#Investment alchemy season in 2022#

$Vanke A(SZ000002)$ $Vanke Enterprise(02202)$

One, the basic overview.

In the first half of 2022, the Group achieved operating income of RMB 206.92 billion, a year-on-year increase of 23.8%;

The net profit attributable to shareholders of the listed company was 12.22 billion yuan, a year-on-year increase of 10.6%;

Fully diluted ROE was 5.22%, an increase of 0.24 percentage points over the same period of the previous year.

Break it down:

First, the increase in revenue was mainly attributable to the increase in settlement items. Although the gross profit margin of the housing business is still at a relatively low level, there is still a relatively obvious recovery from the first quarter.

The real estate development business achieved revenue of 191.672 billion yuan, a year-on-year increase of 21.68%. Below the average for total revenue growth; gross margin was 20.85%, slightly higher than the aggregate level of 20.46%.

Second, the property service business grew strongly, achieving revenue of 12.192 billion yuan, a year-on-year increase of 42.19%.

Third, logistics and warehousing, rental housing, commercial operations, and other businesses maintained a good growth rate. In particular, the revenue of warehousing and logistics business under the “urban operation service” strategy increased by 39.1% year-on-year.

Second, the financial situation remained stable.

During the reporting period:

First, the comprehensive financing cost rate was 4.08%, which continued to decrease from 4.11% at the beginning of the year;

Second, the net debt ratio was 35.52%, a slight increase of 5.83 percentage points from 29.69% at the beginning of the year.

It can be seen that in the first half of the year, in the face of industry sales pressure, the company did maintain the business strategy of “living within our means”, but only slightly increased the scale of interest-bearing liabilities.

And here we also have to consider: based on the opportunity of the continuous decline of the real interest rate in the first half of the year, the company also has to optimize the debt structure, appropriately increase the liquidity, and improve the security of funds, etc. Considerations.

Third, in the first half of 2022, the Group achieved a sales area of 12.907 million square meters and a sales amount of 215.29 billion yuan, down 41.1% and 39.3% year-on-year respectively.

Against such a background, the scale of new construction has declined, but the military industry has maintained growth.

The former is based on “determining production based on sales”, while the latter focuses on “delivering money back.

First half of 2022:

The newly started capacity area of the development business was about 10.688 million square meters, a year-on-year decrease of 38.9%, and completed 55.7% of the plan at the beginning of the year, compared with 55.5% in the same period last year;

The completed capacity area of the development business was approximately 14.437 million square meters, a year-on-year increase of 17.8%, 37.0% of the plan at the beginning of the year, and 34.2% in the same period last year. There is basically no problem in completing the full year plan.

Three, future performance eggs.

First look at a set of data:

In the first half of the year, the total GFA of the Group’s projects under construction was approximately 100.074 million square meters, and the equity-based GFA was approximately 62.815 million square meters;

The total construction area of the planned projects is approximately 37.154 million square meters, and the equity-based construction area is approximately 23.459 million square meters.

The planned capacity area of the new project is 3,077,800 square meters, and the equity capacity area is 2,130,900 square meters.

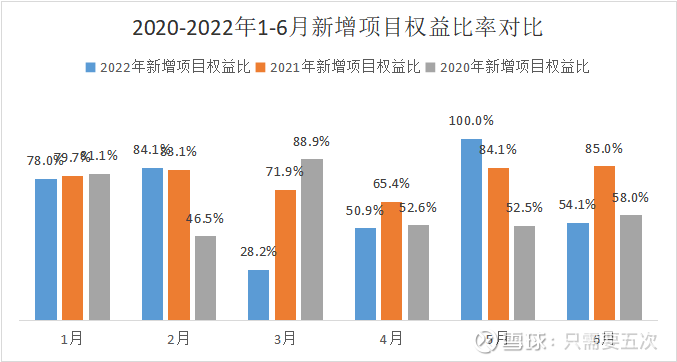

The former’s equity ratio is almost around 63%, while the latter’s equity ratio can reach 69.23%.

