In the past few days, if you want to choose the hottest big melon in the technology and venture capital circle, the “tearing apart” between Luo Yonghao, the former Smartisan Technology founder, and Zheng Gang, the founder of Zihui Venture Capital, will surely occupy the top spot.

So far, the two sides have carried out three rounds of “unfriendly exchanges” centering on a series of aspects such as character, morality, and industry regulations, using short essays and interviews with relatives and friends as channels of voice.

In this process, a series of outrageous emotional speeches such as “Lao Luo kneeling on the X dollar fund” and “Mr. Zheng’s marital legend” were put aside. On the whole, the core issues of both sides are still two points:

1. Is there a violation of interests in the replacement of the repurchase agreement for the equity of the new company?

2. How should GPs (general partners, generally investment managers) and corporate executives get along?

Surrounding the above two points, Mr. Zheng believes that he is “not respected” and “interests are damaged”, while Lao Luo Fang emphasizes that “there is nothing” and “I have given too much”. During this intense battle, many lawyers, investors, big Vs and other relevant people also appeared in the debate, so that the situation was once escalated to Lao Luo’s live broadcast room with goods.

On this basis, taking stock of the “mutual tearing” this time, it is not so much that Luo Yonghao’s own high traffic contributed to the dissemination of the topic, it is better to say that these two rare topics happened to touch the Chinese venture capital circle Two “elephants in the room” – one is the “repurchase agreement” and the other is the “GP role positioning”.

Let’s first look at the part of the repurchase agreement, which is also the point of divergence in the core economic interests of the two parties.

According to Photon Planet, “The D-round financing agreement signed by Hammer Technology in September 2017 stated the 5-year repurchase clause, that is, if the company fails to achieve an IPO within 5 years, it needs to redeem the D-round investment after 5 years after the investment is completed. For the equity held by the individual, the redemption price needs to be charged at an annualized 5% dividend. If the company cannot pay the redemption payment, the founders should bear the joint and several redemption obligation. The agreement clearly requires that within one month after the five-year period expires, more than The share redemption price and dividends will be paid to the D-round investor in one lump sum. By September 2022, the five-year investment period agreed in the agreement has expired, and the investor will also have the right to redeem.”

Zheng Gangfang’s argument is mainly to express support for this agreement from the factual and legal levels:

• Chinese venture capital circles will sign repurchase agreements

• This model was originally imported from the United States to protect the interests of investors

•Domestic jurisprudence also recognizes

In other words, in the eyes of Zheng Gang, as long as he is willing, Lao Luo can recover this part of the share repurchase at any time. This may also be the reason for his dissatisfaction-“The recovery of this 180 million yuan is reasonable and legal, and I don’t want it. But you can’t deny it.”

From the perspective of Lao Luo and his friends, Zheng Gang obviously lost in reason:

•The establishment and practice of the repurchase agreement, there are “overlord clauses”

•Investment is risky, stand at attention when you are beaten

Lao Luo himself may feel aggrieved: the hammer is broken, the investment is yellow, and I pay you out of another company’s shares to compensate you.

Objectively speaking, with regard to these two points, both parties have reasonable cognitions, but they are not comprehensive. This is also a common phenomenon in the Chinese venture capital circle.

On the whole, although the repurchase agreement is nominally to protect the interests of investors, it has also won the joint support of the legal circles of the two countries in terms of judicial stance, but whether it is in the United States or China, the agreement has been endowed with many rights since its inception. It can be described as an out-and-out “lame contract”.

Referring to the factual basis in the article “VAM Agreement and Capital Control of Company Law: American Practice and Its Enlightenment” by Professor Liu Yan of Peking University Law School, the so-called “repurchase agreement” is usually only when the target company cannot complete certain terms. (In the Hammer Technology incident, the clause was that the IPO could not be realized within 5 years), so it was essentially a “gamble”.

This kind of “VAM” was first popular after the financial tsunami in 2008. What it aims to solve is an imbalance in financing contracts-investors take too much risk.

In the stage of capital contribution, investors first bear the risk of high premium shares; Fang is a private equity fund, which has its own indicators for assessing the exit period, so investors have to bear the pressure of the next level.

To put it bluntly, without the protection of this agreement, if your investment partner takes the money and runs away with your sister-in-law, you can only stare blankly.

Unfortunately, however, the U.S. judiciary soon discovered that after joining this agreement, the investor quickly became the other pole of the seesaw.

Affected by this, the Association of American Venture Capital Institutions specially formulated a “Model Venture Capital Contract” (hereinafter referred to as the “Model Contract”), which clearly pointed out three points in terms of “redemption” and other clauses:

• Repurchases must be made with legally available funds

• Repurchases must not have a negative impact on the company’s operations

• Repurchase can be executed in installments

The business logic behind this restriction has been summarized into a brilliant point of view by industry insiders:

“Silicon Valley No Gambling”.

