Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Chen Wenqi

Source: True Detective AlphaSeeker (ID: deep_insights)

The “SaaS originator”, regarded by many SaaS companies as a benchmark and an industry ceiling, is encountering unprecedented challenges.

Recently, Salesforce released its results for the second quarter of fiscal 2023 (ending on July 31). Although revenue and earnings per share both exceeded Wall Street expectations this year, Salesforce stock fell 7% in extended trading on the day. This year, Salesforce shares have fallen 37%.

In the earnings report, a lot of data showed red flags:

-

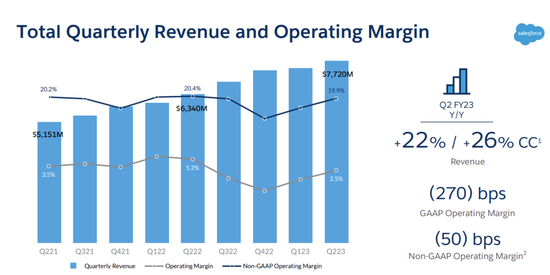

In FY2023Q2, its revenue rose slightly and its net profit fell sharply: Salesforce’s Q2 revenue was US$7.720 billion, a year-on-year increase of 22%, and its net profit was US$68 million, down 87% from US$535 million in the same period last year.

-

Second full-year earnings cut: Salesforce now expects full-year revenue of $30.9 billion to $31.0 billion (including $800 million of negative foreign exchange impacts) and EPS of $4.71 to $4.73, up from the previous The forecast for the quarter was $31.7 billion to $31.8 billion and earnings per share of $4.74 to $4.76. Its FY23Q3 revenue is expected to rise 14% to $7.8 billion, which would be the slowest quarter in the company’s history, according to S&P Global Market Intelligence.

-

Separately, Salesforce announced its first $10 billion share repurchase program, and in the post-earnings call, the company said the repurchase program was a sign of the company’s confidence in its business prospects, but obviously, it’s more for shareholders an account.

With slowing revenue growth, poor profitability, and poor secondary market performance, Salesforce, the CRM giant and the strategic target of countless SaaS companies, seems to have a hard time reversing the downturn in the short term.

It’s not just Salesforce, the SaaS industry saw various IPOs and skyrocketing valuations last year, and this year, it’s collectively dying. Bessemer’s Emcloud index (an important indicator in the cloud and SaaS industry) has lost its momentum to far outperform the broader market this year. It has turned around and the valuation multiples of related companies have retreated significantly. For example, last year’s big bull stock, Snowflake, has now fell below the issue price.

What are the fluctuation factors behind the rapid turnaround, and what enlightenment can this give to domestic SaaS companies?

Source of historical performance of Emcloud index: Bessemer official website

Source of historical performance of Emcloud index: Bessemer official websiteIs Salesforce increasing revenue or not?

From the perspective of revenue and revenue growth in the quarter, Salesforce’s fundamentals are still solid, maintaining a growth rate of more than 20% on a huge base, and its total Q2 revenue reached $7.72 billion.

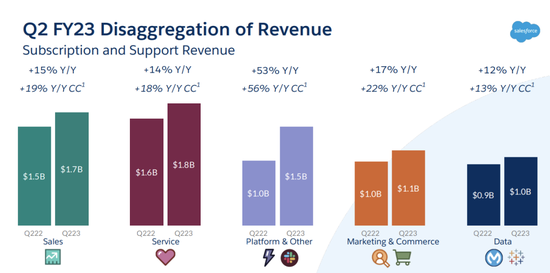

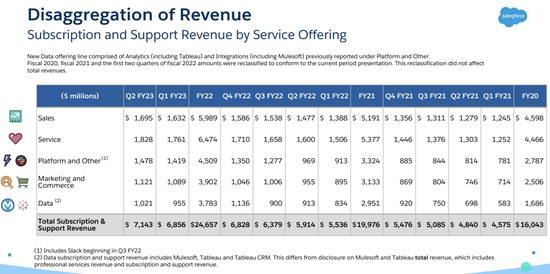

Dismantling the business, Salesforce’s revenue sources are divided into two parts, subscription and support revenue, professional services and other businesses. Among them, the former is the bulk of revenue, with FY23Q2 revenue of US$7.143 billion, an increase of 21% compared with US$5.914 billion in the same period last year, accounting for 93% of total revenue.

