【WuXi Biologics Investment Logic Review 2206】

We have always been optimistic about the field of macromolecular biopharmaceuticals, and WuXi Biologics is a water seller in this field and a leading company in the segmented track that we have always been optimistic about. In the past year, the share price of WuXi Biologics has been fluctuating in the turbulent Hong Kong stock market, which has caused many investors to lose confidence.

Amid the turmoil, our focus is not on market volatility, but on continuing to identify truly great companies and opportunities to wait and see. At the bottom of the market, we insist on continuous research and review, which helps us strengthen our confidence in excellent companies and buy more at low prices.

【Past Links】

Water sellers in the field of innovative drugs: WuXi Biologics “set sail” [Fundamentals]

1. Interpretation of WuXi Biologics’ Business Funnel

The background of WuXi Biologics’ rapid development is the outsourcing trend of the biopharmaceutical industry. According to the 2020 Morgan Stanley Global Biopharmaceutical CDMO Report : In recent years, the outsourcing CDMO industry of biopharmaceuticals has been developing rapidly. The average growth rate of the biopharmaceutical service outsourcing industry is 25%, compared to 16%-18% before. One of the reasons for the accelerated development is that large enterprises are increasingly outsourcing, and the other is that many innovative small and medium-sized enterprises are increasingly outsourcing.

This is very consistent with WuXi Biologics’ business model, serving large enterprises and empowering small and medium-sized enterprises.

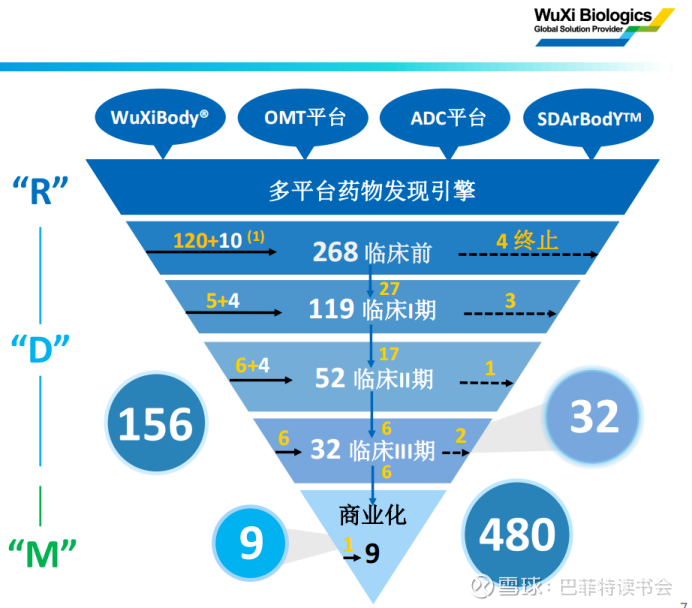

The company’s core business model is to continuously empower customers from the discovery and preclinical stages with a leading integrated biopharmaceutical contract research, development and production organization CRDMO business model (platform), thereby establishing advantages at the beginning of project design, Ultimately advancing outstanding projects to later stages until commercial production. Due to the risk of biological drugs, many projects will be withdrawn midway due to unsatisfactory clinical data or financing and other factors, and very few can actually go to the market, thus forming a funnel in terms of quantity.

Let’s take a look at how the business funnel of WuXi Biologics has changed in the past year through data.

(Funnel description: black arrows are newly added projects from the outside; above the black arrows, white numbers represent the projects entered by mergers and acquisitions. 1. The blue arrows are projects that started at an early stage; 2. The dotted arrows are terminated projects.)

1. Projects with endogenous growth : The funnel growth of endogenous projects proves the effectiveness of the closed loop of the company’s business logic – its own stickiness, its own traffic, and endogenous growth.

New endogenous projects: 138. It is expected to maintain this level in the next few years, that is, more than 138 projects will be added every year.

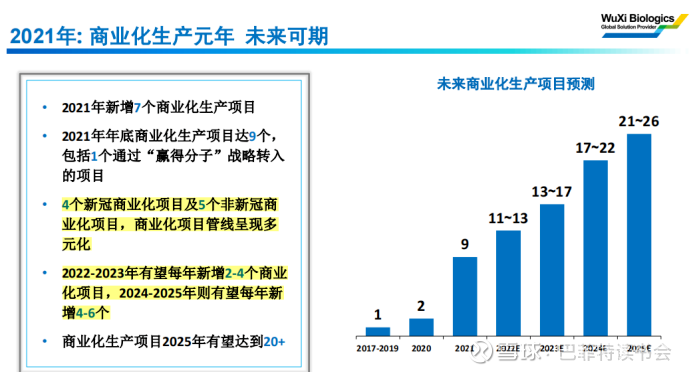

2. The growth rate of Phase III and commercial projects is accelerating, and the fat tail effect is becoming more and more obvious.

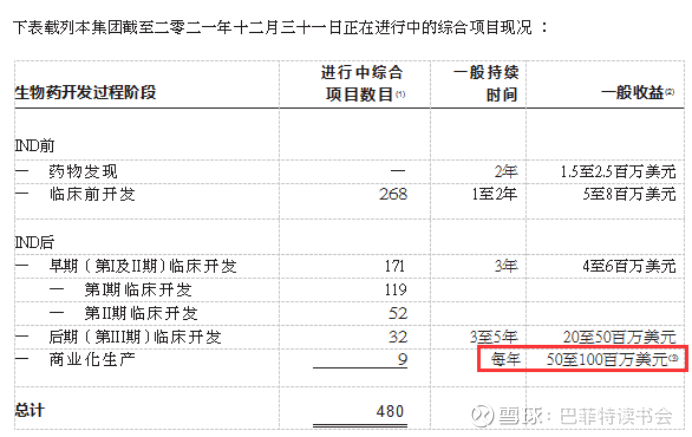

The ultimate goal of WuXi CRDMO is to provide customers from drug discovery services to production; at the same time, biopharmaceuticals, like vaccines, have scarce production capacity, and the gross profit of the production process is relatively high. The accelerated growth rate of Phase III and commercialization projects has accelerated the pace of WuXi’s commercial dreams.

