$Pork(BK0503)$ $Muyuan Shares(SZ002714)$ $Tangrenshen(SZ002567)$

When it comes to the pig cycle, the current market is very divided and there are many quarrels. Everyone is here to beat the market. There is no need to oppose each other. At least they should seek common ground while reserving differences, be calm, look at different viewpoints objectively and dialectically, and put forward their own analysis and thinking calmly and independently. This is what scientific analysis should be. Attitude. Below, based on the current market situation, through bold assumptions and careful verification, the author puts forward his own views, and I hope you will give more advice:

1. New variables have appeared in this pig cycle

1. The multiple outbreaks of the epidemic have led to a shrinking of demand for food and beverages. Due to the lockdown of the epidemic, there may be demand for meat in the short term, or prices may partially rise due to the impact of the supply chain, but these do not change the fact that the overall social demand is relatively shrinking. We lack accurate quantitative data here. Shrinking demand a said.

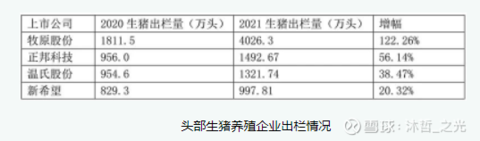

2. The increase in the proportion of large-scale aquaculture leads to greater elasticity of supply. Due to this round of super pig cycle, the proportion of large-scale breeding has increased significantly compared with the past. In 2020, the share of the four leading pig-raising enterprises in slaughtering is about 8.6%, and the proportion of the top 10 major enterprises is about 10.4%; in 2021, the proportion of the four leading pig enterprises has increased to 14.9%. In 2020, the proportion of farming above designated size in my country will be as high as 57%.

Due to the large increase in the proportion of large-scale farming and a higher degree of sensitivity to the cycle, they all hope that they can expand against the trend at the bottom of the cycle and seize market share . Therefore, although we are still at the bottom of the pig cycle, and some companies have fallen into deep losses, both of them predict that the pig cycle will reverse in the second half of this year, and they are all working hard to raise funds to survive the cold winter and maintain their advantage in the number of reproductive sows. Some are even expanding production (such as Muyuan), resulting in a relatively slow detoxification of reproductive sows. Once the price rebounds, it will stimulate some large-scale breeding enterprises to expand production, which will lead to a greater elasticity of pork supply and a change in the slope. slow.

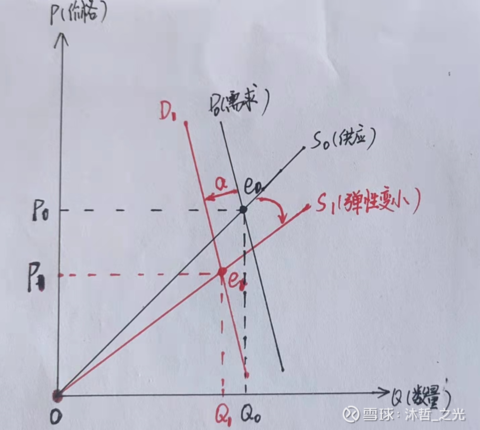

These two variables are reflected on the price elasticity curve of pork supply as follows (drawn by the author):

As shown in the figure above, the original demand curve D0 shifted to the left to D1 due to the shrinkage of the epidemic, the original supply curve S0 rotated clockwise to S1, and the supply-demand balance point changed from the original E0 to E1. Its corresponding equilibrium price is reduced from P0 to P1, and the quantity is reduced from Q0 to Q1.

3. The impact of the situation in Russia and Ukraine has led to an increase in feed costs. Due to the long-term impact of the situation in Russia and Ukraine, the prices of corn, soybeans, wheat agricultural products and other agricultural products have risen sharply. In the future, there are still expectations for price increases, and the depreciation of the RMB exchange rate will be superimposed, which will increase the cost of breeding.