Investment risks should be borne by venture capital companies themselves. Startups lack money, and startup bosses lack wealth accumulation, so they cannot be required to compensate investors in terms of wealth.

Of course, the above-mentioned laws and concepts are not entirely applicable to China’s capital market. From a macro perspective, domestic debates surrounding share repurchase agreements are mainly divided into three factions:

Radicals believe that it should be fully resorted to the law, and it can be implemented as it is sentenced; conservatives believe that it is a complete “moral clause”, and using this agreement for no reason is tantamount to complete “social death” in the circle.

In contrast, the author believes that the “eclectic school” is more worthy of reference. This school mainly focuses on the actual relationship between returns and risks, combined with comprehensive analysis of factors such as the nature and amount of investment.

For example, it is generally believed that the upper limit of financing income of venture capital institutions in the angel round and the A round is relatively high, so the “repurchase agreement” should not be triggered, but in the C and D rounds with a large investment amount, less shares and less income Financing can be implemented as the case may be.

However, no matter which model you refer to, it is worth making it clear that VAM is not a real “gambling”, and the repurchase agreement is by no means “overlord clause” and “rigid payment”, as Feng Lun, the founder of Vantone Group, said :

“The two are essentially adjusting the relationship between the two parties according to the established rules to solve the investment problem.”

Regarding the ideal relationship between an investor and an entrepreneur, Jack Ma gave a metaphor:

“The relationship between two people is like a husband and wife. No one can tell who is taking advantage of the other. In the end, there will always be disagreements on how to educate the children.”

In a sense, this metaphor can be called subtle. Unfortunately, in the “big family” of the domestic capital market, in addition to husband and wife and children, there are also LPs (limited partners, generally investors) who are “parents-in-law” .

As for the GP who is a “daughter-in-law”, the actual experience is just like the lines in a famous historical drama, “both ends are hidden”. .

This has also created two extreme phenomena. One is that the GP who should have become the entrepreneur’s partner, under the pressure of the global economic cycle downturn and LP’s profit requirements, will not hesitate to draw a sword against the entrepreneur and kill the chicken to get the egg.

A typical case is the vision of Softbank. In the difficult moment of operation, Softbank sold the most profitable Ali, but held WeWork, which was losing money.

Peter Lynch once called this behavior “pulling out the blooms, then watering and fertilizing the weeds.”

The above situation seems to also exist in the unpleasant incident between Luo Yonghao and Zheng Gang.

Previously, Zheng Gang told the media, “Of the 175 million yuan invested in Hammer Technology, about 100 million yuan is mine, and 60 million yuan is other people’s money”, and he has repurchased it from the LP of his own fund. More than 40 million yuan.

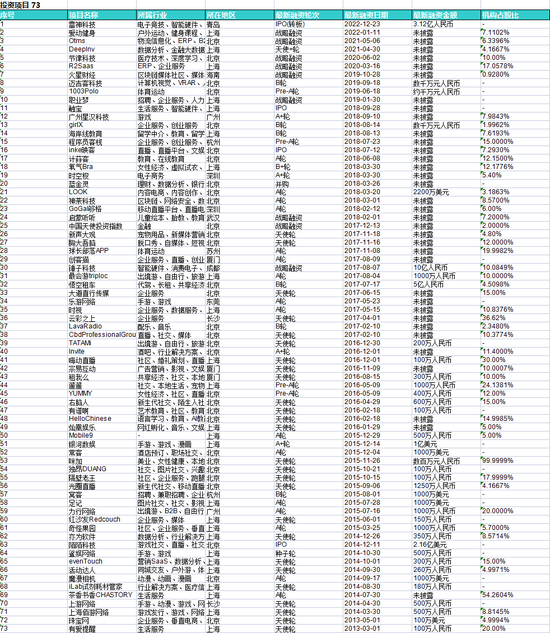

The data from Qichacha also shows the current anxiety of Zheng Gang and other investors. Among the 73 projects invested by Zihui Venture Capital in the past, except for the clichéd Momo, Inke, and TouchPal, this GP is the first to come out. The fruit of the IPO is Raytheon Technology, which injected capital in 2017.

This may also explain in disguise why Zheng Gang himself, who “never repurchases” in his mouth, is so obsessed with this 180 million repurchase agreement-an irresponsible guess is that if this repurchase agreement is kept, For LP, it is still “accounted for”, and if Luo Yonghao’s equity distribution plan is accepted, this investment will undoubtedly fail completely.

