Original link: https://ljf.com/2022/05/24/1099/

Message from the Chairman

In 2021, the annual revenue was 4.49 billion yuan, a year-on-year increase of 78.7%; the adjusted net profit was 1.002 billion yuan, a year-on-year increase of 69.6%.

As a platform enterprise covering the entire industry chain of trendy toys, IP is the core wealth of Bubble Mart.

At present, Bubble Mart has settled in 23 overseas countries and regions including South Korea, Japan, the United States, Canada, the United Kingdom, and Singapore. In 2021, overseas revenue will successfully exceed 100 million yuan. In 2022, we will accelerate overseas layout and export trendy toy culture from Chinese brands to the world.

Management Discussion and Analysis

business review

In 2021, revenue will increase by 78.7% year-on-year, and the total number of registered members will reach 19.58 million.

Artist Discovery and IP Operation

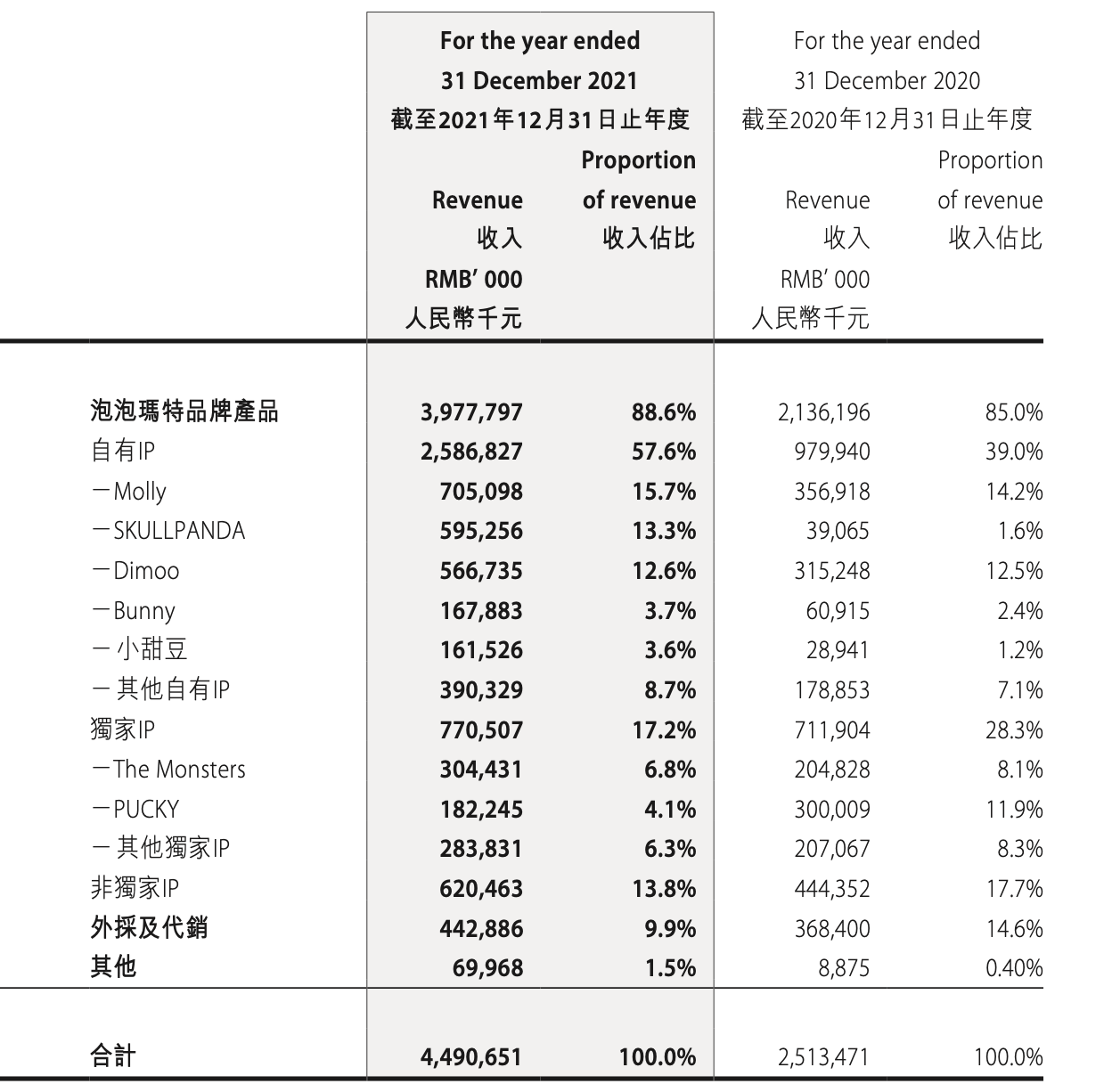

2021 will be the 15th anniversary of Molly’s birth, and it is still loved by fans, and its revenue has grown steadily. In 2021, Molly will achieve revenue of RMB 705.1 million, a year-on-year increase of 97.6%.

Dimoo and SKULLPANDA achieved revenue of RMB 566.7 million and RMB 595.3 million, respectively, in 2021, a year-on-year increase of 79.8% and 1,423.8%, respectively.

Our in-house designer team PDC (Pop Design Center) has launched many popular IPs, Xiaotiandou achieved revenue of RMB 161.5 million in 2021, a year-on-year increase of 458.1%; and new IP Ono, which was listed on PDC in October 2021 Through the unique design style, it is deeply loved by fans, and achieved an income of RMB 52.2 million.

We officially launched our high-end trendy game product line “MEGA Collection Series” during the year. Once the MEGA series of products were launched, they quickly detonated the market, with a total revenue of RMB 178.1 million. We will release the MEGA Collection Series in June 2021. After the SPACE MOLLY x SpongeBob SquarePants joint model, a total of 9 1000% SPACE MOLLY collection products were released, attracting a total of more than 8.7 million people to participate in the lottery.

Consumer reach

offline channels

We will open 106 new offline stores in mainland China in 2021, up from 187 at the end of 2020 to 288 at the end of 20211. We will open 510 new robot stores in mainland China in 2021, up from 1,351 at the end of 2020 1,861 at the end of 2021. By the end of 2021, we have 7 stores in Hong Kong, Macau, Taiwan and overseas, and 9 robot stores in Hong Kong, Macau, Taiwan and overseas

