China Merchants Bank and Ping An Bank are currently joint-stock banks that focus on retail credit. They have many things in common:

Including: headquarters are in Shenzhen; focus on wealth management track; operation is more market-oriented; employee wages are generally high;

This article attempts to comprehensively compare the two banks from the market value, total assets, operating income, net profit, asset quality, credit structure, asset side and liability side, trying to answer which bank is more worth investing in China Merchants Bank or Ping An Bank.

1. Comparison of production materials of enterprises

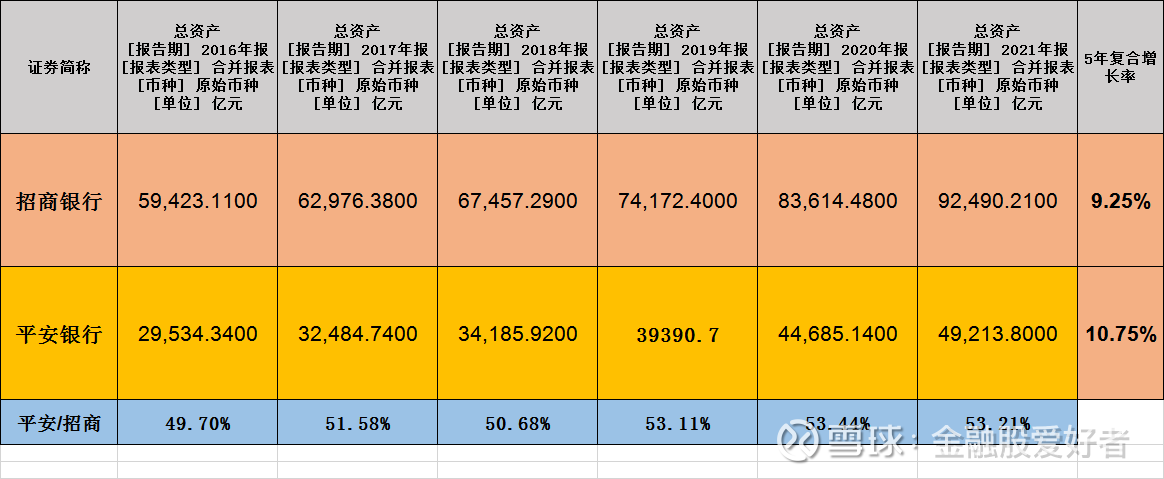

1. Total assets

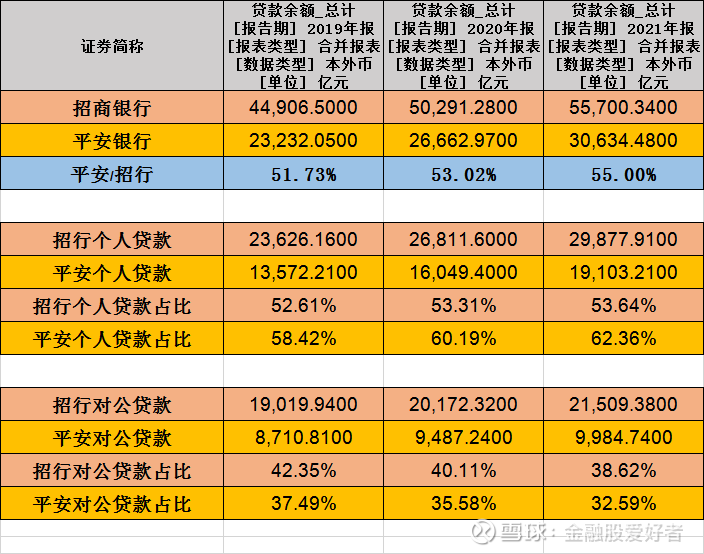

It can be seen from the figure that the compound growth rate of China Merchants Bank and Ping An Bank in the past five years is slightly faster than that of China Merchants Bank. Above, almost 53% in the past 4 years.

