# Changchat CSI 300 Index Investment Value# On April 8, 2005, the first cross-market index in the A-share market was born – the CSI 300 Index, which is the largest and most liquid among the Shanghai and Shenzhen exchanges. It is composed of 300 leading companies to comprehensively reflect the overall performance of China’s stock market. Since then, with its extensive representation of China’s core assets, the CSI 300 Index has been hailed by investors at home and abroad as the “barometer” of the A-share market and China’s “S&P 500 Index”. These 300 constituent stocks accurately cover the leading companies with long-term performance support and stable returns in the A-share market. These outstanding companies have considerable industry status at home and abroad, which is the embodiment of China’s core competitiveness.

Since May 8, 2012, the $CSI 300 (SH000300)$ Total Income Index has risen by 78.08% in ten years, far exceeding the CSI 500 Index and the CSI 1000 Index. Bright. In addition, the annualized volatility level of 22.69% makes the CSI 300 Index have a more prominent risk-return ratio, and the long-term fixed investment returns are more stable and reliable.

Coupled with a moderate number of constituent stocks, active transactions and good liquidity, the index has been regarded by many institutional investors as the most ideal investment target for investing in China since its release. The data shows that there are currently 170 funds tracking the CSI 300 Index, with a total size of 239.117 billion, ranking first among all index funds (10.77%), far exceeding the major market indexes such as the Shanghai Stock Exchange 50 and the CSI 500. The well-deserved “King of Index” in China.

Among them, Huatai Pineapple $CSI 300ETF (SH510300)$ , established on May 4, 2012, with a scale of over 52 billion yuan (as of 20220429), is known as the largest stock ETF in the A-share market. Since its listing on May 28, 2012, the average daily turnover of Huatai Pineapple $CSI 300 ETF (SH510300) $ has reached 1.445 billion yuan, which is also far ahead of all CSI 300 ETFs.

The outstanding investment value of the Chinese market and the good scale and liquidity of the fund itself have attracted a wide range of on-market investors. Huatai Pineapple $CSI 300ETF (SH510300)$ currently has over 360,000 holders, of which more than 70% are institutional investors. Over the past ten years, the product has accumulated 10 dividends, contributing nearly 4.5 billion cash dividends to holders. . ——As an important investment tool to participate in the CSI 300 Index, Huatai -PineBridge $CSI 300ETF (SH510300)$ has become one of the preferred targets for investors at home and abroad to invest in the A-share market.

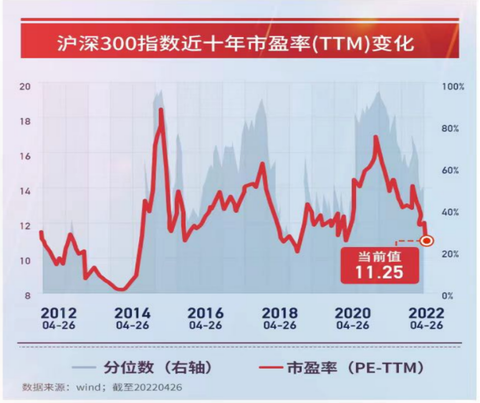

At present, the A-share market has become more attractive after successive declines, and funds are frequently ambush $CSI 300ETF (SH510300)$ for left layout. The data shows that since April, bottom-hunting funds have accelerated to enter the market, and the net inflow of the CSI 300 ETF (SH510300) has reached nearly 10 billion yuan. Coincidentally, in the bottom range of A shares at the end of 2018, $CSI 300ETF (SH510300)$ also staged a similar scene. As the most representative index of A-shares, history tells us that the CSI 300 Index has a particularly important investment value in the previous bottoming and rebounding of the market.

10 years is the 3650-day cycle of the sun rising and the moon setting; it is the alternation of the four seasons with 40 reciprocating changes; it is the 10 annual rings carefully carved on the trunk of the seedlings…

On the occasion of the tenth anniversary of the establishment of the first batch of CSI 300 ETFs, whether you are a veteran driver of CSI 300 ETF or an interested novice, you are welcome to speak freely, talk about the investment value of the CSI 300 Index, and participate in our call for papers. Activity.