online channel

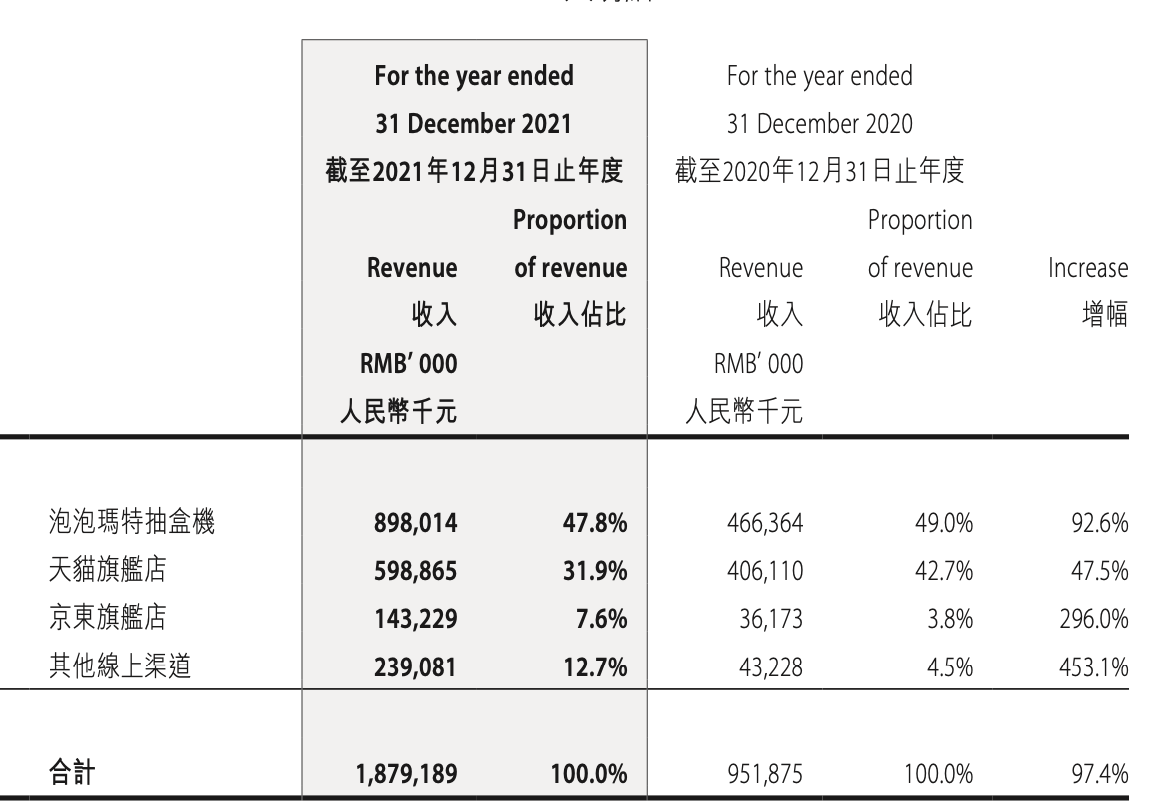

Bubble Mart Box Drawer is a small program independently developed and designed by us on the WeChat platform, aiming to create a fun and interesting shopping experience. In 2021, it achieved a revenue of RMB 898.0 million, a year-on-year increase of 92.6%. The revenue of JD flagship store in 2021 will be RMB 143.2 million, a year-on-year increase of 296.0%. The revenue of the Tmall flagship store in 2021 will be RMB 598.9 million, a year-on-year increase of 47.5%. We have ranked first in sales of Tmall’s Double Eleven major toy categories for three consecutive years.

Member operation

As of December 31, 2021, the total number of cumulative registered members increased from 7.400 million at the end of 2020 to 19.580 million, of which 12.18 million were newly registered members. In 2021, members will contribute 92.2% of sales, and the repurchase rate of members will be 56.5%2.

Financial Review

Sales revenue

The Company’s revenue increased from RMB2,513.5 million in 2020 to RMB4,490.7 million in 2021, representing a year-on-year increase of 78.7%.

cost of sales

Cost of sales increased from RMB919.4 million in 2020 to RMB1,732.0 million in 2021, an increase of 88.4%, mainly due to increased revenue from business expansion.

The increase in cost of sales was mainly due to

(1) The cost of goods increased from RMB748.5 million in 2020 to RMB1,445.0 million in 2021, which was mainly due to the increase in sales and the increase in the unit price of the cost of goods;

(2) Design and licensing fees increased from RMB62.7 million in 2020 to RMB104.7 million in 2021, mainly due to the increase in revenue from our branded products;

and (3) the depreciation of property, plant and equipment increased from RMB 19.9 million in 2020 to RMB 76.4 million in 2021, mainly due to the increase in the number of our merchandise, the addition of product lines and the increase in molds, resulting in depreciation increase in costs.