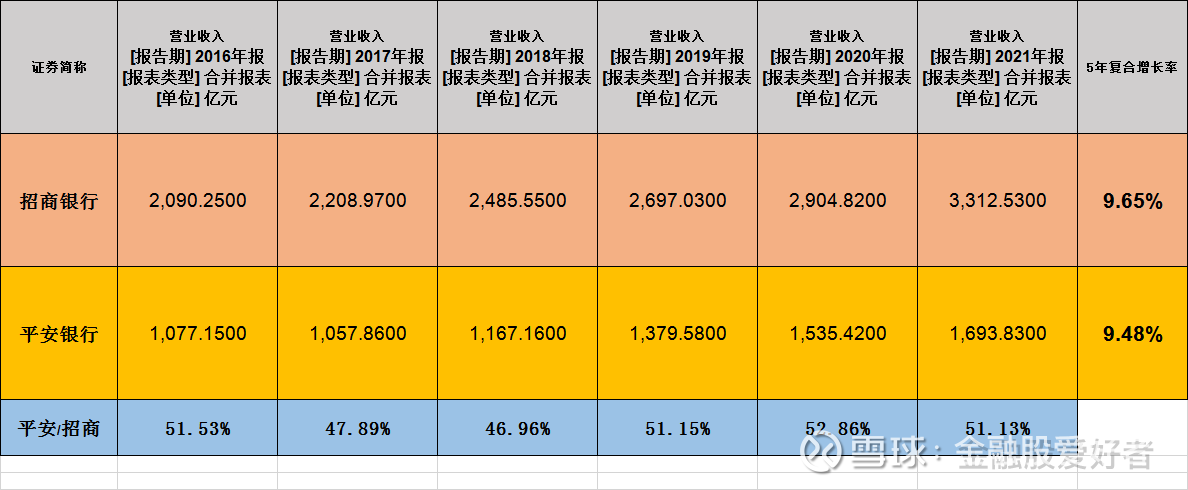

2. Operating income

In terms of operating income, China Merchants Bank and Ping An Bank’s 5-year compound growth rate are both below 10%, and China Merchants Bank is slightly faster than Ping An Bank. From the perspective of operating income, Ping An Bank is almost 50% of China Merchants Bank.

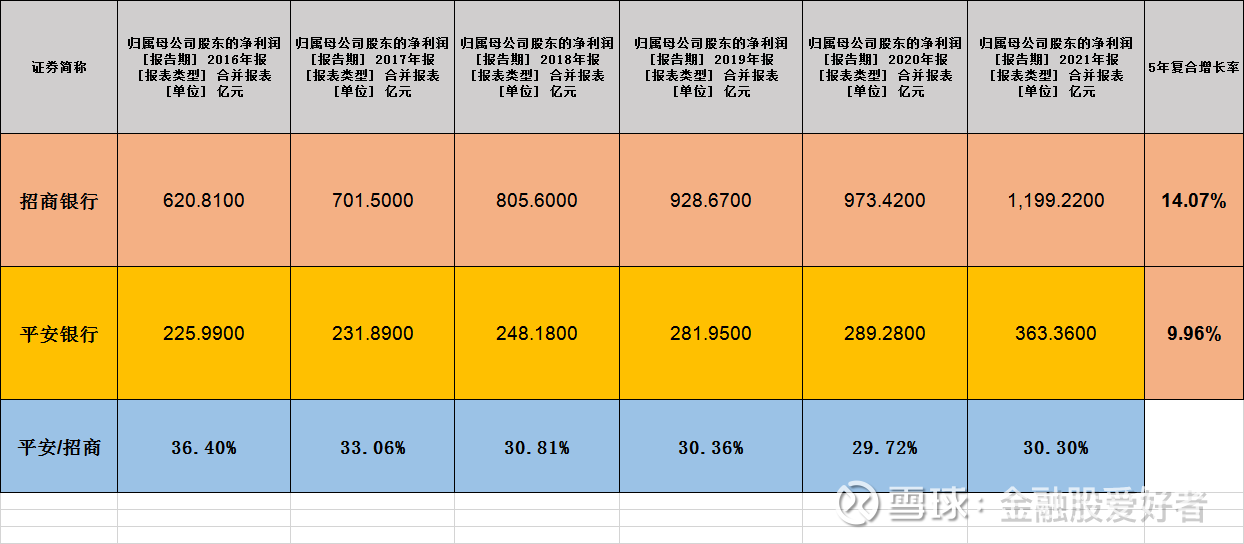

3. Net profit

From the perspective of the compound growth rate of net profit, China Merchants Bank is obviously stronger than Ping An Bank. In the past five years, the compound growth rate of China Merchants Bank’s net profit has reached 14.07%. The compound growth rate of Ping An Bank’s operating income and total assets is similar to that of Ping An Bank. Net profit is only about 30% of China Merchants Bank, which is significantly lower than the proportion of total assets and revenue. The specific reasons are as follows.