Phase III clinical projects : 32 projects, more than 20 products of the 32 are expected to be launched in the next few years;

Commercial production projects : from two to nine, I hope there will be two or three this year, four to six next year, and more than four to six growth every year.

The preceding figures are all in terms of quantity. The bottom 2 data are small but of high quality. In 2021, the average income of the top ten customers in the world has reached 500 million, mainly because the customer project has reached the CMO. The further back the project goes, the more obvious the increase in income will be, which is a typical fat tail effect. It is also the focus of the company’s business model.

2021 is the first year of commercial production of WuXi Biologics. The total M revenue in 21 years accounted for 63%, the revenue of the third phase clinical and commercial production was about 48%, and about 15% came from the first and second phase clinical production projects. The net profit of production can also be about 30%, so the profit margin is also much higher than the industry average. In the following years production became more and more important in the company. If according to the income of M, it may already be in the top three in the world.

3. Win Molecular Strategy: Prove the company’s platform, cost, and efficiency advantages.

Since 2018, a total of 40 projects (transferred to WuXi Biologics from outside) have been won, including 15 Phase III clinical projects and CMO projects. At present, nearly half of the total number of Phase III clinical projects (32) come from the “Win-the-Molecule” strategy introduced two or three years ago, which is also the “Win-the-Molecule” strategy. The most perfect embodiment of the ability of Ming creatures. After that, I hope to transfer to about 5 Phase III clinical projects every year.

From the data point of view, the funnel of performance growth has not been affected by the global economy, policies, epidemics, etc. There are continuous cooperation between customers and companies at the front end, and the commercialization of the back end is becoming more and more mature, with more and more products, and M will become more and more the stronger. There will be no return of projects after the end of the new crown, because the company won these projects not because others can’t do it, others have no production capacity because of the impact of the new crown, but because WuXi Biologics’ capabilities, technology, and execution are better than global competitors. Prioritize, do better, and faster. Therefore, after the new crown epidemic, the company will continue to maintain the world’s leading market share, and may even continue to increase.

2. Driving factors for future performance growth

1. Key data of the front-end funnel:

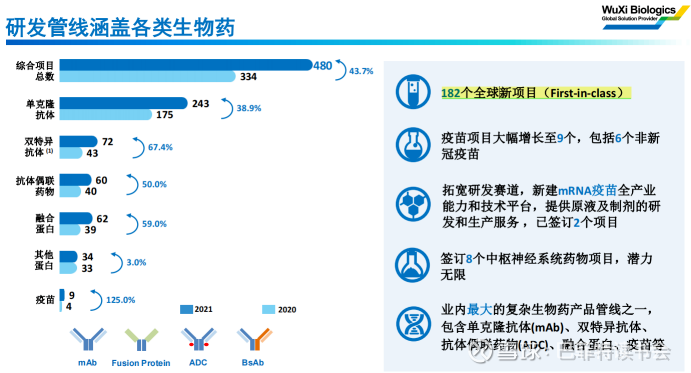

a. The number of comprehensive projects, from 2020 to 2021, from 334 to 480 projects, a year-on-year increase of 43.7%;

b. The number of new projects increased from 103 to 156, an increase of more than 50%;

c. The number of Phase III clinical projects increased from 28 to 32, a year-on-year increase of 14.29%;

d. The number of commercial production projects. In the past, commercial production was very small and contributed little to the business, but now the commercial production industry contributes a lot to the business. The number of commercial production projects will increase from two in 2020 to nine in 2021, a year-on-year increase of 350%;

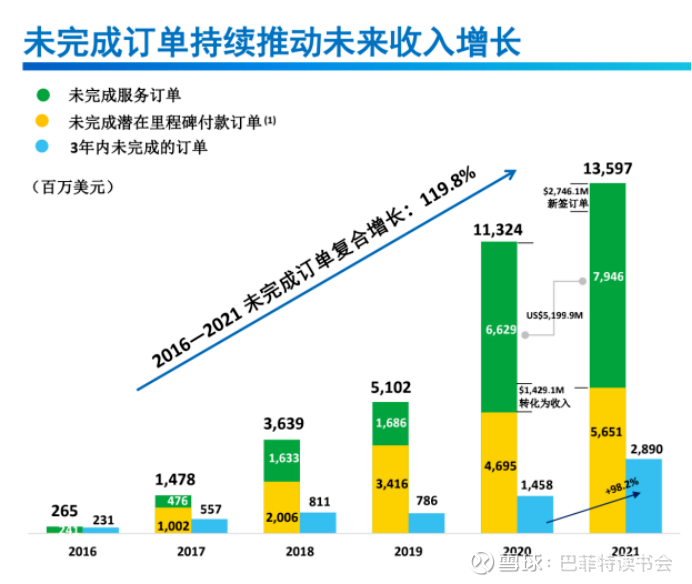

e. Growth of outstanding orders.