gross profit

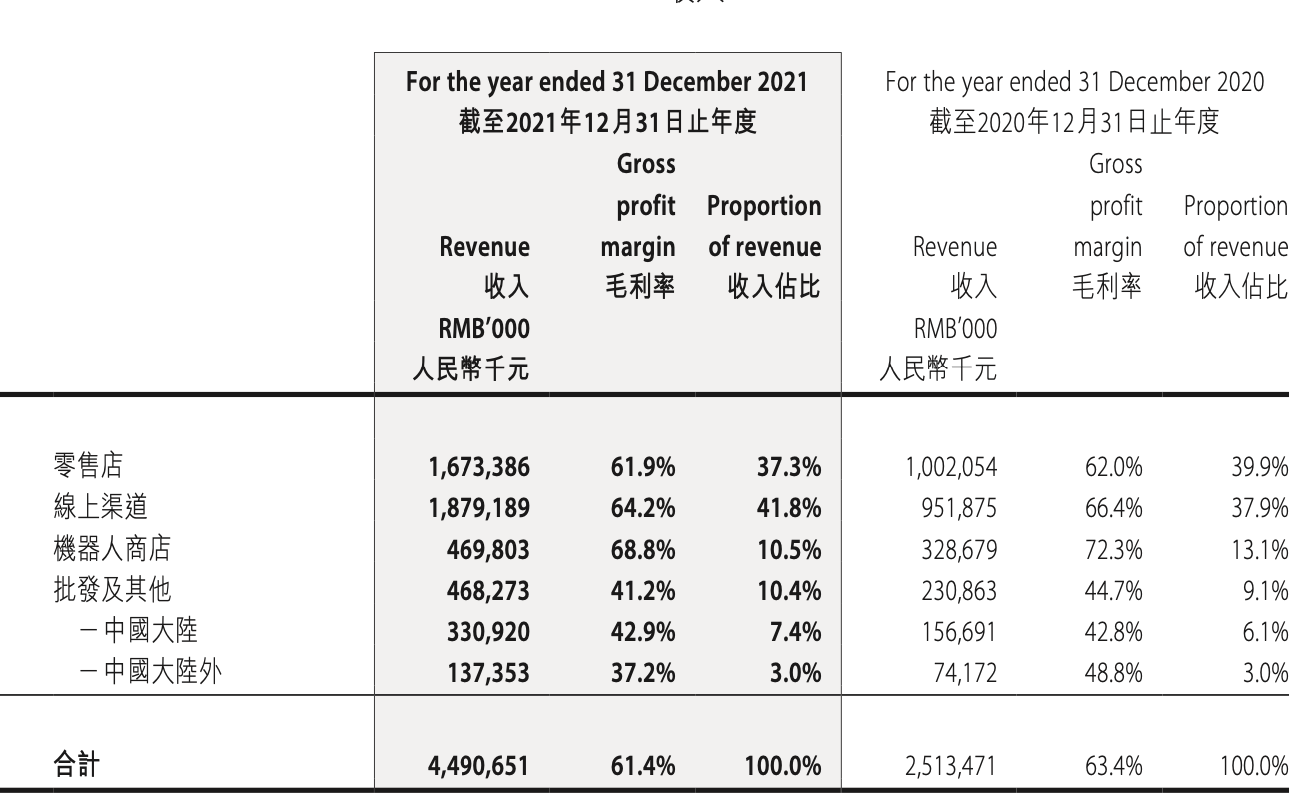

Our gross profit increased by 73.1% from RMB1,594.1 million in 2020 to RMB2,758.6 million in 2021, mainly due to the increase in our revenue. Our gross profit margin decreased from 63.4% in 2020 to 61.4% in 2021, mainly due to the decrease in gross profit margin of our Bubble Mart branded products.

Gross profit generated from our Bubble Mart branded products increased from RMB1,467.9 million in 2020 to RMB2,573.2 million in 2021, an increase of 75.3%. Mainly due to the increase in revenue from Bubble Mart’s own products. The gross profit margin of Bubble Mart branded products dropped from 68.7% in 2020 to 64.7% in 2021, mainly due to our improved product quality, more complex product processes, and a decrease in gross profit margin due to rising raw material costs in 2021.

Gross profit from our outsourcing and other products increased by 46.9% from RMB126.2 million in 2020 to RMB185.4 million in 2021, and gross profit margin increased from 33.4% in 2020 to 36.1% in 2021 , mainly due to the diversification of product composition, the gross profit slightly changed.

Distribution and selling expenses

Our distribution and selling expenses increased from RMB630.1 million in 2020 to RMB1,106.1 million in 2021, an increase of 75.5%. The higher proportions are (1) employee benefit expenses; (2) depreciation of right-of-use assets; and (3) advertising and marketing expenses.

general and administrative expenses

Our general and administrative expenses increased from RMB280.0 million in 2020 to RMB557.5 million in 2021, an increase of 99.1%. The higher proportions are (1) employee benefit expenses; and (2) depreciation of right-of-use assets.