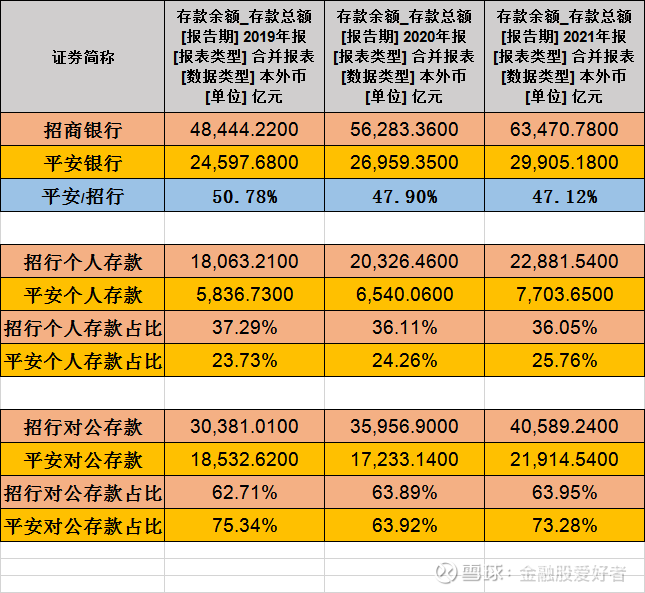

4. Comparison of total deposits

As can be seen from the figure, although China Merchants Bank and Ping An Bank are called retail banks in the market, they mainly refer to the fact that credit assets are mainly personal loans, not deposits. At the same time, China Merchants Bank accounted for about 64% of corporate deposits, and Ping An Bank was as high as 73%.

5. Comparison of total loan amount

It can be seen from the figure that Ping An Bank’s overall loans are more inclined to individuals. China Merchants Bank’s personal loans account for about 53% of the total loans, while Ping An Bank has basically increased year by year, and now it has reached more than 62%.

Conclusion: Whether it is total assets, total deposits and loans, operating income, China Merchants Bank’s production materials are basically twice that of Ping An Bank, but the operating results are more than three times that of Ping An Bank.

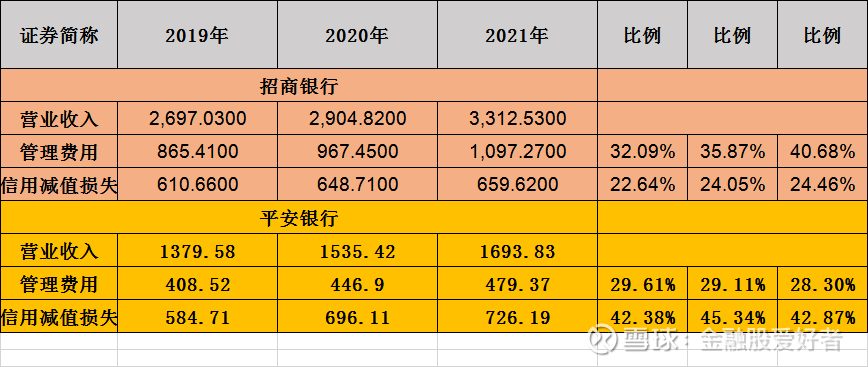

2. Expenditure comparison

It can be seen from the figure that the proportion of management expenses of China Merchants Bank has increased rapidly. The latest proportion has exceeded 40%, which is significantly higher than that of Ping An Bank, which is nearly 12% higher. The main reason is that the number of employees of China Merchants Bank is more than double that of Ping An Bank. The number of employees of China Merchants Bank is 103,920. The total employee expenses in the first half of 2022 are 34.257 billion yuan, and the per capita salary in the first half of the year is 329,000 yuan; the total number of employees of Ping An Bank is 40,427. The staff cost is 16.179 billion yuan, and the per capita income in the first half of the year is 400,000 yuan, which is higher than that of China Merchants Bank. However, because China Merchants Bank’s production materials are double that of Ping An Bank, but the number of people is more than double, about 1.5 times, so the proportion of management expenses is 12 times higher. percentage.