In addition to that, another extreme phenomenon is that GP, which should be the leader of LP, is endlessly staging the brutal competition of “bad money drives good”.

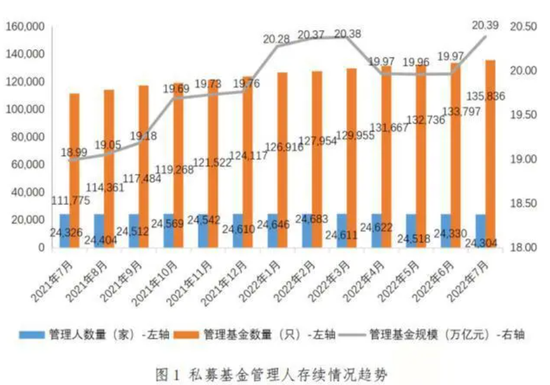

Statistics show that China currently has more than 20,000 equity investment fund managers. For reference, the number of GPs in China is 6 times that of the United States, but the management scale is only 0.4 times that of the United States.

Under such a high-intensity introversion, what a shocking story has the soil for growth.

Previously, news broke that many individual LPs in South China are very superstitious and keen to find “fate”. When they arrive at the office of the fundraising agency, they feel that “feng shui is not good” and they will leave immediately.

For this reason, many GPs have also developed the skills to suit their needs. For example, when choosing a company address, they will pay attention to whether the office faces south and whether the front of the house is open and unobstructed, so that they can accept anger from all directions and welcome customers from all directions. .

This kind of superstitious thinking even once spread to specific investment cases. For example, the GP of a well-known venture capital institution dared to make moves at every turn based on the horoscope of the birth date of the founder of the startup company and the I Ching. million investment.

If there were no media reports, it would be hard for you to believe that this kind of bizarre service even spread to complex projects such as helping LP’s father cry the grave, helping LP’s children find a job, gilding, inviting LP himself to hike in the deep mountains, and listen to symphonies.

For this type of behavior, the GP circle also refers to the Internet industry and invented a brand new title: “service empowerment”.

I just don’t know if this is the reason Zheng Gang said that Luo Yonghao “looked down” on investors.

Of course, regardless of the truth, in order to regain growth in this complex and turbulent environment, the mainland venture capital circle still cannot do without the overall value evolution of GPs.

To be the beacon of value for LPs and the intimate mentor of entrepreneurs should have been the high expectations of the market for investment managers.

But in China, this kind of role distribution has reached a new fork in the road—GPs are sticking to their comfort zone and doing things like reinventing the wheel.

The reasons for this predicament include both historical factors and practical problems.

From a macro perspective, the development trajectory of China’s GP responsibilities has roughly gone through three stages:

In the 1990s, equity investment had just started in China, and the growth of enterprises was accelerating. The assets in the primary market were greater than the demand, so the valuation of new technologies in the primary market was lower than that in the secondary market.

And GP often only needs to discover these stock assets, and can easily arbitrage by using the valuation difference.

At the beginning of the 20th century, GPs entered the stage of the most intense competition, forming their own differentiated advantages through value-added services, such as focusing on post-investment services.

It is not difficult to find that the third stage we are currently in is actually an era that requires GPs to “differentiate” to penetrate into future industry development trends and generate independent thinking and insights.

Unfortunately, the threshold for post-investment services is not high, which instead makes GPs homogeneous.

However, GP, which was supposed to move towards the stage of incremental innovation, has not kept up with the development of the times. It seems that it has formed its own investment resources and track map, but in fact it has not yet stepped out of its comfort zone.

The more critical reason points to cognition. Si Tingyou, president of Fuyu Investment, said in an interview with FOF Weekly that GP homogenization is essentially a human problem. GP investment lacks independent thinking and insights on future industry development trends and cognition, and the investment trends that are open-mouthed are all media outlets. The so-called core competence is “search”.

To sum up, in the current capital market, whether it is LP, entrepreneurs, or GP, there is still considerable room for improvement. Combining the stories of Luo Yonghao and Zheng Gang this time, it can be said that various reasons have caused the current LP, The “impossible triangle” between GPs and entrepreneurs. In any case, what is certain is that during this process, quarreling and tearing cannot solve the problem.

This episode, which began to erupt in 2023, which is expected by economists, in addition to eating melons, seems to be an invisible wake-up call to the current wildly growing venture capital circle.

As one investor elaborated in an interview with the media:

“Investment in the market is an ecological circle. Whether it is in the unique way of China or in the way of the United States, everyone has to be linked together to make it work.”

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2023-01-10/doc-imxzsqhq2197161.shtml

This site is only for collection, and the copyright belongs to the original author.