Other income

The Company’s other revenue increased from RMB45.4 million in 2020 to RMB54.4 million in 2021, an increase of 19.8%. This is mainly due to the increase in IP licensing revenue from brand cooperation projects such as fresh, Ray-Ban, Haagen-Dazs and Kiehl’s from RMB 18.7 million in 2020 to RMB 37.7 million in 2021.

Operating profit

In summary, the operating profit of the Company increased from RMB718.8 million in 2020 to RMB1,149.8 million in 2021, representing an increase of 60.0%.

Human Resources

As of December 31, 2021, we had a total of 4,053 employees, including 2,436 sales employees and 1,617 administrative and development employees. As of December 31, 2021, we incurred a total of RMB669.7 million in employee costs (including salaries, wages, allowances and benefits).

Revenue by Channel

The Company’s revenue comes from the following channels: 1. Retail stores; 2. Robot stores; 3. Online channels; and 4. Wholesale channels and others.

retail store.

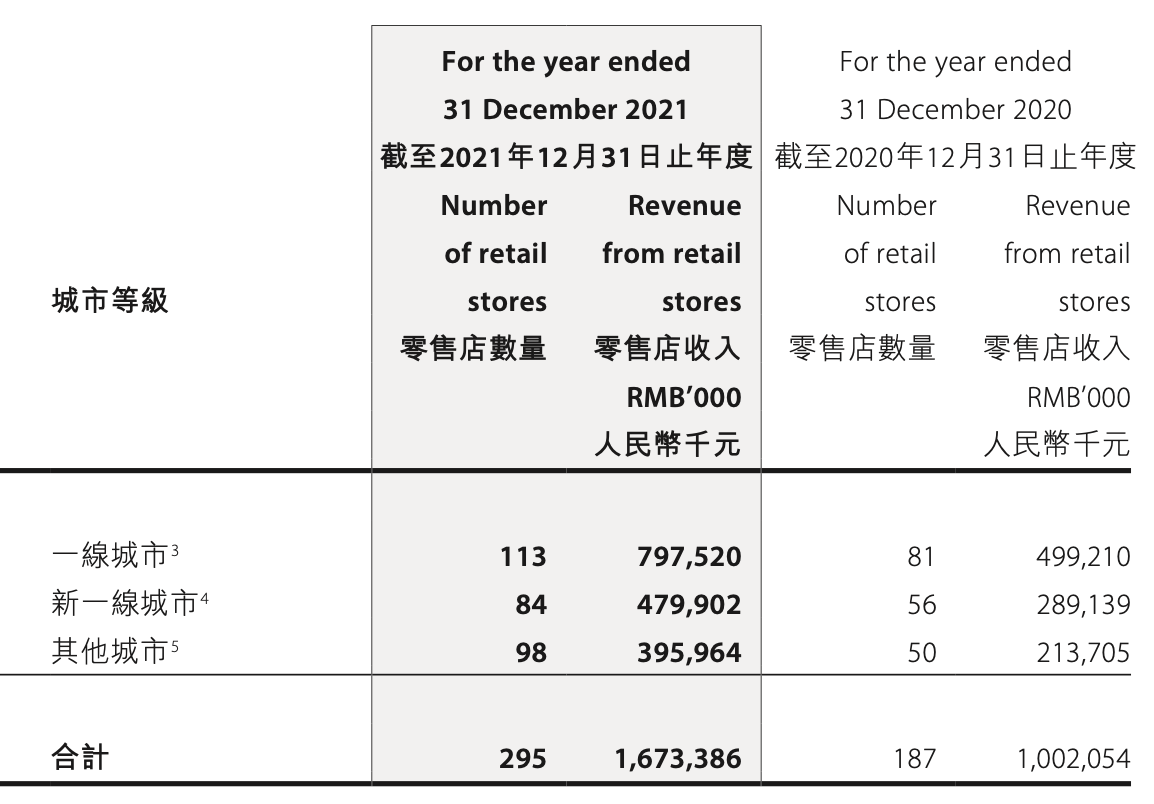

Revenue from retail store sales increased from RMB1,002.1 million in 2020 to RMB1,673.4 million in 2021, representing a year-on-year increase of 67.0%. Mainly due to the effective control of the domestic epidemic in 2021, all retail stores are operating normally, while the initial epidemic in 2020 is severe, which will have a greater impact on retail store sales. There will be 108 net new stores in 2021, bringing the total to 295 retail stores as of December 31, 2021.

