factors such as communication with the regulatory authorities and the current market environment. As for the follow-up listing plans and other issues, there is no further news.

Everyone knows that the market environment is not ideal, and it is not a problem encountered by a company created by thinking. Perhaps the more critical reason is that Mind Creation realizes that, as an educational service company with no obvious advantages, there is a high probability that it will not pass the review by the China Securities Regulatory Commission.

In 2021, the China Securities Regulatory Commission issued the “Regulations on On-Site Inspection of IPO Enterprises” to conduct on-site inspections of the selected enterprises, and all enterprises that “break through the border with illness” will be dealt with severely, and no withdrawal is allowed. If the IPO is killed, the company will face an IPO freeze period of at least six months. After that, if it wants to go public, there will be a more stringent review process.

Official website of China Securities Regulatory Commission

Official website of China Securities Regulatory CommissionIn the whole of last year, five batches of companies that were selected for on-site IPO inspection had an overall withdrawal rate of 40%.

Thinking Creation also has similar problems. Judging from its IPO process, the company’s inquiry phase lasted 21 months. According to the company’s responses to the third round of inquiries, the GEM positioning of Mind Creation is the focus of the Shenzhen Stock Exchange’s review, that is, what are the company’s business model, product form, innovation and advantages of core technologies.

The real answer may be, no.

At present, the main business of Thinking Creation is mainly divided into three parts: online and offline knowledge service business, and e-commerce business.

Online knowledge services are online courses, audiobooks, e-books and other services provided through the “Get” App and other platforms; offline knowledge services are in the form of “Getting Advanced Research Institute” training courses, “Friends of Time” New Year’s Eve speeches, etc.; It is better to understand the commercial business, that is, selling physical books, getting peripheral products such as readers.

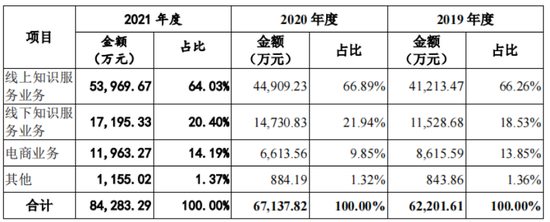

According to the prospectus, from 2019 to 2021, the revenue of online knowledge services will account for 66.26%, 66.89% and 64.03%, respectively. In other words, selling online classes is the most important source of revenue for Mind Creation.

Source: Mind Creation Prospectus

Source: Mind Creation ProspectusBut the business ceiling is low. From 2019 to 2021, the number of new paying users of the “Get” App was 911,000, 826,100 and 590,900 respectively, the willingness to pay decreased, and the number continued to decline.

In this regard, the trick that thinking creators came up with is that if there are fewer people spending money, then the price will increase. The average income of paying users in the past three years is 231.93 yuan/person, 289.15 yuan/person and 418.14 yuan/person. Although users who are willing to pay for knowledge are not considered to be price-sensitive people, the way to increase prices and increase income is really not clever, it is tantamount to drinking poison to quench thirst.

Judging from the specific teaching content, the online courses of Mind Creation are mainly based on success studies, workplace studies and popular science teaching, which are non-rigid courses. At present, the top 3 courses on the “Get” app are Ning Xiangdong’s management course, Cai Yu’s business reference, and Xiong Taihang’s relationship strategy. These courses seem to be “high-level”, but they are not very practical. The originality of the content is limited, and the personal experience is not replicable.

Screenshot of the “Get” app

Screenshot of the “Get” appLooking back at the explanation of thinking creation: the company’s innovation is reflected in the high quality of courses, high learning efficiency, low learning costs, and many learning styles. However, such a description is difficult to express with specific data and an effective growth model, so it is difficult to convince capital and the market.

Pay for knowledge, can’t run

Luo Zhenyu is not the only one in the competition for “the first share of knowledge payment”. In 2019, Wu Xiaobo’s company Ba Jiuling sold 1.5 billion yuan to all-round education, and wanted to go public and sprint for A shares, but it was in vain. Subsequently, Ba Jiuling wanted to go public by himself, but he is still doing listing counseling.

The difficulty in going public shows that the knowledge-paying companies have limited imagination and are never accepted by the capital market. The main reason is that knowledge payment is just a packaged old thing, which is essentially to reintegrate and sell second-hand knowledge. There is no technical threshold for this matter, and it is difficult for companies and platforms to form real core barriers, and its model is sustainable. Development is a big issue.