As of the end of December 2021, the company had outstanding potential milestone payment orders of US$5.6 billion, a year-on-year increase of 20.4%; of which, outstanding orders within three years increased by 98.2% year-on-year to US$2.9 billion, reinforcing the expected near-term revenue growth; of which US$7.9 billion was outstanding Service orders only include 4 long-term service items, and the growth potential of outstanding service orders is huge.

Unfinished orders are things that the company has signed a contract for, and it is very difficult to grow unfinished orders. They are consumed every year, and many unfinished orders have to be turned into revenue. For the next few years, how to protect and improve Margin depends on the growing scale, more and more milestone payments, and sales commissions are not included; the growth of uncompleted orders indicates that the company’s future revenue will continue to rise. one floor. Last year, the company ‘s outstanding orders within 3 years increased by 56%. The company’s CEO said that “the most exciting”, this time the data is 98%, Mr. Chen should be more excited.

The growth of the above data, including order growth, product demand, personnel demand, and outstanding orders, indicates that WuXi Biologics’ performance is guaranteed.

2. Product pipeline and platform advantages:

The company’s current pipeline monoclonal antibody projects account for about half , and double antibodies, ADCs, and fusion proteins each account for about 13%. These are the key development trends of global macromolecular biopharmaceuticals. In view of the complexity of ADC and double antibody projects, the future income will be higher than that of monoclonal antibody. At the same time, there are 182 FICs in WuXi’s pipeline. If these projects can reach the end, they will bring very rich benefits to the company.

WuXi develops and launches various proprietary technology platforms throughout the life cycle of biological drug discovery, development and production, including WuXiBody  Bispecific antibody technology platform, SDArBodY

Bispecific antibody technology platform, SDArBodY  Multispecific antibody technology platform, WuXia

Multispecific antibody technology platform, WuXia  Cell line development platform, WuXiUP

Cell line development platform, WuXiUP  Continuous production platform and mRNA vaccine platform, etc. These patented technology platforms are not only the cornerstone of the company’s CRDMO business model, but also effectively promote project milestones and increase corresponding profits, and help the company to introduce more biopharmaceutical projects. Behind these platforms are more than 3,000 scientists who have industry-university-research cooperation with WuXi.

Continuous production platform and mRNA vaccine platform, etc. These patented technology platforms are not only the cornerstone of the company’s CRDMO business model, but also effectively promote project milestones and increase corresponding profits, and help the company to introduce more biopharmaceutical projects. Behind these platforms are more than 3,000 scientists who have industry-university-research cooperation with WuXi.

3. Capacity advantage: capacity growth rate represents future M growth rate

According to the company’s plan, in order to meet the growing demand, the company’s total production capacity will continue to increase from the current 154,000 liters to 262,000 liters by the end of 2022, and will reach 430,000 liters after 2024. The layout of the company’s production capacity is to match the needs of the business. Some people worry that the larger M is, the profit margin will be affected. From the perspective of vaccines and biological drugs, it should not be bad.

3. The most important growth engine at present

Previously, the analysis logic of the CXO industry always attached great importance to the development of domestic innovative drugs. In fact, medicine is an advantageous industry in Europe and the United States, and Chinese domestic companies, the global pharmaceutical giants, cannot be ranked; There have been many green lights, but domestic innovative drugs started late and took a detour. Most of them are still in the early stage, and there are very few high-quality FICs. WuXi has strengthened its overseas production capacity layout in recent years, which is also an inevitable choice to be close to the market and customers.

1. Go fishing where there are many fish

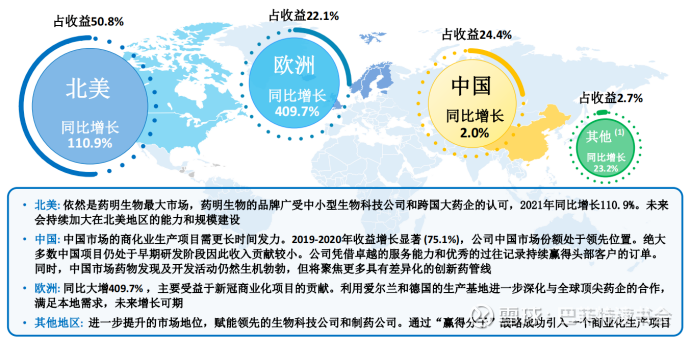

North America: 2021 is the largest engine of WuXi Biologics, accounting for more than 50% of revenue. Due to the growth of clinical phase III and CMO, the growth rate is very fast, reaching 110.9%. Because the new crown makes the growth rate in 2020 very slow, so The growth rate in North America and Europe this year is very beautiful.

Europe: 22% of revenue, with a growth rate of 409.7% in 2021;

China: 24.4% of revenue, up 2% year-on-year.

The company said in the survey that it hopes to do the same thing in China in Europe and the United States, and it is exactly the same thing. In the future, our customers can completely turn a project from toxicology to commercial production without relying on China. Through the efforts of the past few years, the investment of 1.5 billion US dollars, we have made this platform well. Starting this year, our research and development may be done in Cranbury, the United States, and commercial production in Ireland and Germany. This route has been opened. In the next few years, we will continue to invest more than US$1.5 billion to build one in Singapore. In the future, within five years, there will be three production lines, and all projects can be done in Europe and the United States, as well as in Singapore and China.

2. Hug your thighs: BigPharma, more life, more money, the trend of R&D outsourcing is becoming more and more obvious

In addition to traditional small and medium-sized companies, large pharmaceutical companies have gradually become core customers, currently contributing about 40% of total revenue, and become less dependent on start-up companies. We were very excited to see this information. To be honest, we were still worried about the outsourcing trend of large pharmaceutical companies in the biopharmaceutical industry.