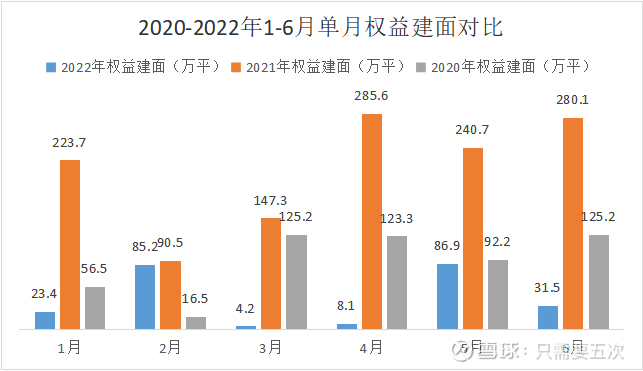

Combined with the trend chart of new project rights and interests that I have counted before:

It can be seen that the upward trend in the equity ratio of Vanke settlement projects in the future should be a high probability event.

If combined with the recovery of the current and future gross profit margins of land market projects and the increase in market concentration of leading companies, I think the performance pressure will be effectively hedged.

To borrow the words of Vanke CEO and COO Liu Xiao at the interim results conference: Vanke insisted on living within our means while acquiring land in the first half of the year, while attaching great importance to acquiring particularly good projects. . . In the early stage, a total of 21 projects have been acquired with Vanke, with a total land acquisition amount of 45.2 billion yuan. All these projects meet the above investment standards without exception.

Fourth, the current situation and trend of the industry.

When reading Vanke’s performance report, I think a very important part is to pay attention to the company’s management’s judgment and goals for the industry status and future development. After all, over the years, Vanke has made correct judgments at key points in most industry cycles.

In the content of this interim report, I think there are several data worthy of everyone’s good taste:

First, the sales area of commercial housing across the country dropped sharply, and real estate development investment turned negative year-on-year.

The sales area of commercial housing nationwide was 689 million square meters, a year-on-year decrease of 22.2%; the sales amount was 6.61 trillion yuan, a year-on-year decrease of 28.9%.

The national real estate development investment completed a year-on-year decrease of 5.4%.

I have pointed out in my usual opinion:

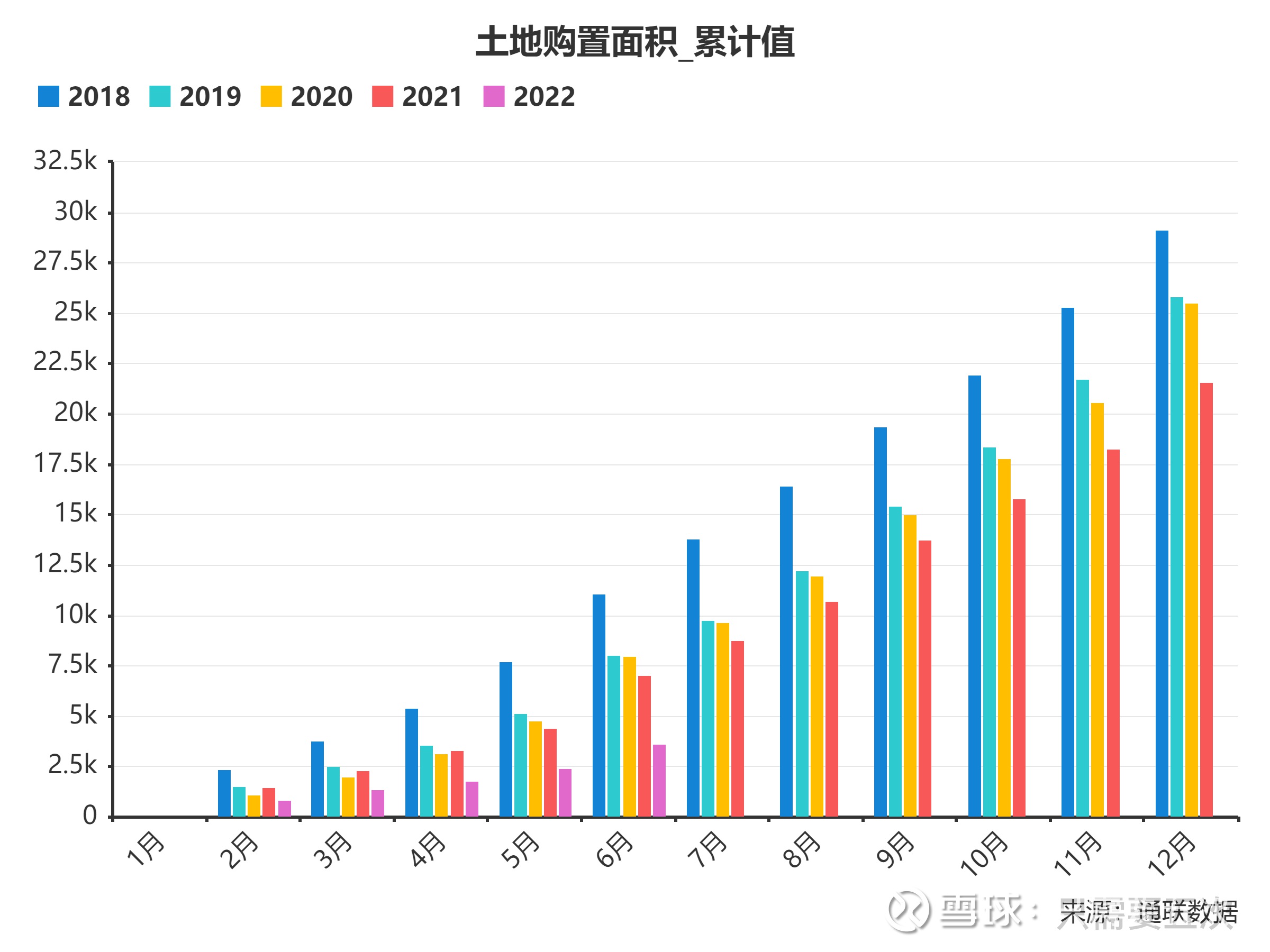

First of all, if real estate companies do not want to increase leverage, they can only “determine production based on sales”. To put it bluntly, the amount of land acquired is in an appropriate proportion with the sales situation. In the past, when many real estate enterprises had demands for scale, the willingness of enterprises to leverage was relatively strong. But now, in the context of three red lines and financing constraints, being able to “survive” is the primary goal.