This part of the business is divided into five parts: sales cloud (sales), customer service cloud (service), platform and application (platform&others), marketing and commerce (marketing&commerce) and data analysis (data). Among them, Slack, the office collaboration platform acquired by Salesforce in 2020, was merged into the platform and application segment, which achieved a year-on-year growth of 53% this quarter.

Sources of Salesforce revenue by business segment Source: Company financial report

Sources of Salesforce revenue by business segment Source: Company financial reportSalesforce’s growth in fundamentals and revenue is obvious to all, and what’s more worrying is its volatile profitability.

In the reported fiscal quarter, Salesforce’s gross profit was $5.593 billion, accounting for 72% of total revenue, compared with 75% in the same period last year, and the gross profit level has been at a high level. However, the Q2 operating profit was $193 million, the operating profit margin under GAAP was only 2.5%, a decrease of 2.7 percentage points from the same period last year, and the operating profit margin under Non-GAAP was 19.9%.

Salesforce operating profit margin trend source: company financial report

Salesforce operating profit margin trend source: company financial reportExplaining Salesforce’s “no profit increase” is not that Salesforce does not make money, but that it invests its profits in frequent external acquisitions.

Salesforce started from CRM, and gradually built a comprehensive layout of the PaaS/SaaS ecosystem. Acquisition/M&A is an important means. Among them, several major acquisitions include Mulesoft, an application integration platform of US$6.5 billion, and a data analysis platform of US$15.7 billion. $22.7 billion in Slack.

The purpose of the acquisition is for future development, and the “card position” faces competition, but at the same time, it will inevitably bring pressure on financial and organizational integration.

Even if its own ecological layout is increasingly complete, Salesforce cannot ignore the threat from its opponents.

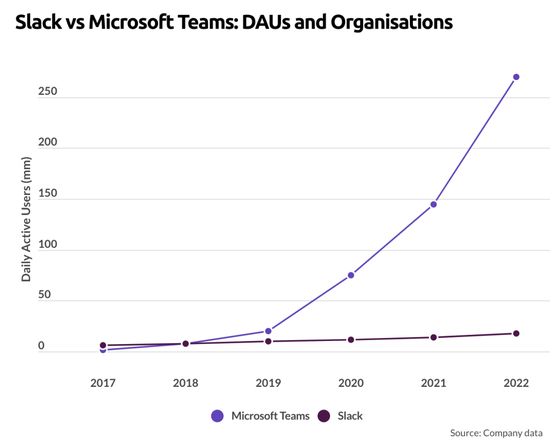

On the one hand, old rivals, such as Microsoft, have deep ToB genes. They have accumulated a large number of customers through the layout of products such as Office365, Skype, and Azure Cloud. The strategy of driving PaaS/Saas business from IaaS has achieved results. In terms of specific business policies, it is similar to the collaboration tool Teams. The synergy with Office365 has boosted its user base, quickly surpassing Slack.

DAU comparison of Slack and Microsoft Teams Source: Business of Apps

DAU comparison of Slack and Microsoft Teams Source: Business of AppsOn the other hand, there are a group of SaaS companies that are deeply engaged in vertical fields, such as Adobe, which has obvious advantages in creativity and marketing, and Shopify, which has e-commerce resources. The industry will compete with it in depth.

From an industry perspective, the SaaS track has entered a stage of “de-bubbling”. The U.S. secondary market’s preference for SaaS has gone through cycles, and valuations have continued to rise. In the past two years, the wave of digitalization catalyzed by the epidemic has made SaaS a small window. Rapid growth, but with monetary policy adjustments, corporate layoffs, budget cuts, geopolitics and other factors, it has shown a decline this year. Salesforce is just a microcosm of that.

Dawn of Chinese disciples?

The concept of SaaS started late in China, and the development stage and model are quite different from the US market. This has been discussed in many analysis articles. At the same time, the industry is also very vulnerable to the fluctuations of the US market.

Since the beginning of this year, there has been a lot of negative industry news such as the cold primary market and the decline in company performance. The primary market has experienced a “big year” in 2021, and rationality is returning. In addition, the state of expanding losses shown in the first half of the financial report of old e-commerce SaaS such as Youzan and Weimeng is worrying.