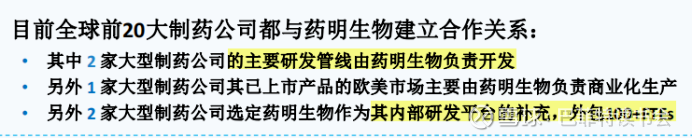

Customer structure optimization. In the past few years, the company ‘s core customers have been small and medium-sized biotechnology companies with a market value of US$500 million to US$5 billion, but through the efforts of the past few years, the company has now turned the world’s top 20 pharmaceutical companies into the company’s core. client.

Regarding the reasons why BigPharma chose WuXi Biologics, the company stated:

1) They want their partners to have a long, strong history, and they want the company to be at least ten years old and to pass dozens of FDA inspections. In 2021, the world’s top 20 pharmaceutical companies are all our core customers, and already contribute 40% of the revenue. There are also five cross-company customers in the top ten customers.

2) More and more outsourcing by multinational companies.

3) Multinational companies have acquired many customers of our small and medium-sized companies, and indirectly become our customers. Through the understanding of the projects we do, we find that WuXi Biologics is really different from traditional CDMOs, thus giving us bigger projects. . In the past few years, 95% of the merger projects of multinational companies still remain in WuXi Biologics.

With more and more top customers, the company’s risk of greater customer concentration is also reduced . Now the top 20 customers account for 55% of the revenue, and the average revenue per customer is less than 3%; the top ten customers account for 47% of the revenue, and the average revenue per customer is less than 5%; the largest single customer revenue Only about 10%. Therefore , customers are relatively scattered, the risk of a single customer is very small, each customer gives us more projects, and each project brings more revenue.

Fourth, the company’s key logic review:

In the previous research report interpretation, we emphasized four key points,

a. Look at the company’s potential to make money in the future from the growth of inbound traffic.

b. The company’s potential to make money in the near future from the accumulation of clinical phase III projects and the growth of commercial production projects.

c. From the future production capacity layout plan, see whether the duck with the mouth can eat and digest it.

d. From the growth of European and American markets, see the company’s international cooperation ability and short-term performance growth ability.

The above four points, we have seen in the previous article.

1. The moat of WuXi Biologics

The biopharmaceutical CDMO industry has high growth and high barriers. Future competition will further focus on technology, enabling efficiency, and production capacity layout. Through the previous performance and achievements, we can see that WuXi Biologics has built its own competition in three aspects. barrier.

1) Empower customers through cutting-edge technology platforms and rich R&D pipelines, accelerate innovation, improve efficiency, and form a sticky and closed loop through experience and data accumulation.

2) Through global production capacity layout close to customers, scale benefits help customers reduce costs.

3) The rational and forward-looking industrial layout of the management team, the international vision of the team, the ability to cooperate with international customers, and the ability to commercialize.

This year the company has particularly emphasized efficiency, cost advantages and quality management systems, which are the value of the CXO industry.

WuXi Speed: In the global fight against the epidemic, the company gave full play to the “WuXi Biologics Speed” to help customers obtain emergency use authorization (“EUA”) from the U.S. FDA for their anti-COVID-19 neutralizing antibodies within 14 months.

Technology cost reduction. The company’s single-use bioreactor technology disrupts the industry. This technology can generate higher ROI with lower construction investment, faster construction speed (1 year), controllable cost (MFG110 ROI is 51%, MFG2 and MFG3 are expected to reach 35% and MFG3 respectively) 50%). At present, 1,500+ kilograms of COVID-19 neutralizing antibodies (2,000-12,000 liters) have been produced in 12 months, and more than 1,700 batches of production experience have been accumulated, with a success rate of about 98%.

Quality system: 22 inspections by global regulators have been completed in 2021. In the past year alone, five inspections were carried out every month, and the FDA inspected 10 times along the way, and once again in the first half of this year, that is, 11 inspections. The company’s management said: “It is for this reason that customers believe in us, and it is also for this reason that it is difficult for new competitors to enter the industry, because many companies have to wait five or ten years to see your quality. Only when the system can be certified will we be willing to cooperate with you.”

Excellent track record, customer stickiness and satisfaction (better quality, faster speed, more price-competitive service) constitute WuXi Biologics’ core competitiveness. Continued orders from the world’s top 20 pharmaceutical companies are evidence of this.

2. Industry trends: the strong are always strong

The global biopharmaceutical market is growing rapidly. In addition to COVID-19-related projects, the biopharmaceutical industry has boomed in recent years with technological advancements, policy reforms, and a surge in investment. With the widespread deployment of digitization and artificial intelligence in the biopharmaceutical industry, especially since the COVID-19 outbreak, explosive innovation breakthroughs in the industry have also accelerated, and the global biopharmaceutical market will continue to maintain rapid growth.

The growth of the biopharmaceutical market drives the demand for outsourcing services.

The rapid growth of the biopharmaceutical industry has also brought unprecedented demand for biopharmaceutical outsourcing services. Small and medium-sized innovative biotech companies have sought outsourcing services due to their lack of R&D capabilities and limited production capacity.

Large biopharmaceutical companies also outsource some of their work to biopharmaceutical CDMOs that provide end-to-end solutions to reduce R&D costs, reduce risks, and focus on developing core businesses they are good at to improve efficiency. The global biopharmaceutical outsourcing market is expected to grow rapidly over the next few years.

