Many people are confused about Buffett selling trams to buy oil in recent months. This does not conform to the logic of the market. In recent months, the sales of trams have increased several times compared to last year. Yes, this is just not in line with the logic of the market, but I think Is it logically true? I think Buffett’s behavior is completely in line with investment logic.

Not to mention that in the past few years, most people think that the pro-cyclical tram is a sea of stars and it is unreasonable for the market to give 100 times the price-earnings ratio of giant market capitalization companies; it also does not discuss whether most people think that fossil energy is the yellow flower of yesterday and the price-earnings ratio of 3 times the counter-cyclical is underestimated. …….I am personally interested in how the facts of the industry and individual companies are evolving? Whether the trend of fact evolution will be completely contrary to the intuitive perception of most people, I do not rule it out, this is the biggest risk of investment perception and logical prediction. Why does this happen?

The root cause of the strong cycle is nothing more than the back-and-forth conversion between supply in short supply and oversupply. The key to understanding future supply and demand lies in understanding the impact of dynamic variables of supply and demand on price and gross profit, and continuing to track and observe changes in supply and demand.

A certain industry, such as trams, is currently pro-cyclical, in short supply, and in great demand. Therefore, some people put the industry increment equal to giving 100 times the price-earnings ratio to the giant market value companies in this industry. What is the risk? The risk is that the demand is limited by the shortage of extremely super charging facilities, which leads to a great decrease in the charging efficiency and poor experience in public places, and even the power supply is limited at certain times, which makes it impossible to charge, and aging brings a series of safety problems. It is possible and is expanding production capacity indefinitely, which will lead to the next time the industry will compete for market share and cost and reduce quality…. In the end, even if the industry expands, it does not mean that individual enterprises will be more profitable, because the threshold is too low, and the ability to expand the production capacity of peers indefinitely leads to oversupply. , Everyone is fighting for costs, and often the rising stars will have lighter historical burdens and can be faster… So, the giant market capitalization companies with a current listing-to-earnings ratio of more than 100 times can still grow by 10 times? The industry is likely to continue to increase demand and supply but specific to the individual business, is the increment you? Will gross margins be squeezed? Even if the most splendid sales surge has brought profits that can support the valuation?

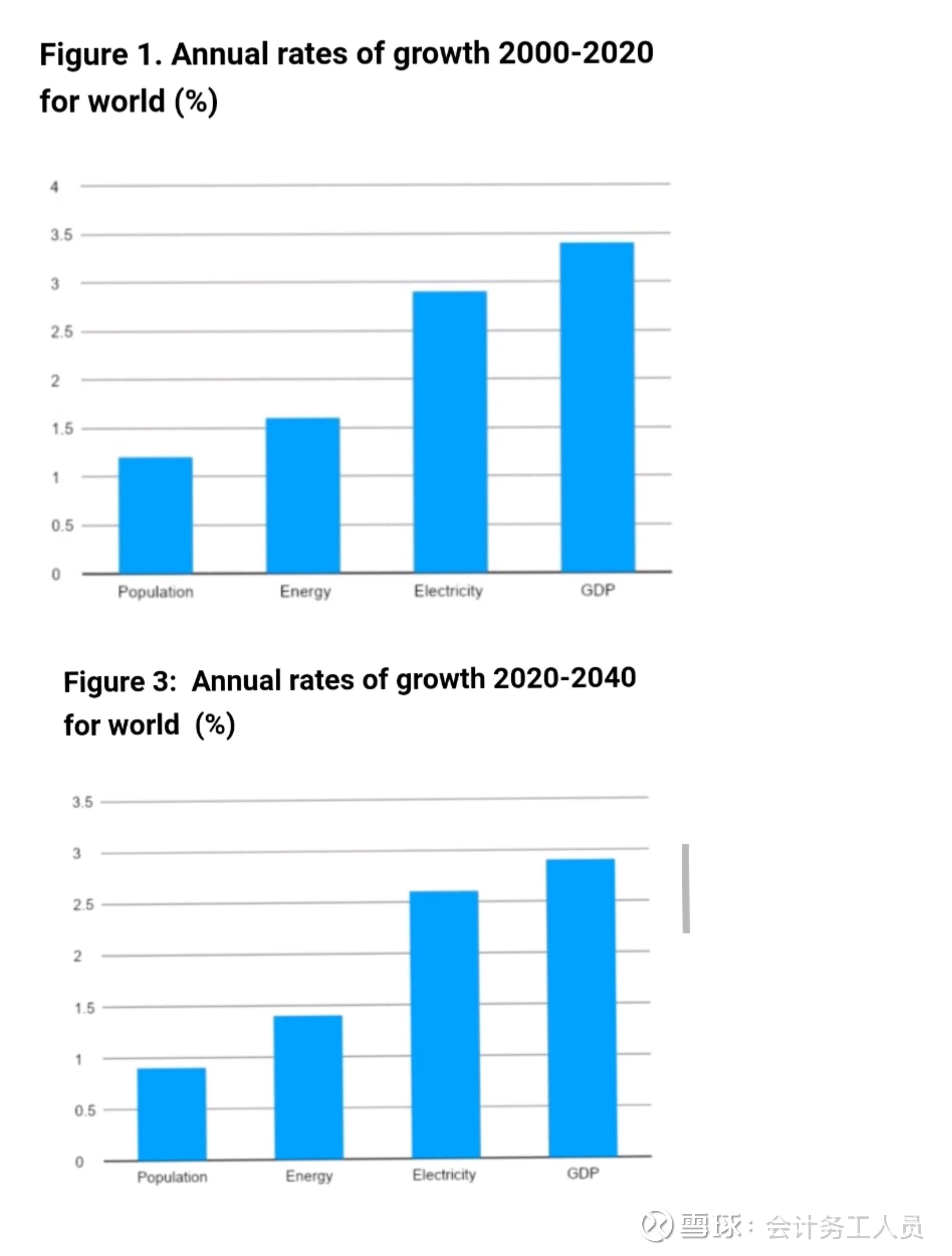

However, fossil energy such as oil, coal and natural gas has not actually declined as predicted by the market in recent years. On the contrary, the actual demand is growing slowly, and the future increase brought by the rising Asia-Pacific represented by India and Vietnam is very large. Yes, but the production capacity at the supply side naturally declines by 2%-4% every year. Insufficient investment will make the supply more fragile, and the final comprehensive utilization cost of the existing fossil energy has an accelerated trend. Whether it is oil or coal, it is the most suitable for large-scale economy. The mined reserves of petroleum and coal have almost declined, and the final utilization cost of new mines is accelerating, which is determined by the lack of equivalent reserves that can be economically exploited for large mines.

The “incorrect” suppression of fossil energy has accelerated the decline of old mines that account for most of the production capacity, and the economical mining of new mines cannot be as readily available as before. The limitation of insufficient investment requires many years of high investment to improve, the actual consumption growth, the actual cycle The trends in supply, demand and price evolution may be completely different from what the market perceives today.

Therefore, looking at the certainty of the future from the evolution of cyclical supply and demand: I personally predict (including dynamics) that the certainty of fossil energy with high reserves and low cost is much higher than that of the tram industry that can expand indefinitely. If the consideration of valuation is superimposed, Buffett’s strategy of selling cars and buying oil is completely in line with my personal logical thinking.

$CNOOC(00883)$ $China Coal Energy(01898)$ $CNOOC(SH600938)$

There are 15 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/2792218779/229950497

This site is for inclusion only, and the copyright belongs to the original author.