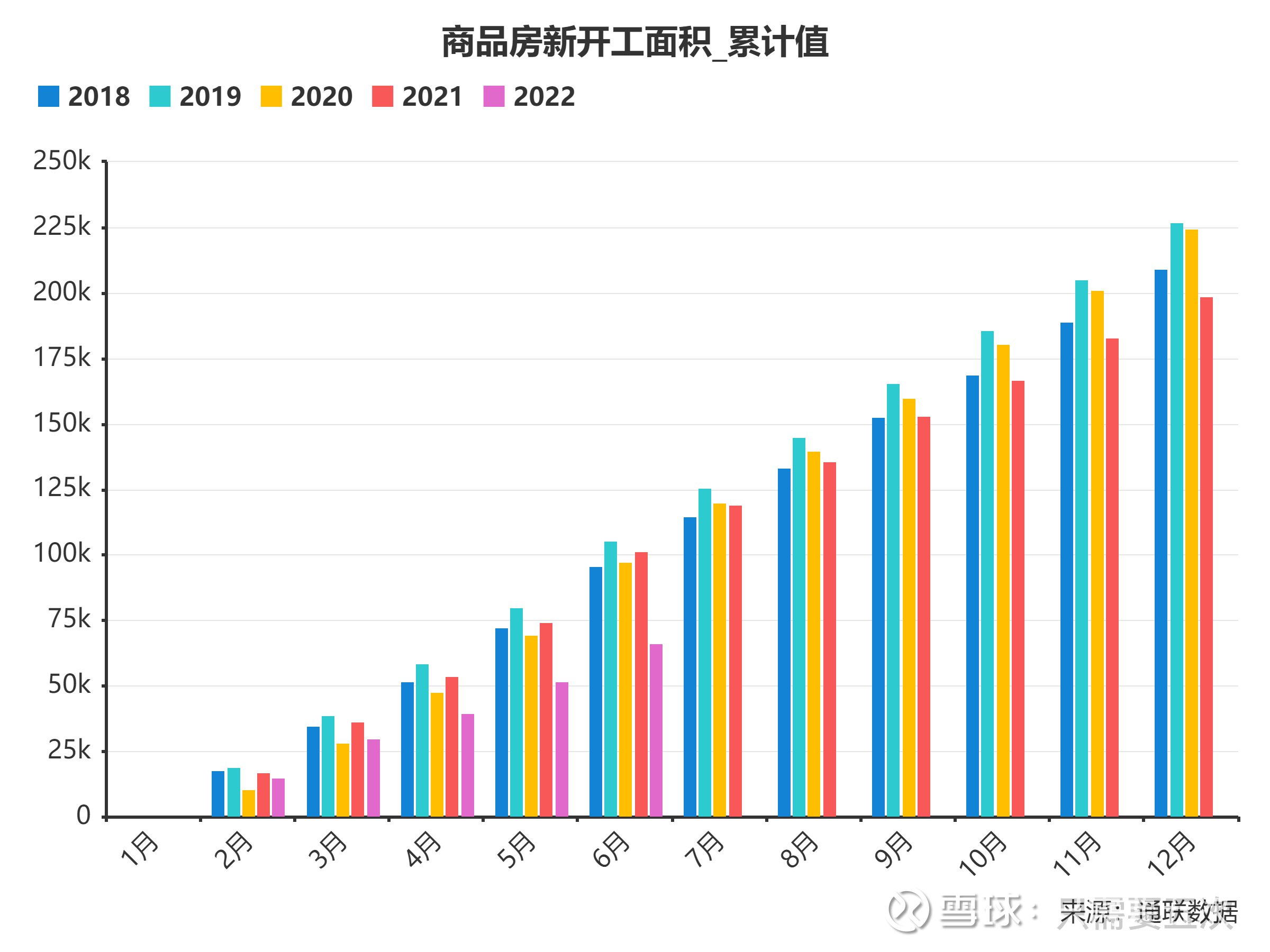

Secondly, there are two areas that investors must pay close attention to as to the real estate development and investment situation: one is the newly added land acquisition area; the other is the newly started construction. These two pieces of data are completely dependent on sales and financing. Therefore, everyone will find that after a circle, it returns to the beginning of logic – sales. No sales, all in vain.

Finally, newly acquired land area and newly started area are forward-looking indicators for future real estate investment.

In other words: the current sales situation determines the future new land acquisition, the land acquisition situation determines the future new construction situation, and the new construction and the new land acquisition together determine the further future industry investment situation. The extent of the abyss of influence can be made up for yourself.

I can provide some pictures here for your reference:

Second, the area of newly started construction has dropped significantly and started to be lower than the area of new sales.

In the first half of the year, the newly started housing area was 664.23 million square meters, a year-on-year decrease of -34.4%.

Among them, the newly started residential area was 488 million square meters, a year-on-year decrease of -35.4%.

More importantly, the 664.23 million square meters of “new housing construction area” has begun to be smaller than the 68.23 million square meters of “commercial housing sales area”.

Friends who know me know that a relatively important logic for my current real estate stock investment is the supply and demand cycle. Looking at this set of data, everyone should have been able to clearly understand the truth.

When most of the voices in the market are currently discussing the future population trends and the impact of the industry sales ceiling on the industry, I think everyone should return to the reality that the data itself tells us what we should pay attention to first.

Fifth, demographic trends determine changes in demand structure.