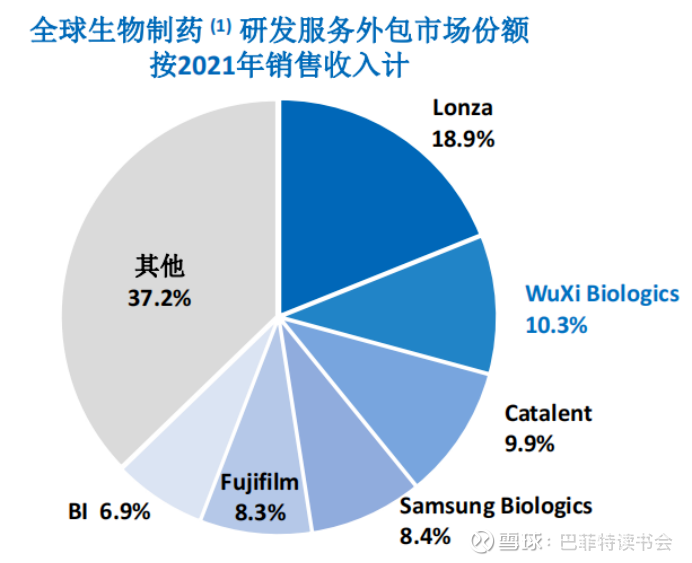

The concentration of the heads of the CDMO industry has been further improved. In 2021, the global biopharmaceutical R&D service outsourcing market will be more concentrated, with the top six companies taking a total market share of 63%. It is expected that the market share of the top ten CDMO companies in the world will exceed 80% by 2025.

In 2017, the company ranked in the top ten in the world. By 2021, it will be the second in the world, with a market share of about 10%. Lozna is the first in the world, with a market share of about 19%. According to the stickiness of the CRDMO business model and the “Follow and Win the Molecule” strategy, the company’s market share will continue to increase in the future.

Regarding the concerns about introversion in the industry, the management emphasized that the barriers to the CXO industry are high, and the threshold for resources, customers, talents, technology platforms, etc. is very high, and it will take 5-10 years to establish its own excellent industry record and gain wide recognition. The international quality system can win the trust of customers. And new entrants face a tough learning curve, making it difficult to gain meaningful market share.

The management said in the communication that the market share of the industry in the future will go to the head, which means that the future competition trend will be more competition among the leading companies, and the company “doesn’t care about those newcomers who enter the industry. “.

3. Medium-term growth drivers of the company

Front-end: Explosive growth in commercial manufacturing programs (M), substantial increase in early- and late-stage clinical programs (D), potential milestone revenue from drug discovery and sales share fees (R).

Backend: Technology platform and R&D capabilities, multiple production licenses from global regulatory agencies, and GMP release and production of new production facilities.