Robot shop.

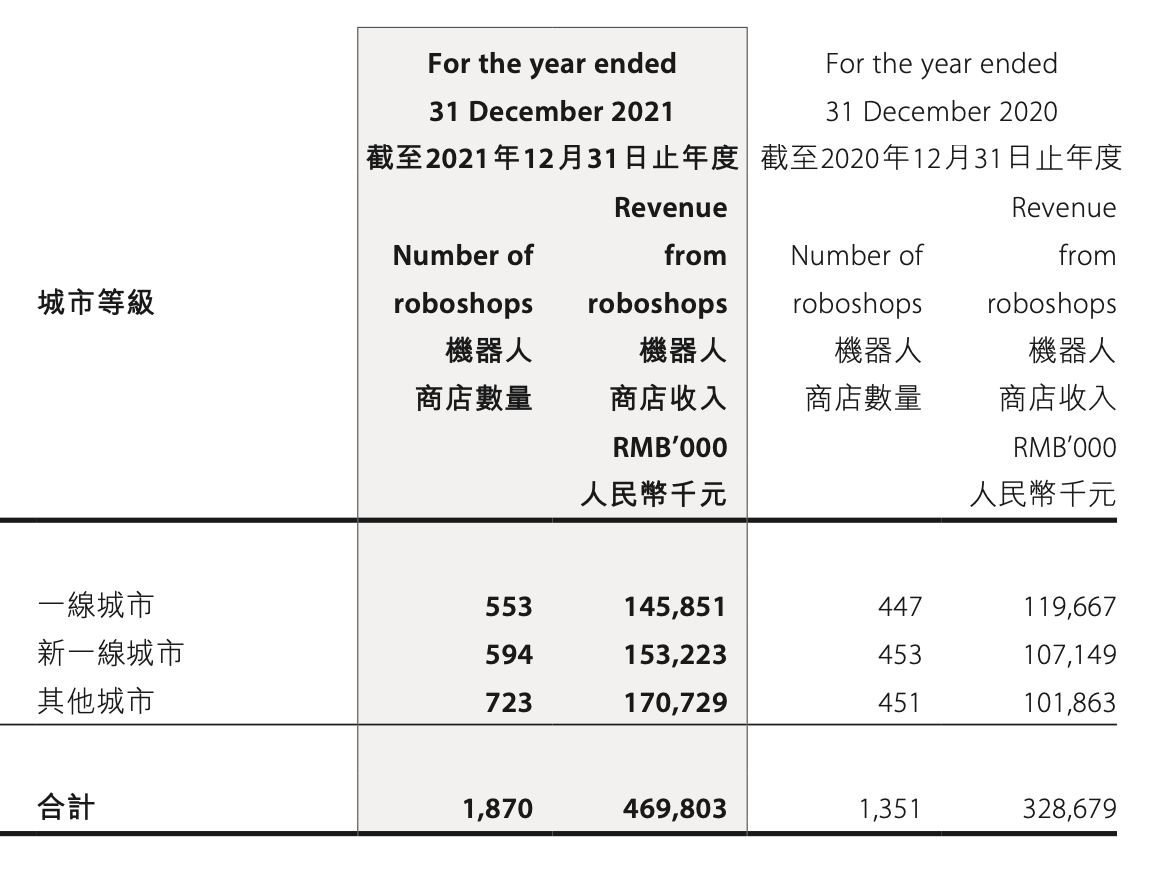

The sales revenue of robot stores increased from RMB 328.7 million in 2020 to RMB 469.8 million in 2021, a year-on-year increase of 42.9%, mainly due to the effective control of the domestic epidemic in 2021. The robot stores are operating normally, while the initial epidemic in 2020 The impact is severe and has a greater impact on robot stores; and 519 robot stores will be added in 2021, bringing a total of 1,870 robot stores as of December 31, 2021.

online channels.

