Today, I read a few more quarterly reports, and there are quite a few stock positions that have been reduced. But instead of choosing to lighten their positions at the peak of the bull market, they choose to lighten their positions when market sentiment collapses, forming negative feedback. The following data interval is: 2022.01.01~2022.04.26.

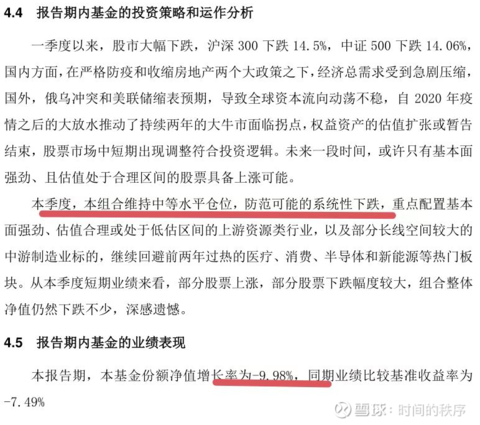

Let’s talk about Shen Xuefeng of Huatai Bai Rui . He will re-manage the public fund in mid-2020. At that time, there was a publicity that she could perceive systemic risks through macro analysis in advance, and make large-scale timing. Looking back at the investment process after returning to public offering, it is not satisfactory. At the end of 2020, the main positions of medicine and food and beverages will be held. In mid-2021, some positions (about 20%) will be gradually replaced by new energy sectors. By the third quarter, the allocation peak will be reached. At this time, the positions will be reduced by 10% compared with the bull market. is 80%. In the first quarter, the stock position was reduced to 40%, while the performance since the beginning of the year was -25%. From the comparison of the performance in the chart below, the position change has basically played little role so far. I don’t know what will happen in the future?

Wells Fargo Fund Hou Wu ‘s new fund, Wells Fargo Large Cap Core Assets Mix (F012147), has a good position-building strategy. As can be seen from the picture, he took a position after feeling that the market stabilized, but the rapid decline in the market since the beginning of the year also made his stock position Reduced to 10%, during this period, compared to other new funds, is to achieve excess returns. He also said in an interview that he doesn’t like to die. However, his new fund is about to reach 6 months and must reach 60%-95% of the position standard set in the contract.

Wells Fargo Select Growth Flexible Allocation, managed by Wells Fargo Yizhiquan , dropped 25% in the first quarter to 65%. (The position in the fourth quarter is about 90%), and the performance this year is relatively good, -19%. There should be a contribution from position adjustment (which may not be large), and there are also reasons for the structure of positions. (The performance has a small peak in 2021.09, because the position structure is adjusted at this time, it is cyclical, and the cyclical sector will plummet immediately.) However, he hopes to achieve absolute gains by reaching a certain level of timing, so he does not dissatisfied.

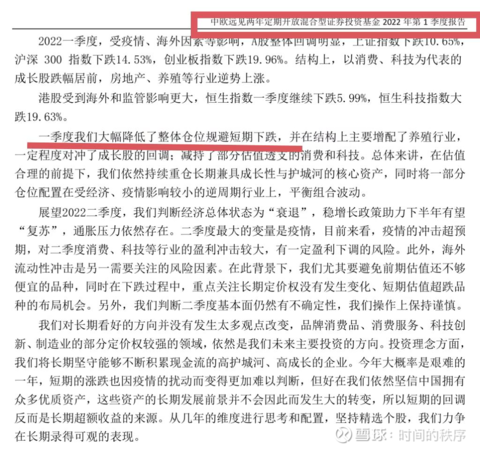

China Canada Feng Hanjie ‘s view is different from that of most fund managers who are “brainless” optimistic about A-shares. He believes that: standing at the moment, the stock market has not improved significantly, and the return on long-term potential returns is limited, which is a neutral state. The stock position is 66%. The operation time of this reduction is in the first quarter of 2021. From the perspective of performance, it still has a positive contribution.