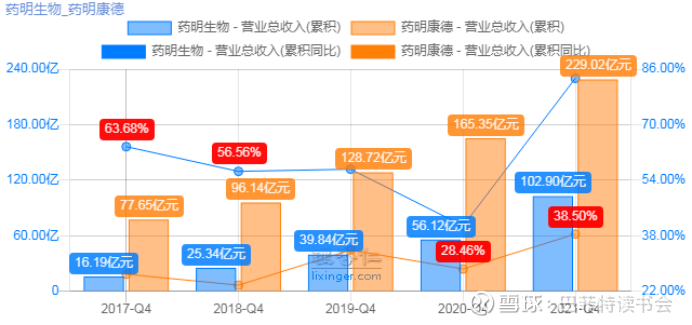

V. Attachment: Comparison of key indicators of WuXi Biologics and WuXi AppTec

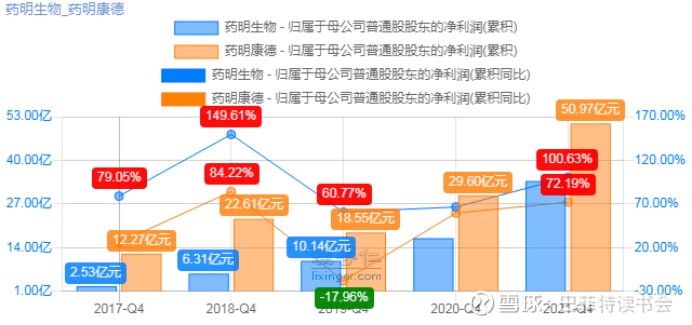

1. Performance growth

1) Operating income: WuXi AppTec > WuXi Biologics

2) Growth rate of operating income: WuXi Biologics > WuXi AppTec

3) Net profit: WuXi AppTec > WuXi Biologics

4) Net profit growth: WuXi Biologics > WuXi AppTec

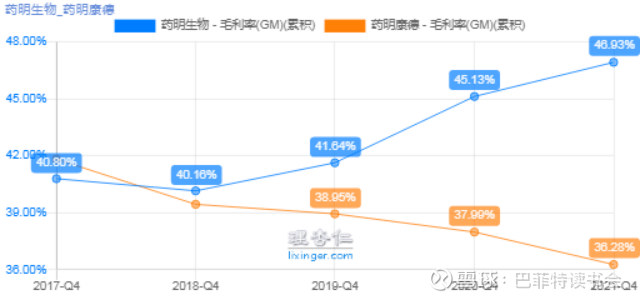

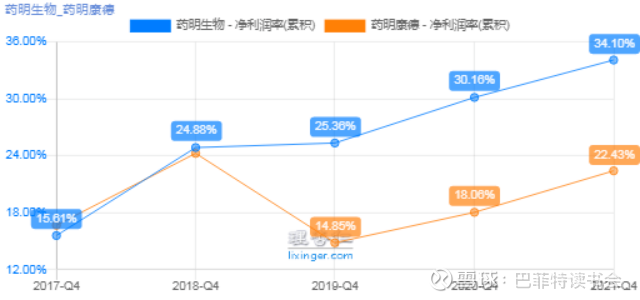

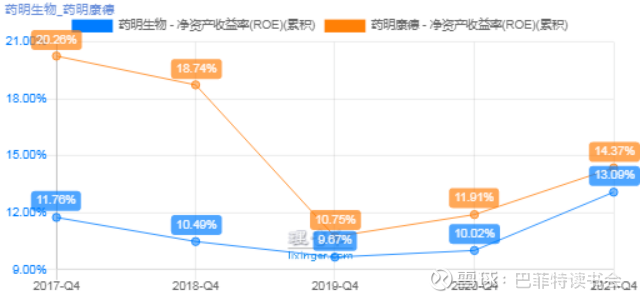

2. Profitability

1) Gross profit margin: WuXi Biologics > WuXi AppTec

2) Net profit margin: WuXi Biologics > WuXi AppTec

3) ROE: WuXi AppTec > WuXi Biologics

In terms of gross profit margin and net profit margin, WuXi Biologics is trending well, significantly higher than WuXi AppTec;

Judging from the ROE indicator, WuXi AppTec is relatively high, and the asset turnover rate of major companies is relatively good.

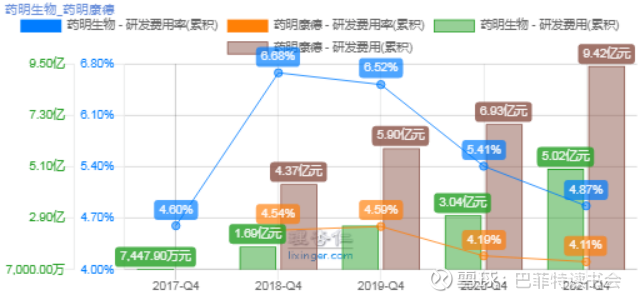

3. R&D investment

1) R&D expenses: WuXi AppTec > WuXi Biologics

2) R&D expense ratio: WuXi Biologics > WuXi AppTec

WuXi Biologics’ R&D expenses increased by 65.2% from approximately RMB303.7 million in 2020 to approximately RMB501.6 million in 2021, mainly due to the company’s continued investment in innovation and technology to enhance and develop the Group’s cutting-edge technology platform.

WuXi PharmaTech’s R&D expenses were RMB 942.2419 million, an increase of 35.91% compared to 2020. The company is committed to improving R&D capabilities, continuously increasing R&D investment, focusing on platform empowerment construction, including enzyme catalysis, flow chemistry, etc. And focus on TESSA  , PROTAC, oligonucleotide drugs, peptide drugs, conjugated drugs, cell and gene therapy, and resource ranking algorithm development and a series of new capacity building R&D activities.

, PROTAC, oligonucleotide drugs, peptide drugs, conjugated drugs, cell and gene therapy, and resource ranking algorithm development and a series of new capacity building R&D activities.

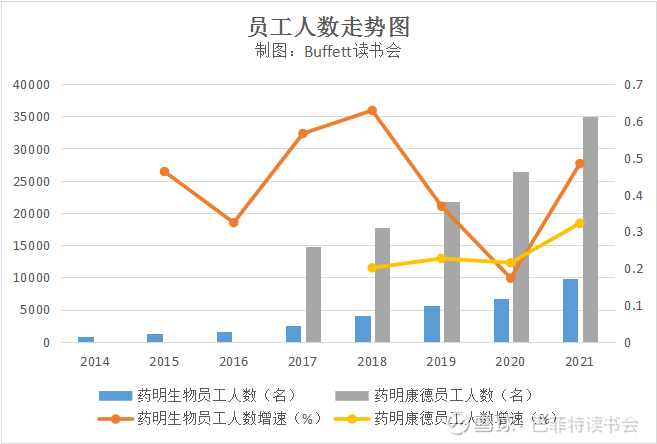

4. Number of employees

Number of employees: WuXi AppTec > WuXi Pharma

In terms of employee base, WuXi AppTec has a very high number of employees. In 2021, the number of employees will be 34,912, of which 11,001 have obtained a master’s degree or above, and 1,302 have obtained a doctorate or equivalent degree. The number of WuXi Biologics employees is about to exceed 10,000. For the macromolecular field, this number is already very high, and the growth rate is very fast.

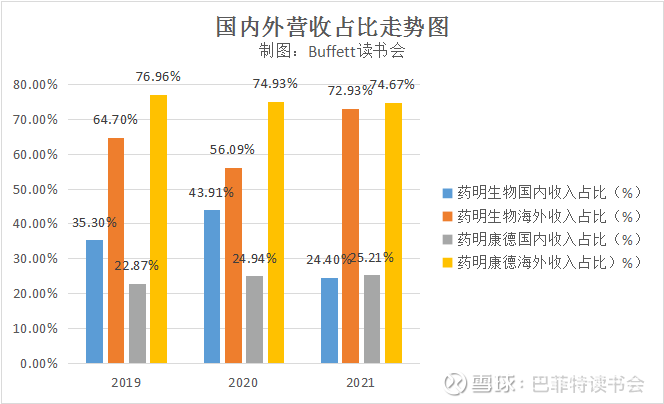

5. Proportion of overseas business

In 2021, WuXi Biologics will account for 72.93% of its overseas business and 24.4% of its domestic business. For specific regions:

North America: 2021 is the largest engine of WuXi Biologics, accounting for more than 50% of revenue. Due to the growth of clinical phase III and CMO, the growth rate is very fast, reaching 110.9%. Because the new crown makes the growth rate in 2020 very slow, so The growth rate in North America and Europe this year is very beautiful.