At the beginning of August, the news of Salesforce’s retreat in China came. Some voices began to “bad” the development of SaaS in the Chinese market, and some voices were optimistic that “this is the dawn of Chinese manufacturers.” In fact, Salesforce’s adjustment to China is not a big deal for itself, and its business in China and the services of other Chinese manufacturers are not simply substitutes.

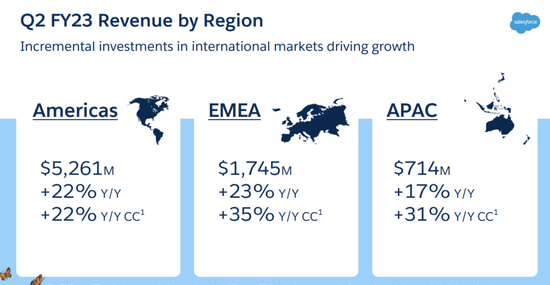

According to multiple media reports and Salesforce’s own response, the company did adjust its entire sales team in China and closed its Hong Kong office responsible for China operations. However, the Asia-Pacific region is not the focus of Salesforce’s business. According to its latest financial report, Salesforce’s business revenue in the Americas, Europe, and Asia-Pacific was $5.261 billion, $1.745 billion, and $714 million, respectively. The Asian region only accounts for less than 10% of the total revenue, and the growth rate is not outstanding, and the sense of presence is very weak.

Salesforce FY23Q2 revenue by region Source: Company Financial Report

Salesforce FY23Q2 revenue by region Source: Company Financial ReportIn addition, according to Techcrunch, Salesforce said: “Due to the cooperation with Alibaba, the company is optimizing its business structure to better serve the Greater China region, and will open new positions while laying off staff.” Alibaba Cloud will act as the general agent To undertake Salesforce’s business in the Chinese market, the Singapore office has also been retained.

In this way, getting out of the China business is more like a strategic abandonment. There is indeed a factor of “acclimatization”. In 2003, Salesforce entered the Chinese market and began to expand its business. The Hong Kong office was established in 2006, but for more than ten years, in this booming market, Salesforce has not achieved big breakthrough.

Objectively speaking, the scale and penetration rate of China’s SaaS market is far less than that of mature markets in Europe and the United States. According to iResearch, the size of China’s enterprise-level SaaS market is expected to reach 99.1 billion yuan in 2022, of which the CRM market size is only 15.6 billion yuan (this figure is far less than Salesforce’s revenue in one fiscal quarter), an increase compared to 2020 16.5%.

This is also one of the reasons why China’s CRM products are too numerous to run out of the top unicorns. In the actual business promotion, there are many problems such as low willingness to pay, inaccurate evaluation of CRM value, high threshold for use, and market price wars, which keep the penetration rate at a low level. Chinese SaaS companies have unique problems to be solved, and Salesforce can only be an object to learn from, and copying them will not work.

However, it cannot be denied that due to the demand for cost reduction and efficiency enhancement, the trend of enterprises going to the cloud and digitalization will not change for a long time. The impact of the economic environment or the limitations of the company’s own development stage are more short-term challenges.

China’s SaaS industry is still a stage where a hundred flowers are blooming and a lot of heroes are competing. Traditional software vendors such as UFIDA, Kingdee, and Kingsoft Office, Internet giants expanding cloud computing services such as Alibaba, Tencent, and Byte, and independent SaaS vendors such as Zan, Inspur, Weimeng, etc., are taking bigger and bigger steps.

Looking further, more subdivision, more vertical, and more professional have become an unstoppable trend. In addition to general-purpose SaaS, there are small outlets emerging in product directions and specific industries, such as cross-border e-commerce SaaS. As more and more brands and sellers go overseas, more infrastructure builders and service providers are needed. In the past two years, there have been frequent large-scale investment and financing events in the primary market. Companies such as Dianxiaomi, Jijia, and Mabang have become hot deals, and new products have appeared a lot. For example, the cross-border e-commerce Dunhuang.com launched the social e-commerce SaaS platform MyyShop.

The slump in the SaaS industry market and bellwether Salesforce is expected to continue for some time, which is clearly visible in the guidance of analysts and companies. Market fluctuations are inevitable, but pessimism will not continue. SaaS companies with product strength and strategic vision will continue to grow steadily in this long-term track.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-09-05/doc-imizmscv9194057.shtml

This site is for inclusion only, and the copyright belongs to the original author.