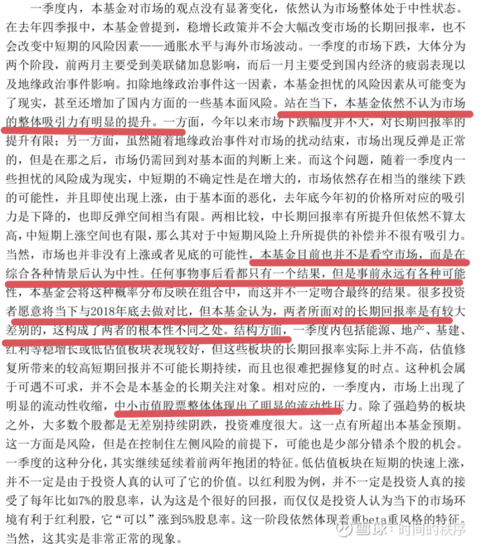

CEIBS Vision , managed by Cheng Yuxuan , reduced its position in the first quarter by 30% to 48%. (79% in the fourth quarter of 2021) Since the beginning of this year, the performance has been -20%, and it should also contribute to the adjustment of positions. This fund belongs to the balance of stocks and debts and should have withdrawal control requirements. The other funds she manages have not reduced their positions, and their performance is about was -27%.

Personally, I am neutral on the use of position management methods by public fund managers. It mainly depends on the cognitive depth of the fund manager, which is in line with their own personality and framework, and is logically self-consistent. All roads lead to Rome. Of course, it is extremely difficult to do well.

Finally, quoting Shu Jinwei’s view on timing, I agree very much.

We believe that the total position setting is the same as the individual stock position setting, which depends on the three elements of winning rate, odds and cashing time . Win rate refers to your probability of winning, and odds refer to how much you can win if you win. First of all, the winning rate multiplied by the odds is equal to the expected rate of return. Obviously, the higher the expected rate of return, the heavier the position should be. In addition, under the same expected rate of return, high winning rate should bet on heavier positions than high odds, such as “100% probability of earning 20%” and “20% probability of earning 1x”. The rate is the same, but the position corresponding to the former should be heavier (there is a Kelly formula in mathematics, which is a detailed discussion of this issue). Moreover, the position also depends on the time to be cashed out. Obviously, the former should have a heavier position than “30% space in one month”.

In the long run, it is right that public funds are always full. There are several reasons.

The first reason is that individual stocks are analyzed for micro variables, while total positions are analyzed for macro variables. Individual stock positions, depending on the analysis of specific companies, can often lead to clear research conclusions, which means that the winning rate, odds and redemption time can be calculated more accurately, and individual stock positions can be quickly changed according to your analysis. . The macro variables are often confusing. In most cases, the winning rate can only be increased from 50% to 51% through careful research. Therefore, most of the time, it is impossible to calculate how the position should be changed. Therefore, the total position is often full for a long time. of. However, at some important nodes, when the analysis of macro variables can draw relatively clear conclusions, the total position should be changed accordingly.

The second reason is that in the long run, human society is always making progress. In terms of cycles, among the four quadrants of the Merrill Lynch clock, only the stagflation quadrant should hold cash, and the other three quadrants can be full of stocks. Therefore, it is appropriate to always be full from a long-term perspective. But if it can be determined that the present is in the stagflation quadrant of the Merrill clock, it should also be timed in stages.

The above two reasons are reasonable, but there is another hidden reason: the strategy of always filling the warehouse is conducive to increasing the scale of the product, but it may not be optimal from the perspective of customers. Under the current game rules and assessment mechanism, fund managers are risk-averse, while clients are actually risk-averse. There is a mismatch. This mismatch is one of the reasons why the fund makes money while the Christian Democrats don’t.

Correspondingly, there is a school of thought in the market that value investment equals long-term holding and low turnover. We think this view is open to question. We believe that long-term holding should be an outcome, not a precondition. The market is very smart and efficient, and it is very difficult to say that you can outperform the market for many years and see a certain result in the first place. My personal experience is that at the practical level, if you stick to this concept, two kinds of movement deformations will easily occur.

The first is that what seems to be a value is actually a trend. In practice, I often make a mistake, which is to paralyze myself with the mentality of holding a good company for a long time. The essence of a fund manager’s job should be pricing, not just picking good companies without judging how expensive they are. At this time, it seems to be doing depth value, but it is actually doing a trend.

The second is to degenerate from active to passive. In practice, I also often make another mistake, which is to paralyze myself with style not drifting. It’s easy to put a label on myself at this time, I just focus on certain tracks, and I can’t lighten up in order to keep my style from drifting. But this is actually contrary to the first principles of investment. Because whether it is the rotation comparison of sectors in the broader market or the rise and fall of a single sector, fund managers immersed in the market should be more professional than FOF managers and clients. Focusing on a single track and never choosing the right time is essentially that fund managers hand over the power of choice to clients, and products become instrumental, degrading from active to passive.

This topic has 13 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9970195706/218215905

This site is for inclusion only, and the copyright belongs to the original author.