2. The impact of the new supply balance on overcapacity reduction

my country’s Ministry of Agriculture and Rural Affairs has proposed to stabilize the number of reproductive sows at 41 million, with a minimum of 37 million. The 41 million heads here should be Q0 under the condition of normal market supply and demand balance, and the corresponding P1 should be the cost price of live pigs at the theoretical equilibrium point of the market. And 37 million heads should be the interval boundary to keep the supply stable, and the calculated fluctuation range is about plus or minus 10%. In order to facilitate the calculation, we make a conservative estimate, assuming that the demand reduction due to the epidemic is 10%, that is, the new supply balance point number is 37 million breeding sows in Q1.

From the above figure, we can find that the original equilibrium price dropped from P0 to P1, resulting in the equilibrium price of the market being always lower than the cost price supplied by the market, and then superimposed on the increase in breeding costs. No matter how the pork price fluctuates and fluctuates, its price balance center is always low. Due to the cost of breeding, this will lead to the continuous reduction of production capacity, and it is also a very powerful response to the end of the cycle. The cycle may be late, but it will never be absent.

3. The shock time at the bottom of this round of pig cycle will be prolonged

Due to the impact of the last super pig cycle, the proportion of large-scale breeding has increased significantly. The excess profits obtained by the company in the last cycle can maintain the company’s continuous operation at the bottom of the cycle for a long time, which objectively lengthens the time at the bottom of the cycle , resulting in energy Slowing down of breeding sows.

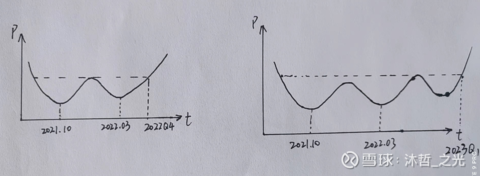

Statement: Many golfers believe that the breeding sows will peak in June 2021. According to the 10-month delay in the production of live pigs, the supply of live pigs should reach the peak around April 2022, and the cycle will start to reverse after bottoming out. It is undeniable that the peak of the supply of live pigs has indeed begun to decrease, but it does not mean that pork prices have begun to reverse rapidly. Therefore, the reversal mentioned in this article refers to the fact that the price of pork begins to break through the starting trend, so that pig stocks can have the opportunity to get out of the main uptrend.

From the peak of 45.64 million breeding sows in June 2021, at the end of the first quarter of this year 41.85 million, only 3.79 million in nine months. With the recent rebound in pork prices after the second bottom of the loss, farmers’ expectations of the cycle reversal have increased, which will slow down the speed of production capacity reduction. If calculated according to the previous detoxification rate, it will take 11.5 months to reach 37 million heads. Of course, as the cash flow of the company decreases in the later period, the speed of reducing the production capacity of reproductive sows is non-linear, but the marginal increase accelerates the reduction.

No matter how long the pork price needs to fluctuate at the bottom, and how fast the breeding sows are going to be, it is certain that the breeding sows have been going away, and there is no such thing as the end of the cycle. Since the cycle time is prolonged, the cash flow of many pig companies will gradually be exhausted. If they cannot continue to raise funds, they will inevitably face the killing of sows, reducing inventory, or even closing down at a loss. Through the first quarterly report of pig companies, it is found that the general cash flow pressure is relatively large. If the current ratio is lower than 0.5 without considering the conditions of financing and extending short-term debt, there is a risk of debt crisis, and the quick ratio is lower than 0.5 within half a year. Real demand for sow inventory reduction. It is very important for a gentleman to survive at the bottom of this cycle. We should avoid these companies with high cash flow risks when investing Behavior. You can choose some companies with relatively high flexibility and sufficient cash flow, especially those companies that have not been speculated in the early stage and have not experienced great growth, such as Dawnrays, Tangrenshen, and Tiankang Biology.

When will the fundamentals of this pig cycle reverse, I think there may be two trends, either in the fourth quarter of the second half of this year, forming a double bottom, or in the beginning of next year after three bottoms and then reversing. Of course, the author prefers the latter, so that the reduction of cyclical production capacity will be stronger, and the strength of the reversal will be higher in the future. If the epidemic can be well controlled across the country, or better vaccines and oral specific drugs come out, the outbreak on the demand side will once again push up the rebound height of this round of pig cycles.

You are welcome to discuss and communicate with objective analysis, and refuse to spray without brains!

There are 94 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/8853634326/218902681

This site is for inclusion only, and the copyright belongs to the original author.