Europe: 22% of revenue, with a growth rate of 409.7% in 2021,

China: Up 2% year over year, accounting for 24.4% of revenue. Investors will be worried that the Chinese market will be dragged back, but the company is still very confident in China and feels that China is entering an innovative era of high-quality development. The reasons for the slow year-on-year growth rate are: 1) There will be a rapid growth in 2020, with a growth rate of more than 70%, so there will be no very significant growth in 2021; 2) The Chinese market is still not large enough for the CMO market, and we have Chinese products listed. , but it will take time for Chinese products to go into the market; 3) Our market share in China is already very high, it is impossible to rely on additional market share to bring growth, we can only rely on this project to bring income in the future, but because of the new crown Influenced by various policies in China, it will also affect the speed of the project in the future; 4) Most of the projects in China are still in clinical phase I and II, which are indeed affected by the new crown or policy. As long as the clinical speed of the project is accelerated in the next few years, the growth of the Chinese market will remain above 40%, and the market share will remain at around 30%.

Other Asia-Pacific regions: It is still a good growth, with 23.2%, which is a very small base in itself, and has corresponding growth.

The east is not bright and the west is bright. In 2020, the Chinese market will grow by 70%, and Europe and the United States will slow down. Last year, it was reversed, becoming the driving force of Europe and the United States. I don’t know which country will drive next year and the year after, but the company plans to have layouts in four regions, which will bring continuous and sustained growth to the company.

WuXi AppTec’s overseas business will account for 74.67% in 2021, basically the same as in previous years, and domestic business will account for 25.21%, with little change.

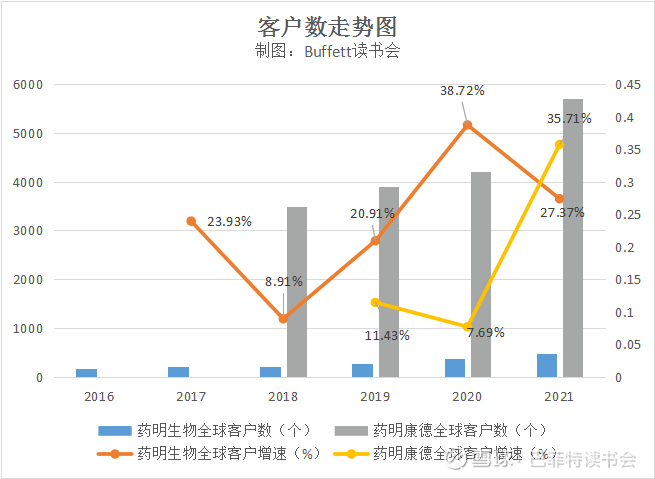

6. Number of customers

WuXi Biologics has grown from 78 customers in 2014 to 470 customers in 2021. For the top ten customers, the average income of each customer has also increased significantly, from 20 million yuan in 2014 to 480 million in 2021. In eight years, the income of the top ten customers has increased by about 24 times.

WuXi AppTec’s revenue from existing customers was RMB 21.295 billion, a year-on-year increase of 28.8%; revenue from new customers in 2021 was RMB 1.608 billion. Benefiting from the company’s global “long-tail customer” strategy and the continuous increase in the penetration rate of other customers, the revenue from the world’s top 20 pharmaceutical companies was RMB 6.733 billion, a year-on-year increase of 24.1%; the revenue from other global customers was RMB 16.170 billion Yuan, a year-on-year increase of 45.6%.

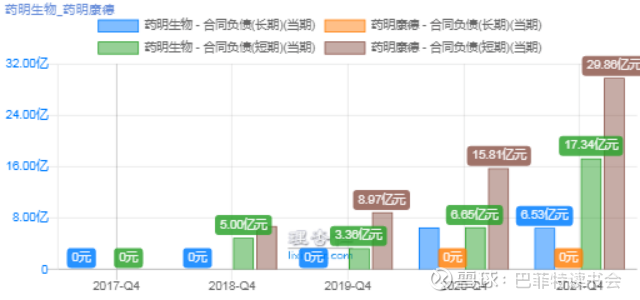

7. Contract liabilities

The short-term contract liabilities of WuXi Biologics have grown rapidly, with long-term + short-term liabilities totaling 2.387 billion yuan by 2021.

WuXi AppTec’s short-term liabilities in 2021 will be 2.986 billion yuan, a year-on-year increase of 88.89%.

8. Capacity

Through new construction and global acquisitions, WuXi Biologics will increase its total production capacity from 54,000 liters at the end of 2020 to 154,000 liters at the end of 2021. To meet growing demand, the group’s total production capacity will continue to increase to 262,000 liters by the end of 2022, and 430,000 liters after 2024.

(On June 6, WuXi Biologics is pleased to announce that the new biologics plant No. 5 (DP5) in Wuxi, Jiangsu Province has officially put into GMP production. This is also the ninth biologics plant that WuXi Biologics has put into production globally. DP5 application It has developed an advanced isolator filling production line, which can provide continuous and stable preparation filling services for pre-filled needles of different specifications such as 1mL slender, 1mL, 2.25mL, 3mL, etc. The fastest filling speed of preparations can reach 400 pieces/min. The annual production capacity is as high as 17 million pieces.)