From the perspective of asset impairment losses, China Merchants Bank’s accrual ratio is significantly lower than that of Ping An Bank. Ping An Bank’s operating income exceeds 40% and should be included in provisions, while China Merchants Bank’s accrued revenue is less than 25%. The proportion of China Merchants Bank It is nearly 18 percentage points stronger than Ping An Bank, which shows that Ping An Bank’s asset quality problem is still relatively large.

3. Asset Quality Comparison

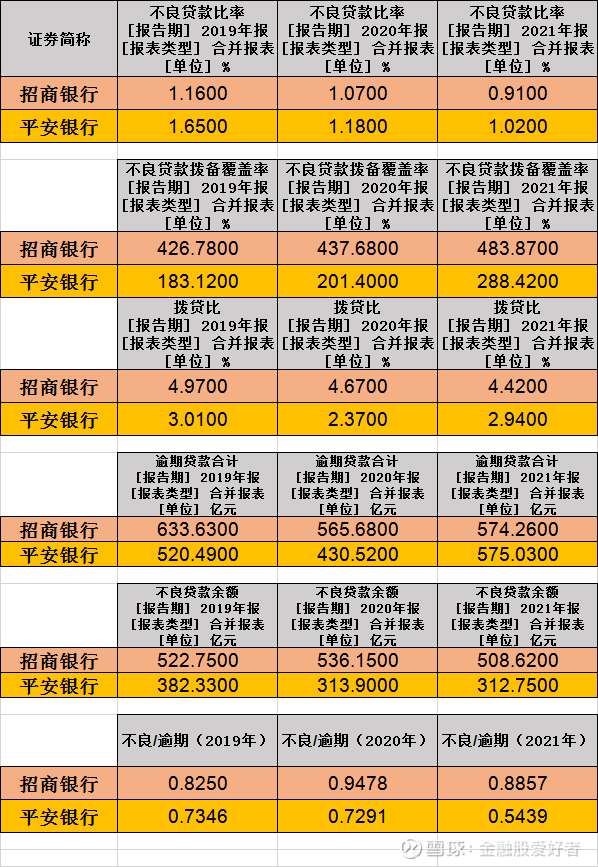

Overall, the asset quality of the two banks has improved in the past three years. China Merchants Bank’s NPL ratio has dropped to less than 1%, and Ping An Bank has also made great progress from the NPL perspective, from 1.65% NPL ratio to 1.02%; From the perspective of provisioning, China Merchants Bank remains above 400%, and Ping An Bank has risen from 183% to 288% by the end of 2021; China Merchants Bank has always been above 4% in terms of provision-to-loan ratio, and Ping An Bank has not exceeded 3% yet;

However, if we look at overdue loans, we can see the obvious gap. China Merchants Bank’s overdue loans have been decreasing year by year in the past three years, and Ping An Bank has not improved significantly. By the end of 2021, Ping An Bank’s overdue loans were 57.5 billion yuan, one more than China Merchants Bank’s 57.426 billion yuan. Diandian, this is when China Merchants Bank has a loan of 5.5 trillion yuan, and the total loan of Ping An Bank is only 3 trillion yuan;

If we look at the non-performing loans, there is a big gap. China Merchants Bank’s 57.426 billion overdue loans have been identified as 50.8 billion non-performing loans, and the non-performing/overdue 0.88. 31.2 billion in non-performing loans, and the non-performing/overdue ratio is only 0.55. The improvement of Ping An Bank’s asset quality is currently limited to book data, but the substance is still average. We continue to ask why?

4. Comparison of credit structure

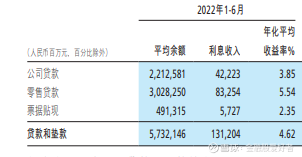

We look at the 2022 China Merchants Bank and Ping An Bank interim performance statements

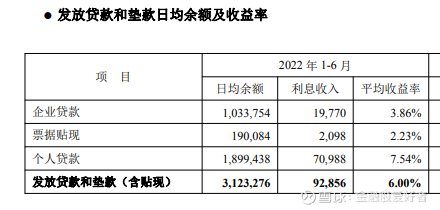

The picture above shows the loan situation of China Merchants Bank, the average yield of corporate loans is 3.85%, the yield of retail loans is 5.54%, and the yield of discounted bills is 2.35%; the picture below shows the loans of Ping An Bank, the average yield of corporate loans is 3.86%, and the yield of retail loans The yield is 7.54%, and the discounted bill yield is 2.23%; the personal loan interest rate of Ping An Bank is 2 percentage points higher than that of China Merchants Bank, indicating that Ping An Bank has selected some customers with general qualifications.