【Writing time】

May 9, 2022 – May 22, 2022

【Writing Prizes】

2 first prizes: 2000 yuan cash reward

5 second prizes: 1500 yuan cash reward

8 third prizes: 1,000 yuan cash reward

Excellent Award N: 8~88 yuan for random reward

【Traffic Incentive】

A high-quality call for papers will provide the following exposure support:

1. Recommend to Snowball’s “Today’s Topics” column for more exposure and opportunities to communicate with golfers

2. Simultaneously release on the official account of Snowball on WeChat, Weibo, Toutiao and other platforms

【way of participation】

Post a long post, add hashtags and fund codes, and @Today’s topic (post → long text → title → #華chat CSI 300 Index Investment Value# + $CSI 300ETF(SH510300)$ + essay content)

【Content of the call for papers】

You can refer to but not limited to the following templates:

1. What do you think of the investment value of the CSI 300 Index?

2. Do you think the CSI 300 ETF can be called a “national ETF”?

3. Do you think the rules for compiling the CSI 300 Index are reasonable? What are your expectations for index rebalancing?

4. What investment objectives do golfers who are investing in the CSI 300 Index like to buy? Did you achieve your investment goals?

5. For golfers who hold the CSI 300 Index, would you choose off-market products or on-market products? why?

6. If you want to recommend index products to novice investors, would you recommend the CSI 300 ETF? why?

7. Do you prefer to buy in one lump sum or in batches to invest in the CSI 300 ETF?

8. What risks and opportunities do you think there are in investing in the CSI 300 Index at this stage?

…

【Selection Rules】

1. Posts must be tagged with #Changchat CSI 300 Index Investment Value# ;

2. For posting, choose Long Text→Title→Text or post directly (it is advisable to post with a title);

3. Objective scoring (40%): based on the weight of the number of interactions such as reading, forwarding, commenting, likes, favorites, and rewards; subjective scoring (60%): Snowball will organize investment veteran drivers to form a jury , to evaluate the quality of the article;

4. Please pay attention to abide by the “Snowball Community Code” when posting;

5. The final interpretation right of the event belongs to Snowball within the scope of law;

6. Instructions for submission:

(1) Any content (including but not limited to pictures, text, charts, etc.) provided by the contributor (hereinafter referred to as “you”) to Snowball in this essay call should be original by the contributor, and plagiarism and plagiarism are strictly prohibited. Discovery will be disqualified.

(2) Contributing users agree to grant Snowball the free, permanent, non-exclusive, and sublicensable rights and licenses to all your submitted content (including selected and unselected content). For the purpose of traffic incentives and promotion of content dissemination, Xueqiu has the right to use the content you submit, including but not limited to: synchronously publishing the content on Xueqiu’s official account of WeChat public account, Weibo, Toutiao and other platforms; publishing the content To “Snowball Special Issue” and upload it to major platforms for users to download and circulate; disseminate the content to other legal channels.

$Huatai Pineapple CSI 300ETF Link A(F460300)$ $Huatai Pineapple CSI 300ETF Link C(F006131)$

@华泰博瑞基金@上海工业300ETF_510300 @lazy person raising foundation @research evaluationge @ mingda hierarch @ shujianxiaoao @North beggar asset allocation practice @ZPVermouth @Investor in the stock market @gusu december @zhirong @大马哈投@,我能報@豊菜花雪维维@布Lao Investment @ retail investor’s self-salvation @lanse001 @三鱼@青水 Bird @Mute Financial Diary @Migrant Workers Kanshi @ETF Portfolio Research @raccoon Zikan Market @ zhihuzibuyu @qzy69 @rainbow seeds @刘德夏@博世@Valentinompx @calculus quantified price investment @ Mr.Cai123 @ Caitou diary @ engaged in money base @ big data quantitative analysis @ 星雪@ Qian Mo said

There are 2 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/8152922548/219408393

This site is for inclusion only, and the copyright belongs to the original author.