WuXi AppTec expands production through endogenous and epitaxy methods. In terms of endogenous construction, Hequan Pharmaceutical, a subsidiary of the company, actively promoted the international layout. During the reporting period, it announced the construction of a preparation and API production base in Delaware, USA. It is expected to be officially put into operation in 2025 and will become Hequan. The second base built by the pharmaceutical industry in the United States is also the company’s eighth R&D and production base in the world. With an area of 15,300 square meters, it has become the company’s second cell and gene therapy production base in China after Wuxi Huishan. All-round and integrated customized services for GMP-level production; the new high-end testing laboratory expanded by the company’s subsidiary WuXi Biologics in the Philadelphia base of the United States has been officially put into operation. With an area of 13,000 square meters, the laboratory will triple the company’s high-end testing capacity after it is put into operation, so as to better meet the growing demand for cell and gene therapy products from global customers. In terms of external mergers and acquisitions, in July 2021, the company’s subsidiary Hequan Pharmaceutical completed the acquisition of Bristol-Myers Squibb’s GMP preparation production base in Kuwait, Switzerland. The base has advanced production capacity and is capable of large-scale commercial production of capsules and tablets , The factory has become the first production base of Hequan Pharmaceutical in Europe, and further expands the global production capacity of Hequan Pharmaceutical to serve global customers.

9. Capital expenditure

WuXi Biologics’ capital expenditure in 2021 is about 6.5 billion yuan, mainly for capacity expansion in Europe, China and the United States, and this year’s capital expenditure is expected to be about 5.5 billion yuan.

WuXi AppTec’s capital expenditure in 2022 will be 9 billion-10 billion, 60-70% of which will be used for CDMO, Changzhou Phase III, Taixing, and the US base. The funds raised this time accounted for 2.5% of the total share capital, and 70% was used for the expansion of overseas production capacity, mainly the construction of CMO.

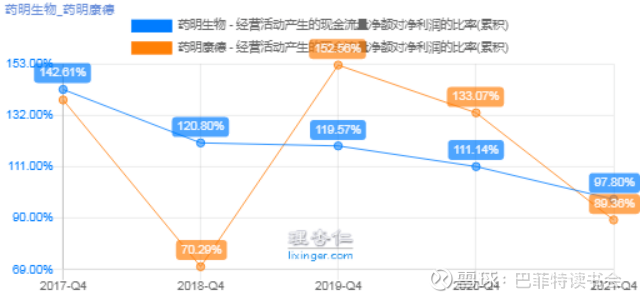

10. Cash flow

The cash flow of the two companies in 2021 is not very good, and WuXi PharmaTech has fallen even more.

summary:

From the above fundamental comparison,

1) From the perspective of performance indicators, the revenue and profit bases of WuXi AppTec are higher than that of WuXi Biologics, but the growth rate is obviously better than that of WuXi AppTec, and they are relatively high all year round;

2) In terms of profitability, in terms of gross profit margin and net profit margin, WuXi Biologics is much higher than WuXi AppTec; the return on net assets of WuXi Biologics is not as high as that of WuXi AppTec, but it is on the rise;

3) In terms of R&D capabilities, WuXi Biologics has less R&D investment than WuXi AppTec, but the total expense ratio is higher than WuXi AppTec, but the R&D expense ratio of both companies is going down;

4) In terms of the number of employees, WuXi AppTec is significantly higher, and WuXi Biologics has more than 10,000 employees. For the field of macromolecules, this number is already very high, and the growth rate is very fast.

5) In terms of the proportion of overseas business, more than 70% of the revenue of the two companies comes from overseas. WuXi Biologics has increased significantly compared with 2020, and WuXi AppTec has a relatively stable overseas proportion all year round;

6) In terms of the number of customers, both companies have grown, but the bases are not on the same level. WuXi AppTec has a relatively large number of global customers;

7) In terms of contract liabilities, WuXi Biologics will grow faster in 2021 than in 2020;

8) In terms of production capacity, both WuXi Biologics and WuXi AppTec are expanding production capacity through self-construction, acquisition, etc. to meet the order demand;

9) In terms of capital expenditure, WuXi Biologics is mainly used for capacity expansion, and 70% of WuXi AppTec is used for overseas capacity expansion, mainly for the construction of CMO;

10) In terms of cash flow, both of them are not good, and WuXi AppTec has a relatively large decline.

Finally, let’s look at the valuation. The PE and PS valuations of WuXi Biologics are at historically low levels, and the valuation of WuXi PharmaTech is also hovering at the bottom.

Special reminder: This article is for investment logic sharing and does not constitute investment advice.

Buffett Book Club

Value investment concept, knowledge experience learning and exchange platform, investment risk education platform.

Discover value and practice value. The book club has carried out independent investment and research activities for a long time, regularly publishes original research reports, and organizes offline sharing activities.

“Stable and far-reaching”, uphold the spirit of “professionalism, prudence and integrity”, and strive to achieve long-term value and steady growth with members and customers.

@雪ball research group @雪ball research small fans @today’s topic @investor Moses @big financial snowball @entering the batting area @一 Swordsman Zhouzhixin @Shanghai-Hong KongDeep dividend growth low wave @exorcist detective @10 years of freedom路88 @上景如川@星台場hat @bigfatcat @玉山罗雨@千和屋@overtime accountant @machinework club Xu Fan

This topic has 7 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7173595940/221920634

This site is for inclusion only, and the copyright belongs to the original author.