Online revenue increased from RMB951.9 million in 2020 to RMB1,879.2 million in 2021, representing a year-on-year increase of 97.4%.

The revenue of Bubble Mart’s box extractor increased from RMB 466.4 million in 2020 to RMB 898.0 million in 2021, an increase of 92.6%; the revenue of Tmall flagship store increased from RMB 406.1 million in 2020 to 2021 598.9 million yuan in 2020, an increase of 47.5%; Jingdong flagship store revenue increased from 36.2 million yuan in 2020 to 143.2 million yuan in 2021, an increase of 296.0%. The growth of online channels in 2021 is mainly due to the increase in brand influence and membership, as well as the sales growth of Bubble Mart Box Machine, JD.com flagship store and the expansion of new channels in 2021.

Wholesale and others.

Wholesale and others revenue increased from RMB230.9 million in 2020 to RMB468.3 million in 2021, an increase of 102.8%. Among them, wholesale and other revenue in mainland China increased from RMB156.7 million in 2020 to RMB330.9 million in 2021, an increase of 111.2%, mainly due to the increase in revenue of the distributor Nanjing Golden Eagle Bubble Mart Trading Co., Ltd. , accounting for 53.6% of dealers in mainland China; wholesale and other revenue outside mainland China increased from RMB 74.2 million in 2020 to RMB 137.4 million in 2021, an increase of 85.2%, mainly due to overseas markets. Expansion, and our branding in different countries overseas.

Revenue by IP

Bubble Mart’s branded products are our main commodity types. Revenue from branded products accounted for 88.6% of total revenue as of December 31, 2021. Branded products increased from RMB2,136.2 million in 2020 to RMB2,136.2 million in 2021. 3,977.8 million yuan, an increase of 86.2%.

Bubble Mart’s brand products are mainly divided into: own IP, exclusive IP and non-exclusive IP. The following is the revenue breakdown by IP.

Own IP .

Self-owned IP is the main product type of the company, mainly including Molly, SKULLPANDA, Dimoo, Bunny, etc. The proportion of revenue from self-owned IP will increase from 39.0% in 2020 to 57.6% in 2021, and the revenue contribution will increase significantly. Revenue from proprietary IP increased from RMB979.9 million in 2020 to RMB2,586.8 million in 2021, an increase of 164.0%. Mainly due to higher sales contribution from Molly, SKULLPANDA and Dimoo.

Exclusive IP .

Exclusive IP revenue rose from RMB711.9 million in 2020 to RMB770.5 million in 2021, an increase of 8.2%. Mainly due to revenue contribution from The Monsters.

Non-exclusive IP .

Non-exclusive IP revenue increased from RMB444.4 million in 2020 to RMB620.5 million in 2021, representing a growth rate of 39.6%, mainly due to the release of new series of products and the increase in new IP.

retail store. The following table sets forth the revenue of the Company’s retail stores by geographic region in 2021 and 2020:

Robot shop. The following table sets forth the revenue of the Company’s Robot Store by geographic region in 2021 and 2020:

Board of Directors report

Main business

According to the Frost & Sullivan Report, in terms of retail value in 2019 (with a market share of 8.5%) and revenue growth from 2017 to 2019,

dividend distribution

We intend to pay annual dividends to shareholders of not less than 20% of our distributable net profits, subject to the discretion of our directors.

The board of directors has decided to declare a final dividend of RMB 15.24 cents per ordinary share in issue for the year ended 31 December 2021. The proposed final dividend is subject to shareholders’ consideration and approval at the forthcoming annual general meeting of the Company (the “AGM”) to be held on Wednesday, 1 June 2022. The final dividend will be paid to shareholders whose names appear on the company’s register of shareholders on Friday, June 10, 2022. A final dividend is expected to be distributed on Thursday, June 23, 2022, subject to approval at the AGM.

This article is reproduced from: https://ljf.com/2022/05/24/1099/

This site is for inclusion only, and the copyright belongs to the original author.