Users pay for premium content, not platforms. In this case, the content producers at the head have stronger voice and bargaining power, and platforms such as “get” are just relatively large channels for paying for knowledge. It’s hard to tell whether the platform’s traffic is its own or is it blessed by a knowledgeable V.

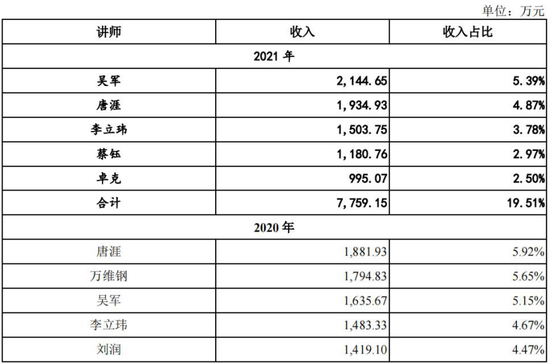

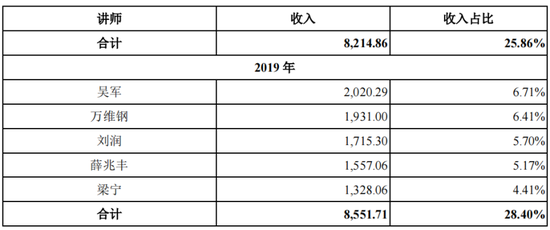

In the past few years, the head lecturers of the “get” platform have shown an amazing ability to attract money. From 2019 to 2021, the contribution income of the head lecturer Wu Jun was 20.2029 million yuan, 16.3567 million yuan and 21.4465 million yuan respectively. The total income of the top five lecturers was 85.5171 million yuan, 82.1486 million yuan and 77.5915 million yuan respectively, accounting for the course The proportion of income is 28.40%, 25.86% and 19.51% respectively, while the share of lecturers is generally 50% of net sales.

Source: Mind Creation Prospectus

Source: Mind Creation ProspectusWhat is this concept? From 2019 to 2021, after deducting non-recurring gains and losses, the net profit attributable to the parent company of Thinking Creation was 30.6757 million yuan, 28.1222 million yuan and 48.6473 million yuan respectively. That is to say, the money earned by a few top lecturers can easily catch up with the hard work of thinking creators for a whole year.

It is also a problem that companies and platforms rely too much on personal IP, such as Luo Zhenyu and Wu Xiaobo, who are not only the company’s golden brand, but also bring potential risks to the company’s development.

In the prospectus, Thinking Creation frankly admitted the risk of relying on Luo Zhenyu, and the company relies on him to a certain extent in publicity and activity organization. Business operations may be affected.

The IP personality may collapse. Fans who gather because of interests and expectations may also attack the IP itself because of the reversal of public opinion, thus affecting the company’s overall operation.

This has already happened to some extent. In recent years, Luo Zhenyu has continuously overdrawn the influence of his own IP for profit. He once praised companies such as ofo, Baofeng, and LeTV, but the reality gave him a slap in the face.

At the moment when young people shouted to lie down and oppose involution, Luo Zhenyu was labeled as “selling anxiety”. His views often seemed reasonable, but they were useless. Earlier, he mentioned in the live chat with Yu Minhong, “If you are still submitting resumes at the age of 35, it proves that the most important thing before the age of 35 has not been done, which is the ability to develop your personal connections and social networks. It’s not finished”, which caused ridicule among netizens.

In addition, video platforms such as station B, Douyin, and video accounts also bring challenges to knowledge payment companies. These platforms have a lot of free knowledge content, larger user traffic, and more out-of-the-circle knowledge bloggers. For example, Luo Xiang, the legal UP master of station B, is a good example.

“Everything is the best arrangement”

The defeat of the thinking creation is a foregone conclusion, but is Luo Zhenyu behind it really so sad?

In the face of Thinking Creation’s withdrawal of the IPO application, Luo Zhenyu responded in an internal letter, “Thank you for the experience of preparing for the listing, everything is the best arrangement.” He also revealed that in the past period of time, the company was on the one hand promoting a deep organizational change; on the other hand, it was undergoing difficult business iterations.