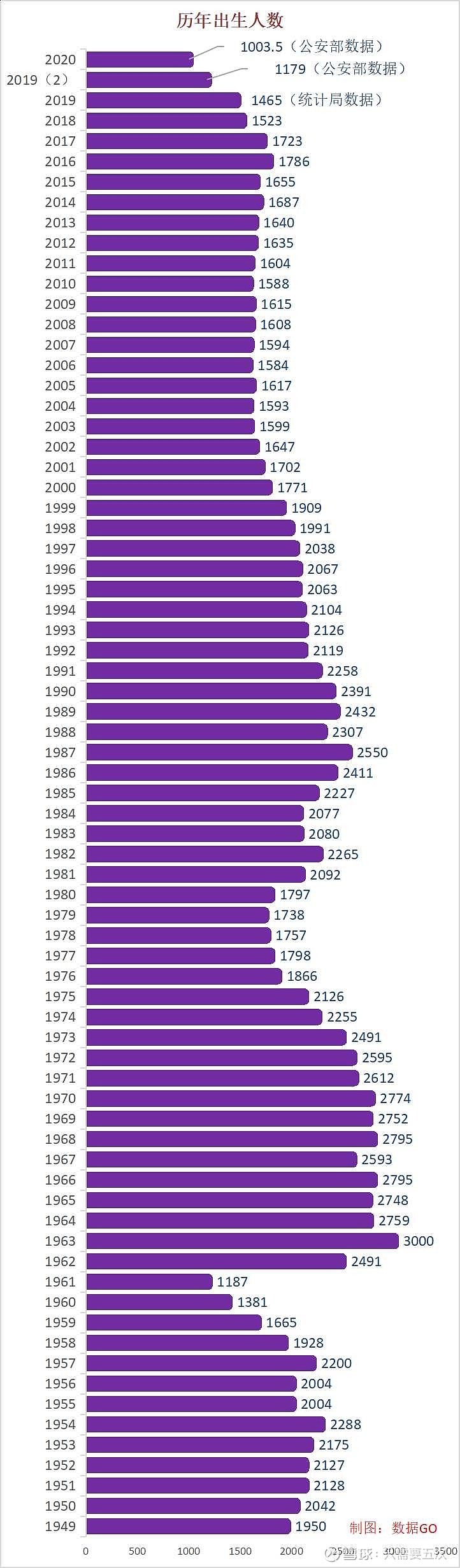

Here is a picture that I have used many times:

From the figure it can be inferred that:

2022-30=1992

Counting from 1992 and counting back about seven years, it is almost as follows:

From 1992 to 1998, the age group contributed “just need”;

2022-30-(10~15)=1977~1982

If you continue to count forward 10 to 15 years in 1992, it is almost as follows:

“Post-75s” and “Pre-85s” contribute to “improving” needs.

In other words, the future industry is “rigid demand + improvement” to jointly provide demand. And over time, the proportion of “improvement needs” will continue to increase. Investors mainly consider three factors in the process of investing in this industry in the future: financial security, population inflow, and product type.

Sixth, valuation.

I look at the current valuation of Vanke from three perspectives:

First, from the price-to-book ratio provided by Snowball, Vanke is currently 0.82PB, with a quantile value of 0.97.

Basically at all-time low regional levels.

Second, from the perspective of dividend yield.

Friends who follow me know that since the company disclosed its first quarterly report, I have calculated the expected dividend rate of Vanke next year at the current price based on the expected profit growth rate of 5% and 10%:

1.94×1.05x(0.35~0.40)/16.63=4.28%~4.89%;

1.94×1.10x(0.35~0.40)/16.63=4.49%~5.13%.

Third, do a simple calculation:

18×0.7×0.05×0.7x(0.08~0.1)=35.2~44.1 billion yuan.

Briefly explain:

The 18 trillion market shrinks by 30%, gets 5% market share, 70% project equity ratio, 8%~10% net profit rate, and finally can achieve a net profit level of 35.2~44.1 billion yuan.

The corresponding valuation is 4.4-5.5PE.

Combined with the actual situation:

1. As mentioned above, the newly started area of the market is already lower than the newly added sales area, so it can be said that the current market expectations have been overly pessimistic. In other words, if you want to match supply and demand in the future, the current shrinking sales situation is unsustainable.

2. Combining the sales data of Vanke in the past two years, it can be seen from the calculation that the current market share of Vanke is actually less than 4%. So there is definitely room for improvement.

3. At present, most leading companies are actually increasing the project equity ratio.

Actually this is also quite understandable:

On the one hand, the current financial situation makes many leading real estate companies not very confident to find reliable partners;

On the other hand, according to the current interest rate situation, leverage situation, and the potential profit situation of the project, many leading companies are not very motivated to find partners. Unless it has more ideas for scale expansion.

4. Net profit margin.

In the future, even if real estate development is regarded as a manufacturing industry, a net interest rate of 8% to 10% is very reasonable or even conservative for outstanding manufacturing companies.

in conclusion:

Looking at the interim report as a whole, we can really feel Vanke’s business strategy of “focusing on stability”.

Different investors and even different companies may have different views and coping strategies when faced with the status quo of the industry. However, as Vanke, who has made correct judgments at key points in the industry cycle many times, I think it is the wisest choice to continue to give the company and management the necessary trust.

@Investment Alchemy Season @Today’s topic @Player welfare

There are 2 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/2301623438/229680190

This site is for inclusion only, and the copyright belongs to the original author.