The yield of corporate loans is similar to the yield of discounted bills, and the interest rates are both relatively low. It can be seen that China Merchants Bank and Ping An Bank both choose to lend to high-quality corporate customers, while the homogeneity of high-quality corporate customers is more obvious, and the difference in asset quality is not large. At the same time, most of the assets of China Merchants Bank and Ping An are invested in individuals, so their difference is still in personal loans, as follows:

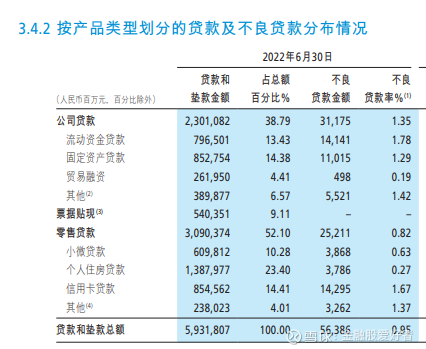

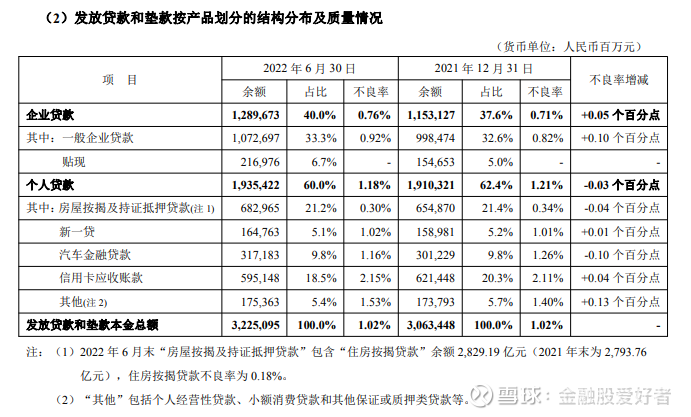

The picture above is China Merchants Bank, and the picture below is Ping An Bank. In terms of personal loans, we see that although the proportion of Ping An’s personal housing mortgage loans and certified mortgage loans is 21.2%, the remarks say that housing loans are only 282.9 billion yuan, accounting for all The proportion of loans is 8.77%, which means that a considerable part of Ping An Bank’s housing mortgages and certified mortgage loans are personal housing mortgage business loans, similar to small and micro enterprise loans. It is 23.4%, far exceeding that of Ping An, and the proportion of personal small and micro business loans is 10.28%, which is less than that of Ping An Bank. Ping An Bank has a relatively high proportion of auto loans, and the proportion of loans from the two credit card banks is also slightly higher than that of Ping An Bank. It can be clearly seen that although Ping An Bank mainly provides credit to individuals, due to its high interest rate strategy, its customer qualifications are relatively general, so its asset quality has a certain gap compared with China Merchants Bank.

Why Ping An Bank chose the high interest rate strategy, I think the main reasons are as follows:

Ping An Bank’s interest payment costs are relatively high, so from the perspective of customer credit, high-yield assets must be selected. Among personal customers, business loans, credit cards and auto finance are all good scenarios. High-quality personal customers often choose low-interest banks, and Ping An Bank may The customer structure is inherently disadvantageous.

4. Conclusion

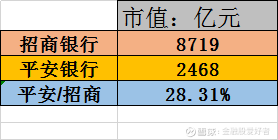

At present, the market value of China Merchants Bank is about 871.9 billion yuan (considering Hong Kong stocks and exchange rates), the market value of Ping An Bank is 246.8 billion yuan, and the market value of Ping An Bank is about 28.31% of China Merchants Bank, which is similar to the proportion of net profit. At present, from an investment perspective, the valuations of the two banks are relatively reasonable, and there is no serious undervaluation of Ping An Bank. China Merchants Bank’s non-interest income accounts for nearly 40%, and Ping An Bank’s non-interest income accounts for about 30%. There is a certain gap between Ping An and China Merchants Bank. At the same time, the asset quality is based on the foundation, the current data, and the future situation. The gap between Ping An and China Merchants Bank Still a lot. From an investment perspective, I might still be willing to choose China Merchants Bank.

There are 8 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5725525083/230538165

This site is for inclusion only, and the copyright belongs to the original author.