Is there a possibility that Luo Zhenyu will be the beneficiary regardless of the success of Thinking Creation’s listing?

At present, Luo Zhenyu directly holds 30.35% of the shares and indirectly holds 16.26% of the shares through the holding company. Therefore, Luo Zhenyu holds a total of 41.66% of the shares of Thinking Creation. If the IPO goes well, Luo Zhenyu’s worth will reach 1.3 billion yuan according to the diluted shareholding ratio.

Although the IPO of Thinking Creation has been terminated, Luo Zhenyu has already cashed out hundreds of millions of yuan with Thinking Creation in the past few years, and the investor’s money has been given to him for a long time. To sum up, Luo Zhenyu’s cash-out path is: overseas gold plating, crazy financing to raise valuations, and continuous cash-out.

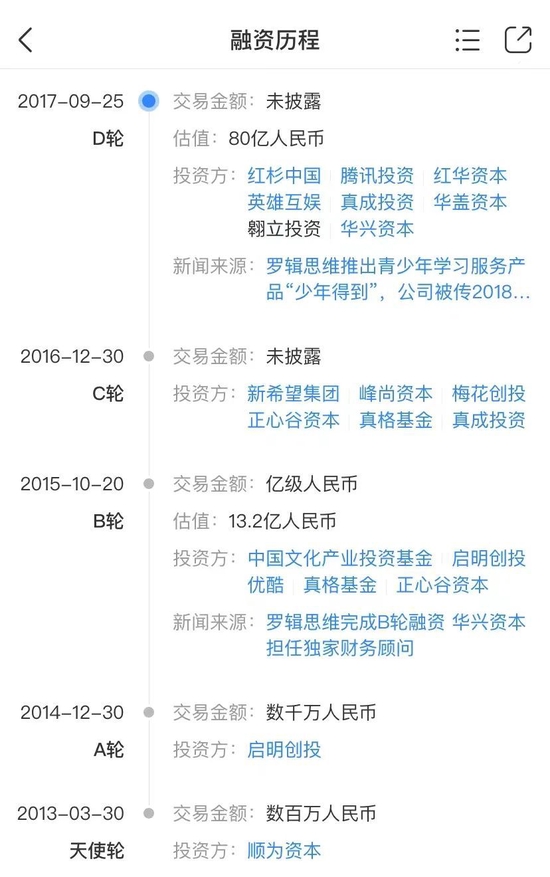

In 2014, Mind Creation began to build a red chip framework. The IPO prospectus stated that it was for overseas financing, but the actual investors were Lei Jun and Jack Ma. After Luo Zhenyu registered the company overseas, Lei Jun’s Shunwei won 6% of the shares for US$1.91 million, and Youku invested US$1.47 million for 3% of the shares.

With the original capital accumulation, after returning to China, Luo Zhenyu began to enter the cycle of continuous financing, increasing the valuation of thinking creations, and continuous cashing out.

In October 2015, Thinking Creation announced the completion of the B round of financing, led by the China Cultural Industry Fund, and Qiming Venture Capital and other investors. At this time, the valuation of Thinking Creation reached 1.32 billion yuan. By the end of the year, Luo Zhenyu cashed out 79.2 million yuan unceremoniously.

In 2016, Thinking Creation received C-round investment from investors such as ZhenFund, New Hope Group, and Meihua Venture Capital. At this time, the valuation has reached 3.6 billion yuan. Luo Zhenyu and Li Tiantian, another founder of the company, cashed out 156 million yuan together.

By 2017, after the completion of the last round of D round of financing, the valuation of the outside world has reached 8 billion yuan. Taking this opportunity, Luo Zhenyu cashed out another 189 million yuan.

Screenshot of Tianyancha, the financing process of thinking and creation

Screenshot of Tianyancha, the financing process of thinking and creationIt is hard to say whether Mind Creation can continue to pay for knowledge and achieve more profits. The market is still waiting to see, but Luo Zhenyu is really a businessman pretending to be a literati and making up a circle of stories. He has made money from investors in the past few years. .

After the IPO of Mind Creation fails, the difficulty factor of landing in the capital market will only continue to increase. I wonder if Luo Zhenyu, who has made a lot of money, has thought about how to play the next cards.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-08-10/doc-imizmscv5674151.shtml

This site is for inclusion only, and the copyright belongs to the original author.